Abstract

This paper assesses the value of the availability of menus of different selling mechanisms to agents in an online platform in the context of scarce perishable goods. By analyzing the choice between auctions and posted prices in the context of National Football League tickets offered on eBay, it estimates a structural model in which heterogeneous, forward-looking sellers optimally choose which selling mechanism to use and its features. Counterfactual results suggest that sellers would experience an average 87.37% decrease in expected revenues if auctions were removed and just a 4.34% decrease if posted prices were. In turn, buyers would benefit from an auction-only platform since the expected number of transactions would increase and expected transaction prices would decrease. These results suggest that while sellers benefit from menus of different selling mechanisms, the same does not hold for buyers. Thus, the implications for a platform, which should take into account both sides of the market, are ambiguous.

Similar content being viewed by others

Notes

On eBay, start prices are the price at which bidding starts, acting effectively as a public reserve price, while reserve prices are private and only disclosed if bids are submitted. Since reserve prices are rarely binding in my data, I will ignore them and use only start prices, referring to them as reserve prices instead.

These are all eligible games because there are 256 regular season games in total, but Washington Redskins (8) and International Series (3) games were excluded.

For an introduction to this topic, see, for example, Rogerson et al. (2005).

This set is the same as the one offered by eBay, so that \(\mathbb {L}=\{1,3,5,7,10\}\).

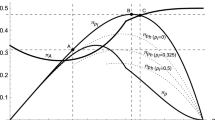

A random variable, V, that follows a Rayleigh distribution with parameter σ2 has the following probability density function: \(f(v)=\frac {v}{\sigma ^{2}}\exp \left \{-\frac {v^{2}}{2\sigma ^{2}} \right \}\) and its cumulative distribution function is \(F(v)=1-\exp \left \{-\frac {v^{2}}{2\sigma ^{2}} \right \}\).

These levels are interactions between upper, club, and lower levels with sideline, corner, or end zone seats, as well as a VIP category.

For example, if seller j enters ten days before the game, chooses a three-day auction that is not successful, followed by a posted-price listing in the next two days, and then exits the market without selling the tickets, then Tj = {5, 6, 7, 10}.

It is important to note that this approach is not as efficient as possible because predicted prices are not matched to the observed ones.

See, for example, chapter 10 in Train (2009).

Determining the existence of such an equilibrium, even when seller choices are exogenous, is a complicated task. See Maslov (2020b) for an example.

Ideally the process would be based on the seat numbers being offered as they would make the creation of chains trivial. Unfortunately this information was rarely available, a difficulty also faced by Leslie and Sorensen (2014).

References

Ackerberg, D.A. (2009). A new use of importance sampling to reduce computational burden in simulation estimation. Quantitative Marketing and Economics, 7(4), 343–376.

Athey, S., & Haile, P.A. (2002). Identification of standard auction models. Econometrica, 70(6), 2107–2140.

Backus, M., & Lewis, G. (2020). Dynamic demand estimation in auction markets. Working paper, Columbia University.

Bauner, C. (2015). Mechanism choice and the buy-it-now auction: A structural model of competing buyers and sellers. International Journal of Industrial Organization, 38, 19–31.

Bhave, A., & Budish, E. (2018). Primary-market auctions for event tickets: Eliminating the rents of “Bob the Broker”. Working paper, University of Chicago.

Board, S., & Skrzypacz, A. (2016). Revenue management with forward-looking buyers. Journal of Political Economy, 124(4), 1046–1087.

Bodoh-Creed, A.L., Boehnke, J., & Hickman, B. (2021). How efficient are decentralized auction platforms? Review of Economic Studies, 88(1), 91–125.

Caldentey, R., & Vulcano, G. (2007). Online auction and list price revenue management. Management Science, 53(5), 795–813.

Coey, D., Larsen, B.J., & Platt, B.C. (2020). Discounts and deadlines in consumer search. American Economic Review, 110(12), 3748–3785.

Courty, P. (2003). Some economics of ticket resale. Journal of Economic Perspectives, 17(2), 85–97.

Cullen, Z., & Farronato, C. (2020). Outsourcing tasks online: Matching supply and demand on peer-to-peer internet platforms. Management Science, forthcoming.

Eeckhout, J., & Kircher, P. (2010). Sorting versus screening: Search frictions and competing mechanisms. Journal of Economic Theory, 145(4), 1354–1385.

Einav, L., Farronato, C., & Levin, J. (2016). Peer-to-peer markets. Annual Review of Economics, 8, 615–635.

Einav, L., Farronato, C., Levin, J., & Sundaresan, N. (2018). Auctions versus posted prices in online markets. Journal of Political Economy, 126(1), 178–215.

Einav, L., Kuchler, T., Levin, J., & Sundaresan, N. (2015). Assessing sale strategies in online markets using matched listings. American Economic Journal: Microeconomics, 7(2), 215–247.

Etzion, H., & Moore, S. (2013). Managing online sales with posted price and open-bid auctions. Decision Support Systems, 54(3), 1327–1339.

Etzion, H., Pinker, E., & Seidmann, A. (2006). Analyzing the simultaneous use of auctions and posted prices for online selling. Management Science, 8(1), 68–91.

Goettler, R.L., & Gordon, B.R. (2011). Does AMD spur Intel to innovate more? Journal of Political Economy, 119(6), 1141–1200.

Gowrisankaran, G., & Rysman, M. (2012). Dynamics of consumer demand for new durable goods. Journal of Political Economy, 120(6), 1173–1219.

Hammond, R.G. (2010). Comparing revenues from auctions and posted prices. International Journal of Industrial Organization, 28(1), 1–9.

Hammond, R.G. (2013). A structural model of competing sellers: Auctions and posted prices. European Economic Review, 60, 52–68.

Hendricks, K., & Sorensen, A. (2018). Dynamics and efficiency in decentralized online auction markets. Working paper, University of Wisconsin.

Huang, G. (2020). Selling-mechanism design for peer-to-peer lending platforms: Multiunit uniform-price dynamic auctions vs. posted price. Working paper, Purdue University.

Hummel, P. (2015). Simultaneous use of auctions and posted prices. European Economic Review, 78, 269–284.

Julien, B., Kennes, J., & King, I.P. (2001). Auctions and posted prices in directed search equilibrium. Topics in Macroeconomics, 1(1), 1–16.

Kultti, K. (1999). Equivalence of auctions and posted prices. Games and Economic Behavior, 27(1), 106–113.

Lee, C.-Y., Roberts, J.W., & Sweeting, A. (2012). Competition and dynamic pricing in a perishable goods market. Mimeo, Duke University.

Leslie, P., & Sorensen, A. (2014). Resale and rent-seeking: An application to ticket markets. Review of Economic Studies, 81(1), 266–300.

Maslov, A. (2020a). Competition in online markets with auctions and posted prices. Working paper, Central Michigan University.

Maslov, A. (2020b). A note on buyers’ behavior in auctions with an outside option. Games, 11(3), 26–34.

Myerson, R.B. (1981). Optimal auction design. Mathematics of Operations Research, 6(1), 58–73.

Myerson, R.B. (1998). Population uncertainty and Poisson games. International Journal of Game Theory, 27(3), 375–392.

Nair, H.S. (2007). Intertemporal price discrimination with forward-looking consumers: Application to the US market for console video-games. Quantitative Marketing and Economics, 5(3), 239–292.

Rogerson, R., Shimer, R., & Wright, R. (2005). Search-theoretic models of the labor market: A survey. Journal of Economic Literature, 43(4), 959–988.

Selcuk, C. (2017). Auctions vs. fixed pricing: Competing for budget constrained buyers. Games and Economic Behavior, 103, 262–285.

Song, U. (2004). Nonparametric estimation of an eBay auction model with an unknown number of bidders. Mimeo, University of British Columbia.

Sun, D. (2008). Dual mechanism for an online retailer. European Journal of Operational Research, 187(3), 903–921.

Sweeting, A. (2012). Dynamic pricing behavior in perishable good markets: Evidence from secondary markets for Major League Baseball tickets. Journal of Political Economy, 120(6), 1133–1172.

Sweeting, A. (2013). Auctions vs. fixed prices vs. both: Mechanism choices for perishable goods. Mimeo, Duke University.

Sweeting, A. (2015). A model of non-stationary dynamic price competition with an application to market design. Mimeo, University of Maryland.

Sweeting, A., & Sweeney, K. (2015). Staggered vs. simultaneous price setting with an application to an online market. Mimeo, University of Maryland.

Talluri, K., & van Ryzin, G. (2004). The Theory and Practice of Revenue Management. Berlin: Springer.

Train, K.E. (2009). Discrete Choice Methods with Simulation. Cambridge: Cambridge University Press.

Wang, R. (1993). Auctions versus posted-price selling. American Economic Review, 83(4), 838–851.

Wei, Z., & Lin, M. (2017). Market mechanisms in online peer-to-peer lending. Management Science, 63(12), 4236–4257.

Zeithammer, R., & Adams, C. (2010). The sealed-bid abstraction in online auctions. Marketing Science, 29(6), 964–987.

Zeithammer, R., & Liu, P. (2006). When is auctioning preferred to posting a fixed selling price? Mimeo, University of Chicago.

Zhang, H. (2020). Prices versus auctions in large markets. Economic Theory, forthcoming.

Ziegler, A., & Lazear, E.P. (2003). The dominance of retail stores. NBER working paper 9795.

Acknowledgements

I am hugely indebted to my advisors, Harikesh Nair, Brad Larsen, and Han Hong for constant guidance and support. Several conversations with Isa Chaves, Liran Einav, Pedro Gardete, Jon Levin, Guido Martirena, and Andy Skrzypacz substantially improved this study. I am especially thankful to Tom Blake and Dimitriy Masterov for great aid with the data and several helpful discussions throughout this project. I have also benefited from comments by Lanier Benkard, Vivek Bhattacharya, Tim Bresnahan, Matt Gentzkow, Brett Gordon, Wes Hartmann, Ken Hendricks, Kevin Hutchinson, Jim Lattin, Gordon Leslie, Sarah Moshary, Paulo Somaini, Nico Pierri, Navdeep Sahni, Stephan Seiler, Anna Tuchman, Milena Wittwer, and Frank Wolak, as well as audiences at several schools and conferences. Finally, I thank the editor, Günter Hitsch, and two anonymous referees for their detailed comments and feedback. Part of this work was conducted while I was a non-paid consultant to the economics team at eBay Research. Financial support from the Stanford Institute for Economic Policy Research through a dissertation fellowship is gratefully acknowledged. All mistakes are mine.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Sample construction

I describe here in detail the procedure I used to create the chains of listings described in Section 2. The key information used to create the chains consists of the number of tickets being offered, the game they corresponded to, and the section and row where the seats were located. This information is key for two reasons. First, the linking process to track the same set of tickets over time is based exclusively on them.Footnote 12 Second, these variables allow me to identify the price of these tickets on the primary market, which yields a measure of their quality.

The first step is obtaining information on the game corresponding to a given listing, which is often available in a standardized fashion. When this is not the case, I obtained this information from the title or subtitle of the listings. When these are not informative, the dates in which listings were created by the sellers are ordered to potentially fill in this missing information. I also make use of this procedure to correct listings for tickets that were created after the games they corresponded to had taken place, which were usually instances in which the seller corrected the information shortly after. When this was not the case, sellers just removed the listing within a few days indicating that they were erroneous and possibly the result of automatic re-listing.

Of the valid listings with information regarding the game to which the tickets corresponded, around 97% also had information on number of tickets and section and row where the tickets were located. To fill in the missing information I use the listing’s title or subtitle. I also verify whether sellers had offered multiple listings for the same team at the same location and whether the listings with missing information were created and terminated in between listings with complete information. This procedure was also useful to correct instances in which the information was erroneous, either because the section and row numbers were exchanged or because the information did not conform with what was reported on the title or subtitle.

With this information in hand I define as potential chains of listings combinations of different seller-game-section-row quadruples. I then identify instances in which listings within the same chain are created before the previous one was over. These cases are inspected and classified into five scenarios. First, multiple chains at the same location offered by the same seller. This is done based on information on the titles, complete sales, and other chains by the same seller. Cases in which the seller creates two identical listings across all dimensions at virtually the same time are assumed to be for different tickets. The second scenario is reorganization of quantities, or rebundling. For example, turning a single listing for four tickets into two listings for two tickets each. Third, listings which were removed within a day and recreated shortly after are assumed to be mistakes and deleted. The final two scenarios concern listing the same set of tickets more than once concurrently, which I call doublelisting.

I classify doublelisting scenarios into two cases. The first is separation across quantities: for example, having a listing for four tickets and, at the same time, two separate listings for two tickets each. This is again cross-checked with the seller’s history of listings and their outcomes. Returning to the example from the previous paragraph, if both a two-ticket and four-ticket listings are sold then they were for different sets of tickets, while if the four-ticket one is sold and the other two two-ticket listings are then removed from the website it suggests that the same tickets were listed twice. Finally, the second case consists of listing the same set of tickets through different mechanisms. I verified these cases according to the same procedure that I employed in the previous case.

At the end of this procedure I obtain a sample of 38,520 sets of tickets, which were offered across 78,863 listings. However, the analysis will be restricted to activity within four weeks of a game. This restriction is not extreme: in this period, almost 61% of tickets were introduced to the market, more than 70% of tickets were available at the website, and more than 67% of the transactions observed in the data took place. The resulting sample contains 27,047 sets of tickets across 43,215 listings. This subsample is used to construct the measures of market tightness and of potential demand on the platform at every point in time. To estimate the model, I drop the 293 listings, spread across 226 chains, that do not have information on the number of tickets, type of tickets, or section or row where tickets were located. I further restrict the sample to tickets that were always offered as a pair and were never rebundled or doublelisted. Therefore, the final sample is smaller, containing 19,174 pairs of tickets over 28,257 listings. Nevertheless, pairs are the most common bundle offered (more than 74% of listings).

Appendix B: More mechanisms

I now document patterns relative to mechanisms that were not explicitly considered in the main text: auctions with an immediate purchase option, also known as buy-it-now (BIN) or hybrid auctions, and bargaining-enabled posted prices. First, Fig. 8 shows which among the four options sellers choose across time. Hybrid auctions are not as popular as regular auctions until the week of the game, possibly because the additional flexibility they yield becomes more attractive closer to the deadline, when buyers seem to be relatively less willing to participate in auctions. In turn, despite being the default option for posted prices, bargaining-enabled listings only become slightly more prevalent within two weeks of the game, possibly due to their additional flexibility akin to hybrid auctions.

A different consideration is if and how prices are chosen differently across these mechanisms. Figure 9 displays the choice of start prices for regular and hybrid auctions, posted prices with and without the bargaining option, and buy prices for hybrid auctions. It is interesting to note that hybrid auctions consistently have higher start prices than regular ones, which could be a consequence of sellers with higher outside options self-selecting into the hybrid format. Moreover, posted prices with a bargaining option are consistently higher than those without it, possibly because sellers anticipate a potential negotiation that would likely reduce the final agreed upon price. Finally, it is interesting to note that buy prices in hybrid auctions are often higher than posted prices regardless of whether bargaining is available to buyers.

A final consideration is whether buyers make use of this richer set of mechanisms. First, it is interesting to note that despite being slightly more prevalent than regular auctions, hybrid auctions are less likely to convert, possibly because of higher start and buy prices, as displayed in Fig. 9. In addition, just a little more than 15% of successful hybrid auctions were actually sold via buy prices, in part because when the reserve price is met the buy-it-now option goes away. Similarly, bargaining-enabled posted prices are more commonly used than regular posted prices, but have a lower conversion rate. Furthermore, even though almost half of the bargaining-enabled listings were involved in negotiations at some point, less than 30% of these were sold at a negotiated price. These numbers show that abstracting from these more detailed, hybrid mechanisms is not a dramatic simplification.

Appendix C:: Derivation of expected utility and profit functions

I now derive the expected utility and profit functions from Section 3.

1.1 C.1 Expected utility from auctions

For ease of notation I will ignore the subscripts. Assume that a buyer with original valuation v is matched on day t with an auction with reserve price r, end date τ, Poisson arrival rate λ, and characteristics x. Conditional on v ≥ r and on the number of opposing bidders being n, the buyer’s expected utility from the auction is:

The number of opposing bidders, n, is unknown to the buyer. As demonstrated by Myerson (1998), the Poisson distribution yields environmental equivalence: the number of opposing bidders from a buyer’s perspective will follow the same distribution as the one guiding the overall arrival of bidders. Hence, summing over all realizations of n:

1.2 C.2 Expected utility from posted prices

Now assume that buyer i with valuation v is matched with a posted price with price p such that v ≥ p and arrival rate λ. If the number of opposing buyers is zero, a purchase is made. If there is one opposing buyer, with 50% probability i is called first and makes a purchase and with 50% probability i is called second and purchases because the other buyer’s valuation is below p. Thus, applying this to all realizations of n yields:

1.3 C.3 Computing choice-specific value function for auctions

I now describe how the choice-specific value functions for auctions (\(\tilde {\pi }_{jt}^{A_{\ell }}\)) were computed. To ease notation I will drop the subscripts for seller (j), date when the auction started (t), and auction length (ℓ), as well as the superscript indicating that an auction was chosen (k = A).

To calculate \(\mathbb {E}\left [\max \limits \{V^{(N-1:N)},r\}\right ]\), I first re-write the seller’s payoff using analogous equivalences from static auction theory. First, for any number of bidders n, any reserve price r, and any seller continuation value, π0, it follows that revenue can be expressed as  . Hence, the expected payoff from an auction is given by:

. Hence, the expected payoff from an auction is given by:

First, I compute the second term in the right-hand side of (C.1). It follows that, if bidders arrive according to a Poisson distribution with parameter λ,

To compute the first term in the right-hand side of (C.1) first note that if N ≤ 1, then r ≥ VN− 1:N with probability one. For these two values the expression simply is:

Finally, consider now the case when N > 1. In particular, for any n and r it follows that:

The two terms in (C.4) are now evaluated separately, beginning with the first in the right-hand side. Remember that due to properties of order statistics it follows that Fn− 1:n(r) = nF(r)n− 1 − (n − 1)F(r)n. Thus,

Now I compute the expectation over N of the second term in the RHS of (C.4):

where the first equality follows from Fubini’s theorem, the second from properties of order statistics, the penultimate from a change of variables in which x = λ[1 − FV(y)], and the last from the Rayleigh distribution which was assumed. The last integral, defined as ξ, is solved via Gauss-Chebyshev quadrature using ten nodes.

Plugging (C.5) and (C.6) in (C.4) yields:

and plugging (C.2), (C.3), and (C.7) in (C.1) finally yields:

Rights and permissions

About this article

Cite this article

Waisman, C. Selling mechanisms for perishable goods: An empirical analysis of an online resale market for event tickets. Quant Mark Econ 19, 127–178 (2021). https://doi.org/10.1007/s11129-021-09236-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-021-09236-z