Abstract

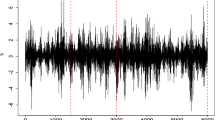

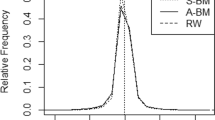

Normality and static variance are very common assumptions in traditional financial theories and risk modeling for mathematical convenience. Empirical evidence suggests otherwise. With the rapid growth in volatility-based financial innovations and market, it is beneficial and essential to look beyond the traditional restrictive assumptions. This paper discusses Bayesian analysis of the variance changepoints problem in linear models with flexible error distributions. Specifically, we consider the class of scale mixtures of normal distributions, which not only exhibits symmetric heavy-tailed behavior, but also includes many common error distributions as special cases, such as the normal and Student-t distributions. Our proposed approach can reduce the influence of atypical observations and thus offer a robust technique for detecting the variance changepoints in many financial and economic data. We propose an efficient Gibbs sampling procedure to generate posterior samples and in turn to perform Bayesian inference. Simulation studies are conducted to demonstrate satisfactory performance of the proposed methodology. The closing price data set from the US stocks database is analyzed for illustrative purposes.

Similar content being viewed by others

References

Abanto-Valle, C. A., & Dey, D. K. (2014). State space mixed models for binary responses with scale mixture of normal distributions links. Computational Statistics & Data Analysis, 71, 274–287.

Abanto-Valle, C. A., Migon, H. S., & Lachos, V. H. (2012). Stochastic volatility in mean models with heavy-tailed distributions. Brazilian Journal of Probability and Statistics, 26, 402–422.

Andrews, D. F., & Mallows, C. L. (1974). Scale mixtures of normal distributions. Journal of the Royal Statistical Society Series B, 36, 99–102.

Azzalini, A., & Dalla Valle, A. (1996). The multivariate skew-normal distribution. Biometrika, 83, 715–726.

Chacko, G., & Viceira, L. M. (2005). Dynamic consumption and portfolio choice with stochastic volatility in incomplete markets. The Review of Financial Studies, 18, 1369–1402.

Chen, J. (1998). Testing for a change point in linear regression models. Communications in Statistics-Theory and Methods, 27, 2481–2493.

Chen, J., & Gupta, A. K. (1997). Testing and locating variance changepoints with application to stock prices. Journal of the American Statistical Association, 92, 739–747.

Chen, J., & Wang, Y. P. (2009). A statistical change point model approach for the detection of DNA copy number variations in array CGH data. IEEE/ACM Transactions on Computational Biology and Bioinformatics, 6, 529–541.

Choy, S. T. B., & Chan, J. S. K. (2008). Scale mixtures distributions in statistical modelling. Australian & New Zealand Journal of Statistics, 50, 135–146.

Fonseca, T. C. O., Ferreira, M. A. R., & Migon, H. S. (2008). Objective Bayesian analysis for the Student-\(t\) regression model. Biometrika, 95, 325–333.

Garay, A. M., Bolfarine, H., Lachos, V. H., & Cabral, C. R. B. (2015). Bayesian analysis of censored linear regression models with scale mixtures of normal distributions. Journal of Applied Statistics, 42, 2694–2714.

Geweke, J. (1992). Priors for macroeconomic time series and their application. Institute for Empirical Macroecomomics discussion paper no. 64, Federal Reserve Bank of Minneapolis.

Geweke, J. (1994). Priors for macroeconomic time series and their application. Econometric Theory, 10, 609–632.

Horváth, L., & Steinebach, J. (2000). Testing for changes in the mean or variance of a stochastic process under weak invariance. Journal of Statistical Planning and Inference, 91, 365–376.

Kang, S. (2015). Bayesian change-point analysis in linear regression model with scale mixtures of normal distributions. Master’s thesis, Michigan Technological University.

Lachos, V. H., Ghosh, P., & Arellano-Valle, R. B. (2010). Likelihood based inference for skew-normal independent linear mixed models. Statistica Sinica, 20, 303–322.

Lange, K., & Sinsheimer, J. S. (1993). Normal/independent distributions and their applications in robust regression. Journal of Computational and Graphical Statistics, 2, 175–198.

Lange, K. L., Little, R. J. A., & Taylor, J. M. G. (1989). Robust statistical modeling using the \(t\) distribution. Journal of the American Statistical Association, 84, 881–896.

Li, F., Tian, Z., Xiao, Y., & Chen, Z. (2015). Variance change-point detection in panel data models. Economics Letters, 126, 140–143.

Lin, J., Chen, J., & Li, Y. (2012). Bayesian analysis of Student-\(t\) linear regression with unknown change-point and application to stock data analysis. Computational Economics, 40, 203–217.

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7, 77–91.

Page, E. S. (1954). Continuous inspection schemes. Biometrika, 41, 100–115.

Papanicolaou, A., & Sircar, R. (2014). A regime-switching heston model for VIX and S&P 500 implied volatilities. Quantitative Finance, 14, 1811–1827.

Raftery, A. E., & Lewis, S. M. (1992). [Practical Markov Chain Monte Carlo]: Comment: One long run with diagnostics: Implementation strategies for Markov Chain Monte Carlo. Statistical Science, 7, 493–497.

Ross, S. A. (1976). The arbitrage theory of capital asset pricing. Journal of Economic Theory, 13, 341–360.

Sharpe, W. F. (1964). Capital asset prices: a theory of market equilibrium under conditions of risk. Journal of Finance, 19, 425–442.

Talwar, P. P. (1983). Detecting a shift in location: Some robust tests. Journal of Econometrics, 23, 353–367.

Vostrikova, L. (1981). Detecting “disorder” in multidimensional random processes. Soviet Mathematics, 24, 55–59.

Zhou, H., & Liang, K.-Y. (2008). On estimating the change point in generalized linear models. In Beyond parametrics in interdisciplinary research: Festschrift in honor of Professor Pranab K. Sen, vol. 1 of Inst. Math. Stat. Collect. Inst. Math. Statist., Beachwood, OH, pp. 305–320.

Acknowledgements

We would like to thank the editor and one reviewer for their constructive comments that led to a significant improvement of the paper. This work appeared in first author’s Master thesis (Kang 2015) which was supervised by the corresponding author.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kang, S., Liu, G., Qi, H. et al. Bayesian Variance Changepoint Detection in Linear Models with Symmetric Heavy-Tailed Errors. Comput Econ 52, 459–477 (2018). https://doi.org/10.1007/s10614-017-9690-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-017-9690-8