Abstract

Mortgage risk assessment is based on hazard models using data on “seasoned” mortgages, endorsed in previous years. These models assume that the lender’s pricing decision has no effect on the parameters of the hazard function. This paper argues that, when indicators of creditworthiness that can be influenced by applicants have a significant effect on credit cost, applicants behave strategically to influence the information disclosed to lenders. This gives rise to a Lucas Critique in which models generally perform well but occasionally fail because applicants are able and motivated to behave strategically.

Similar content being viewed by others

Introduction

The price and availability of mortgage products depend on estimates of hazard models estimated based on reported characteristics of the applicant including income, assets, credit history, credit score, tenure status, employment type, and stability, etc. The relation between loss and individual characteristics is based on historical correlation and does not reflect deep parameters derived from technology or preference functions. Accordingly, when these models are used to set policy, i.e. to price credit, they are potentially subject to a Lucas Critique.Footnote 1 Specifically, if applicants know that lenders price based on these characteristics and the effect of these factors on credit cost is substantial, rational applicants, or agents who represent them, have a strong incentive to influence the information used to price credit in a manner that has not been captured by the historical correlations used to calibrate the hazard model.

Under normal economic conditions, when employment and housing values are growing, the baseline hazard rate is low. Modest changes in individual characteristics have a small influence on credit costs and the financial incentive for applicants to incur costs to raise their apparent credit worthiness is small. However, in exceptional times when the baseline hazard is high, effects of borrower characteristics on credit cost can be substantial. In such situations, applicants have an incentive to expend effort to influence the characteristics reported to lenders. Hazard models calibrated using mortgages endorsed when the baseline hazard is low will tend to underpredict credit risk in periods when the hazard increases, giving rise to a Lucas Critique of the stability of the model predictions during these periods.

Modeling credit risk in mortgage lending is a daunting task. Accordingly, the literature has adopted a practice of substantial simplification. For example, the competing hazard model of prepayment and default based on the seminal work of Deng et al. (2000) is used in both research and by lenders for pricing and underwriting. In practice, lenders generally adopt pricing and screening designs based on performance of past mortgages often using the results of a competing hazards model of default and prepayment (Avery et al., 2000; Einav et al., 2013). These estimators assume that both loan terms requested, and reported borrower characteristics are invariant to lender pricing decisions. As a consequence, many models of the mortgage securitization process ignore the possible role that applicant choices and signaling have in the data generating process. At a minimum, there is a common assumption, as in Ragan, Seru, and Vig (2015), that some applicant characteristics represent “hard information”, i.e. they are observed accurately at low cost. Information on other characteristics, “soft information”, is observed after paying a fee. Neither type of information is controlled by applicants. In sum, there is a substantial literature on credit risk in mortgage lending that assumes the applicant has no control over the characteristics that are reported on the loan application, on the loan terms selected, or on the choice of lender. In some cases the lender or an intermediary may influence soft information but this is not part of the applicant’s choice function. This will be termed the “inert applicant” assumption.Footnote 2

Other research has assumed that applicants choose mortgage terms, particularly down payments, term to maturity, and points, in a rational, self-interested fashion. These will be referred to as “rational applicant” models. However, these rational applicant models generally limit the degree of applicant rationality to a single mortgage characteristic and not to applicant characteristics used in underwriting. This has the virtue of making empirical analysis more tractable. Examples of this type of constrained rational applicant research abound. Models of prepayment routinely assume, and the empirical evidence confirms, that applicants select mortgage products based on their expected holding period and the size of prepayment penalties, or the lender’s point-rate tradeoff. The mass point of loans with an LTV of 0.8 is commonly understood to reflect applicant responses to the notch in pricing created by the mortgage insurance requirement.Footnote 3 It has been known for some time, see Barth, Cordes, Yezer (1980) or Maddala and Trost (1982), that as the expected probability of default rises, an applicant’s choice of LTV and term to maturity rise. Rational applicant modeling can even be extended to incentives for mortgage fraud. Carrillo (2011) has used the rational applicant approach in designing a successful test for detecting fraudulent borrower behavior.

In terms of economic theory, the applicant can be viewed as participating in an environment in which the information received by the lender can be manipulated. This suggests that models of the mortgage market include an opportunity for applicant signaling not unlike models commonly applied to labor markets.Footnote 4 Labor market models recognize that job seekers manipulate the characteristics revealed to employers, and college applicants incur costs to improve their grades or test scores.Footnote 5 Recently Frankel and Kartik (2019) have suggested that the signaling literature can apply to credit markets, and credit scores specifically, in what they term the muddled information model. This model has inspired the approach taken here in which mortgage applicants are assumed to be informed rather than inert. Consequently, credit scores along with other applicant characteristics presented to lenders are assumed to be muddled information.

The next section reviews empirical evidence, both direct and indirect, of strategic behavior by informed applicants regarding several aspects of the mortgage contracting process. One unusual aspect of the research in this paper is that much of the most credible empirical evidence supporting the theoretical model has been published, but not used to support a general theory of signaling, muddled information or strategic behavior. The third section provides a theoretical model, based on the signaling and muddled information literature, of strategic applicant behavior. The model is specifically adapted to the issue of credit scores manipulation in response to lenders using hazard models to price credit.

The theoretical model generates testable hypotheses regarding applicant responses to changes in lender policies. One hypothesis has already been observed empirically. Keys, et. al. (2010) test the effects of imposition of a securitization rule of thumb. They find, just as predicted by the model of strategic applicants developed here, that the predictive power of credit score is eliminated in the region of the imposed rule of thumb. The second hypothesis requires a new empirical test. There has been research on the change in borrower credit scores after mortgage origination. However, the specific hypothesis implied by the theory, and tested for the first time here, is that the partial derivative of the change in credit score, after origination, holding characteristics of the loan, borrower, and housing location constant, varies directly with the tradeoff between credit score and APR observed at origination. This is the first attempt to test this hypothesis regarding strategic manipulation of credit scores by applicants. A final section concludes with implications for the use of hazard models and the inclusion of new variables in credit scoring models.

Stylized Facts Indicating Strategic Applicant Behavior

Much of the evidence of strategic applicant behavior has already appeared in the literature but it has not been organized into a Lucas Critique of the current approach to mortgage lending. This section begins with the literature on under prediction of mortgage losses even when ex post information on actual conditions was used to make the estimates. This is followed by a review of recent empirical research that demonstrates strategic behavior of mortgage applicants in choice of mortgage terms and/or in information revealed to the lender. These examples supplement the obvious cases involving choice of mortgage terms well known in the literature. For example, applicant willingness to accept prepayment penalties or pay points is based on their expectation of prepayment as well as the pricing of prepayment penalties and points. Another common example is the mass point in requested LTV at the level (typically 80%) which is necessary to avoid mortgage insurance.Footnote 6 These traditional indications of strategic applicant behavior have been extended in recent empirical research.

Failure of Competing Hazard Models to Predict Default

A Lucas Critique requires documentation of model failure to establish that the model parameters are not deep and invariant to policy. The literature examining the ex-post performance of default models over the period after 2006 identifies two stylized facts. First, Bhardwaj and Sengupta (2015) report that the inverse relation between credit score and other credit quality variables and default held. Second, a number of papers, beginning with Haughwout, Peach, and Tracy (2008) find that models substantially under-predicted default even when the actual change in house prices, along with other actual characteristics of the market, were used to forecast default. For example, An, et. al. (2012) fit a competing hazard model for mortgages endorsed in 2003 and use it to forecast defaults in the 2006 vintage subprime stock. They under-predict defaults by up to 40%. Kau, et. al. (2011) also report that the parameters of default model estimates varied significantly over time and by type of mortgage during this period.Footnote 7 An, et. al. (2021) describe this as a shift in the propensity to exercise the default option that is not captured in estimates of the standard hazard model. They estimate the importance of the structural shift in default rates as equivalent to the effect of the large decline in house prices on default during the housing crisis. Most recently, Haughwort, Tracy, and van der Klaauw (2018) have characterized this instability in loan performance models as a vintage effect. Taken together papers noted above have demonstrated that something has caused instability in the default models used to price mortgage credit. The reasons for this instability, such as the Lucas Critique raised here, have not been advanced.

Given that these models are estimated on massive data sets using maximum likelihood techniques, the problems in forecasting default of mortgages endorsed after 2005, when actual future values are substituted into the models, are remarkable. First, the partial effects of credit risk parameters still hold, i.e. default rates vary directly higher debt burdens and inversely with credit scores, but the level of default associated with these parameters is far higher than forecast when realized values are substituted into the predictive equations. How could such sophisticated methods retain their relative predictive power but be so wrong in assessing the overall level of losses? This is not a problem created by exotic new mortgage products because this literature deals with prime mortgages.

The basis of the Lucas Critique raised here is that the assumption of inert applicant behavior underlying the competing hazards estimator is responsible for the instability of the parameter estimates. The theoretical model in the next section will demonstrate how such failure to perform can come about when applicants react strategically to mortgage pricing based on default models calibrated on using seasoned mortgages. When the baseline hazard rate is low and stable, the incentive for applicants to invest in signaling effort is both stable and modest so that the models perform well. However, in rare periods where the baseline hazard rises and lenders price individual indicators of credit risk more aggressively, applicants are motivated to enhance the information conveyed to lenders and this rising in applicant signaling alters the relation between reported characteristics and default losses.

Before turning to the theory that relates the form of the hazard function to applicant signaling behavior, it is useful to review the many individual instances of strategic behavior that are well established in the empirical literature and only lack a general theoretical model to unite them. The examples of strategic applicant behavior noted below cover a wide range of possibilities. Some are perfectly legal responses to incentives produced by lender price rationing. Others may rise to the level of civil fraud depending on state law. Finally there is organized criminal fraud. In discussing these examples, issues of violation of civil or criminal law are not considered. For the purposes of this paper, these are all examples of strategic applicant behavior in response to the manner in which lenders choose to price mortgage credit.

Adverse Applicant Selection in Response to Lender Products and Pricing

A significant strand of the theoretical literature on non-price rationing in credit markets assumes that applicants choose lenders strategically. The rational for expecting a separating rather than pooling equilibrium in credit markets, stemming from seminal work by Stiglitz and Weiss (1981), is based on informed applicants selecting among lenders based on price and the probability of rejection.

There are examples of results in the empirical literature that support the principle of applicant selection. Garmaise (2013) reports that the distribution of risk in the applicant pool changed significantly in ways that were not easily detected using standard underwriting variables after a lender offered new option-arm loan products. This selection effect resulted in a substantial increase in losses on non-option arm products offered by the lender.

The experience of lenders after the introduction of low-documentation loans provides a nice experiment in selection effects. In full documentation lending, income, assets, and employment are “verified” by the lender. At the other extreme, the no documentation product omits income, assets, and employment from the application and lenders rely almost exclusively on credit score and LTV. Based on a host of recent papers, the opportunity to omit full disclosure at the cost of higher interest rates is selectively attractive to applicants who are more likely to default. Of particular interest, is the finding by Paley and Tzimouis (2011) that default rates are higher on loans where the applicant initiated the request for lower documentation. Ambrose et al. (2016) confirm this result and find evidence that income exaggeration is larger when applicants could have provided documentation. Finally, Lacour-Little and Yang (2013) report that their measure of income exaggeration is positively related to default probability. These and other papers demonstrate that adverse selection into reduced documentation products is systematically related to default risk and that applicants reveal information about income, and assets strategically.

Occupancy Fraud

Occupancy fraud is a straightforward illustration of strategic applicant behavior in response to lenders who use estimates from hazard models to support risk-based pricing. Statistical default models estimated for lenders who did not price occupancy predicted lower rates of default for mortgages on owner-occupied properties. Lenders relying on these models naturally reacted to this empirical result by pricing the higher credit risk associated with rental properties. Specifically, they raised interest rates for loans on investor properties above those for owner occupants. This generated an incentive for occupancy fraud.

Griffin and Maturana (2016) and Elul and Tilson (2015) both detect substantial amounts of occupancy fraud on mortgages endorsed at the onset of the financial crisis. Griffin and Maturana (2016) report that there was no interest premium paid by investors which indicates that loan officers were not aware of, or at least did not charge more for, occupancy fraud. The default rate on loans with occupancy fraud was significantly higher than that for either legitimate owner loans or investor loans. Thus, those investors most likely to default were differentially attracted to occupancy fraud. Bayer, et al (2020) find that entry of flippers and speculators may exacerbate occupancy fraud. The misrepresentation of occupancy status is a strategic response to the pricing innovations by lenders using models estimated on data before the pricing innovation which necessarily assumed that applicants were inert rather than strategic.Footnote 8

Early Payment Default (Fraud for Profit)

Early payment default (EPD) is generally based on default within the first year. A portion of EPDs, particularly loans on which borrowers made fewer than three payments, are likely fraudulent, i.e. default is intentional. Such planned defaults can be part of a criminal enterprise that may also involve appraisal fraud. The Federal Bureau of Investigation distinguishes fraud for profit as a separate type of criminal enterprise and the (2011) Mortgage Fraud Report estimates fraudulent mortgage volume at over $25 billion for 2006. Carrillo (2011) finds that early payment defaults had a loan to value ratio of 99% and sold at a 3.5% premium to estimated market value. He then shows that they were locally concentrated and significantly related to particular real estate offices.

Fraud for profit became easier when lenders allowed low documentation loans, particularly in states where deficiency judgments are not allowed. While the initial experience with “low doc” loans was favorable, applicants reacted strategically to the “light” underwriting practices in a way that raised credit risk on these loan products well above initial statistical estimates. Furthermore, once applicants plan EPD, their response to the loan terms offered by lenders changes dramatically. Fraudulent borrowers chose mortgage terms strategically. They are not concerned with payment burdens, particularly payment burdens that increase over time, i.e. in teaser rates. Higher interest rates do not price them out of the market. Instead they wish to minimize initial equity because that is lost upon default. This clearly violates the fundamental assumption in competing hazard models that the choice of loan terms is not influenced by the applicant’s expected probability of default.Footnote 9

Income and Asset Falsification

Income plays an important role in the pricing of and qualification for mortgage credit. Detecting income falsification is difficult. The accepted technique involves comparing the distribution of income reported by mortgage applications in a restricted area with what is known about that distribution from alternative sources. Mian and Sufi (2009) use this technique and find an unusual, inverse, relation between income growth in census tracts and stated income for mortgagors during the 2002 to 2005 period. Blackburn and Vermilyea (2012) compare income reported in HMDA data with incomes of homebuyers in the AHS. They find that these incomes were comparable until 2005–2006 when the HMDA incomes rose 20% above those on the AHS. Basiri and Mahmoudi (2021) find income misstatement in Canada in response to rising housing price and relate misstatement to elevated levels of subsequent default. These studies are consistent with the hypothesis that incomes of mortgage applicants were increasingly overstated after 2002.

Asset falsification has also proved difficult to measure. It is detected by indirect inference. Garmaise (2015) infers differences in falsification probabilities from the bunching of reported assets above thresholds. He then finds significantly elevated levels of delinquency on these loans identified by the bunching algorithm. All his observations are from 2004 to 2008 so it is not possible to determine if asset falsification was lower in earlier periods. While some may regard this evidence as far from conclusive, it is at least suggestive that substantial income and asset falsification occurred in the period leading up to the rise in defaults in 2007. The incentive for this falsification by rational applicants is likely related to the use of debt-to-income ratios that determine the cost and availability of credit.

Appraisal Inflation

Inflated appraisals are important when an organized criminal enterprise undertakes EPD fraud. In addition, the important role of loan-to-value ratio in mortgage pricing provides an incentive to have appraisals meet certain targets. Concern with appraisal bias is not new. LaCour-Little and Malpezzi (2003) document the problem in loans made in Alaska in the 1990’s. They find that positive appraisal errors were associated with higher rates of default.

Griffin and Maturana (2014) consider a large sample of loans originated from 2002 to 2007. They estimate that 45% of these loans had appraisal overstatements of at least 5% of estimated value. They find that: the appraisal overstatement rate rose over the 2002 to 2007 period. The rate was positively associated with default rates. However, the rate was not associated with the level of loan documentation, and was inversely associated with credit score. At credit scores above 700, they report that default rates for mortgages with appraisal overstatement are not higher than for cases where the appraisal was accurate or too low. Finally the association between inflated appraisals and interest rates charged is weak indicating that lenders failed to price, because they were not aware of, the high appraisals.

Are applicants aware of appraisal bias? The studies reviewed above do not test for the role of applicants in appraisal bias. If applicants are unaware of appraisal bias, the deception likely causes them to overpay for properties. Alternatively, if they are aware, applicants benefit from higher appraisals because they lower the LTV used to price the loan, thereby decreasing the potential for private mortgage insurance fees and increasing the likelihood of loan approval. Accordingly, appraisers may be responding to the preferences of rational applicants. Belief that appraisal bias could have been a factor in the financial crisis led to the passage of the Home Valuation Code of Conduct (HCVV). Recently Agarwal et. at. (2016) have demonstrated that implementation of the HVCC substantially lowered the fraction of overstated appraisals.

Unreported Second Liens

Second liens added considerably to credit risk during the financial crisis. If these liens are reported, they should not bias estimates of default probabilities provided by models estimated using combined loan-to-value data. Failure to disclose a second lien clearly biases estimates because it systematically understates the total loan-to-value ratio. The second lien is an applicant choice motivated by a response to the lender’s mortgage pricing, including the mortgage insurance requirement.

In some cases, loan originators are aware of the silent second because both the primary and secondary instruments are provided by the same lender. There are cases in which both the applicant and the originator cooperate to deceive investors who were relying on their own hazard models of credit risk. For purposes of the arguments in this paper, it is immaterial whether the failure in predictions of the hazard model is at the level of the originator or the investor. Applicants, perhaps aided by the realtors, appraisers, and/or loan officers respond to the pricing of combined loan-to-value (CLTV) by resorting to silent seconds. Clearly, the assumption underlying hazard models of default, that applicants would not strategically avoid disclosure of the true CLTV by resorting to silent seconds, was misplaced.

Griffin and Maturana (2016) report that the frequency of silent seconds varies inversely with credit score. In the case of fully documented loans, it falls close to zero as credit score approaches 700 and even for low documentation loans it is barely significant for those with credit scores in this range. Thus the probability of silent seconds is closely related to creditworthiness as indicated by credit score. Piskorski et al. (2015) find that their measure of undisclosed second liens rises with FICO and with the extent of documentation. Both studies find strong evidence that loan officers were aware of the seconds. Approximately two thirds of the loans with silent seconds had both the primary and secondary loan from the same lender. Presumably the loan originator was aware of this misrepresentation and the underwriter may have been informed. This type of misrepresentation may be prompted by the relation between originators and the secondary market, but it requires the active cooperation of the applicant and needs to be understood with a model that includes the rational applicant as a participant.

Conclusions from this Literature Review

The empirical papers discussed above identify individual instances in which applicants respond strategically to specific incentives provided by lender pricing or underwriting behavior. This response results in systematic underestimation of default and loss. However, these papers stop short of claiming that applicants are fully strategic or of relating the findings to general problems associated with reliance on hazard models. Instead, they focus on a single loan characteristic or piece of information supplied by applicants. The forcing variable being tested is generally either binary as in the cases of owner occupancy, prepayment penalties, mortgage insurance, homeownership, or silent seconds, or has a simple relation to mortgage pricing as in income, asset, or appraisal errors. In most cases, no formal theory is provided and/or the theory does not offer a connection between the use of hazard models to price credit and applicant signaling.

The next section presents a formal model of rational applicant signaling in response to mortgage pricing and underwriting criteria that extends the literature in three ways. First, it involves applicant efforts to modify what is generally regarded as the hardest of hard information, her credit score. Second, credit score has a continuous relation to the pricing of mortgage credit. Third, the relation between credit score and pricing as well as between efforts to raise score and the resulting increase in that score are both highly non-linear. Credit scores are limited from above and their effects on interest rates are similarly limited from below. These properties are convenient in both theoretical modeling and subsequent empirical testing. However, the theoretical analysis provided here could easily be applied to the cases of strategic behavior in the literature reviewed above. In such cases applicants have incentives to manipulate other types of information used by lenders to price mortgage credit.

The model includes a rational for lenders continued use of hazard models to price credit. Applicant signaling efforts are limited during periods when the baseline hazard risk is low. Only in isolated periods where the baseline hazard risk rises significantly does applicant signaling behavior cause substantial model failure.

Model of Signaling by Rational Applicants

Frankel and Kartik (2019) have proposed a signaling model in which agents have “natural” actions and “gaming ability” which jointly determine the signals that they produce. One possible application of the model is to credit scores although it could apply to other elements of mortgage applicant signaling discussed in the previous section. The model proposed here is specifically adapted to the case of mortgage lending as practiced by major lenders. Specifically lenders estimate credit risk using a proportional hazards model and assume that applicants do not respond to pricing decisions based on that model.

Applicants maximize utility by minimizing the cost of credit in response to lender attempts to price credit risk using a credit scoring scheme applying the results of a standard competing hazards approach to predicting default. No attempt is made here to explain why lenders use hazard models to evaluate credit risk or price loans. The behavior of lenders is based on reality, not on theory.Footnote 10 This model identifies implications for the interaction between strategic applicants and lenders using standard approaches to mortgage pricing.

Credit Supply by Lenders Engaged In Full Price Rationing

The probability of default is estimated by lenders using a competing hazard model calibrated based on past lending experience. The hazard is the product of a baseline hazard function, B, and a function of individual borrower characteristics, P. Given the focus on the role of credit score in this section, the expected loss function is simplified to depend only on credit score and the baseline hazard.Footnote 11 The general form of the lender’s expected default function is:

where e is expected loss probability, s is a credit score, z is a vector of exogenous market conditions that determine the baseline hazard.Footnote 12

Both P(s) and B(z) are convex functions. They are necessarily positive lying on the 0 – 1 interval which means that their product is convex and also lies on that same interval. Equation (2) arises logically when lenders use a proportional hazard model to estimate default risk. These models have a baseline hazard, for the worst risks. The baseline hazard is shifted by changes in z. Consider the case in which z = z* and the baseline credit score is 550. Assume P(550)B(z*) = 0.040 is the current baseline hazard for applicants with credit scores of 550. A typical hazard model might estimate default risk for similar applicants with a credit score of 700 as 30% of the baseline hazard or P(700)B(z*) = 0.012. Given the form of the proportional hazard model, if the value of z falls to z’ (e.g. future house price expectations fall), the baseline hazard might rise to P(550)B(z’) = 0.08, but the estimated probability of default for otherwise similar applicants with scores of 700 would only rise to P(700)B(z’) = 0.024. Note that changes in the baseline hazard in this illustrative case have nothing to do with individual credit score or with the rate of decrease in the default hazard with credit score. Because of the form of the hazard function, the effect on credit risk is proportional. Therefore, the absolute effect on interest rates used to price credit risk is proportional to the initial level of credit risk. In this example, assuming a simple mapping from risk estimates to interest rates, if the rate charged to borrowers with a 550-credit score rose by 40 basis points due to the fall in z, rates for borrowers with a 700 score would rise only 12 basis points. Put another way, d2e/dsdz > 0 and d3e/dsd2z < 0 which implies that the relation between s and p becomes less convex as z rises and B(z) → 0. The fact that the relation between credit score, s, and the expected loss probability becomes more convex as z falls and the baseline hazard rises is central to the novelty of the argument regarding the incentives for applicant signaling being made here.

The general proposition that, at high rates of house price appreciation, the marginal effects of differences in borrower characteristics have little effect on expected default losses is well known. Gorton (2010) and Foote, et al. (2012) have observed that rising house prices were responsible for making careful documentation of borrower characteristics optional and hence prompting the introduction of low documentation products.

Lenders in a competitive industry engaged in risk-based pricing evaluate individual applicants and set the note rate according to:

where io is a rate charged when default risk is zero. Totally differentiating (2), the properties of the credit supply function follow in a straightforward fashion.

This provides an incentive for accepted applicants to expend effort and funds to raise s and qualify for mortgage credit at a lower interest rate. Finally, (3) has the property that the convexity of credit supply as a function of s falls as z rises, d3i/d2sdz < 0 due to the multiplicative nature of the hazard function. The relation in Eq. (2) is commonly observed empirically on loan pricing sheets of lenders as well as in the literature.

Choice by a Rational Applicant

In models of inert applicants this section would be blank. In these models, either applicants are assumed to be passive or to lack the information and technology needed to alter the individual characteristics that determine the value of s. Even in models where applicants can choose among lenders, they, along with any advisors that they employ, are assumed to be technologically or intellectually incapable of adjusting to the supply behavior of lenders. The difference in the rational applicant approach is that applicants are equipped with a technology in the form of a cost function that allows them to modify the information set used by the lender to evaluate their application. In Frankel and Kartik (2019) this technology is called “gaming ability” and is distributed randomly and independently from the natural score of this individual. The approach here is different because it is specialized to the mortgage underwriting process. Here all applicants are assumed to have access to the same technology for credit management. Although individual applicants may differ in their financial knowledge they have access to professionals, particularly realtors and mortgage brokers who can assist in enhancing credit score and other components of the lender’s underwriting scorecard. However, applicants are heterogeneous in that their natural credit scores differ which provides diversity in both the cost of credit score enhancement and its benefits.

The technology available to applicants is summarized by a credit score opportunity function of the following form:

where s is the final credit score on the application, c is a measure of the cost to the applicant of actions that can be taken to raise an individual’s credit score and s* is the individual’s natural credit score which would be observed by the lender if c = 0, i.e. s = s* and 0 = S(0; s*). Following the muddled markets model, the natural score is the credit score that would be observed if the applicant believed that incurring costs to raise their current score would have no effect on the cost of credit. This is observationally similar to the notion of rational ignorance in which the applicant believes that the benefit from improvements in credit score are too small to warrant the effort. One important element of cost may be opportunity cost of the time necessary to raise scores which varies directly with the urgency of obtaining mortgage credit.

The general nature of the S(c; s*) function is based on the empirical literature, particularly Avery et. al (2010), which has characterized the properties of credit scoring and default equations. First, the marginal cost of raising credit scores above the “natural” or current level is always positive, Sc > 0. Second, the cost increases at an increasing rate because small improvements in scores may be achieved by simply correcting errors in the credit report or making payments promptly. However, large improvements require significant changes in financial condition including paying delinquent accounts and hiring firms that provide credit counseling services. Thus, Scc < 0, the credit score improvement function is concave. It is more costly to raise a credit score that is already high because most opportunities to raise the score have been exhausted and there is an upper limit on scores so that Scs* < 0 and Sc → 0 as s* → smax, the credit score limit. The marginal cost of increasing credit score is lowest for those with initially low scores who are seeking a small increase. Overall, the marginal cost is much larger for a large improvement in a low score or a modest increase in a score that is already high.

The applicant’s objective is to minimize the cost of mortgage credit recognizing the true nature of the lender’s pricing policy.

where θ is a conversion factor designed to annualize the up-front cost of credit score enhancement into an interest cost equivalent. First order conditions for choosing c to minimize the cost of credit are easily interpreted as marginal benefit equaling marginal cost.Footnote 13

Second order conditions indicate that this solution, if it exists, is a minimum.Footnote 14 However, there is no guarantee that an internal solution which satisfies (6) exists. This leads to the following proposition:

Proposition (1):

As B(z) → 0 or s* → smax optimal c = 0 and the applicant reports her natural credit score, s*.

The proof is evident from Eq. (6) because as B(z) → 0 marginal benefit on the left side of (6) approaches zero and as s* → smax marginal cost on the right side of (6) becomes infinite. The finding that individuals whose natural credit scores are high do not exert significant effort to raise their scores further is not remarkable. Credit enhancement efforts should be concentrated among those with low scores where Sc is large. However, the effect of variation in the pricing response to changes in the baseline hazard is a new result and gives rise to the Lucas Critique of current underwriting and pricing policies.

The applicant’s decision to expend effort to change her credit score in response to lender risk-based pricing is demonstrated in Fig. 1. The figure illustrates behavior of two otherwise identical applicants with either high or low initial credit scores. The marginal benefit schedule is the savings in credit cost from an increase in credit score, i.e. – PsB(z), and the marginal cost schedule is the cost of achieving that increase in scores, θ/Sc. Marginal benefit and cost have natural limits, at zero and infinity because, as s becomes sufficiently large, both Ps and Sc approach zero. There is a single marginal benefit schedule assuming that the two applicants are observationally equivalent except for their initial credit scores.Footnote 15 The lender only observes the final credit score and is unaware of c.

Proposition 1

follows logically. For those with low initial credit scores illustrated by the solid curves in Fig. 1, marginal benefit initially exceeds marginal cost. These applicants achieve an internal maximum net benefit from efforts to raise their scores at the point s* + Δs*. The initial excess of marginal benefit over marginal cost at low levels of s is due to the height of the marginal benefit schedule as lenders aggressively price ration at the low end of the creditworthiness spectrum. For those with low credit scores the cost of credit falls sharply as credit score increases. Those with initially high credit scores face the same solid marginal benefit schedule but have different marginal cost shown by the dashed line in the figure. These high score applicants reach a corner solution at c = 0 and Δs’ = 0. They make no attempt to raise their credit scores artificially because marginal benefit is always less than marginal cost, i.e. Ps is very small for those with high credit scores, and 1/Sc is large because it is difficult to raise scores that are already high (and limited from above by a ceiling).

Effects of a Fall in the Baseline Hazard

Next, consider the effect of changes in economic conditions, z, on the choice of c for applicants who have optimal c > 0. A rise in z, perhaps due to increased house price appreciation, has no effect on the marginal cost schedule. However, it shifts the entire marginal benefit schedule down as di/ds = − Ps B(z) falls because d2i/dsdz = − Ps Bz < 0. This fall in the marginal benefit schedule of applicants induces them to lower their efforts to raise credit scores, lowering the optimal s compared to the natural s*. For some applicants this will drive them to a corner solution where c = 0 while others will choose less c because the marginal cost schedule is not altered by changes in the baseline hazard.

Proposition 2:

Optimal c is a decreasing (increasing) function of any argument, z, that lowers (raises) the baseline hazard rate.

The first order condition in (6) shows marginal benefit of c varies inversely with z while marginal cost is invariant. Thus, in periods when price rationing is less aggressive, the marginal benefit schedule will fall and the return to raising credit scores will decline. Figure 2 illustrates the effect of a rise in z on the behavior of the low credit score borrower who initially opted to invest substantial effort to raise her credit score in Fig. 1. At the higher level of z, the marginal benefit schedule falls and becomes less convex while marginal cost remains unchanged. The result is that efforts to raise credit score are reduced and the final increase in credit score falls from ΔsLow z to ΔsHIgh z.

The underlying characteristics of the applicant, particularly the natural credit score, have remained constant. From the point of view of the econometrician estimating the hazard model, both the baseline hazard and the risk premium associated with credit score appear to have fallen as applicants with lower credit scores seem to be better risks but this is simply an artifact of their strategic reaction to the change in the marginal benefit of efforts to raise credit score. Higher rates of house price appreciation appear to lower credit risk both by lowering the baseline hazard and by reducing the incentive to raise credit scores. Under these circumstances, even those with low credit scores experience small returns to efforts to raise their scores.

Implications for Lenders

The theory has implications for lenders engaged in risk-based pricing who use hazard models which, of necessity, are estimated using credit risk experienced on mortgages endorsed previously and seasoned long enough for default experience to accumulate. If the relation between underlying borrower creditworthiness and credit score varies with the aggressiveness of price rationing, the borowing cost associated with an observed credit score will depend on the degree of risk pricing employed by lenders at the time of origination. That is, the data generating process for defaults and losses depends on marginal benefit of that effort, – Ps B(z) at the time of origination. The validity of models to forecast losses depends on whether the future values of this marginal benefit to credit score enhancement are the same as those in the past.Footnote 16

During periods when z and the other determinants of the baseline hazard are relatively stable, hazard models forecast losses well because the incentive to raise scores is constant. Risk based pricing justified by the results of hazard models appears to work well in stable markets. When housing prices rise more rapidly than usual, credit risk declines both because of the direct effect of z on default and because incentives to raise credit scores fall so that, applying Proposition 2, the creditworthiness of individuals with low scores appears to rise. This leads to lower pricing of credit risk and a further decline in incentives to enhance credit scores. All seems well in the industry until z falls and lenders react by raising the cost of credit risk. Then, by Proposition 2, this induces applicants to expend additional effort to raise credit scores in a manner that invalidates the loss predictions of the models. Thus, the theory presented here predicts that hazard models estimated using data on mortgages endorsed when house prices are rising and the baseline hazard is low will under-predict losses in a subsequent period when house prices are flat or falling and lenders attempt to price the rising baseline hazard as noted in Ragan et. al. (2010, 2015).

Lenders Engaged in Non-Price Rationing Based on Credit Score

Lenders routinely engage in non-price rationing, i.e. deny credit or force applicants into a different product category, based on perceptions of overall creditworthiness. In response to such supply behavior, applicants can respond by lowering lender perceptions of default risk along a number of dimensions, including raising down-payments, securing cosigners, identifying additional income or assets, lowering monthly credit payments, and, given the model presented here, raising credit scores. Because there are many margins open to the applicant seeking to qualify for a particular loan product, raising their credit score as the primary response would depend on the relative cost among various alternatives and would not likely lead to testable implications.

Given that the purpose of this subsection is to establish testable implications of the theory, it focuses on the special case in which lenders impose a minimum credit score below which applicants are rejected for a class of attractive mortgage products. This situation is shown in Fig. 3 where there is a low limit for credit scores that is non-binding for the applicant and another high limit that is binding. The minimum credit score constraint is displayed as an increment above the current natural credit score, s*. Clearly a minimum score below s* has no effect even if the applicant is inert. For a rational applicant with the marginal benefit and cost curves shown on Fig. 3, the minimum credit score shown at sL is also not binding because, in the absence of this limit, applicants would raise their credit scores to s* + Δs > sL.

However, if the limit is set at sH > s* + Δs, it is binding. A rational applicant must either expend greater effort to raise her score although marginal cost exceeds marginal benefit or consider alternative financing. The applicant has alternatives, including not getting a mortgage, not considered in this analysis. She must compare the net benefit of the next best alternative with the current choice that is producing the baseline hazard associated with the marginal benefit and cost curves shown in Fig. 3. The applicant will expend extra cost to meet the higher minimum credit score if the net benefit of the current alternative mortgage product and terms associated with the solution at s* + Δs minus the net loss associated with meeting the credit limit, which is the area between the marginal cost and benefit curves noted ψ on Fig. 3, still exceeds the value of her best outside alternative credit option. If this is the case, she will improve her credit score to meet or just exceed the minimum. Otherwise, she will pursue alternative financing at other lenders or alternative products at the same lender.

Other rational applicants for whom the credit score limit is binding will make similar calculations and the result will be that, while some will choose alternatives, there will be a mass point of credit scores just above the minimum which includes a large group of applicants whose credit scores were significantly below the limit prior to being raised. The selection effect among those applicants who invest heavily to raise their scores is rather different in the presence of the credit score limit. Recall that in the absence of a limit there is little incentive for fraudulent borrowers or those with short expected holding periods to incur the costs of raising scores because the θ parameter is small so marginal benefit is low. But, if these applicants have few attractive outside options, note that they have a strong preference for high LTV, they are far more likely to justify expenditures to raise their scores.

Thus, a minimum credit score limit tends to produce two observable outcomes. First, a mass of mortgages with credit scores just above the limit. Second, a much higher than expected rate of default on the mortgages just above the limit because these applicants include substantial numbers of individuals whose reported score is elevated significantly above their natural credit score. This artificial shift of credit scores should produce a concentration of credit risk just above the minimum score. If this effect is large enough, it could reverse the fundamental predictive power of these scores, i.e. it could reverse the normal monotonic relation between credit scores and default loss as losses above the limit after its imposition would exceed those below the limit observed before it was observed. Thus, one prediction of the theory is that the relation between credit score and default can be reversed among the group of mortgages endorsed just above and below a minimum score requirement.

Evidence of Applicant Credit Score Manipulation

Three types of evidence are offered here in support of the rational borrower model. First, and most obvious is the reality of a credit score improvement industry. Second, is the reported change in credit risk and predictive power of credit scores around thresholds imposed on credit score needed to qualify for some mortgage products. Third, is an ambitious new attempt to relate the steepness of an estimated marginal benefit curve to the subsequent change in credit scores after the mortgage is endorsed, i.e. a direct test of Proposition 1.

Existence of a Commercial Credit Score Enhancement Industry

A simple web search under the title “improve my credit score” yields thousands of “proven” methods that applicants are advised to use. Many of these sites are maintained by government agencies and non-profit organizations to provide applicants with advice on ways to raise scores. Others are advertisements from commercial firms that promise to raise scores for a fee.

One technique, “piggybacking,” has been identified as particularly effective. Avery et. al. (2010) provide an excellent analysis of the market for “piggybacking” in which authorized users are added to credit cards for a fee.Footnote 17 This technique was apparently sufficiently effective and important to prompt recent attempts to restrict its use. Mortgage credit provides a very large incentive for this activity because of the importance of scores for pricing and acceptance. Commercials touting systems for boosting credit scores produced by the score enhancement industry appear in major media. Clearly a credit enhancement industry exists.

Reaction to a Minimum Threshold Credit Score

One of the theoretical predictions of the model of rational applicants presented in the previous section has already been observed in the literature although it has not been related to models of rational applicants. Adoption of a minimum threshold credit score in order to be eligible for a particular type of loan product was predicted to create a mass point of lending just above the threshold and a disruption in the normal monotonic relation between credit scores and default.

Keys, et al. (2010) discuss a natural experiment called the securitization rule of thumb model. Securitized low-documentation loans needed a FICO score of 620 while 600 was required for full documentation loans. They report the distribution of loans by FICO score around these points and there is a clear break at these critical points with the number of loans rising significantly just past the threshold. They then find that, for low (high) documentation loans, the rate of default was higher in the 620–625 (600–605) range than in the 615–619 (595–599) interval. This reversal of the relation between credit score and default was attributed to lax underwriting standards on loans destined to be securitized. These stylized facts have been confirmed in a number of papers although Bubb and Kaufman (2014) have recently offered an alternative origination rule of thumb model.

While there may be some truth in the securitization rule of thumb and the origination rule of thumb models, the model of rational applicants developed here also predicts both loan bunching above the threshold and the inability of credit scores to predict default in the region just above the threshold. The rational applicant model predicts that, if the interval above the breakpoint is given favorable treatment by lenders, a fraction of those applicants with scores below the interval use the resources described above to “artificially” raise their scores above the threshold. These are individuals for which the area of ψ in Fig. 3 is particularly large. Upward migration of these individuals whose natural scores are significantly lower will artificially raise default experience above the threshold just as observed in the previous literature.Footnote 18

It is interesting to note the close analogy between the effect of imposing a credit score threshold and the case of occupancy fraud reported by Griffin and Maturana (2016). Investors who misreported occupancy had higher default rates than compliant investors, those who engage in credit score manipulation may also be selected to be worse risks from among those with lower initial credit scores. This extra selection effect, could be worthy of additional study beyond the model presented here. Because of their low θ, fraudulent applicants will only invest in credit score manipulation in order to exceed a threshold. Accordingly, it may be that credit score manipulation, which is one factor that promotes bunching at the thresholds, tends to be most attractive to applicants who are more likely to default. The combination of this possible adverse selection effect and the simple effect of manipulating low to high scores produces an expectation that default will rise with credit score over the interval of scores surrounding the threshold.

A new test for manipulation as a reaction to use of scores to price credit risk

This section presents a new test for strategic manipulation of credit scores in response to pricing incentives. The reason that this test has not been attempted previously is that credit score manipulation is very difficult to observe and to distinguish from permanent changes in behavior. It is possible that the prospect of homeownership itself can inspire fundamental changes in creditworthiness that raise scores permanently without any manipulation. The challenge here is to formulate a test to detect the transitory component of credit score manipulation that is related to the financial incentives presented by the lender’s credit supply schedule.

The test for rational credit score manipulation in response to score-based pricing implemented here first requires an estimate of the relation between scores and interest rates. Based on previous estimates, this relation is expected to be very nonlinear with the interest rate discount approaching zero as credit scores exceed 725. The challenge here is to estimate interest rate variation as a function of scores facing individual borrowers. It is also necessary that this tradeoff vary over time or across lenders so that the reaction of applicants to different patterns of tradeoff between scores and rates can be examined. This means that the data should be generated over a period in which the baseline hazard is rising so that relation between credit worthiness in general and credit scores in particular is changing and the primary reason for these changes, according to the model presented above is variation in the baseline hazard.

The second challenge is to observe credit score manipulation produced by the relation between scores and interest rates. This is difficult because credit scores change continuously for a variety of reasons. Given that housing purchase or even refinancing is a major financial transaction, undertaking such action could indicate significant changes in the circumstances of applicants that would alter credit scores without being motivated by the prospect of influencing the cost of credit. The finding that scores rise in the period before mortgage application could indicate manipulation caused by a perception of rate discounts or it could be the result of a host of other changes in household circumstances associated with homeownership and/or the mortgage transaction. Accordingly, the test for score manipulation based on interest rate discounts adopted here does not rely on the change of scores in the period before mortgage application. Instead, it relates the effect of scores on the cost of credit at origination to the subsequent change in credit score after the mortgage is origination. The hypothesis is that manipulated credit scores are transitory and hence applicants whose scores were artificially raised in anticipation of achieving interest rate discounts will tend to decline in the time after the mortgage is endorsed. To distinguish credit score change after origination due to the tradeoff between APR and score at origination, a host of other regressors including score at origination, loan characteristics, applicant characteristics, and neighborhood characteristics are forced into the credit score change equation. The hypothesis being tested is that there is positive relation between credit score decline after origination and the estimated ARP-score tradeoff at origination holding constant the effects of all other observable factors on credit score change including characteristics of the loan, applicant, and neighborhood.

Data Used in the Empirical Testing

The two tests discussed above place significant constraints on the data used for empirical testing. First it is necessary to observe the partial effects of credit score on the price of mortgage credit that is salient to applicants over a time period where this tradeoff or implicit benefit of score improvement is changing. The period selected was 2005 through 2008 and the location was the state of Florida because the rate of house price appreciation peaked in 2005, and by 2008 housing prices were depreciating rapidly. This pattern mimics the effect of changes in z in the theory section and should have given rise to a sharp increase in marginal benefit of raising credit score. This hypothesis is confirmed by the estimation results displayed in Table 1. These results were obtained by estimating a mortgage APR pricing equation using proprietary data on 51,591 mortgages originated in Florida from 2005 through 2008 by nine large mortgage lenders. The estimating equations that produce the relation between APR and mortgage terms are shown in Table A3. These results were produced at the request of the authors by Rajeev Darolia who had access to the underlying data. The focus on APR is based on the belief that it is the single most salient indication of the cost of mortgage credit that must be disclosed to borrowers. Given that the test performed here involves the reaction of applicants to credit pricing, it is important that price comparisons be based on perceptions of borrowers when they apply for credit.

The second data set involves the change in credit score for borrowers 12 and 24 months after the mortgage was originated. The credit score data, for the state of Florida, includes a panel of nearly 7 million observations of roughly 270 thousand individual mortgage borrower’s FICO scores issued over the observation period. The loan level data is from a sample prepared by Black Knight Financial Services, (formerly, LPS Applied Analytics), that represents the servicing reports on individual loans reported by participating lenders. Observed loans have been issued between January, 2005 and December, 2008. The sample is restricted to first lien mortgages used for the purpose of purchase or refinance of the owner-occupied residence. Each observation includes the FICO score at origination and at different points into the horizon.Footnote 19

Estimating the Relation Between Credit Scores and Interest Rates

The first objective of this section is to estimate the partial relation between mortgage interest rates and credit scores holding other elements of credit risk constant. Essentially this involves measurement of – Ps B(z) using the massive sample of mortgages endorsed in Florida by 9 major lenders discussed above. The estimates relate APR to the credit score as well as other characteristics of the loan. There may be other factors that are related to risk that were ignored by these lenders, but the hard data factors used in loan pricing were collected and retained by the lender and are available for use in the estimation. Clearly the exact relation of APR and credit score can vary daily, so that what is obtained empirically here is an estimate of the average tradeoff offered to any given applicant during a given year.

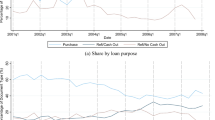

The second objective of this section is to explore the possibility that the pattern of price rationing, i.e. the shape of the di/ds relation, changed over time. In particular, for those at the lower end of the credit score spectrum, the effect of credit score on APR is expected to increase over the 2005 to 2008 period as lenders respond to an increase in the baseline hazard and attempt to price that risk by raising the tradeoff between credit risk and APR. The model in the previous section predicts that this increase should generate a response by rational applicants who would then increase their efforts to raise credit scores.

Estimates of the APR equation are achieved using ordinary least squares and a “laundry list” of variables available in the mortgage data. Given that these variables are taken from lenders files, they should reflect the arguments of the credit pricing function used by those lenders. The effect of credit score on APR is expected to be convex given the nature of the hazard function used to estimate credit risk. A stepwise linear function is used to allow for the substantial non-linearity in this relation incorporating a series of score dummies at twenty-point intervals. The estimating equation is given by:

where fji is a vector of loan terms such as LTV, ski is a vector of credit score dummies, zli is a vector of other variables reflecting borrower characteristics, α, β, π, ρ are parameters to be estimated and ε is an iid error term. Estimation of mortgage pricing equations like (7) is common in the literature and the overall results are consistent with expectations.Footnote 20

Table 1 contains summary results showing the relation between credit score and APR over each annual period from 2005 through 2008 as well as the entire sample period. Given the stepwise linear functional form, the effect of score on APR is simply the difference in the estimated coefficients across intervals. Table 1 confirms the expectation that di/ds is quasi-convex with the function essentially flat as the credit score exceeds 730. Additionally, there are significant variations in the slope of the function over time. Standard errors for these parameters in the 2005 through 2007 regressions range from 2 to 5 basis points. The estimates show that, over this period, the relation between credit score and APR became more convex in response to perceptions that the baseline hazard was increasing.Footnote 21

The results in Table 1 can be used to compute the marginal benefit to applicants from raising their credit score based on their credit score at origination. This is not the same as the ideal measurement of the benefit to applicants based on their score before they contemplated application because the initial or “natural” credit score is not observed. Ideally one would observe the weekly rate sheets of the specific lender dealing with each applicant. The difference between this rate sheet and the estimated relation between APR and credit score is one of several possible sources of measurement error in the marginal benefit from improved credit score computed from the results in Table 1. Accordingly, it is likely that there is significant attenuation bias in the parameter estimate used to test for effects of marginal benefit to be discussed in the next section. The bias introduced by this measurement error works against confirming the hypothesis that applicants are behaving strategically.

Test for Manipulation in Response to the Estimated Apr – Score Tradeoff at Origination

The theory section developed a model which predicted that applicants with the greatest incentive to raise their credit scores based on the consequent fall in APR would be most likely to do so. The previous empirical section provided a mechanism for estimating the expected fall in APR associated with a borrower whose credit score was in a particular range. Taken together these two sets of results imply that it is possible to identify the applicants who are most likely to have invested effort and funds to raise their credit scores above their natural level before applying for a mortgage. Credit scores could change in the months before origination of the mortgage for many reasons other than manipulation designed to achieve a lower APR. A rise in credit score to a level that is permanently higher in the years after origination is likely a permanent rather than transient change designed to lower mortgage credit cost.

To the extent that there is an incentive to raise scores artificially to lower the cost of mortgage credit, once this advantage is gained, households are more likely to allow the scores to fall back to their “normal” level. In terms of the theory and in contrast to expectations based on simple mean reversion, this suggests credit scores that were initially lower, and faced the largest tradeoff between score and APR, should fall furthest post origination. Mean reversion should hold for the highest scores, but be completely reversed for those homebuyers whose initial credit scores were low because these scores have the largest return from manipulation.

For each mortgage, it is possible to compute the change in credit score over the first and second year after origination, Δs1 and Δs2, and to relate this change to the initial credit score and terms of the mortgage, location factors, and to changes in the housing market where the unit was located. In addition to all these factors which might influence changes in the credit score, the theory of strategic applicant behavior predicts that the estimated slope of the relation between APR and credit score that motivated the applicant to artificially raise her score at application, will then explain the reversion to the applicant’s “normal” score. A larger financial incentive to artificially raise the score before applying should produce a larger fall in score after origination. Of course, the ideal measure of the incentive to raise scores would be to observe the rate sheet of the lender serving each applicant. Instead, the marginal benefit computed in the previous section is based on the estimate of ΔAPR/Δs obtained using the estimation results from the data for the year that the mortgage was endorsed.

The resulting equation for the change in credit score over time, estimated by ordinary least squares for different years, has the general form:

Here Δsti is the change in credit score over t = 1, 2 years after origination, fji is a vector of loan terms associated with the mortgage at origination, (ΔAPR/Δsi) is the estimate of the slope of the marginal benefit curve facing the applicant at origination, Mkti is a vector of variables at time t characterizing the market area k in which the housing unit is located, α, β, φ, and ρ are parameters or vectors of parameters to be estimated, and εti is an error term for applicant i at time t.

The loan terms in the vector fji include, initial FICO score, appraised value, LTV ratio, interest rate, debt-to-income ratio, and a dummy for LTV = 0.80 (indicates likely presence of a second mortgage).Footnote 22 The current housing market characteristics in the Mkti vector are the percent Hispanic and black population in the census tract where the property is located, whether there had been any delinquent payments on the mortgage, whether the mortgage was current, whether the mortgage had terminated due to prepayment or default, the current interest rate, and an estimate of the current LTV which serves as an indicator of the current value of the put option.Footnote 23 Descriptive statistics for these variables, globally and disaggregated by year, along with a full set of estimated results for Eq. (8) are given in Tables A4 through A7.

While the theory presented here has no implications for most of the parameters in Eq. (6), there is a prior expectation for φ based on the theoretical model. Perhaps for this reason, this is the first time that estimates of the equation system represented by (7) and (8) have appeared in the literature. The model of rational, informed applicant behavior and endogenous credit scores predicts that Δsti should be negative and significant for those applicants for which (ΔAPR/Δsi) is also negative and numerically large. Accordingly, φ should be positive and significant. The estimation results in Table 2 indicate that φ is never negative and generally positive and significant as expected. Estimates in the first column pool across years. This provides the greatest variation in the marginal benefit from improving credit scores. Given the substantial potential for classical measurement error bias associated with matching the loan pricing schedule estimates with individual borrowers and the consequent problem of attenuation bias, this result is rather remarkably robust.Footnote 24

Based on these results, it appears that borrowers in the data during this test period were behaving strategically. Those with the most to gain from artificially raising their credit scores, generally those with the lowest initial scores, had their credit scores fall by the largest amount over the one and two-year periods following origination.

This result contrasts with the normal expectation based on stochastic processes and public policy initiatives supporting homeownership. Mean reversion implies that the lower scores should be the most likely to rise and the highest most likely to fall. Public policy has promoted homeownership among those households who are least creditworthy on the presumption that it has beneficial effects on their welfare. Presumably plunging credit scores are not regarded as beneficial. Therefore, both the implications of stochastic processes and public policy would predict that homeownership should have a positive effect on the credit scores of homebuyers whose scores at application were low.

Clearly, this view is not supported in the data. However, the fall in credit scores found here does not contradict either stochastic or public policy expectations of rising scores. Furthermore it does not indicate a failure of the work done by credit scoring bureaus. Rather it reflects yet another process, strategic behavior by mortgage applicants, that has not previously been considered and which appears from the estimates to be sufficiently large to overwhelm the processes that would normally raise credit scores of applicants whose initial scores were below the mean.

V. Summary and Conclusions.

This paper began with the simple observation that the current literature is divided into papers that assume applicants do not behave strategically, the inert applicant assumption, and others that have identified strategic applicant behavior, the rational applicant assumption. Generally, the rational applicant assumption has been associated with specific instances of elevated default risk ranging from income or asset exaggeration, and appraisal bias, to ownership fraud. Until recently, the credit score has been regarded as hard information, not subject to manipulation. However, even that has changed, because a recent theoretical model has illustrated the possibility of adapting a signaling model to reported credit scores.

The first contribution of this research is to collect the empirical literature on different types of rational applicant behavior, ranging from exaggeration of income, assets, appraised value, etc. to fraud. Second, a model of signaling behavior by rational applicants who have access to a technology for enhancing their apparent creditworthiness above their natural rate is formulated. The theory is inspired by Frankel and Kartik’s (2019) muddled information but specialized to the particular institutions found in mortgage lending including the reliance on historical estimates of the determinants of credit risk from a competing hazards model. While the theory is used to model the case of credit score enhancement, it could easily be adapted to other items in which disclosure by applicants has both a natural component and gaming opportunity. Third, the theory is validated by appealing to a variety of empirical evidence ranging from the reality of a credit enhancement industry to the observed failure of credit scoring to reflect default rates in the region above a notch in credit supply, to a completely new test suggested by the theory. This new empirical test finds that, in spite of the attenuation bias created by classical measurement error and the forces of mean reversion, applicants who have a stronger financial incentive to enhance their score above the natural rate, are more likely to have scores fall in the years after origination.

These contributions have important implications. First, research that treats the credit score as hard information and blames changing default losses on originators alone may be ignoring a significant contribution to credit risk from applicant signaling behavior. Second, the general presumption that applicants fail to behave strategically is called into question. Third, and most significant, is the interaction between strategic applicants and lenders pricing credit risk based on conventional hazard models. In periods when the baseline hazard is low, the return to investing in credit enhancements, including improved credit scores, will be low. Accordingly, applicants will provide information that reflects their natural characteristics. When lender expectations change and the baseline hazard rises, the effect on mortgage pricing will be to raise the return to credit enhancement. This, of course will induce an applicant response that supplements natural information with credit enhancement efforts. These efforts undo the predictions of the credit risk model. Given that re-estimation of these models takes years because change in mortgage credit risk takes years to manifest itself, the consequence is that lenders will experience losses that exceed estimates based on the credit risk models that were estimated assuming that applicants are inert. This failure of default models has been chronicled in the literature. Based on the theory and empirical results here, it appears that current loan pricing based on hazard model estimates is subject to a Lucas Critique in which models underpredict losses at the most crucial time when the baseline hazard is rising. The scenario identified here will likely occur again after a period of pricing based on low baseline hazards is followed by a period of rapidly rising baseline hazards that prompt more aggressive pricing of credit risk.

Finally, the theory has implications for attempts to add new variables to credit scoring models. Given that these new variables have not been used to price credit, there has been no incentive for applicant signaling. Accordingly, the new variables may predict loss well when applied to historical data. This does not mean that these new variables will function well when they are implemented in pricing schemes in situations where the baseline hazard is high enough so that pricing effects are significant and applicants have an incentive to augment their natural signals to improve their apparent creditworthiness. The same Lucas Critique argument that applies to existing credit risk models applies equally to attempts to extend the models by adding new variables, particularly if applicant signaling cost for the new variables is low. For example, it may be that prompt payment of utility bills predicts default well when this information is not used to price mortgage credit. However, if this information is then used to price mortgage credit, informed applicants may react to the ability to raise scores by changing their attitudes toward payment of utility bills. Of course, they will tend to change behavior precisely at times when the baseline hazard rises and the marginal benefit of changing behavior is largest.

Data Availability

The data used to generate the results in this paper are proprietary and are not available for public access or distribution by the authors.

Notes

The term Lucas Critique of basing policy on macroeconomic models estimated using historical time series by Lucas (1976) is now widely applied to instances of model failure. Rajan, Seru, and Vig (2010) first apply it to default models where estimation problems are based on omitted variable bias which distorts pricing in secondary markets. They assume applicants are heterogeneous but inert and that credit scores are not malleable. The model presented here considers the possibility that applicants are rational and credit scores can be manipulated.

Inert applicants could be generated by several processes. They could lack information on the lending process, or have single peaked preferences for mortgage products and terms and lack the ability to alter the personal characteristics, either through deception or manipulation, on the loan application. Later this paper presents substantial evidence that none of these circumstances characterize applicants entirely.

The literature on appraisal bias suggests that appraisers may play an independent role in creating mass points in the distribution of LTV.

See, for example seminal paper by Spence (1973).

The recent college admissions scandal in the U.S. suggests that some applicants, or at least their parents, are even willing to go beyond legal means to influence the admissions process. Similar fraudulent behavior has also been document among mortgage applicants.