Abstract

While research has focused on financial and social goals in impact investing, we add to the limited research that focuses on how individuals manage identity multiplicity, defined as three or more role identities. Based on our qualitative study of Christian impact investors, we develop a model of identity multiplicity work, explaining how individuals manage their multiple role identities (financial, social, and religious) to reduce identity tensions during the process of impact investing. We find individuals engaged in an interactive, ongoing three-step process of identity multiplicity work: prioritizing one of their salient identities, managing their identity multiplicity interrelationships, and reinforcing their prioritized identity. Investors generally prioritized an identity that was neither financial nor social, but rather religious. We also find this identity work implemented through three novel mechanisms: shadowing, one identity casts a shadow over another thereby enabling the simultaneous pursuit of related goals; distinguishing, all identities are retained and at least a minimum threshold of role expectations are met; and surrendering, partial sacrificing of goals of one (or more) identity in favor of another identity based on an individual’s self-reflective importance of the role. Our findings offer new insights to multiple identities, impact investing and business ethics literatures.

Similar content being viewed by others

Introduction

There is growing interest in understanding how investors jointly pursue multiple goals in impact investing (e.g., Agrawal & Hockerts, 2019; Lee et al., 2020). This is important because it affects the number of investors and amount of capital focused on solving intractable social problems (GIIN, 2020b). While money has been increasingly flowing into impact investing, these flows still represent only a fraction of the capital needed to solve problems such as hunger, poverty, and sex trafficking (Clark et al., 2015). Impact investing refers to “investing with an intention to generate positive, measurable social and environmental impact alongside a financial return” (GIIN, 2020), and is a subset of the broader field of socially responsible investing. To date, research on impact investing has generally examined macro-level, institutional explanations of product categories (Arjaliès & Durand, 2019; Lee et al., 2020), institutional logics (Yan et al., 2018), and organizational identities (Battilana & Lee, 2014; Smith et al., 2013).

The focus of macro-level research has largely overlooked the investor and their micro-level processes inherent in impact investing as they develop and manage multiple expectations. In this context, identity theory – including role identity, defined in social psychology as the meaning related to oneself in relation to a certain role (Burke & Tully, 1977), and identity work, defined as the dynamic processes to modify identities (Alvesson & Wilmott, 2002) – offers a unique theoretical lens to understand how investors navigate multiple and often competing role expectations. In impact investing, we have yet to explore how expectations beyond one’s investor role(s) influence and guide decisions made by investors (Jones, 2020). Because impact investors are not limited to financial and social role expectations, understanding a broader scope of one’s identity work is critical to the micro-level processes of impact investing.

Religion is an important aspect of everyday life that encourages some investors to integrate their religious role expectations with their financial and social expectations in impact investing (Yan, et al., 2018). The inclusion of a religious identity to the existing financial and social identities held by many impact investors leads to identity multiplicity, defined as three or more identities (Fleischmann et al., 2019; Ramarajan, 2014). Identity multiplicity raises questions about the processes, challenges, and mechanisms of managing multiple identities because research has long recognized the potential for increasing role conflict in conjunction with an increasing number of roles (e.g., Merton, 1957). Despite the growing literature on impact investing and extensive literature on multiple identities, we know little about the management of more than two identities (Battilana et al., 2017) or the specific mechanisms of role identity adaptations in such situations (Jain et al., 2009). To address these gaps, we ask the following research question: How do investors manage identity multiplicity in impact investing?

The purpose of our study is to elaborate theory on how individuals manage their role identities and navigate identity tensions in impact investing. Based on our qualitative study of Christian impact investors, we develop a model of identity multiplicity work, where individuals negotiate three identities through an interactive, ongoing three-step process: prioritizing one of their salient identities, managing their identity multiplicity inter-relationships, and reinforcing their prioritized identity. Our study makes three contributions. First, we contribute to research on multiple identities by examining how investors manage identity multiplicity. In so doing, we uncover two identity inter-relationship mechanisms of shadowing (equating two identities as one) and distinguishing (retaining three identities separately). Second, we contribute to the literature on impact investing by focusing on the micro-level processes of how a third, alternate identity is prioritized beyond the expected financial and social identities in impact investing. Third, we contribute to research that highlights the role of religion in impact investing and identity research by discovering a novel mechanism we call surrendering, which consists of sacrificing other identities to reinforce a prioritized identity.

Theoretical Background

Impact Investing from a Macro-Level: An Institutional Perspective

Research on impact investing initially focused on the definitional and conceptual issues, often lacking clear theoretical frameworks (Agrawal & Hockerts, 2019; Hochstädter and Scheck, 2015). To provide a theoretical framework that accounted for multiple expectations, scholars relied largely on institutional theory as a foundation for impact investing research. For example, recent research from an institutional perspective has examined the role of product categories and categorical cognition to explain judgments and capital allocation decisions (Arjaliès and Durand, 2020; Lee et al., 2020). Studies have also examined the competing and complementing financial and social institutional logics in the emergence of impact investing (Yan et al., 2018). Further, related studies in social enterprises have focused on how institutional logics inform the management of multiple financial and social identities (e.g., Battilana & Dorado, 2010).

Research from an institutional perspective has added much to our understanding of impact investing and, in turn, contributed important knowledge back to institutional theory, including field ideology (Hehenberger et al., 2019), new practice adoption (Hockerts, 2015; Lehner & Nicholls, 2014; Quinn & Munir, 2017), and organizational identities (Battilana et al., 2017; Höchstädter & Scheck, 2015). Although extant research has considered the individual in navigating multiple identities, it has retained a focus on macro-level explanations, examining how individuals within these organizations adopt one logic or another to address conflicts related to their organizational identities (e.g., Pache & Santos, 2013). Despite these advances from institutional theory, most research in impact investing and multiple identities has focused on the macro-level issues of contestation and therefore provides limited insight into how individual, intrapersonal tensions are experienced and managed.

Impact Investing from a Micro-Level: An Identity Perspective

A promising approach to understanding the plurality of values and goals for individual investors in impact investing is identity theory, including role identity and identity work. Identity theory provides a useful theoretical foundation for impact investing because it accounts for individuals holding multiple complementary and / or conflicting roles (Stryker & Burke, 2000), such as financial and social. Roles define the social positions that individuals occupy and carry expectations for behavior and interaction with others (Merton, 1957). When a role cues “a certain persona – replete with specific goals, values, beliefs, norms, interaction styles, and time horizons,” it refers to a role identity (Ashforth et al., 2000: 475). Role identitiesFootnote 1 represent socially constructed definitions of an individual within the role and their self-reflective interpretation of the role (McCall & Simmons, 1978). Role identity is an insightful framework to study impact investing because “as a role becomes more closely tied to an individual’s sense of self or identity, the individual tends to behave in accordance with this role identity” (Jain et al., 2009: 923). Extant research has recognized the social and financial role identities in impact investing and related fields (e.g., social entrepreneurship), including the tensions and challenges of managing these different identities (e.g., Agrawal & Hockerts, 2019; Smith et al., 2013; Wry & York, 2017), but has overlooked critical influences of investor roles beyond social and financial expectations.

Dual Identity to Identity Multiplicity: An Overlooked Reality

While much has been gained by focusing on two identities, scholars encourage research that moves beyond two identities to add a third identity, which substantially increases complexity and the potential for role conflict (e.g., Battilana et al., 2017; Merton, 1957; Ramarajan, 2014). Research on social entrepreneurship recognizes that financial and social role expectations do not exist within a vacuum, but rather within a larger context where other identities may be salient (Wry & York, 2017). In the context of impact and socially responsible investing, religion—defined as “the feelings, thoughts, experiences, and behaviors that arise from the search for the sacred” and the “means and methods (e.g., rituals and prescribed behaviors) of the search” (Hill et al., 2000: 66)—has been identified as a variable that holds much promise for understanding multiple identities (Yan et al., 2018).

Religion is important because it plays a major role in the self-concept and social reality for many people (Emmons, 1999; Wimberly, 1989). Religion is also associated with the founding (Yan et al., 2018) and persistence of socially responsible investments (Peifer, 2011), and potentially creates substantial identity expectations (Ysseldyk et al., 2010), particularly in Christianity and Isalm (Gümüsay, 2020; Smith et al., 2021). As a result, many investors attempt to align religious identity expectations with their impact investments (Bouri, 2019, GIIN, 2020a). Unfortunately, we know little about how the integration of a third (religious) identity influences multiple identity management because research has largely focused on dual-identity contexts (Battilana et al., 2017). Therefore, we augment the limited research that is beginning to take seriously the role of religion in impact investing, social entrepreneurship, and organizational studies (e.g., Smith et al., 2019; Spear, 2007; Tracey, 2012; Yan, et al., 2018).

An emphasis on a limited set of identities (financial and social) has generated theory that is contingency-based and reductionist (Fisher, 2020). Extant theory on impact investing fails to account for other identities that may be salient, including identities that may be of higher salience than financial and social identities. To address this limitation, research has argued for scholarship that shifts the focus from a dual-identity to situations of identity multiplicity, where research can begin to examine three (or more) intra-personal identities (Ramarajan, 2014; Ramarajan et al., 2017).

Managing Multiple Identities Through Identity Work

Not only has the number of identities been overlooked, but there is also a limited knowledge that addresses how impact investors manage their multiple identities. Identity work is defined as the range of activities individuals engage in for “forming, repairing, maintaining, strengthening, or revising” their self-meanings (Alvesson & Wilmott, 2002). It refers to the dynamic process of forming a distinctive and coherent sense of self (Sveningsson & Alvesson, 2003). Identity work is useful for understanding how individuals manage the multiple role expectations of impact investing because it accounts for the ongoing negotiation of identities and management of multiple identity tensions (Caza et al., 2018). Identity work has been successfully employed in the context of investing (Smith & Bergman, 2020) and has been recognized as a promising theoretical lens to understand business ethics (Carollo & Guerci, 2018; Greenwood & Freeman, 2018).

While scholars have theorized about managing multiple identities, limited empirical research focuses on the mechanisms for multiple identity work or the context of impact investing. Theoretical research has focused on different mechanisms, including aggregation and compartmentalization, for managing situations of dual identities (Pratt & Foreman, 2000). Compartmentalization attempts to keep the two identities separate from one another, whereas aggregation attempts to integrate the identities into a meta-level identity. In the context of managing social and financial identities, scholars researching social enterprises theorize how multiple identities may (not) result in identity tensions based on the strength of accountability pressures and knowledge of the institutional logics (Wry & York, 2017). While this is a step toward understanding multiple identities and resulting tensions, this research is also limited to theoretical prescriptions.

While extant research provides theoretical guidance about possible mechanisms to manage identity tensions, it does not provide empirical evidence of the purported mechanisms. One important exception is an empirical study on managing intra-personal multiple identity tensions of university scientists who engage in commercial activity (Jain et al., 2009). It provides two qualitatively derived mechanisms for role identity work: delegating, which offloads tasks of a new role to others, and buffering, which protects cherished aspects of an established identity (Jain et al., 2009). While this study advances our empirical understanding of identity work mechanisms, it does not advance our empirical understanding of mechanisms beyond dual identities or in the context of impact investing.

Identity theory—including role identity and identity work—provides a theoretical foundation to extend beyond identity duality into the overlooked reality of identity multiplicity in impact investing. In so doing, we focus on the micro-level, intra-individual processes and mechanisms generally neglected in impact investing to examine how investors manage financial, social and religious identities. Given the paucity of research on the management of three or more identities, we conducted an inductive study to elaborate theory (Fisher & Aguinis, 2017) on how individuals manage identity multiplicity and navigate resulting identity tensions in impact investing.

Methods

To examine our research question about managing identity multiplicity in impact investing, we collected interview and archival data on the growing number of impact investors who sought to integrate their religious beliefs and practices into their investments. This sample was theoretically important because it allowed us to move beyond two identities (social and financial) to explore how investors included a third identity (religious).Footnote 2 Based on primary and secondary data, it became clear investors struggled with the tensions of managing identity multiplicity (financial, social, and religious role identities). Finally, the sample was theoretically relevant because the investors were making—rather than merely contemplating—impact investments, thereby allowing us to empirically connect identity multiplicity challenges with mechanisms used to make investment decisions.

Data Collection

There is a growing movement of organizations providing guidance to individuals that are seeking to integrate their religious beliefs into their entrepreneurial ventures and investments. Over the last five years, a number of major entrepreneurial support organizations including Praxis, Ocean, and the Lion’s Den advanced this movement for Christian entrepreneurs and investors through accelerators, events, conferences, and competitions. We began data collection during some of these inaugural events, and continued to collect primary and secondary data through partnerships with some of these organizations. For example, in 2016, we attended a summit hosted by Ocean, entitled Exploring Deeper Relationships, to coordinate, unify and explore partnerships between some of the 20 + key players in the field. In 2018, we began working with a platform organization called Faith-Driven Entrepreneur (hereafter, FDE), which was launched “to encourage, equip, empower, and support Christ following entrepreneurially minded people worldwide with world-class content and community” (www.faithdrivenentrepreneur.com). FDE aggregates, creates, and disseminates information about the field through a website, podcasts, and meetings. To date, it has completed 130 + podcasts with entrepreneurial leaders who integrate their faith into their entrepreneurial activity.

In 2019, we began collecting data from Faith-Driven Investor (hereafter, FDI), which launched as part of the Faith-Driven Family that includes FDE, to help investors align their financial capital to “join God, although imperfectly, to bring about his kingdom on earth” (FDI website). In its inaugural year, FDI developed a set of unifying and guiding principles for the movement. For example, one of guiding principles states:

“We believe that God speaks to us through His word and that all of scripture is useful for instruction on how to formulate and execute an investing strategy. Scripture, when taken in aggregate, provides as a great handbook on every question of investing—why, how, where, what, and when” (B10).

In addition, we attended FDI’s first organizing conference in Utah in July 2019, and its larger (online) conference in September 2020. The initial FDI conference anticipated a small gathering of 30 people and grew to 175 + people from Asia, Australia, Europe, and North America. In September 2020, 1800 + people attended online. FDI currently has more than 10,000 people who engage annually with their content. Collectively, these investors manage billions of dollars and previously focused primarily on financial considerations. An important component of the conferences and the overall movement was impact investing, where Christian values, beliefs, and expectations are integrated into investment and management decisions. As mentioned, primary and secondary data illustrated the identity tensions experienced by these impact investors and affirmed the relevance of the sample.

Data Sources

We collected five different types of data over the last five years, as shown in Table 1. First, we conducted semi-structured interviews with key people engaged in impact investing including, but not limited to, the founder of FDE and FDI, leading family office investors, and leaders of impact investing foundations. As previously explained, we used a purposeful sampling approach of impact investors and leaders for theoretical reasons (Lincoln & Guba, 1985). Second, we collected data from presentations at many of the leading conferences on FDI including the 2016 Exploring Deeper Relationships, 2018 Lion’s Den, and 2019 and 2020 FDI conferences. The presentations included individual and panel discussions about impact investing including motivation, examples, measurement, and the future of the movement. Third, we collected data from publicly available podcasts on impact investing. While we listened to 100 + podcasts from FDE, FDI, Kingdom Driven Entrepreneurs, and Redemptive Edge, we identified specific podcasts that dealt directly with impact investing. Fourth, we used archival data from blogs / articles about impact investing. Finally, we collected data from white papers and direct correspondence with experts in the field of impact investing (Table 2).

In total, we collected 99 distinct pieces of data (interviews, presentations, podcasts, blogs, and white papers). The interviews, presentations, and podcasts ranged in length from approximately 30 min to more than 2 h, with the average length of about one hour. Each piece of data was converted into a transcription based on digital recordings or the original written documents. In total, we had 889 pages of text from the five sources of data. We collected data over a five-year period from 2016 to 2020, which allowed us to analyze data as it was collected and pursue additional data based on the initial analysis of collected data (Kreiner, 2015). We continued to toggle back and forth between data collection, theory, and data analysis until we reached a point of theoretical saturation (Glaser & Strauss, 1967), where no new themes emerged from our data.

Insider–Outsider Approach

We leveraged an insider–outsider approach to our research team to allow for access to and collection of data (Bartunek & Louis, 1996; Gioia et al., 2010), an approach used recently in a study on the field dynamics of impact investing (Hehenberger et al., 2019). Within our team of five researchers, one researcher was the co-founder of an impact investing foundation. This insider was also one of the key leaders, interviewed on FDE and FDI, and the author of a white paper and blog. In addition, the insider was a main actor at the key conferences, which created unique access for interviews to other leaders in the field of impact investing. Based partly on access provided by the insider, a second team member attended many of the summits and conferences, which facilitated data collection including the digital recording of sessions from the conferences. Data analysis was completed by two outside researchers. This allowed us to keep “scholarly distance” between data collection and data analysis (Gioia et al., 2010; Hehenberger et al., 2019). After the outside researchers analyzed the data, we returned to the insider as a form of member check. This process ensured the consistency of our analysis and helped us identify other impact investors who could further inform our findings.

Data Analysis

The analysis of our data used several coding processes, as recommended for rigor in qualitative and inductive research (Gioia et al., 2013; Kreiner, 2015). First, we relied on an open-coding process to examine all of the transcripts from our different data sources (Strauss & Corbin, 1998). In the open coding process, we attempted to identify and categorize direct statements of first-order codes, where the codes represent a form of meaning condensation or thought units (Lee, 1999). We used in-vivo codes and direct language to capture the meaning of these first-order codes. We used a primary coder and a secondary coder, as well as member checks with respondents, to ensure trustworthiness of the data (Lincoln & Guba, 1985). This included peer debriefing between the outside researchers and the resolution of differences early in the coding process (e.g., Kreiner et al., 2015).

Second, we introduced theory into the coding process earlier rather than later. This is a process known as “tabula geminus” or twin slate, where theory is introduced intentionally into the process of coding to extend theory rather than replicate theory or build theory too removed from existing frameworks (Kreiner, 2015). In our case, we introduced identity theory into our analysis. As is common in qualitative research, this shifted the focus of our analysis (Kreiner, 2015) from the role of religion in impact investing to how investors construct and manage identity multiplicity in impact investing.

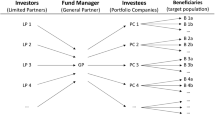

Third, we used axial coding where our first order codes were clustered into second order themes (Corbin & Strauss, 2008; Gioia et al., 2013). Here, we sought to understand the relationships between the first-order codes and second-order themes. For example, the first-order codes of norms of investing and human flourishing pointed to the second-order theme of comparing role identity trade-offs by investors. Finally, we used theoretical coding to analyze the relationships between the second-order themes and aggregate dimensions (Gioia et al., 2013; Glaser, 1978). For example, comparing role identity trade-offs led to prioritizing one of the salient identities. The toggling back and forth between theory and data helped us to understand the relationships between our codes and develop a model of identity multiplicity work by impact investors. Figure 1 shows the data structure, emanating from first order codes used by the respondents, to second-order theoretical themes induced from our data research team, to aggregate dimensions to synthesize the data.

Findings

Given extant research on impact investing and dual-identities, we were unsurprised to find that nearly all of the investors in our study pointed to substantial identity tensions as they managed their multiple identities (financial, social, and religious) in impact investing. Investors offered many examples of these tensions, where the role expectations of their identities pulled in different directions as they negotiated identity multiplicity. To address these identity tensions, we found impact investors engaged in an interactive, ongoing three-step process, which we label identity multiplicity work.

First, investors prioritized one of their salient role identities. In our study, investors generally prioritized their religious role identity to reduce identity tensions among their financial, social, and religious identities. While prioritization relieved some identity tensions by providing clarity on identity hierarchy, investors still needed to further negotiate their identity multiplicity. Second, investors managed the inter-relationships among their identities. Despite similarities in prioritization, investors differed on the strategies they used to manage these inter-relationships. Some investors shadowed their religious identity with their social identity; others distinguished their three identities keeping them separate but related. Finally, investors regularly reinforced their prioritized identity through a mechanism we called, surrendering. Here, investors strengthened the prioritized (religious) identity by sacrificing the role expectations of the other identities. Figure 2 illustrates our emergent model and conceptual relationships of identity multiplicity work, which we now explain.

Prioritizing One of their Salient Identities

In our study, investors managed identity multiplicity by prioritizing one of their salient identities. After comparing the role identity trade-offs, investors generally prioritized their religious role identity. We explain how investors compared identity trade-offs and then prioritized one of their salient identities.

Comparing Role Identity Trade-Offs

As impact investors began to manage their multiple role identities, they encountered identity tensions because they confronted trade-offs between expected religious, social, and financial returns. Based on our data, investors experienced few identity tensions when all returns were high but experienced many and substantial identity tensions when they had to decide between different return expectations for each identity. Speaking about these trade-offs, one investor explained, “Everyone is happy to make these investments. There’s no return trade-offs, so there’s no tension. But the minute you start talking about reducing financial returns, everyone walks away” (I21). In our data, we found comparing the role identity trade-offs came from two sources which often pulled in different directions: norms of investing practices and the pursuit of human flourishing.

One the one hand, the norms of investing practices encouraged investors to lean into their financial identity and to favor higher financial returns. One investor noted, “We are programmed our entire lives to seek higher returns. You sit at the bar and say, ‘I made this investment and got these incredible financial returns.’ No one says, ‘I fed a few people in Africa and I got my money back.’” (I21). Another investor suggested the dominant norm of investing focuses on financial returns themselves, often neglecting how the returns are generated. The respondent suggested investors often seek financial outcomes, “acting like the wives of a mob boss. You’re not asking where the money comes from. The money just comes into the household and you use it, but you’re going to close your eyes to where the money’s coming from” (P3, 2). The dominant norm of focusing on financial returns raised identity tensions for impact investors because it often conflicted with the goals of their social and religious role identities.

On the other hand, the goal of human flourishing pulled investors towards expectations stemming from their social and religious role identities.Footnote 3 One investor explained, “Human flourishing is to realize the fullness of what is possible, the true potential, within a human being” (I5, 1). Another investor suggested, human flourishing encourages us “to go to those who have been marginalized by the world, the people that would have the most challenge of being seen as having full worth as individuals created in the image of God” (P4, 3). As a result, investors wrestled with the identity tensions of different return trade-offs, where financial returns may take a back seat to social and religious returns. One investor stated, “I think God gives us a different vision of human flourishing than what the field of economics does” (P3, 2). Therefore, investors often made decisions that contrasted with their financial role. For example, an investor shared, “We try to provide jobs for the marginalized. I’d much rather invest in a place that assists 25 previously incarcerated individuals on the south side of Chicago because no one else is helping them” (I7).

Given multiple identities pulling in different directions, investors often struggled with identity tensions in making their decisions. One investor shared, “We know what we are called to, but in our hearts we often act out the world’s dominant script” (W12). Another investor suggested, “The question is, ‘Are we worried enough about certain populations or certain problems where it says if we are truly coming from a place of faith and biblical values, we might be encouraged to be more concessionary on the financial returns and more aggressive and ambitious on our social and spiritual returns?’” (I1). Often, investors were considered naïve, or not real investors, calling into question their financial identity, for making investments with lower financial returns. For example, a major investor shared, “People assume if you accept a lower return then you’re A, a soft investor or B, a stupid investor, because, ‘Why would you do that? Do you realize you can get an 18% return over here? Don’t you realize that you can get a better financial return, especially if you reduced your other considerations’” (I7)? While constantly wrestling with these identity tensions, the investors in our study suggested it was not naiveté but rather a prioritization of their religious identity that drove their investing decisions. The investor continued, “Of course we realize we can get higher returns elsewhere. But, we are making an intentional decision to worry less about the financial returns” (I7).

After comparing the role identity trade-offs, we found investors generally prioritized one of their salient identities as a first step in identity multiplicity work. Reflecting the prioritization of their religious identity, one investor explained, “I consider myself a faith-driven impact investor, meaning I start with a faith lens.” (I7). Another investor suggested, “We’re not just Christians in the social entrepreneurship space, we’re putting Jesus at the center of what we do” (C16, 4). By elevating their religious identity, investors were able to reduce some of the multiple identity tensions from other role identities. An investor explained, “Prioritizing [religious identity] reduces the tensions of feeling like I’m a bad financial investor (for taking lower returns) because of the strength of the religious side” (I23).

Despite the prioritized religious identity, nearly all of the investors considered prioritizing their religious identity to be an ongoing process. For example, one investor explained, “I was a Christian for a long time, but it’s only within the last few years that this identity became central to all that I do, including investing” (I21). Yet, the prioritization of an identity did not suggest a permanent, fixed prioritization. In the same breath, the investor recognized, “But, I am flawed and this identity fluctuates day-to-day” (I21). As a result, investors engaged in additional steps in identity multiplicity work to negotiate identity multiplicity and associated tensions.

Managing Identity Multiplicity Inter-Relationships

While prioritization of the religious identity was an important first step, we found investors often managed inter-relationships among the constellation of three identities as a second step of identity multiplicity work. Our findings reveal that investors used two mechanisms for managing identity multiplicity inter-relationships: some investors managed identity multiplicity by overlaying two of their identities as one, a mechanism we refer to as shadowing; others managed their three identities by keeping them distinct from one another, a mechanism we refer to as distinguishing. We explain both mechanism and how they reduced identity tensions.

Shadowing

Our data showed that some investors engaged in an identity multiplicity management mechanism called shadowing, where one identity casts a shadow over another thereby enabling the simultaneous pursuit of related goals, effectively treating two identities as one. In our data, investors often enveloped their religious with their social identity expectations, thereby leaving only two remaining identities (a social-religious identity and a financial identity). However, rather than merging social and religious identities, we found investors maintained the independence of their religious identity but reduced the complexity of assessing and measuring both their social and religious identities. Shadowing enabled investors to reduce identity tensions because it decreased the number of role expectations pulling them in different directions, from three to two. In our data, investors shadowed their identities by equating social outcomes as religious outcomes and by encapsulating the measurement of both outcomes as one.

The rationale for shadowing the religious identity with the social identity was often the large overlap in values and / or returns emanating from these two identities. Some investors pointed to how religious values of human dignity and protecting the environment aligned with social goals of the United Nations Sustainable Development Goals (e.g., ending poverty and protecting the planet). For example, one investor explained, “Lifting people out of poverty is a good Kingdom outcome. It’s consistent with the Bible. Healing people, giving people education, clean energy, social infrastructure, all of these are consistent with a Christian worldview” (I12). Other investors suggested religious values encouraged investors to seek social returns. For example, one investor shared, “There is a part of the gospel that compels us to ask, ‘Who are the people who are most in need? And how are we making sure that we are actively and intentionally going to them?” (P4, 3). Regardless of the means or ends, investors often shadowed their religious identity with their social identity. For example, one investor claimed, “I do not see spiritual impact as different than social impact. They are the same thing.” (I24).

Consistent with equating social and religious outcomes, we found investors also engaged in shadowing when it came to the measurement of their social and religious outcomes, generally focusing on the measurement of social outcomes. In this way, investors attempted to reduce identity tensions by limiting the number of different measured outcomes. For example, one investor explained, “Trying to incorporate religious, social, and financial goals adds complexity, so much so that some investors are not willing to do it” (I23). Instead, investors frequently enveloped social and religious returns into a single measurement of social outcomes, thereby reducing religious role expectations to the subjective assessment of the entrepreneur. For example, one investor explained, “Listen, if you met Mel and you spent 10 min with her, you would say, ‘I don't have to worry at all about a spiritual measurement.’ She is an incredibly strong Christian person producing great social outcomes…I don't need anything more than that” (I5). Based on the common social and religious role expectations, investors allowed the social outcomes to also serve as a proxy for religious outcomes. For example, one investor suggested, “One of the most thoughtful ways to measure is to use SDG’s because all of them come from scripture” (P6). Another investor shared, “I don't need to go back and say, ‘Hey, what did you do this month to make your spiritual impact grow?’ I don’t need an entrepreneur saying, ‘Hey, I got three baptisms this week.’ We don't force corporate chaplaincy or anything like that” (C8, 2). Investors who shadowed their religious identities with their social identities reduced identity tensions by simplifying the evaluation of an investment from three outcomes (financial, social, and religious) to two (a combined social-religious outcome and a financial outcome).

Distinguishing

Although some investors effectively combined two of their salient role identities through shadowing, other impact investors managed their identity inter-relationships by distinguishing, keeping all three of the identities separate, because it allows the investors to maintain all of their role identities. While shadowing reduced identity tensions by decreasing the number of identity expectations, distinguishing reduced identity tensions by maintaining some role expectations for each of the different role identities. As a result, investors did not compromise the expectations of one of their identities in favor of another; exceeding the role expectations of one identity did not compensate for failing to meet the role expectations of another identity. Instead, the non-compensatory mechanism of distinguishing required all role expectations to meet at least a minimum threshold of role expectations.

We found investors distinguished their financial, social, and religious identities by evaluating each investment across all identity facets and by measuring all three outcomes separately. This process included due diligence on each of three identities. One respondent explained the challenges of measuring all three:

Financial, we get that. That’s the way investments have always been done. Social impacts are increasingly more measurable with things like SDGs and GIIN. But when you’re talking about spiritual impact, you’re talking about someone’s heart and their mind or what’s going on spiritually inside of them. You want to measure inputs and outputs. You can’t always measure the impact. (C16, 4).

Even in the face of measurement challenges, investors found metrics to evaluate the religious aspects potential investments. For example, one investor conducted “religious due diligence” and required “a character letter from the pastor” of the founder (I9). Other investors developed entire evaluation systems that weighted financial, social, and religious considerations. For example, one investor assessed potential deals on a scale of 1 to 5 for each area. The investor explained that financial impact was necessary but also shared, “I have to have social impact and I have to have spiritual impact…and all elements need to be at least a 4 or I'm not making the investment” (C16, 3). For investors, this non-compensatory nature of including all three impacts with minimum threshold levels reduced some of the identity tensions of weighing trade-offs of impacts. However, it did not resolve all of the identity tensions. An investor commented, “There are deals that I have to pass on despite their wonderful spiritual impacts and I hate it” (I23).

While investors assessed all three identities before making an investment, they also managed their identity inter-relationships by measuring all three outcomes separately. Similar to financial and social outcomes, investors sought to measure ongoing religious outcomes of their investments. As one investor expressed, “After hundreds of conversations, dozens of metrics reviewed, and organizations analyzed, I am convinced this is not only possible, but critical to measure [religious returns]” (C13, 1). The religious outcomes were measured by a range of mechanisms from simple to complex. Some investors emphasized qualitative, even narrative, outcomes. For example, one investor explained, we “measured outcomes by asking: How many Bible studies? How many chaplaincy visits? And then they’re telling stories that kind of demonstrate the outcomes that we're seeking” (C13, 3). Others offered a more comprehensive set of measures including inputs, outputs, and outcomes. For example, one investor used a framework that focused on a “theology of work (clear mission of company around faith / calling), leader transformation (observe 24 h period of rest each week; spend regular time in God’s word), ministry in deed (offered corporate chaplaincy), and ministry in word (prays with others in the marketplace; shares biblical truth with staff and stakeholders)” (W13). Finally, some used tools such as the Kingdom Impact Framework by Eido Research developed to “measure and communicate spiritual effectiveness of Christian development and missions organizations, Kingdom businesses, and social enterprises” based on the biblical principle of “fruit of the spirit” (W6).

Regardless of the form, the unique measurement of religious impact allowed investors to manage the role identity inter-relationships by tracking separate but related inputs and outcomes across all role identities. The measurement of religious outcomes helped investors “speak the language of what already exists (financial and social impact measurement), whilst being distinctive to our Christ-centered approach (e.g., voluntary prayer or understanding employee spiritual engagement)” (C25). The practice of distinguishing all three identities appeared to be on the rise as a forward-looking survey suggested nearly 50% of impact investors and organizations wanted to measure religious outcomes of discipleship and / or evangelism (W15).

Reinforcing Identity Prioritization

After investors managed their three identities by shadowing or distinguishing, we found investors often reinforced identity prioritization as a third step of identity multiplicity work. Based on our data, reinforcement was necessary because of the ongoing nature of identity multiplicity work and because the multiple identity management strategies (shadowing and distinguishing), shifted the focus from the prioritized identity to the relationships between the identities. As a result, investors often needed to fortify their previously prioritized (religious) identity to return it to its elevated position in the identity multiplicity hierarchy. This was important because the prioritized identity served as a primary motivation in the impact investment decision. Our findings uncovered a mechanism used by investors to reinforce their prioritized identity, which we refer to as surrendering. We define surrendering as the partial sacrificing of goals of one (or more) identity (identities) in favor of the goals of another identity, based on an individual’s self-reflective importance of the role. We now explain the mechanism of surrendering.

Surrendering

After managing financial, social, and religious identities through different mechanisms, our data showed that investors often reinforced their prioritized (religious) identity by surrendering the role expectations of other identities. When identity inter-relationships were managed through shadowing of social and religious identities, investors generally sacrificed (at least partially) the goals and expectations of their financial identity in favor their combined social-religious identity. For example, one investor asked, “How much am I prepared to lose that the Kingdom might come and that the name of Jesus might become famous in all of the earth?” (C12). Likewise, when multiple identity relationships were managed by distinguishing all three identities, investors also surrendered the goals and expectations of the financial and social identities in favor of their reinforced religious identity. In this case, surrendering occurred above the minimum thresholds for all identity goals but resulted in a reinforced religious identity. For example, one investor explained, “We will not invest in anything that doesn’t meet at least 4 out of 5 on financial, social, and spiritual impact. But, we prioritize a 5 on spiritual over a 5 financial or social impact” (W14).

Despite all of the effort to acknowledge and measure different impacts, our qualitative data revealed that investors took steps to reinforce their prioritized religious identity. For these investors, surrendering is not a passive but rather an active choice to relinquish one’s own goals to God’s goals. One investor shared, “The thing that we need to sacrifice or surrender is really our will” (P20, 2). In our data, we found three things contributed to surrendering by Christian investors: a belief in God as owner of capital, personal calling, and an awareness of enough.

Many investors engaged in surrendering the goals of other identities in favor of their religious identity because of an understanding of God’s ownership of the investment capital. One of the core beliefs of FDI states, “We believe God owns it all – not just our tithe, but all of it” (B10). For several investors, this realization reinforced the primacy of their religious identity. For example, one investor explained, “When I figured out it was zero percent mine and 100% God’s, then it really changed the way I looked at things” (P20, 2). A recognition of God’s ownership also led to the sacrificing of other identity expectations by clarifying the expectations of their religious role identity. An investor explained, “The Bible starts with the idea that the earth is the Lord’s. And so, it’s fundamentally His. He’s the owner of absolutely everything. And, our task is to manage His stuff” (P3, 2). Another investor shared, the focus is on “how we might think about how God would have us steward His investment assets” (C4, 2).

Investors commonly noted the importance of a personal calling in the practice of surrendering. One investor explained, “A calling to lead a more purposeful life, which I was scared to death to do, but I felt like this is what God was calling me to do” (I7). The focus of the personal calling for investors consistently reinforced their prioritized identity above other identities. For example, one investor shared, “God is all about bringing everything under His Lordship, and inexplicably He calls us to do this” (C14, 2). Related to personal calling, investors made an important distinction between being ‘willful’ to other role expectations or being ‘faithful’ to their religious identity. For example, one investor offered, “It’s critical to check: Am I trying to push to make this successful because I feel like that’s what the Lord is asking me to do, or because I want to satisfy some internal motivation that isn’t from the Lord?” (P6, 2).

The final element that led investors to surrender the goals of other identities in favor of those associated with their religious identity was an awareness of enough. Investors decided to “set a finish line” or “cap their lifestyle” as a means of deciding what was “enough” regarding their financial goals and submitting all of the rest of their capital to the service of their religious goals. While generating extensive wealth did not guarantee a prioritized religious identity, this awareness of enough provided investors with an increased desire to pursue religious goals while sacrificing financial goals. For example, one investor explained, “If God chooses for us to prosper, we’re not going to see that as a call to increase our lifestyle, but instead see it as an opportunity to use the dollars God provides for Kingdom purposes” (P10, 2). As a result, many investors reinforced their prioritized religious identity because of an awareness of enough. For example, one investor said, “It wasn’t about me and it wasn’t about building bigger barns for myself, but it was about building a Kingdom impact with my wealth” (P19, 2).

Our data provides evidence that investors reduced identity tensions based on reinforcing their prioritized identity through surrendering. For many investors, surrendering reduced identity tensions by turning over the locus of control to God. For example, one investor explained, “I literally was on my hands and knees saying every morning, ‘Lord these are not my resources. Tell me how I am supposed to use them’” (P21, 2). Surrendering also reduced identity tensions of impact investing by reshaping the battle as more comprehensive and existential. An investor shared, “I came to an understanding that God didn’t want my money, He didn’t need my money, but what He wanted was me. And I really became cognizant of this whole thing of surrender” (P20, 2). Finally, surrendering helped investors reduce identity tensions by reframing their primary risk from financial to religious expectations. For example, one investor explained, “Making the wrong investment isn’t the greatest risk; disobedience is” (C15). While surrendering was an important mechanism to reduce identity tensions by sacrificing to bring misaligned identities and into a prioritized hierarchy, it was also an ongoing and challenging process for most investors. For example, one investor candidly shared, “I am on my knees every day and I am only on the S in surrendering” (I21).

Discussion

In our study, we investigated how investors managed identity multiplicity in impact investing. As investors attempted to manage their financial, social, and religious identities, we found they often experienced identity tensions stemming from their competing role expectations. To address these tensions, we found investors engaged in an interactive, ongoing three-step process to manage identities and identity tensions. These three steps included: prioritizing one of their salient identities, managing their identity multiplicity inter-relationships, and reinforcing their prioritized identity. In our study, investors generally prioritized an identity that was neither financial nor social, but rather religious. We also found investors managed their identity inter-relationships by shadowing (equating two identities as one) or by distinguishing (keeping all three identities separate). Finally, we found investors reinforced their prioritized identity through the mechanism of surrendering, where they sacrificed goals and expectations of their financial and / or social identities in favor of their religious goals and expectations. In summary, our findings develop a model of identity multiplicity work. We now explain the theoretical and practical implications of our study.

Managing Role Identity Multiplicity and Inter-relationships

Our study contributes to the literatures on multiple identities and impact investing. While extant scholarship often focuses on two identities (e.g., Agrawal & Hockerts, 2019; Besharov & Smith, 2014; Jain et al., 2009; Pratt & Foreman, 2000; Ramarajan, 2014; Smith et al., 2010), we complement research on multiple identities and impact investing by responding to calls by scholars to add more identities (e.g., Battilana et al., 2017; Ramarajan, 2014). The inclusion of a third identity is not simply the addition of one more identity where identities are managed by dual-identity processes. Rather, a third identity increases identity complexity by adding multiple relationships among the identities and “complex patterns of relationships between identities emerge” (Ramarajan et al., 2017: 497). As such, our study develops a model that moves from a contingency (dual-identity) to configuration (three or more identities) perspective, identifies specific mechanisms for managing identity multiplicity, and explains how some mechanisms are used in combination in identity multiplicity work.

First, we contribute to the research on multiple identities and impact investing by developing a model of identity multiplicity work, which explains how individuals manage their identities in the presence of role expectations emanating from three identities. In this way, we add to the nascent work on identity configurations (Ramarajan, et al., 2017), which moves beyond a single relationship and pair of identities to multiple relationships and identity inter-relationships. A configurational approach moves from a “unidimensional, variance-based, reductionist” contingency view to a “multidimensional, processual, intertemporal” view of multiple identity management (Fisher, 2020: 3). This is because “configurational inquiry represents a holistic stance, as assertion that the parts of a social entity take their meaning from the whole and cannot be understood in isolation” (Meyer et al., 1993: 1178). By moving to the triadic level, we begin to build an “important bridge between studies of a single relationship between a pair of identities to studies of a larger number of relationships” (Ramarajan, 2014: 628). This bridge is important because research finds that individuals often hold four to seven identities (Roccas & Brewer, 2002).

Second, we add to the limited research on multiple identity management mechanisms used to manage inter-relationships among three identities. We found investors engaged in shadowing and distinguishing, which complement prior mechanisms of managing identity synergy and plurality (Pratt & Foreman, 2000). Extant research suggests identities with high synergy will be integrated (Pratt & Foreman, 2000). In contrast, we found that despite potential synergies between social and religious identities, investors opted to shadow the two identities rather than integrate them. Whereas integration requires a fusing of two identities into a distinctly new identity (Pratt & Foreman, 2000), we found investors wanted to maintain the independence of their religious identity but reduce the complexity of assessing and measuring both their social and religious identities. This was possible because of the high degree of overlap between the identities. Extant research suggests two mechanisms for managing identity plurality: compartmentalization, keeping identities completely separate, and aggregation, forging links between multiple identities to develop a meta-identity (Pratt & Foreman, 2000). Our study suggests a middle-ground strategy of distinguishing, which includes features of both compartmentalization and aggregation. We found investors kept their financial, social, and religious identities separate from each other and utilized a common assessment system to link their outcomes. As such, distinguishing builds from the compartmentalization identity strategy by keeping three identities distinct but still maintains a connection between the identities through a common assessment. Distinguishing reduced some identity tensions by developing a common minimum threshold for each of the different identities, utilizing unique measurement for each identity but a common system across the identities. While our findings are consistent with prior research on managing multiplicity of logics through combination and separation in collective social entrepreneurship (Mitzinneck & Besharov, 2019), our mechanisms focus on individual mechanisms for managing identity inter-relationships in impact investing.

Third, we extend prior research that has focused on the use of a single dual-identity strategy (Pratt & Foreman, 2000). We found investors attempted to manage their identity inter-relationships by using a combination of dual-identity strategies in concert. In our study, some investors used a novel strategy of shadowing with a strategy of compartmentalization (Pratt & Foreman, 2000). The strategy of shadowing effectively combined the expectations of two identities (religious and social) into one (religious-social). Then, the investors used a compartmentalization strategy of reinforcing the importance of the religious-social identity over the financial identity. In this way, our study illustrates the need to use several strategies in combination to focus on multiple identity relationships. It also highlights the importance of research on multiple identities and impact investing as a context to expand nascent research on configurational approaches to intrapersonal identity (Ramarajan, 2014; Ramarajan et al., 2017). Our study also raises the questions about the efficacy of the sequence and compatibility of different strategy combinations for different identity relationships.

Prioritizing a Salient Alternate Identity

Prior research in impact investing and social entrepreneurship has largely focused on the benefits and challenges of managing financial and social identities, goals, and logics (Agrawal & Hockerts, 2019; Smith et al., 2013). By contrast, our study finds individuals often prioritized a third, alternate identity. Despite the inclusion of financial and social identities, investors frequently elevated a religious identity above their financial and social identities. Our findings raise important issues for research on impact investing, social entrepreneurship, and business ethics.

First, we challenge the assumption that investors or entrepreneurs in impact investing are limited to, or motivated by, the common prescriptions of financial and social identities, goals, and motivations. In our study, we found the salience of the religious identity often superseded the salience of social or financial identities. Even when social and religious identities aligned, investors generally identified the religious identity as the driver of their behavior. As a result, our study implies the current understanding of impact investing and social entrepreneurship may be under-specified, assigning predictive value to a role identity that may (not) be aligned or even related to another identity that has been overlooked. As such, our study suggests the social role identity of impact investing and social entrepreneurship may need to be more fully explicated. This is consistent with research that recognizes other identities play an important role when pursing financial and social goals (Wry & York, 2017). In our study, a religious identity motivated the pursuit of outcomes often attributed to social identities. However, a religious identity is only one of several identities (e.g., gender, race, environmental)Footnote 4 that may hold an elevated salient role and motivate behavior previously characterized generically as social.

Second, our study encourages the use of novel theoretical lenses and levels of analysis in impact investing and business ethics research. While extant research on impact investing lacks theoretical grounding or relies heavily on a macro-level, institutional lens (e.g., Agrawal & Hockerts, 2019; Lee et al., 2020), we contribute to research that examines the micro-level, identity processes of impact investors. Such an approach brings the investor back into the conversation and highlights the agency of the investor, and their investor identity, in making and managing investment decisions (Smith & Bergman, 2020). In so doing, we answer the call for novel theoretical frameworks – identity theory and identity work—to enrich the fields of impact investing (Agrawal & Hockerts, 2019) and business ethics (Greenwood & Freeman, 2018). Specifically, we broaden the theoretical base of identity work by adding identity multiplicity work as a complement to other forms of identity work (Caza et al., 2018) for impact investing and business ethics. We also extend research on identity work and ethics, which focused on social and professional identities of sustainability managers (Carollo & Guerci, 2018), with research on role identities of impact investors.

The Role of Religion in Impact Investing and Identity Theory

Our study also contributes to the literatures on impact investing and identity theory by highlighting the role of religion. While religion is often ignored or deemed too sensitive for research in organizational studies (Chan-Searfin et al., 2013; Tracey, 2012), we found it played a central role in impact investing and as a context for identity theory development. This is consistent with research that recognizes religion as a meta-logic (Dyck, 2014; Gümüsay, 2020).

First, we emphasize the potential importance of the role of religion, and religious identity, in the context of impact investing. Our findings show a religious identity is a primary motivating factor in the pursuit of impact investing. This is consistent with prior research that suggests religion is important for socially-responsible investing, social entrepreneurship and entrepreneurship (e.g., Smith et al., 2019; Spear, 2007; Tracey, 2012; Yan, et al., 2018). In this way, we extend the “theological turn” to impact investing and related areas, where it has much to offer (Smith et al., 2021). The theological turn defines leading philosophers and organizational theorists who develop “social theory based on the assumption there is an altruistic god” (Dyck, 2014: 27) and calls into question the “meta-ethics and value-laden assumptions that underpin all of organization and management theory…including the mainstream individualistic-materialistic iron cage” (Dyck, 2014: 55). The theological turn allows us to theorize about concepts, such as altruism and compassion, which are difficult to explain within an instrumental management paradigm (Ferraro et al., 2005) and is critical to understanding impact investing and other areas pursuing social value such as social entrepreneurship and corporate social responsibility.

Second, our study illustrates how the context of religion offers fertile ground for identity theory development. In our study, we develop the construct of surrendering, which we define as the partial sacrificing of goals of one (or more) identity (identities) in favor of the goals of another identity, based on an individual’s self-reflective importance of the role. From an identity perspective, surrendering extends our understanding of how investors manage multiple role identities (e.g., Pratt & Foreman, 2000; Wry & York, 2017). Specifically, it highlights a form of aggregation where multiple identities are retained (Pratt & Foreman, 2000), but it illustrates how categorical preference is given to one identity over others.Footnote 5 In our study, we found investors reduced the identity tension between their religious and financial identities by surrendering the expectations of their financial identity in favor of their religious identity. The mechanism of surrendering adds empirical evidence to what is a largely theoretical understanding of identity multiplicity (Jain et al., 2009).

While the surrendering construct was developed in a religious setting, it also transcends the context as a theoretical mechanism for managing multiple role identities. A religious identity, or context, is not necessary for an individual to surrender, as an individual may be willing to sacrifice the role expectations of one identity in favor of another in any number of professional, organizational, or relational roles. For example, a venture capitalist may choose to sacrifice her salient role identity as an investor in favor of her role as an environmentalist, which may lead her to invest in green technology founders, even if these entrepreneurs are newer to the field or have unproven technology and therefore may present a higher degree of uncertainty. In this example, the construct of surrendering, while developed in a religious context, offers theoretical value beyond the religious context. This approach is consistent extant research in religious contexts that extend identity theory through new theoretical constructs, such as the construct of identity elasticity (Kreiner et al., 2015).

Practical Implications

Our study also has important practical implications. The field of impact investing is trying to encourage more participation from religious investors (GIIN, 2020a). Market research suggests a number of potential contributing factors to the low level of participation by religious investors, including perception of lower financial returns and a mismatch of impact offered by impact investments and sought by these investors (GIIN, 2020a). Our study suggests some investors may be able to overcome these barriers through identity multiplicity work. In addition, the practical implications of our study suggest religion may be a useful starting point to ‘change the mindset of the role of capital in society’ beyond financial performance (GIIN, 2018: 47). For example, one investor explained, “We note that capitalism is influenced by the actors around. And, so if we can as a group collective and say, ‘As a set of believers in Jesus, here’s our beliefs and therefore here’s our investment strategies,’ we will have a tremendous impact on capitalism and impact investing by allowing Christians to reflect their own values and also influence the capital markets” (C5, 1). This suggests religion can encourage investors to support socially relevant causes. Building on the 2019 Business Roundtable, which broadened the purpose of business to include all stakeholders, our study suggests business practitioners, and the field of impact investing, may need to take more seriously God as an important stakeholder to appeal to religious investors (Schwartz, 2006).

Limitations and Future Research

While our qualitative and inductive research approach provided unique insights of impact investing, we recognize that our approach also comes with limitations. First, our qualitative approach enabled us to understand how and why Christian investors participated in impact investing. However, our method does not provide a generalizable test of the likelihood, strength, or consistency of our findings. It could be that identity multiplicity work may influence investment decisions only after an investor participates in impact investing or may not hold true for other investors who chose not to participate. Our intent in this study was to elaborate a conceptual model of identity multiplicity work for future empirical testing.

Second, our study zoomed in on many of the leaders and the earliest stages of this movement of impact investors. The perspectives may (not) be shared by all followers of the movement and may unfold differently over time. While the development of unifying principles and core beliefs at recent events reduce the risk of major differences between leaders and followers, this must be assessed over time. Third, our study may suffer from social desirability bias in responses. While we acknowledge this potential, our epistemological perspective is one of social construction and therefore relies on self-referential views of the respondents (McCall & Simmons, 1978). We attempted to triangulate data across multiple sources, including actual investments with lower financial returns, and found evidence of respondents talking about their challenges in identity work and navigating identity tensions. Fourth, we focused on a sub-set of Christian investors. Our findings do not speak to the differences within and between different religions. In addition, we focus on religion, rather than related constructs such as spirituality. Future research could compare and contrast our findings with that of other denominations within Christianity, other religions including major world religions of Islam and Hinduism, and other constructs. Such an approach recognizes an intra-religious logic plurality (Gümüsay, 2020).

Recognizing the limitations and boundary conditions of our study, we believe our study makes an important contribution as a model of identity multiplicity work by Christian investors to navigate the identity tensions to participate in impact investing. We also believe our study provides a number of new avenues for research. Our study opens several paths for future research at the interfaces of impact investing, identity, ethics, and religion. First, for research in impact investing, our study adds the theoretical framework of identity work and focuses on the role of identity work of impact investors themselves. In this way, it adds to the limited research on the micro-processes of multiple identities. Yet, this is just the beginning of the potential for identity work to increase our academic knowledge of impact investing and multiple identities. Future research should focus on identity construction and formation processes (Gioia et al., 2010). Identity work could also inform impact investing research across and between many different actors and levels of analysis including organizational, institutional, and field levels of analysis (Ashforth et al., 2011; Kreiner & Murphy, 2016). As the identity work of different actors is understood, a more comprehensive picture could emerge of identity interplay between different actors, levels, and identities in impact investing.

For identity research, our study offers both a conceptual model and new mechanisms for understanding identity multiplicity work to reduce identity tensions. These contributions provide many new paths for research on identity. First, the conceptual model needs to be tested for generalizability. For example, how do inter-relationship approaches, such as shadowing and distinguishing, relate to the frequency and magnitude of reducing identity tensions? Second, it opens up new questions by moving beyond dual identities. For example, what are other configurational and network structures of identity multiplicity? What are the antecedents and outcomes of these identity configuration and network structures? How many identities are too many to manage? Third, the new mechanisms of shadowing, distinguishing, and surrendering need to be more fully tested. Are there times when these mechanisms are more effective or lead to different outcomes? Are there dark sides, such as surrendering a role identity to coercive or questionable power?

Our study adds to research in ethics by illustrating how identity work was used to navigate the identity tensions in impact investing. We build on the recent literature that calls for and uses identity work to understand business ethics (Carollo & Guerci, 2018; Greenwood & Freeman, 2018). One path for future research in ethics is to use identity work in other settings including corporate social responsibility, base-of-the-pyramid, and social entrepreneurship, among others. Our study focused on role identities. It may also be fruitful to study social identity, based on group memberships, as well as other professional and individual identities in future research on ethics. Such an approach expands identity work to a more robust engagement with identity and social identity theory in business ethics and impact investing research.

Another path for future research is on the role of religion in impact investing and social entrepreneurship. The theological turn has both historical roots and recent emergence in organizational and entrepreneurial studies. Yet, religion is often neglected in many different kinds of organizational studies research (Smith et al., 2019; Tracey, 2012). Our study highlighted how the role of religion, and its influence on identity, affected impact investor participation. Future research could examine the role of religious identity in other areas of social entrepreneurship and across different religions. Importantly, our study opens the door for research that questions the dominant individualistic-materialistic perspective in management theory. The theological turn is particularly important in fields such as impact investing, where alternative motivations and logics are commonly present, and may open avenues to answer foundational questions about motives and desired outcomes.

Conclusion

While the growing literature on impact investing recognizes multiple identities exist, our study explores how Christian impact investors engaged in managing multiple role identities in impact investing. We develop a model of identity multiplicity work of impact investors, explaining how individuals manage their multiple identities (financial, social, and religious) to reduce identity tensions during the process of impact investing. We find individuals engaged in an interactive, ongoing three-step process: prioritizing one of their salient identities, managing identity multiplicity inter-relationships, and reinforcing their prioritized identity. Our study contributes to research on identity, impact investing, and ethics through an in-depth examination of how investors implemented identity work through novel mechanisms to navigate identity tensions and participate in impact investing.

Notes

The literature on identity recognizes different bases for the formation and maintenance of identities, including role identities and social identities. The identities differ based upon where the sense of self is derived. In role identity, the sense of self is derived based on the enactment of a role. In social identity, the sense of self is derived from group membership. In our study, we focus on role identities because we are interested in the identities derived from individually-constructed roles, rather than identities from group membership. We do return to social identity theory in the discussion section. A complete discussion of social identity theory is beyond the scope of our study.

While we consistently use the term religion or religious, respondents often used terms such as “faith” or “spiritual” as synonyms for our theoretical definition of religion. To maintain data and theoretical integrity, we report respondent language in their own words in the findings but use the term religion in the balance of the manuscript. While a focus on the commonalities and differences of religion, faith, and spirituality are beyond the scope of this study (see Hill et al., 2000), we collected and analyzed our data with a consistent theoretical focus on religion. For our study, the specific religion of interest to our respondents was Christianity.

We will elaborate on the similarities and differences between social and religious identities later, but here draw attention to the contrast between these two and the financial identities.

We appreciate an editor raising the issue of other types of salient identities.

We thank an anonymous reviewer for articulating this view.

References

Agrawal, A., & Hockerts, K. (2019). Impact investing: review and research agenda. Journal of Small Business & Entrepreneurship, 33, 1–29.

Alvesson, M., & Wilmott, H. (2002). Identity regulation as organizational control: Producing the appropriate individual. Journal of Management Studies, 39(5), 619–644.

Arjaliès, D. L., & Durand, R. (2019). Product categories as judgment devices: The moral awakening of the investment industry. Organization Science, 30(5), 885–911.

Ashforth, B. E., Kreiner, G. E., & Fugate, M. (2000). All in a day’s work: Boundaries and micro role transitions. Academy of Management Review, 25(3), 472–491.

Ashforth, B. E., Rogers, K. M., & Corley, K. G. (2011). Identity in organizations: Exploring cross-level dynamics. Organization Science, 22(5), 1144–1156.

Bartunek, J., & Louis, M. R. (1996). Insider/outsider team research. USA: Sage Publications Inc.

Battilana, J., Besharov, M., & Mitzinneck, B. (2017). On hybrids and hybrid organizing: A review and roadmap for future research. The SAGE Handbook of Organizational Institutionalism, 2, 133–169.

Battilana, J., & Dorado, S. (2010). Building sustainable hybrid organizations: The case of commercial microfinance organizations. Academy of Management Journal, 53(6), 1419–1440.

Battilana, J., & Lee, M. (2014). Advancing research on hybrid organizing—Insights from the study of social enterprises. The Academy of Management Annals, 8(10), 397–441.

Besharov, M. L., & Smith, W. K. (2014). Multiple institutional logics in organizations: Explaining their varied nature and implications. Academy of Management Review, 39(3), 364–381.

Bouri, A. (2019) Why impact investing is a natural fit for faith-based investors. Financial Times, August 12.

Burke, P., & Tully, J. (1977). The measurement of role identity. Social Forces, 55(4), 881–897.

Carollo, L., & Guerci, M. (2018). ‘Activists in a suit’: Paradoxes and metaphors in sustainability managers’ identity work. Journal of Business Ethics, 148(2), 249–268.

Caza, B. B., Vough, H., & Puranik, H. (2018). Identity work in organizations and occupations: Definitions, theories, and pathways forward. Journal of Organizational Behavior, 39(7), 889–910.

Chan-Serafin, S., Brief, A. P., & George, J. M. (2013). How does religion matter and why? Religion and the organizational sciences. Organization Science, 24(5), 1585–1600.

Clark C, Emerson J, & Thornley B (2015) The impact investor: Lessons in leadership and strategy for collaborative capitalism. Wiley.

Corbin J, & Strauss A (2008) Strategies for qualitative data analysis. Basics of Qualitative Research. Techniques and procedures for developing grounded theory, 3rd edition

Dyck, B. (2014). God on management: The world’s largest religions, the “Theological Turn”, and organization and management theory and practice. Religion and Organization Theory (Research in the Sociology of Organizations, Volume 41). Emerald Group Publishing Limited, 41, 23–62.

Emmons, R. (1999). The psychology of ultimate concerns: Motivation and spirituality in personality. Guilford Press.

Global Impact Investing Network (GIIN). (2020a). Engaging faith-based investors. https://thegiin.org/research/publication/engaging-faith-based-investors-in-impact-investing