Abstract

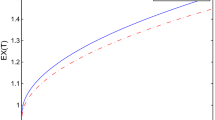

The main goal of the paper is the evaluation of the Solvency Need SN(h), where h is the maximal duration of the insurance contracts that we will consider. We define it as the quantile of R(h, S) − 𝔼[R(h, S)], where R(h, S) is the reserve introduced in Nichil and Vallois (Insurance: Mathematics and Economics 66:29–43, 2016) and S := (Sx, x ⩾ 0) is a systemic risk. We prove that the normalized reserve converges in distribution, as h → + ∞, to the sum of a Gaussian RV and an independent RV which is an integral of a function of the systemic risk. In the case of mortgage guarantee we can go further in the description of the non-Gaussian RV and we propose three numerical schemes to estimate SN(h) when h is large and we compare the results of simulation.

Similar content being viewed by others

References

Barbe P, Fougères A-L, Genest C (2006) On the tail behaviour of sums of dependent risks. ASTIN Bulletin 36(2):361–373

Bertoin J, Yor M (2002) On the entire moments of self-similar markov process and exponential functionals of lévy processes. Ann Fac Sci Toulouse Math (6) 11(1):33–45. ISSN 0240-2963

Biard R, Lefevre C, Loisel S (2008) Impact of correlation crises in risk theory: asymptotics of finite-time ruin probabilities for heavy-tailed claim amounts when some independence and stationarity assumptions are relaxed. Insurance: Mathematics and Economics 43(3):412–421. ISSN 0167-6687. https://doi.org/10.1016/j.insmatheco.2008.08.004. http://www.sciencedirect.com/science/article/pii/S0167668708001030

Boudreault M (2006) On a risk model with dependence between interclaim arrivals and claim sizes. Scandinavian Actuarial Journal: Actuarial Society of Finland

Boumezoued A, Angoua Y, Devineau L, Boisseau J P (2012) One-year reserve risk including a tail factor: closed formula and bootstrap approaches. papers arXiv.org. http://EconPapers.repec.org/RePEc:arx:papers:1107.0164

Dhaene J, Capital Solvency, Measures Risk (2004) Comonotonicity a review. Katholieke Universiteit Leuven, [Faculty of Economics and Applied Economics] Department of Applied Economics. http://books.google.fr/books?id=nglKHQAACAAJ

Directive (2009) 2009/138/EC of the european parliament and of the council of 25 november 2009 on the taking-up and pursuit of the business of insurance and reinsurance (solvency II). Official journal of the european union, 25 november. http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2009:335:0001:0155:fr:PDF

Dufresne D (1990) The distribution of a perpetuity, with applications to risk theory and pension funding. Scand Actuar J. https://doi.org/10.1080/03461238.1990.10413872

Le Financement de L’Habitat En (2015). https://acpr.banque-france.fr/fileadmin/user_upload/acp/publications/analyses-syntheses/201607-AS71-Financement-habitat-2015-V2.pdf

Les assurances de biens et de responsabilité - données clés (2015). http://www.ffa-assurance.fr/content/assurances-de-biens-et-de-responsabilite-donnees-cles-par-annee

Nichil G (2014) Provisionnement en assurance non-vie pour des Contrats à Maturité Longue Et à Prime Unique: Application à la Réforme Solvabilité 2 2014 Thèse de Doctorat Dirigée par Vallois, Pierrecalbiac, Martial de Et Herrmann, Samuel Mathématiques Université de Lorraine. http://www.theses.fr/2014LORR0200

Nichil G, Vallois P (2016) Provisioning against borrowers default risk. Insurance: Mathematics and Economics 66:29–43

Nourdin I, Peccati G (2012) Normal approximations with malliavin calculus: from stein’s method to universality. Cambridge tracts in mathematics. Cambridge University Press, Cambridge. ISBN 978-1-107-01777-1. http://opac.inria.fr/record=b1134318. Informations complémentaires sur la publication à l’adresse http://www.cambridge.org/9781107017771

Ohlsson E, Lauzeningks J (2009) The one-year non-life insurance risk. Insurance: Mathematics and Economics 45(2):203–208. http://EconPapers.repec.org/RePEc:eee:insuma:v:45:y:2009:i:2:p:203-208

Planchet F, Guibert Q, Juillard M (2010) Un cadre de référence pour un modèle interne partiel en assurance de personnes. post-print. HAL. http://EconPapers.repec.org/RePEc:hal:journl:hal-00530864

Planchet F, Guibert Q, Juillard M (2012) Measuring uncertainty of solvency coverage ratio in orsa for non-life insurance. Eur Actuar J 2(2):205–226. ISSN 2190-9733. https://doi.org/10.1007/s13385-012-0051-7

Reitzner M, Schulte M (2013) Central limit theorems for U-statistics of poisson point processes. Ann Probab 41(6):3879–3909. ISSN 0091-1798. https://doi.org/10.1214/12-AOP817

Salminen P, Yor M (2005) Perpetual integral functionals as hitting and occupation times. Electron J Probab 10:371–419. https://doi.org/10.1214/EJP.v10-256

Vedani J, Devineau L (2012) Solvency assessment within the ORSA framework: issues and quantitative methodologies. http://hal.archives-ouvertes.fr/hal-00744351

Wuthrich MV (2003) Asymptotic value-at-risk estimates for sums of dependent random variables. ASTIN Bulletin 33(1):75–92

Wüthrich MW, Merz M, Lysenko N (2009) Uncertainty of the claims development result in the chain ladder method. Scand Actuar J 2009(1):63–84

Yor M (1992) On some exponential functionals of brownian motion. Adv Appl Probab 24(3):509–531. ISSN 0001-8678

Yor MJ (2001) Exponential functionals of brownian motion and related processes. Springer finance. Springer. ISBN 3-540-65943-9

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nichil, G., Vallois, P. Solvency Need Resulting from Reserving Risk in a ORSA Context. Methodol Comput Appl Probab 21, 567–592 (2019). https://doi.org/10.1007/s11009-017-9609-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-017-9609-9

Keywords

- Solvency II

- ORSA

- Solvency need

- Reserving risk

- Quantile

- Geometric Brownian motion

- Poisson point process

- Perpetual integral functional of Brownian motion

- Gamma distribution

- Monte-Carlo simulation