Abstract

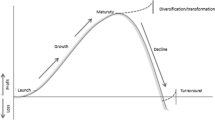

Empirical research on the consequences of the use of the balanced scorecard (BSC) has mostly been conducted in large firms. Previous findings are not easily applied to the small business literature, and assumptions about the benefits of BSC for small- and medium-sized enterprises (SMEs) are not based on quantitative empirical evidence. We investigated the effects of SME’s use of BSC in terms of financial performance and innovation outcomes. Our arguments are based on the efficiency gains and potential flexibility losses associated with formalizing managerial practices in SMEs. We propose that the developmental stage of the firm may influence this trade-off. Based on a survey of 201 SMEs in Spain, we found that firms using BSC for feedforward control obtained better financial performance and presented higher levels of exploitative innovation. We also found that the positive effect of BSC on perceived and attained financial performance is stronger in more established SMEs.

Similar content being viewed by others

Notes

Evidence shows that the BSC adoption rate is 60% among large firms and 25 to 31% among small and medium size firms (CIMA 2009).

It has been suggested that managers of large firms could address the efficiency-flexibility trade-off by promoting spatial separation (e.g., structurally separate R&D units) (Benner and Tushman 2003), temporal differentiation (Nickerson and Zenger 2002), or strategic alliance networks (Lin et al. 2007). The small business literature has shown that these options are less accessible to SMEs and that top management teams, and the managerial practices supporting their decision-making play a pivotal role in managing the trade-off (Lubatkin et al. 2006; Volery et al. 2015).

Even though early studies questioned the suitability of BSC for SMEs (McAdam 2000; Hoque 2003), more recent research developments on the adoption of managerial practices suggest that the adoption and use of BSC are related to the complexity of the firm rather than to size-related factors (Kallunki and Silvola 2008; Davila et al. 2009).

Admittedly, to be consistent with prior literature, these labels could also be ‘interactive’ and ‘diagnostic’ (Bisbe and Malagueño 2009; Koufteros et al. 2014). Interactive and diagnostic uses have been employed to examine managerial control practices in large firms. Whereas the interactive use of controls involves double-loop learning, the diagnostic use concerns single loop learning. We opt not to introduce these labels into our discussion of small business and instead base our types on the extant prior literature. Several researchers in the small business literature have shown that the behavioural and organizational effects of managerial practices are deeply associated with how they are used. Among those studies, analogous typologies were examined, including loose/flexible and tight (De Massis et al. 2015), organic and mechanistic (McAdam et al. 2014) and feedback and feedforward (Ebben and Johnson 2005).

The sample for this study is part of a larger research project. Only firms that reported 10 to 250 employees in their financial statements were selected for this research paper. We acknowledge that the reliance of this paper on a single industry constrains generalizations of our findings. An important advantage of this choice is that analysis of a single industry presents higher internal validity than multi-industry analysis, as a number of spurious effects can be better controlled (Ittner et al. 2003).

For comparability, we include the standardized variables in the models.

For content validity, we also asked in the survey whether the company had adopted budgets (the most extended control system among SMEs) and strategic planning, so that the respondents were aware that they were being asked about a balanced scorecard.

We thank an anonymous SBE reviewer for signalling to the importance of this variable in the research model.

The effect of innovation on the long-term profitability of a firm may be substantial; however, in this research, we only assess the performance implications of the use of BSC in the short- and mid-terms. Thus, the effects of innovation on financial performance are not tested.

To avoid issues of multicollinearity, variables for the use of BSC and development stage were mean centred before creating the interaction term.

We checked whether the incremental variances in the explained variables that stem from the control variables are statistically significant. In models 1 to 6, ΔR2 (ranging from 0.179 to 0.465) are significant to all cases (p < 0.01). ΔAdjusted R2 (ranging from 0.073 to 0.400) are also significant (p < 0.01), with the exception of ‘Perceived performance’ models.

References

Anderson, B. S., & Eshima, Y. (2013). The influence of firm age and intangible resources on the relationship between entrepreneurial orientation and firm growth among Japanese SMEs. Journal of Business Venturing, 28(3), 413–429. doi:10.1016/j.jbusvent.2011.10.001.

Ates, A., Garengo, P., Cocca, P., & Bititci, U. (2013). The development of SME managerial practice for effective performance management. Journal of Small Business and Enterprise Development, 20(1), 28–54. doi:10.1108/14626001311298402.

Benner, M. J., & Tushman, M. L. (2003). Exploitation, exploration, and process management: The productivity dilemma revisited. The Academy of Management Review, 28(2), 238–256 Retrieved from http://www.jstor.org/stable/30040711.

Biazzo, S., & Garengo, P. (2012). Performance measurement with the balanced scorecard. A practical approach to implementation within SMEs. Berlin: Springer ISBN 978-3-642-24761-3.

Biddle, G. C., Hilary, G., & Verdi, R. S. (2009). How does financial reporting quality relate to investment efficiency? Journal of Accounting and Economics, 48(2), 112–131. doi:10.1016/j.jacceco.2009.09.001.

Bisbe, J., & Malagueño, R. (2009). The choice of interactive control systems under different innovation management modes. European Accounting Review, 18(2), 371–405. doi:10.1080/09638180902863803.

Bisbe, J., & Malagueño, R. (2012). Using strategic performance measurement systems for strategy formulation: does it work in dynamic environments? Management Accounting Research, 23(4), 296–311. doi:10.1016/j.mar.2012.05.002.

Bititci, U., Garengo, P., Dorfler, V., & Nudurupati, S. (2012). Performance measurement: challenges for tomorrow. International Journal of Management Reviews, 14(3), 305–327. doi:10.1111/j.1468-2370.2011.00318.x.

Bititci, U. S., Garengo, P., Ates, A., & Nudurupati, S. S. (2015). Value of maturity models in performance measurement. International Journal of Production Research, 53(10), 3062–3085. doi:10.1080/00207543.2014.970709.

Branzei, O., & Vertinsky, I. (2006). Strategic pathways to product innovation capabilities in SMEs. Journal of Business Venturing, 21(1), 75–105. doi:10.1016/j.jbusvent.2004.10.002.

Brinckmann, J., Grichnik, D., & Kapsa, D. (2010). Should entrepreneurs plan or just storm the castle? A meta-analysis on contextual factors impacting the business planning-performance relationship in small firms. Journal of Business Venturing, 25(1), 24–40. doi:10.1016/j.jbusvent.2008.10.007.

Bromiley, P., & Harris, J. D. (2014). A comparison of alternative measures of organizational aspirations. Strategic Management Journal, 35(3), 338–357. doi:10.1002/smj.2191.

Busco, C., & Quattrone, P. (2015). Exploring how the balanced scorecard engages and unfolds: articulating the visual power of accounting inscriptions. Contemporary Accounting Research, 32(3), 1236–1262. doi:10.1111/1911-3846.12105.

Busenitz, L., & Barney, J. (1997). Differences between entrepreneurs and managers in large organizations: biases and heuristics in strategic decision making. Journal of Business Venturing, 12(1), 9–30. doi:10.1016/S0883-9026(96)00003-1.

Cardinal, L. B., Sitkin, S. B., & Long, C. P. (2004). Balancing and rebalancing in the creation and evolution of organizational control. Organization Science, 15(4), 411–431. doi:10.1287/orsc.1040.0084.

Cardon, M. S., & Stevens, C. E. (2004). Managing human resources in small organizations: What do we know? Human Resource Management Review, 14(3), 295–323. doi:10.1016/j.hrmr.2004.06.001.

Chang, Y.-Y., & Hughes, M. (2012). Drivers of innovation ambidexterity in small-to-medium-sized firms. European Management Journal, 30(1), 1–17. doi:10.1016/j.emj.2011.08.003.

Cheng, M. M., & Humphreys, K. A. (2012). The differential improvement effects of the strategy map and scorecard perspectives on managers’ strategic judgments. The Accounting Review, 87(3), 899–924. doi:10.2308/accr-10212.

Chowdhury, S. (2011). The moderating effects of customer driven complexity on the structure and growth relationship in young firms. Journal of Business Venturing, 26(3), 306–320. doi:10.1016/j.jbusvent.2009.10.001.

CIMA (2009). Research report: management accounting tools for today and tomorrow. Chartered Institute of Management Accountants. (Available from: http://www.cimaglobal.com/Documents/Thought_leadership_docs/CIMA%20Tools%20and%20Techniques%2030-11-09%20PDF.pdf). Accessed 02 July 2016.

Cooper, D. J., Ezzamel, M., & Qu, S. Q. (2017). Popularizing a management accounting idea: The case of the balanced scorecard. Contemporary Accounting Research, 34(2), 991–1025. doi:10.1111/1911-3846.12299.

Cosh, A. D., Fu, X., & Hughes, A. (2012). Organization structure and innovation performance in different environment. Small Business Economics, 39(2), 1–17. doi:10.1007/s11187-010-9304-5.

Covin, J. G., & Slevin, D. P. (1989). Strategic management of small firms in hostile and benign environments. Strategic Management Journal, 10(1), 75–87. doi:10.1002/smj.4250100107.

Cuerva, M. C., Triguero-Cano, Á., & Córcoles, D. (2014). Drivers of green and non-green innovation: empirical evidence in low-tech SMEs. Journal of Cleaner Production, 68, 104–113. doi:10.1016/j.jclepro.2013.10.049.

Danneels, E. (2002). The dynamics of product innovation and firm competencies. Strategic Management Journal, 23(12), 1095–1121. doi:10.1002/smj.275.

Davila, A., Foster, G., & Li, M. (2009). Reasons for management control systems adoption: Insights from product development systems choice by early-stage entrepreneurial companies. Accounting, Organizations and Society, 34, 322–347. doi:10.1016/j.aos.2008.08.002.

Davila, T., Epstein, M., & Shelton, R. (2012). Making innovation work: how to manage it, measure it, and profit from it. Upper Saddle River: Pearson Education ISBN-13: 978-0-13-149786-3.

De Geuser, F., Mooraj, S., & Oyon, D. (2009). Does the balanced scorecard add value? Empirical evidence on its effect on performance. European Accounting Review, 18(1), 93–122. doi:10.1080/09638180802481698.

De Massis, A., Frattini, F., Pizzurno, E., & Cassia, L. (2015). Product innovation in family vs. non-family firms: An exploratory analysis. Journal of Small Business Management, 53(1), 1–36. doi:10.1111/jsbm.12068.

Dillman, D. A. (2000). Mail and internet surveys: the tailored design method (2 ed). NewYork: Wiley ISBN-13: 978-0-470-03856-7.

Ebben, J. J., & Johnson, A. C. (2005). Efficiency, flexibility, or both? Evidence linking strategy to performance in small firms. Strategic Management Journal, 26(13), 1249–1259. doi:10.1002/smj.503.

Eggers, F., Kraus, S., & Covin, J. G. (2014). Traveling into unexplored territory: radical innovativeness and the role of networking, customers, and technologically turbulent environments. Industrial Marketing Management, 43(8), 1385–1393. doi:10.1016/j.indmarman.2014.08.006.

Eisenhardt, K. M., Furr, N. R., & Bingham, C. B. (2010). Microfoundations of performance: Balancing efficiency and flexibility in dynamic environments. Organization Science, 21(6), 1263–1273. doi:10.1287/orsc.1100.0564.

Evans, J. R. (2004). An exploratory study of performance measurement systems and relationships with performance results. Journal of Operations Management, 22(3), 219–232. doi:10.1016/j.jom.2004.01.002.

Evans, W. R., & Davis, W. D. (2005). High-performance work systems and organizational performance: the mediating role of internal social structure. Journal of Management, 31(5), 758–775. doi:10.1177/0149206305279370.

Fernandes, K. J., Rajab, V., & Whalley, A. (2006). Lessons from implementing the balanced scorecard in a small and medium size manufacturing organization. Technovation, 26(5–6), 623–634. doi:10.1016/j.technovation.2005.03.006.

Freel, M. S. (2000). Strategy and structure in innovative manufacturing SMEs: the case of an English region. Small Business Economics, 15(1), 27–45. doi:10.1023/A:1012087912632.

García-Teruel, P. J., & Martínez-Solano, P. (2007). Short-term debt in Spanish SMEs. International Small Business Journal, 25(6), 579–602. doi:10.1177/0266242607082523.

Garengo, P., & Bititci, U. (2007). Towards a contingency approach to performance measurement: an empirical study in Scottish SMEs. International Journal of Operations & Production Management, 27(8), 802–825. doi:10.1108/01443570710763787.

Garengo, P., & Sharma, M. K. (2014). Performance measurement system contingency factors: a cross analysis of Italian and Indian SMEs. Production Planning and Control, 25(3), 220–240. doi:10.1080/09537287.2012.663104.

Garengo, P., Biazzo, S., & Bititci, U. S. (2005). Performance measurement systems in SMEs: a review for a research agenda. International Journal of Management Reviews, 7(1), 25–47. doi:10.1111/j.1468-2370.2005.00105.x.

Glaser, L., Fourné, S., & Elfring, T. (2015). Achieving strategic renewal: The multi-level influences of top and middle managers’ boundary-spanning. Small Business Economics, 45(2), 305–327. doi:10.1007/s11187-015-9633-5.

Golovko, E., & Valentini, G. (2011). Exploring the complementarity between innovation and export for SMEs' growth. Journal of International Business Studies, 42(2), 362–380. doi:10.1057/jibs.2011.2.

Gong, M. Z., & Ferreira, A. (2014). Does consistency in management control systems design choices influence firm performance? An empirical analysis. Accounting and Business Research, 44(5), 497–522. doi:10.1080/00014788.2014.901164.

Grafton, J., Lillis, A. M., & Widener, S. K. (2010). The role of performance measurement and evaluation in building organizational capabilities and performance. Accounting, Organizations and Society, 35(7), 689–706. doi:10.1016/j.aos.2010.07.004.

Gumbus, A., & Lussier, R. N. (2006). Entrepreneurs use a balanced scorecard to translate strategy into performance measures. Journal of Small Business Management, 44(3), 407–425. doi:10.1111/j.1540-627X.2006.00179.x.

Hervas-Oliver, J.-L., Sempere-Ripoll, F., & Boronat-Moll, C. (2016). Does management innovation pay-off in SMEs? Empirical evidence for Spanish SMEs. Small Business Economics, 47(2), 507–533. doi:10.1007/s11187-016-9733-x.

Hill, C. W. L., & Rothaermel, F. T. (2003). The performance of incumbent firms in the face of radical technological innovation. The Academy of Management Review, 28(2), 257–274 Retrieved from http://www.jstor.org/stable/30040712.

Hoque, Z. (2003). Total quality management and the balanced scorecard approach: a critical analysis of their potential relationships and directions for research. Critical Perspectives on Accounting, 14(5), 553–566. doi:10.1016/S1045-2354(02)00160-0.

Hudson-Smith, M., & Smith, D. (2007). Implementing strategically aligned performance measurement in small firms. International Journal of Production Economics, 106(2), 393–408. doi:10.1016/j.ijpe.2006.07.011.

Ittner, C. D., Larcker, D. F., & Randall, T. (2003). Performance implications of strategic performance measurement in financial services firms. Accounting, Organizations and Society, 28(7–8), 715–741. doi:10.1016/S0361-3682(03)00033-3.

Jänkälä, S., & Silvola, H. (2012). Lagging effects of the use of activity-based costing on the financial performance of small firms. Journal of Small Business Management, 50(3), 498–523. doi:10.1111/j.1540-627X.2012.00364.x.

Jansen, J. J. P., Van den Bosch, F. A. J., & Volberda, H. W. (2006). Exploratory innovation, exploitative innovation, and performance: effects of organizational antecedents and environmental moderators. Management Science, 52, 1661–1674. doi:10.1287/mnsc.1060.0576.

Jones, O., & Macpherson, A. (2006). Inter-organisational learning and strategic renewal in SMEs: Extending the 4I framework. Long Range Planning, 39, 155–175. doi:10.1016/j.lrp.2005.02.012.

Kallunki, J. P., & Silvola, H. (2008). The effect of organizational life cycle stage on the use of activity-based costing. Management Accounting Research, 19(1), 62–79. doi:10.1016/j.mar.2007.08.002.

Kaplan, R. S., & Norton, D. P. (1996). The balanced scorecard. Boston: Harvard Business School Press.

Kaynak, E., & Kara, A. (2004). Market orientation and organizational performance: a comparison of industrial versus consumer companies in mainland China using market orientation scale MARKOR. Industrial Marketing Management, 33(8), 743–753. doi:10.1016/j.indmarman.2004.01.003.

Koufteros, X., Verghese, A., & Lucianetti, L. (2014). The effect of performance measurement systems on firm performance: a cross-sectional and a longitudinal study. Journal of Operations Management, 32(6), 313–336. doi:10.1016/j.jom.2014.06.003.

Koskinen, K. U., & Vanharanta, H. (2002). The role of tacit knowledge in innovation processes of small technology companies. International Journal of Production Economics, 80(1), 57–64. doi:10.1016/S0925-5273(02)00243-8.

Leonard-Barton, D. (1992). Core capabilities and core rigidities: a paradox in managing new product development. Strategic Management Journal, 13(S1), 111–125. doi:10.1002/smj.4250131009.

Lin, Z. J., Yang, H., & Demirkan, I. (2007). The performance consequences of ambidexterity in strategic alliance formations: empirical investigation and computational theorizing. Management Science, 53(10), 1645–1658. doi:10.1287/mnsc.1070.0712.

López, O. L., & Hiebl, M. R. W. (2015). Management accounting in small and medium-sized enterprises: current knowledge and avenues for further research. Journal of Management Accounting Research, 27(1), 81–119. doi:10.2308/jmar-50915.

Lubatkin, M. H., Simsek, Z., Ling, Y., & Veiga, J. F. (2006). Ambidexterity and performance in small- to medium-sized firms: the pivotal role of TMT behavioral integration. Journal of Management, 32(5), 1–27. doi:10.1177/0149206306290712.

Malmi, T., & Brown, D. A. (2008). Management control systems as a package—opportunities, challenges and research directions. Management Accounting Research, 19, 287–300. doi:10.1016/j.mar.2008.09.003.

McAdam, R. (2000). Quality models in an SME context a critical perspective using a grounded approach. The International Journal of Quality & Reliability Management, 17(3), 305–323. doi:10.1108/02656710010306166.

McAdam, R., Antony, J., Kumar, M., & Hazlett, S. A. (2014). Absorbing new knowledge in small and medium-sized enterprises: a multiple case analysis of six sigma. International Small Business Journal, 32(1), 81–109. doi:10.1177/0266242611406945.

McCarthy, I. P., & Gordon, B. R. (2011). Achieving contextual ambidexterity in R&D organizations: a management control system approach. R&D Management, 41(3), 240–258. doi:10.1111/j.1467-9310.2011.00642.x.

Medori, D., & Steeple, D. (2000). A framework for auditing and enhancing performance measurement systems. International Journal of Operations & Production Management, 20(5), 520–533. doi:10.1108/01443570010318896.

Micheli, P., & Manzoni, J. F. (2010). Strategic performance measurement systems: benefits, limitations and paradoxes. Long Range Planning, 43(4), 465–476. doi:10.1016/j.lrp.2009.12.004.

Minnis, M. (2011). The value of financial statement verification in debt financing: evidence from private U.S. firms. Journal of Accounting Research, 49, 457–506. doi:10.1111/j.1475-679X.2011.00411.x.

Nickerson, J. A., & Zenger, T. R. (2002). Being efficiently fickle: a dynamic theory of organizational choice. Organization Science, 13(5), 547–566. doi:10.1287/orsc.13.5.547.7815.

Nørreklit, H. (2000). The balance on the balanced scorecard critical analysis of some of its assumptions. Management Accounting Research, 11(1), 65–88. doi:10.1006/mare.1999.0121.

Nunnally, J. C. (1978). Psychometric theory. New York: McGraw Hill Book Company.

Patatoukas, P. N. (2011). Customer-base concentration: Implications for firm performance and capital markets. The Accounting Review, 87(2), 363–392. doi:10.2308/accr-10198.

Patel, P. C. (2011). Role of manufacturing flexibility in managing duality of formalization and environmental uncertainty in emerging firms. Journal of Operations Management, 29(1), 143–162. doi:10.1016/j.jom.2010.07.007.

Pavlov, A., & Bourne, M. (2011). Explaining the effects of performance measurement on performance. International Journal of Operations & Production Management, 31(1), 101–122. doi:10.1108/01443571111098762.

Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioural research: a critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879–903. doi:10.1037/0021-9010.88.5.879.

Rigby, D., & Bilodeau, B. (2015). Management tools & trends 2015. Bain & Company. http://www.bain.com/publications/articles/management-tools-and-trends-2015.aspx. Accessed 4 May 2017.

Rosenbusch, N., Brinckmann, J., & Bausch, A. (2011). Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. Journal of Business Venturing, 26(4), 441–457. doi:10.1016/j.jbusvent.2009.12.002.

Schjoedt, L., & Bird, B. (2014). Control variables: use, misuse, and recommended use. In A. Carsrud & M. E. Brännback (Eds.), Handbook of research methods and applications in entrepreneurship and small business (pp. 136–155). Northampton: Edward Elgar ISBN:978-0-85793-504-5.

Spithoven, A., Vanhaverbeke, W., & Roijakkers, N. (2013). Open innovation practices in SMEs and large enterprises. Small Business Economics, 41(3), 537–562. doi:10.1007/s11187-012-9453-9.

Srećković, M. (2017). The performance effect of network and managerial capabilities of entrepreneurial firms. Small Business Economics, 1–18. doi:10.1007/s11187-017-9896-0.

Taylor, A., & Taylor, M. (2014). Factors influencing effective implementation of performance measurement systems in small and medium-sized and large firms: a perspective from contingency theory. International Journal of Production Research, 52(3), 847–866. doi:10.1080/00207543.2013.842023.

Tuomela, T. S. (2005). The interplay of different levers of control: a case study of introducing a new performance measurement system. Management Accounting Research, 16(3), 293–320. doi:10.1016/j.mar.2005.06.003.

Van Campenhout, G., & Van Caneghem, T. (2013). How did the notional interest deduction affect Belgian SMEs’ capital structure? Small Business Economics, 40, 1–23. doi:10.1007/s11187-011-9364-1.

Venturini, F. (2015). The modern drivers of productivity. Research Policy, 44(2), 357–369. doi:10.1016/j.respol.2014.10.011.

Vermeulen, P. A. M. (2005). Uncovering barriers to complex incremental product innovation in small and medium-sized financial services firms. Journal of Small Business Management, 43(4), 432–452. doi:10.1111/j.1540-627X.2005.00146.x.

Volery, T., Mueller, S., & Vonsiemens, B. (2015). Entrepreneur ambidexterity: a study of entrepreneur behaviours and competencies in growth-oriented small and medium-sized enterprises. International Small Business Journal, 33(2), 109–129. doi:10.1177/0266242613484777.

Voss, U., & Brettel, M. (2014). The effectiveness of management control in small firms: Perspectives from resource dependence theory. Journal of Small Business Management, 52(3), 569–587. doi:10.1111/jsbm.12050.

Wijbenga, F. H., Postma, T. J. B. M., & Stratling, R. (2007). The influence of the venture capitalist’s governance activities on the entrepreneurial firm’s control systems and performance. Entrepreneurship: Theory and Practice, 31(2), 257–277. doi:10.1111/j.1540-6520.2007.00172.x.

Wouters, M., & Wilderom, C. (2008). Developing performance-measurement systems as enabling formalization: a longitudinal field study of a logistics department. Accounting, Organizations and Society, 33(4), 488–516. doi:10.1016/j.aos.2007.05.002.

Acknowledgements

We acknowledge Margaret Abernethy, Shannon Anderson, Tiago Botelho, Victor Maas, David Naranjo-Gil and the participants of II Research Forum: Challenges in Management Accounting and Control at Seville for their helpful comments. We are also grateful for the comments of conference participants at the 2016 and 2017 European Accounting Association Congress, seminar participants at the Universidad Autónoma de Madrid and attendees of the XXII Workshop on Accounting and Management Control. We acknowledge financial assistance from the Spanish Ministry of Education and Science (ECO2016-77579-C3-3-P).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Appendix 2

Rights and permissions

About this article

Cite this article

Malagueño, R., Lopez-Valeiras, E. & Gomez-Conde, J. Balanced scorecard in SMEs: effects on innovation and financial performance. Small Bus Econ 51, 221–244 (2018). https://doi.org/10.1007/s11187-017-9921-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-017-9921-3