Abstract

This paper examines the effectiveness of the use of executive compensation linked to Corporate Social Responsibility (CSR) goals across US firms. Empirical analysis of a cross-industry sample of 746 listed companies for the period 2002–2013 showed that the use of CSR-linked compensation contracts for Named Executive Officers (NEOs) promotes CSR performance. More specifically, we found that linking NEOs’ compensation to CSR goals produces positive effects in the 3rd year after adoption. As firms accumulate experience and learn how to use the system over the following eight periods, CSR performance increases monotonically. Furthermore, experience accumulated over time affects the different specifications of CSR performance asymmetrically, by reducing both environmental and social CSR concerns and increasing only environmental CSR strengths. Interestingly, we also found that the simultaneous use of other CSR-focused governance systems moderates the effect of a firm’s accumulated experience in using CSR-linked executive compensation on CSR performance: the existence of a CSR committee at the board level and the public release of a CSR report are likely to have a positive moderating effect, while the purchase of a CSR audit has no moderating effect.

Similar content being viewed by others

Introduction

Over the last 40 years, the relationship between CSR performance and financial performance has been investigated in an effort to assess whether CSR performance affects shareholder value [see Margolis et al. (2009)]. Empirical findings (Brammer and Millington 2008; Hong et al. 2016) show that, among other different factors, this relationship depends on the type of CSR performance analyzed [e.g., environmental versus social (Konar and Cohen 2001)], on industry characteristics [e.g., high polluting industries versus low polluting industries (Al-Tuwaijri et al. 2004)], on firm-specific characteristics [e.g., strategic positioning and financial risk (Matsumura et al. 2014; Mishra and Modi 2013)], and also on the moderating effect of disclosure transparency (Barth et al. 1997; Clarkson et al. 2008; Eccles et al. 2014; Neu et al. 1998). Whereas prior studies have provided deep understanding of how CSR performance influences financial performance, there are few empirical academic contributions on what firms do to achieve better CSR performance.

As a result of changing regulations and emerging investor activism (Maas 2018), this question has become a priority concern for firms and has focused the attention of Boards of Directors (BODs) on how to promote CSR performance (PRI 2012; TCB 2012). In particular, BODs debate which governance systems are more effective in promoting executive managers’ CSR efforts (Berrone and Gomez-Mejia 2009; Cho and Patten 2007; de Villiers et al. 2011; Dhaliwal et al. 2011; Oh et al. 2016; Walls et al. 2012). The use of a formal link between Named Executives Officers’(NEOs)Footnote 1 compensation and the achievement of CSR goals to promote CSR issues on executives’ agendas has become one of the focal points in the debate (Kolk and Perego 2014; Maas 2018; The Guardian 2014).

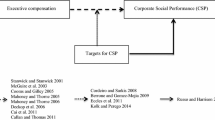

While a growing number of firms are linking executive compensation to the achievement of CSR goals, empirical findings on the effect of using these incentive systems are mixed (Berrone and Gomez-Mejia 2009; Cai et al. 2011; Coombs and Gilley 2005; Cordeiro and Sarkis 2008; Deckop 2006; Eccles et al. 2014; Hong et al. 2016; Kolk and Perego 2014; Maas 2018; Mahoney and Thorn 2006; McGuire et al. 2003; Russo and Harrison 2005; Stanwick and Stanwick 2001).Footnote 2 In this regard, Thomson Reuters’ ASSET4Footnote 3 reveals that in 2013 approximately 31.82% of large public firms linked the compensation of at least one of their NEOs to CSR performance, as compared to 3.85% in 2002. While the increasing adoption of CSR-linked executive compensation would support the idea of its widespread usefulness, we also note that firms that are considered CSR-champions do not necessarily anchor CSR performance to NEOs’ compensation. Several of the firms included in the Dow Jones Sustainability Index (DJSI) for 5 consecutive years did not use CSR-linked executive compensation or used it discontinuously.Footnote 4 Although inclusion in the DJSI does not necessarily equate with effective use of CSR-linked executive compensation, this evidence casts doubts on the general usefulness of the incentive system in encouraging better CSR performance and calls for more investigation.

Since the work by Russo and Harrison (2005) documenting a weak direct association between environmental targets and desired environmental performance in the electronic industry, only Maas (2018) and Flammer et al. (2019) have investigated this issue in detail through longitudinal analysis over a large cross-industry sample. Maas (2018) confirmed that the use of CSR targets in general does not automatically lead to better CSR performance. In contrast, she showed that the use of quantitative hard targets can foster significant CSR improvements, while the use of qualitative soft targets is ineffective. More recently, Flammer et al. (2019) have found that the adoption of CSR targets in executive compensation leads to an increase in the number of corporate initiatives to the benefit of the local community and the natural environment as long as CSR contracting terms are well-specified, i.e., executive compensation is directly targeted at these stakeholders through the use of specific performance goals. Additionally, the authors showed that this is especially true the greater the share of CSR-related compensation compared to total compensation.

Using a cross-industry sample of 4472 firm-year observations from 746 US listed companies during a 12-year period (2002–2013), this study extends and complements the findings of Maas (2018) and Flammer et al. (2019) by adopting a dynamic perspective that helps explain the effectiveness of firms’ use of CSR-linked executive compensation over time. Moreover, the study adopts a corporate governance perspective to examine the functioning of CSR-linked executive compensation used in combination with other CSR-focused governance systems that monitor and advise on executives’ CSR activities. Specifically, this study contributes to existing knowledge in three ways. Firstly, it is the first to investigate how organizational learning over time influences the relationship between CSR-linked executive compensation and CSR performance. Secondly, the study separates the impact of the firm’s experience in using CSR-linked executive compensation on CSR environmental strengths and concerns, as well as on CSR social strengths and concerns, to test the relative effectiveness of CSR contracting experience on different CSR constructs. Thirdly, it explores the moderating role of specific CSR-focused governance systems (i.e., the release of a CSR report, the purchase of a CSR audit and the presence of a CSR committee at the BOD level) in supporting a firm’s experience in using CSR-linked executive compensation.

To foster the effectiveness of CSR contracting, firms might invest in CSR-focused governance systems to monitor and advise executive managers in CSR-oriented decision making and subsequent adjustments. More specifically, ASSET4 reveals a growing proportion of firms releasing CSR reports, purchasing CSR audits and establishing a CSR committee at the BOD level. We believe that CSR reports may be of great support to BOD members who are learning how to use CSR incentives effectively. CSR audits are likely to enhance the credibility of the disclosed CSR-related information and, therefore, facilitate external users’ monitoring of the CSR actions of formally incentivized NEOs (Simnett et al. 2009). CSR committees possibly provide NEOs with appropriate knowledge and expertise, fostering accountability on sustainability issues (Paine 2014). Few studies, however, have examined the effectiveness of these CSR-focused governance systems when coupled with CSR-linked executive compensation, despite the formers’ growing popularity.

Interestingly, we found that the mere use of CSR-linked executive compensation does not immediately promote CSR performance. However, linking NEOs’ compensation to CSR performance goals is likely to produce positive effects starting from the 3rd year after adoption, as firms accumulate experience and learn how to use the system over time. The experience accumulated over time contributes especially to reducing both CSR social and environmental concerns and to increasing only CSR environmental strengths. We also found that the joint use of other CSR-focused governance systems moderates the effect of the firm’s accumulated experience in using CSR-linked executive compensation on CSR performance. The presence of a CSR committee within the BOD and the public release of a CSR report are likely to have a moderating role. The purchase of a CSR audit, however, has no moderating effect. The results are robust after controlling for potential endogeneity concerns using an event study following Granger (1969), as well as after checking for measurement errors and other confounding effects, including specific agency concerns.

This research has important practical implications. The findings are useful for investors interested in allocating their assets to socially responsible investments. Our results are also informative for BOD members responsible for CSR-related compensation contracting. Their choice of design variables may account for our results. Business leaders and policy makers may gain inspiration on how, respectively, to promote and incentivize the adoption of specific corporate governance mechanisms to help firms better achieve CSR goals, while firms already using CSR-linked executive compensation may be encouraged to seek benefit from the voluntary establishment of a board committee with a CSR-specific advisory function, or from the public release of a CSR report facilitating the monitoring of executives’ CSR efforts.

Background Literature and Hypotheses

Incentives and CSR Performance: Performance Measurement Assumptions in the CSR Setting

An abundant stream of literature has been produced on the use of monetary incentives and their effectiveness in motivating management effort. Although a comprehensive review of this vast literature falls outside the scope of this study, we observe that three fundamental controversies on the use of monetary incentives have long been at the center of the academic debate.

The first controversy relates to the prevailing purpose for using monetary incentives: motivational vis-à-vis informational (Merchant and Van der Stede 2012). When incentives have a prevailingly motivational purpose, evidence suggests that they constitute an effective means to motivate managers’ efforts to perform the assigned tasks in accordance with the firm’s strategic goals (Merchant and Van der Stede 2012). When incentives have a prevailingly informational purpose, they provide specific signaling to shareholders and other stakeholders (Merchant and Van der Stede 2012; Armstrong et al 2010), i.e., incentives are adopted primarily as a way to inform, to communicate, and to build awareness on certain strategic goals, rather than as a means to achieve performance. As a result, the use of incentives for informational purposes might have a negligible effect on performance.

The second controversy refers to how the use of monetary incentives may undermine individual motivation to achieve results. In this respect, individuals within firms perform tasks under the influence of two types of motivation: the intrinsic goals of their work and activities and the extrinsic incentives offered in exchange for their effort (Ryan and Deci 2000). Extant literature shows that intrinsic and extrinsic motivation interact, and that this interaction may affect the achievement of results (Frey and Jegen 2001; Ryan and Deci 2000). An extensive body of research has documented the potential crowding-out effect of intrinsic motivation associated with the use of extrinsic incentives (Frey and Jegen 2001). In this light, the use of incentives could be associated negatively (or less positively) to performance, depending on the intensity of the crowding-out effect (Bénabou and Tirole 2010).

The third controversy is more generally related to how incentives are designed and used in an agency setting to optimize their effectiveness (Eisenhardt 1989; Holmstrom and Milgrom 1991). We based our study on the agency theory, arguing that incentives serve to align agents’ efforts with the principal’s desires (Eisenhardt 1989; Holmstrom and Milgrom 1991). Our main assumption is that in order to pursue CSR goals, BODs representing shareholders’ interests can design compensation contracts that make executive pay contingent on achieving specific CSR performance goals. In particular, agency models posit that effective incentive design requires appropriate consideration of specific concerns that are endogenous to the principal-agent relationship (Eisenhardt 1989). Taking a managerial control perspective, we consider two main concerns that can explain a null or even negative relationship between CSR-linked incentives and CSR performance: the measurability of the performance used to evaluate agents’ efforts and the multiplicity of tasks assigned to agents. Our underlying motif is that the agency theory may not necessarily apply tout court to the CSR setting.

The measurability of CSR performance is the first concern. Traditionally, agency theory has been applied to settings where performance is defined in financial terms. CSR performance, however, lies in a non-financial performance domain. According to Ioannou et al. (2016) and Kolk and Perego (2014), non-financial performance is generally more difficult to measure than financial performance. CSR performance entails achievements in many environmental and social performance areas, from the reduction of carbon footprints to avoidance of modern slavery. While more tangible elements of CSR (e.g., carbon footprints) can be measured objectively and accurately, softer elements seem rather difficult to measure with precision and therefore less controllable and harder to understand (e.g., the ‘good faith efforts’ performance target, as used by Walmart International (2014, p. 55)Footnote 5).

Controllability and understandability of performance measures, as a corollary of their measurability, are other crucial pre-requisites of incentive design effectiveness (Merchant and Van der Stede 2012). Environmental and social metrics are not standardized either, leading to issues of verifiability for the principalFootnote 6 (Kolk and Perego 2014). When the measurement process cannot ensure controllable and verifiable performance measures, the contractibility of these measures is hindered. Unverifiable performance measures make it more difficult to elicit managerial effort and therefore they are less suitable as the basis for “optimal” incentive systems (Kolk and Perego 2014). In this regard, the recent work by Maas (2018) has shown that the use of quantitative, hard, i.e., more measurable, CSR targets helps to improve CSR performance, while the use of soft, qualitative, i.e., less measurable, CSR targets is not associated with CSR performance improvement.

The multiplicity of contracted tasks (Eisenhardt 1989; Holmstrom and Milgrom 1991) is the second reason why the positive relationship between CSR-linked incentives and CSR performance may be altered. In a multi-task agency setting, managers are assigned multiple tasks with potentially incongruent goals some of which, at least in the short run, attract their attention at the expense of others (Hill and Jones 1992; Jo and Harjoto 2011). Competing objectives may therefore lead to effort allocation concerns on the part of managers (Holmstrom and Milgrom 1991). Effective incentive design should address this concern and induce the agent to allocate effort optimally among the multiple tasks assigned (Holmstrom and Milgrom 1991). With the tasks needed to improve CSR performance being multiple and having different natures, promoting certain outcomes beneficial to a certain group of stakeholders can affect other stakeholders negatively and, therefore, impair the firm’s overall CSR performance (Cai et al. 2011). In the short term particularly, managers need to trade the interests of various stakeholders off; for example, managers may not favor corporate environmental policies that put their jobs at risk. Similarly, Flammer et al. (2019) contend that managers tend to give priority to key stakeholders that contribute to short-term performance (i.e., consumers and employees), as opposed to stakeholders not having an immediate effect on financial performance, but which are financially material to the firm in the long run (i.e., natural environment and local communities). Once created, these misalignments may also persist for a prolonged period of time and hinder (at least in the short run) the benefit of CSR-linked incentives (Hill and Jones 1992).

MSCI ESG STATS data itemize CSR performance and provide an indication of the multiplicity of tasks involved in generating CSR outcomes. This multiplicity is reflected in MSCI ESG in two different dimensions. Firstly, MSCI ESG taxonomy identifies various stakeholder relationships based on different areas of CSR performance (Freeman 1984; Miles 1987). Secondly, MSCI ESG distinguishes between a firm’s CSR strengths and concerns, based on a continuum of activities for CSR reputation building (Carroll 1979). These activities involve on the one hand reacting to unwanted CSR negative outcomes, and on the other being pro-active on specific CSR issues. ESG identifies CSR strengths as positive events resulting from discretionary corporate actions. For example, MSCI ESG recognized as a strength of Agilent Technologies Co. Ltd. its inclusion in the 50 companies with the best reputations for employing the disabled in 2007 (Krüger 2015). “Negative events,” in contrast, “are often the result of lack of care or lack of ethical standards” and “materialize because a company is passive and/or fails to reduce the severity of controversies” (Krüger 2010). For example, MSCI ESG filed as a negative indicator for Ashland Inc. the news from the Chicago Tribune in March 2007 that eight people had been hospitalized after a chemical spill at one of the company’s distribution plants in Illinois (Krüger 2015).

To summarize, from a managerial control perspective, how the use of CSR targets in executive compensation serves as effective governance to influence corporate actions remains far from obvious (Flammer et al. 2019).

Experience in Using CSR-Linked Executive Compensation and Effects on CSR Performance

Taking the above arguments together, it seems unlikely, at least in the short run, that firms are able to contract “optimally,” i.e., addressing the above-mentioned concerns endogenous to the principal-agent relationship in the CSR setting. However, adjustments may occur over a longer time span, as firms accumulate experience in using CSR-linked executive compensation.

The organizational learning literature documents the long-term increasing returns of cumulative experience in using and adjusting formal procedures (Argote and Miron-Spektor 2011; Levitt and March 1988).Footnote 7 This evidence suggests reasonableness in expecting firms to gain experience in using CSR-linked incentives and therefore become able to address the above concerns over time. Furthermore, the use of CSR-linked executive compensation is relatively novel, which reinforces our belief that there is significant room here for organizational learning. In this regard we quote Ioannou et al. (2016, p. 1468), who argued that “companies have much less experience in setting CSR targets, and very limited information is available about a firm’s own past non-financial performance or about other firms’ performance, given the short history of such practices.”

Longer-term use of CSR-linked executive compensation entails collecting considerable feedback, which is referred to by Sprinkle (2000) as management accounting information. In fact, it seems that integrating feedback for CSR activities into managerial accounting information renders the feedback more institutional and systematic. Feedback from CSR activities still has lower understandability than financial accounting measures, and efforts to render it ever more “accounting-like” seem to require time. Sprinkle (2000) also documented the effectiveness of performance-based compensation contracts, showing that considerable feedback and experience are required to generate performance improvements. In contrast, a lack of feedback and experience may even reverse the positive relationship between incentives and performance.

Longer-term use of CSR-linked executive compensation also means firms accumulate considerable experience, reaping benefits in three ways. Firstly, experience may help balance dynamically the potentially competing objectives embedded in CSR performance (Hill and Jones 1992). As managers are assigned possibly competing—at least in the short run—multiple tasks, the use of incentives over a prolonged period is likely to induce agents to take the dynamic interrelations between distinct CSR performance goals into specific consideration, and they may be induced to alleviate these misalignments. Secondly, experience may help in identifying areas of performance where incentive-induced learning is more pronounced and thus performance improvement is more likely to happen (Campbell 2008). Thirdly, experience may lead to adjustments over time to the design of CSR-linked executive compensation systems for purposes of incentive alignment.

These premises lead us to believe that as a firm accumulates experience in using CSR-linked executive compensation, it learns how to use this management practice more readily (Eisenhardt 1989). We therefore formulate the following hypothesis:

H1:

Firms are more likely to have better CSR performance as they accumulate experience in using CSR-linked executive compensation.

The Moderating Effect of CSR-Focused Governance Systems

As firms accumulate experience in using CSR-linked executive compensation, one may wonder what the effects of other CSR-focused governance systems on CSR performance are. This paragraphs focus on these other systems. Based on the agency theory, the effectiveness of incentives provided to the agent is also a function of the effectiveness of monitoring and advisory processes implemented by the principal (Milgrom and Roberts 1992). Principals may invest in information systems to increase the overall quality of measurement and better inform agents regarding their desires. Information systems include budgeting systems, reporting procedures, direct supervision, and internal as well as external auditing. Better monitoring may also deter agents from manipulating their behavior opportunistically (Milgrom and Roberts 1992). For example, given the multiplicity of contracted CSR tasks there is the risk that NEOs might pick and choose, pursuing a “low hanging fruit” strategy, which would not lead to improved CSR performance in the longer run, while giving good results as regards short-term CSR targets. As stated above, ASSET4 shows that a growing number of firms have adopted CSR-focused governance systems (CSR reports, CSR audits, and CSR committeesFootnote 8) which, in the terminology of Milgrom and Roberts (1992), represent different forms of information systems with monitoring or advisory functions.

CSR reports are produced and released to signal efforts to reduce the information asymmetry between the firm and the public regarding social and environmental aspects of the business (Christensen 2016; Dhaliwal et al. 2011, 2012; Matsumura et al. 2014; Simnett et al. 2009). CSR reports provide a segmentation of CSR performance, risks, and actions which aggregate measures alone (e.g., stock price or aggregate CSR scores) do not provide (Global Reporting Initiative 2013). “Knowledge about the firm’s specific strengths and weaknesses can help both BODs and shareholders to monitor executives and correct certain agency conflicts, such as perquisite consumption, poor investments, and misleading disclosures” (Armstrong et al 2010, p. 203). Furthermore, the CSR reporting process may help firms manage their operations better. CSR reporting helps managers run the firm by measuring, analyzing and reporting on CSR activities (Christensen 2016).

CSR audits are voluntary purchases of external assurances on CSR reports, serving “as a useful control mechanism to enhance the credibility of the disclosed information and facilitate greater users’ confidence” (Simnett et al. 2009, p. 941). From an agency theory perspective, voluntary external assurances help mitigate potential information asymmetry with external stakeholders and compensate for the lack of observability of managers’ behavior (Chow 1982). In the CSR setting, the use of external auditing appears important given the voluntary nature of CSR disclosures. In some cases, corporate reputation or image concerns with respect to shareholders and other stakeholders may also drive firms to engage in some sort of instrumental CSR reporting in the form of ‘greenwashing’ (Bénabou and Tirole 2010). As such, CSR audits can enhance the credibility of the disclosed CSR-related information and, thereby, facilitate external users’ monitoring activities of CSR actions and the performance of managers who are formally accountable for CSR targets. As a result, external monitoring could be a way of policing executive contracting, therefore exerting a positive moderating effect on the relationship between CSR-linked executive compensation and CSR performance.

CSR committees are groups of knowledgeable board members, executives, and other managers to whom CSR-related advisory tasks and responsibilities are delegated (Berrone and Gomez-Mejia 2009). The bulk of literature on corporate governance and executive compensation discusses the key role played by BODs in advising executives (Armstrong et al. 2012; Coles et al. 2008). As stated by Mace (1971), the BOD serves as a source of advice for the CEO and executives, providing expertise when the firm faces an issue one or more board members are experts in. In the field of CSR management, a CSR committee can thus be a powerful tool for providing executives with appropriate knowledge and fostering CSR performance (Paine 2014). A BOD with CSR-specific expertise can be useful in guiding NEOs in managing CSR issues effectively.

However, it is important to note that other scholars in the fields of management, accounting, and finance have assessed the relationship between monitoring and executive compensation and noted that these may work as substitutes for each other in a system of governance (Armstrong et al. 2010; Hoskisson et al. 2009; Lippert and Moore 1995; Rediker and Seth 1995). More specifically, they argue that the intensity of board monitoring should be lower when NEOs are granted effective incentives and therefore suggest the presence of a systematic balance between these governance systems. This argument seems in line with the above-mentioned evidence for a number of DJSI champions that use specific CSR-focused governance systems but do not adopt CSR-linked executive compensation. In spite of this, we believe that CSR-focused governance systems act as complements to CSR-linked executive compensation. Some characteristics of CSR performance may justify an integrative rather than a substitutive use of monitoring and incentive systems. In line with previous authors (Milgrom and Roberts 1992; Rutherford et al. 2007), we argue that the difficulty of precise measurement, a lack of experience in measuring, analyzing, monitoring and reporting CSR performance, an absence of standards to verify obtained outcomes, and the need to balance multiple goals may induce the principal to invest in information systems to improve the effectiveness of monitoring and advisory processes. We therefore propose the following hypothesis:

H2:

Firms using CSR-focused governance systems are more likely to have better CSR performance as they accumulate experience in using CSR-linked executive compensation.

Research Design

Data and Sample Collection

Table 1 displays the sample selection process. First we obtained information on CSR-linked executive compensation contracts and CSR-focused governance systems from the ASSET4 database.Footnote 9 We identified a panel of 10336 firm-year observations corresponding to 996 US-based unique firms for the period 2002–2013.Footnote 10 We then combined ASSET4 data with CSR performance information from MSCI ESG STATS.Footnote 11 As of 1991 MSCI ESG (formerly, KLD Research & Analytics Inc.) has used a combination of publicly available and privately collected information to determine whether a firm is socially responsible in seven performance areas (Employee relations, Diversity, Product, Community, Governance, Environment and Human rights) and its involvement in specific controversial business categories (Alcohol, Gambling, Firearms, Military contracting, Nuclear power and Tobacco). To quantify a firm’s impact on the welfare of its main stakeholders, each year MSCI ESG analysts assign a number of binary indicators, either positive (strengths) or negative (concerns) in each non-exclusionary dimension, to a number of items. If the firm does not have a strength or concern in any one issue, this is indicated by 0.Footnote 12 Companies then participate in a formal data verification process. Matching MSCI ESG with ASSET4 data reduced our initial sample by 1684 firm-year observations.

We then retrieved annual corporate governance data, financial information and NEOs’ compensation from ASSET4, Datastream and Compustat Execucomp, respectively. To alleviate the noise caused by smaller company size, we removed firms with net sales and total assets of less than $10 million, as well as those with less than ten employees. Our sample included 5070 firm-year observations and 848 unique firms. Table 2 presents the industry distribution of sample firms; firms operate in 15 CIGS Industry Groups, with greater concentrations in Industrial goods and services, Financials, Technology, Retail, Healthcare, and Oil and gas. To check for possible selection biases, we compared sample firms’ year-end market value to the total market capitalization of companies listed on US stock exchanges. According to the World Bank, 2012 US total market capitalization accounted for approximately $18,668 billion; for the same year, our sample had a total value of around $9500 billion. This represents a significant portion (50.46%) of total US capitalization.

Measurement of Dependent and Independent Variables

CSR-Linked Executive Compensation

We used the variable “Compensation Policy/Sustainability Compensation Incentives” from ASSET4 to proxy for a firm’s choice to tie NEOs’ compensation to CSR/H&S/Sustainability targets. Specifically, we created the binary indicator CSR COMP, taking a value of 1 each year the firm reported inserting explicit CSR goals in the compensation contracts of NEOs, and 0 otherwise.

Based on ASSET4, over the period 2002–2013 firms increasingly included CSR performance goals in NEOs’ compensation: the diffusion of CSR-linked executive compensation across firms increased by 31.42%, from 6.28% in 2003 to 37.70% in 2013, providing evidence of the growing relevance of this organizational practice in the US. Also, sample firms revealed high consistency over time in the use of CSR-linked executive compensation. 78.58% of companies adopting CSR-linked incentives in a certain year t continued to use them in t + 1. In contrast, 89.49% of firms not using CSR-linked incentives in a year t maintained the same strategy in t + 1. To sum up, time distribution characteristics strengthen our confidence in the quality of this indicator.

Experience in Using CSR-Linked Executive Compensation

We created the variable CSR COMPEXP to measure a firm’s level of accumulated experience in using CSR-linked executive compensation over the years. CSR COMPEXP measures the cumulative number of years the firm linked NEOs’ compensation to CSR performance goals. In our setting, the variable ranges from 0 to 11 years.

CSR-Focused Governance Systems

From ASSET4 we created three indicators to identify the use of governance systems with an advisory or monitoring function on CSR issues. (1) CSR COMMITTEE proxies for a firm’s use of a dedicated BOD committee with an advisory role on CSR issues. In this respect, two different ASSET4 binary indicators provide useful information. The first indicator shows whether a firm had a CSR committee or team or not, but does not specify its hierarchical level within the organization. The second refers to a firm having a policy aimed at maintaining an effective and independent CSR committee within the BOD. We assumed the simultaneous presence of the two practices to be a good proxy for a firm’s use of a CSR committee at the BOD level. As a result, we calculated the product between the two indicators, obtaining CSR COMMITTEE as a binary indicator assuming a value of 1 each year if a firm had a CSR committee within the BOD, and 0 otherwise. (2) CSR REPORT refers to a firm’s release of a CSR report. CSR reports are publicly disclosed separate reports or sections in the firm’s annual report dedicated to CSR/H&S/Sustainability, produced on a voluntary basis and intended to meet the information needs of all stakeholders. Based on ASSET4, a minimum of five pages are required in order for the document to be classified as a CSR report. In our study, CSR REPORT is a binary indicator taking the value of 1 each year the firm publicly released a CSR/H&S/Sustainability report, and 0 otherwise. (3) CSR AUDIT indicates a firm’s purchase of an audit on the CSR report. Including a CSR audit in the analysis would help account for the effects associated with an instrumental use of the CSR report and assess the monitoring function of CSR-related publicly disclosed information. In this work, CSR AUDIT is a binary indicator taking the value of 1 each year the firm purchased an audit on the CSR/H&S/Sustainability report, and 0 otherwise.

CSR Score

We computed five different CSR performance measures using various combinations of MSCI ESG strengths and concerns. We began by creating the variable CSR SCORE as total strengths minus total concerns in the following six categories: Environment, Community relations, Diversity, Employee relations, Product, and Human rights. Like Servaes and Tamayo (2013), we did not consider MSCI ESG exclusionary categories in the CSR scores, as these dimensions do not pertain to a firm’s discretionary activities. We also excluded the Governance category, as it is perceived as being a distinct construct from CSR (Servaes and Tamayo 2013). Specifically, we added the minimum of the net score distribution to obtain CSR SCORE as an aggregate measure of non-negative integers. Overall, total numbers of strengths range from 33 to 34 and total concerns from 26 to 27.Footnote 13

In addition, some CSR scholars have contended that although it is common practice to aggregate CSR strengths and concerns in a single measure (Barnett 2007), each dimension accounts for very different company events, thereby representing distinct constructs (Krüger 2010; Mattingly and Berman 2006). Accordingly, scholars have recommended studying MSCI ESG CSR strengths and concerns in isolation. The recent work by Maas (2018), for instance, uses this specification. Also, previous research has itemized environmental actions in isolation from actions in other CSR performance areas (Konar and Cohen 2001). Reasons may go beyond differences in the number and nature of the tasks to be performed. However, we believe that specification of CSR as CSR environmental performance and CSR social performance is significant. We therefore created four variables: ENV CONCERNS and SOC CONCERNS measure the sum of total concerns in, respectively, the Environment category only and the remaining five categories excluding Environment; similarly, ENV STRENGTHS and SOC STRENGTHS measure the sum of total strengths in the respective categories.

Measurement of Control Variables

Additional factors may affect both a firm’s use of CSR-linked incentives and its CSR performance. Firstly, from ASSET4 we included BOD TENURE, which measures the average number of years board members have been on the board, and BOD IND, which measures the percentage of board members who are strictly independent.Footnote 14 Secondly, some studies have documented the existence of a positive relation between the presence of female board members and the firm’s CSR behavior, explaining this finding by referring to the argument that women are on average more concerned with altruism (Harjoto et al. 2015; Krüger 2010; Walls et al. 2012). In line with this evidence, from ASSET4 we used BOD FEMALE to account for the proportion of female directors on the board. Thirdly, we computed LT COMP to control for the potential effects of NEOs’ orientation to long-term results due to the structure of the monetary compensation system (Berrone and Gomez-Mejia 2009; Deckop 2006; Johnson and Greening 1999). Like Deckop (2006), from Compustat Execucomp we measured LT COMP as the average fraction of total annual compensation that is made up of performance plans, stock options, and restricted stock plans for all NEOs, CEO included. Fourthly, we checked for firm size using firm net sales (SALES). Fifthly, we used MTB, the ratio of market-to-book value, as a proxy for firms’ growth opportunities. Sixthly, we controlled for financial distress and economic performance by using company leverage (LEV) and profitability (ROE). Finally, we included dummies for industry-years and state-years to account for unobserved time-invariant differences, as well as changes in norms that occurred between 2002 and 2013.Footnote 15

Empirical Models

To test the hypothesized relationships, we estimated the following equations:

where ε represents the residual or that portion of the endogenous variable that is not explained by the exogenous regressors, and i represents firm i. In Eqs. (1) and (2), we used alternatively CSR SCORE, ENV CONCERNS, ENV STRENGTHS, SOC CONCERNS, and SOC STRENGTHS as dependent variables measuring different areas of CSR performance. To normalize the distribution of residuals, we used the natural logarithm of 1 plus the CSR performance and 1 plus CSR COMPEXP. We also log-transformed 1 plus BOD IND, 1 plus BOD EXP and 1 plus BOD FEMALE, as well as SALES. To prevent simultaneity issues, independent variables in all models were lagged 1 year.

We estimated Eq. (1) to test for H1, and Eq. (2) to test for H2. Specifically, we estimated Eqs. 1, 2 using panel data linear regressions with a firm fixed effects (FE) estimator. FE estimates were used to control for firm characteristics which are unobservable but stable over time and which possibly correlate with the explanatory variables, as well as with the dependent variable.Footnote 16 Finally, standard errors were clustered by firm to account for heteroskedasticity among observations from firms included in various years.

Descriptive Statistics

Table 3 contains summary statistics for our final sample.Footnote 17 The mean value of CSR SCORE is 10 (ranging from 0 to 26).Footnote 18 The mean values of ENV CONCERNS and ENV STRENGTHS are 0.46 and 0.67, respectively, with the worst performing firm reporting 5 concerns and the best performer 5 strengths. The mean values of SOC CONCERNS and SOC STRENGTHS are 1.80 and 2.51, respectively. The worst performing firm reports 12 concerns and the best performer 17 strengths.Footnote 19

CSR COMP indicates that between 2002 and 2013, 21.56% of sample firms linked NEOs’ compensation to CSR performance goals. CSR COMPEXP reveals that less than 25% of sample firms used CSR-linked executive compensation for the entire period. A more detailed analysis (not tabulated) also indicates that the median adopting firm used this system for 2 years. Also, 18.65% of firms established a CSR committee (CSR COMMITTEE), 77.82% released a CSR report (CSR REPORT), and 21.47% purchased a CSR audit (CSR AUDIT).

Sample firms were relatively large due to the ASSET4 inclusion criterion. Annual SALES of the average (median) firm were $13,000 million ($4600 million). The average (median) firm had a ROE of 15.23% (14.51%), LEV (total liabilities divided by total assets) equal to 0.58 (0.59), and a MTB ratio of 3.17 (2.30). Moreover, the long-term component of NEOs’ total annual pay (LT COMP) accounted on average for 65.82%, board members had been on the board (BOD TENURE) for, on average, 13.41 years, the average percentage of strictly independent board directors (BOD IND) was 44.55%, and the average proportion of female members on the board (BOD FEMALE) was 9.23% (with a maximum of 26.57%).

Table 4 provides the correlation matrix for the variables included in the analysis. Overall, Pearson correlation coefficients give little cause for multicollinearity concerns.

Results

CSR-Linked Executive Compensation and CSR Performance

Table 5 reports the results of three different regression models. Model 1 is created as a base line model and displays the effects on the CSR net score associated with the use of CSR-linked executive compensation. R2 equals 0.78, indicating that the independent regressors explain a high portion of the variance in firms’ CSR net scores.Footnote 20 Results from model 1 show that the coefficient for CSR COMP is strongly significantly and positively associated with CSR performance. Ceteris paribus, linking NEOs’ compensation to CSR goals is likely to increase the CSR score of the average sample firm by around 3.5%. At first sight, these findings reveal the general effectiveness of using CSR-linked executive compensation, in line with previous studies (Flammer et al 2019; Maas 2018). In addition, this evidence indicates that over time CSR-linked incentives are more likely to have a prevailing motivational purpose than an informational purpose (Merchant and Van der Stede 2012). Finally, the results seem to dissipate the concern that using CSR targets in executive contracting undermines intrinsic motivation, e.g., by exerting a crowding-out effect (Ryan and Deci 2000). Model 2 then disentangles the effects of a firm’s mere use of CSR-linked executive compensation and its accumulated experience in using CSR-linked executive compensation (Eq. 1) on the CSR net score. In model 2, the coefficient for CSR COMP becomes insignificant while the coefficient for CSR COMPEXP is positive and strongly significant. Taken together, results provide support for H1, i.e., firms are more likely to have better CSR performance as they accumulate experience in using CSR-linked incentives. In particular, model 2 indicates that, ceteris paribus, a firm with a year’s more experience in tying NEOs’ compensation to CSR goals has a CSR score which is 9.0% higher.

Finally, model 3 separates the effects associated with different years of corporate experience in linking NEOs’ compensation to CSR goals; instead of fitting the regression as a continuous function of the firm’s cumulative experience, it includes indicators for each year of experience as separate covariates. The results reveal the presence of a monotonic non-linear relationship between CSR COMPEXP and CSR SCORE, showing increasing marginal effects for higher levels of experience.Footnote 21 Specifically, model 3 indicates that, ceteris paribus, firms accumulating experience in using CSR incentives show a net CSR score higher than non-adopting firms of, respectively, 7.0% in the 3rd year after adoption, 11.2% in the 4th year, 21.4% in the 5th year, and 22.6% in the 6th year. For example, considering the CSR net score mean of 10 in the overall sample period, a firm with 5 years’ cumulative experience in implementing CSR incentives would achieve, ceteris paribus, an average CSR net score 2.26 points higher than non-adopting firms. Given the relatively sticky nature of the MSCI ESG ratings used to compute the variable CSR net score (Krüger 2015), 2.26 points represents a relevant improvement. This evidence corroborates H1 and indicates that the use of CSR-linked executive compensation is able to promote a firm’s CSR net score significantly as of the 3rd year subsequent to adoption. At first sight, this result is in line with previous research discussing the long-term nature of CSR investments (Bénabou and Tirole 2010; Deckop 2006; Porter and Kramer 2011).

We interpret these results in the light of three combined elements. Firstly, the benefit of the use of CSR-linked executive compensation seems to be hampered, as measurability concerns and issues from multiple competing tasks are likely to arise (in the short run). Secondly, in the short run firms are unlikely to address these concerns. Thirdly, adjustments are likely to occur over a longer time span as firms accumulate experience in using CSR-linked executive compensation, and are able to generate significant increasing marginal effects on CSR performance (Argote and Miron-Spektor 2011; Levitt and March 1988). For example, on analyzing the proxy statements of Alcoa Inc. we noted that various modifications to the CSR-linked executive compensation design have been introduced over the 10 years since adoption (see Appendix A). This evidence supports our belief that as a firm accumulates experience in using CSR-linked executive compensation, it learns how to use this practice more effectively (Eisenhardt 1989).

Furthermore, the results show that the release of a CSR report (CSR REPORT) is positively and significantly associated with a firm’s CSR net score across all model specifications. In contrast, the establishment of a CSR committee (CSR COMMITTEE) and the purchase of external assurance on the CSR report (CSR AUDIT) are weaker predictors of a firm’s CSR performance, not being significantly associated with the CSR net score in model 3. These findings suggest the symbolic role of CSR committees and CSR audits, and emphasize the reputational value of issuing public CSR reports as a form of voluntary contract between managers and stakeholders (Christensen 2016). Consistent with agency theory predictions, companies seem to disclose information on the social and environmental aspects of their business as a formal signal of their commitment to CSR. CSR reports provide valid information for assessment, independent of the additional reliability given by external assurance of the content of the disclosures. The report itself is a relevant measurement exercise and incorporates considerable feedback on the CSR outcomes, attracting BOD attention and fostering learning.

Among the other control variables, female board representation (BOD FEMALE) and the market-to-book value ratio (MTB) relate positively and significantly to the CSR net score, while the firm leverage (LEV) coefficient is negative and significant. Long-term compensation (LT COMP), board experience (BOD TENURE), board independence (BOD IND), firm size (SALES), and financial performance (ROE) are not significantly associated with the CSR score.

Inferring Causality via the Timing of Incentive Adoption

One concern regarding our research design is whether a firm’s use of, and in turn, accumulated experience in using CSR-linked executive compensation, are exogenous in the model specifications. In our setting, potential endogeneity would stem from sample selection bias, reverse causality or correlated omitted variables (Antonakis et al. 2010). For instance, using CSR-linked compensation represents a choice that firms make as the perceived benefits of implementing this management practice outweigh the perceived costs. There is therefore the possibility that self-selection could lead to biased coefficients. Moreover, despite Eq. (1) employing a lead-lag design to address simultaneity issues, it is still possible that the CSR COMPEXP bi-directionally relates to CSR SCORE. For example, given the long-term nature of CSR performance (Bénabou and Tirole 2010; Deckop 2006; Porter and Kramer 2011), some variations in a firm’s CSR scores might exist at time t yielded by prior investments or disinvestments in CSR activities which had not yet produced any visible effect at time t − 1. This unobserved impact is unlikely to be incorporated in prior CSR scores by MSCI ESG analysts. In situations such as this, a firm’s actual engagement towards CSR (i.e., any change in its CSR strategy) may justify the adoption of dedicated management practices (e.g., CSR-linked incentives). Reverse causality may also be found in the case of firms contracting CSR-linked incentives in anticipation of the achievement of expected CSR performance. As an example, a BOD which has already undertaken actions likely to improve future CSR performance may decide to adopt CSR-linked compensation and be confident of capturing the expected CSR results. An analysis of this firm might therefore conclude that current use of CSR-linked incentives leads to better future CSR performance. However, the causality of this association is reversed. Also, the multidimensional nature of CSR performance may raise concerns in terms of correlated omitted variables. It is possible that MSCI ESG ratings do not capture the CSR performance of a firm entirely. The presence of unobserved CSR aspects may bias the results.

To address this concern, one approach is to conduct an event study of firms that have adopted CSR-linked executive compensation contracts to see whether they experienced an increase in the CSR performance around the time of and since the adoption year. Angrist and Pischke (2009) noted that when the sample includes many years, event study methodology lends itself to a test for causality in the spirit of Granger (1969). Granger’s idea is to see whether causes occur before consequences, and not vice versa. In a context where the variable of interest changes at different times for different firms, Granger causality testing involves a check on whether post-treatment (adoption and accumulated experience) effects affect the CSR score while anticipatory effects do not. If CSR COMPEXP causes the CSR score to change but not vice versa, then dummies for anticipatory changes should not matter in the model (Angrist and Pischke 2009). To check for this, we modeled firm data on the use of CSR-linked executive compensation prior to and after the adoption year. Like Autor (2003), we replaced CSR COMPEXP with dummy indicators for 1, 2, and 3 years before adoption (leads), for the adoption year, and for years 1–11 after adoption (lags).

Table 6 reports the FE estimates of an OLS regression including leads and lags (y indicates a firm’s adoption year). The coefficients of the adoption leads are close to zero, showing no effects in the 3 years before adoption. Coefficients of post-treatment lags are significant from the 3rd year after adoption and increase monotonically over the subsequent 8 years. This pattern (Fig. 1) seems consistent with a causal interpretation of the findings, providing evidence for H1: firms’ accumulated experience in using CSR-linked executive compensation leads to higher CSR scores rather than vice versa.

In addition, we ran a series of tests to assess the robustness of our results. First, we controlled for possible measurement error in the main explanatory variable that does not seem to capture explicitly any effect associated with a firm’s choice to discontinue the use of CSR-linked executive compensation. Second, we accounted for possible bias in the dependent variable given the documented presence of an implied measurement error in MSCI ESG ratings (Chatterji et al. 2016). Lastly, we controlled for potential omitted variables that may affect both NEOs’ decisions and the effect of CSR-linked incentives. Results from these tests (not tabulated) are consistent with our hypotheses (see Appendix C for a detailed illustration of these robustness tests).

Analysis Based on Strengths and Concerns

We then performed Eq. (1) analysis using CSR environmental concerns (ENV CONCERNS) and strengths (ENV STRENGTHS), as well as CSR social concerns (SOC CONCERNS) and strengths (SOC STRENGTHS) as alternative dependent variables. Table 7 presents the results of these analyses. Models 1–4 show the estimated marginal effects of firms’ accumulated experience in using CSR-linked executive compensation on different proxies for CSR performance. Consistent with H1, we expected the coefficient of CSR COMPEXP to be significant and negatively associated with CSR environmental and social concerns (models 1 and 3, respectively), but positively associated with CSR environmental and social strengths (models 2 and 4, respectively).

In model 1, the coefficient of CSR COMPEXP is strongly significant and negatively associated with ENV CONCERNS, while in model 2, the coefficient of CSR COMPEXP is strongly significant and positively associated with ENV STRENGTHS. These results provide support for H1: firms are more likely to have better CSR performance (i.e., lower concerns and more strengths) as they accumulate experience in using CSR-linked executive compensation. Overall, these findings indicate that firms with greater experience in using CSR-linked incentives tend to have better environmental scores in terms of both fewer concerns and more strengths. In particular, the difference in the absolute value of the two coefficients is not statistically significant. The estimated effects therefore seem to derive equally from a reduced number of CSR environmental concerns and a higher number of CSR environmental strengths.

Moreover, CSR COMPEXP is significantly associated with CSR social performance. Interestingly, while the coefficient of CSR COMPEXP (model 3) is strongly significant and negatively associated with SOC CONCERNS, the coefficient becomes positive but insignificant (model 4) when regressed on SOC STRENGTHS. Overall, these findings provide only partial support for H1. Greater experience in using CSR-linked incentives helps prevent the occurrence of negative events in the fields of Community, Diversity, Employee relations, Human rights and Product, but is not able to direct NEOs’ efforts to improve CSR social strengths.

To summarize, NEOs whose compensation contract is linked to CSR goals seem to integrate environmental performance information fully into decision making (Flammer 2015). This may explain how CSR-linked incentives significantly promote CSR environmental performance, both in terms of fewer concerns (better risk management) and of more strengths (increased discretionary opportunities). In contrast, the results indicate that NEOs struggle to create a business case for CSR social performance. Accountable NEOs focus more on controlling the risks of negative events (i.e., reducing CSR social concerns) than on improving strengths. This evidence is in line with previous empirical findings (Maas 2018), as well as theoretical works discussing the role of image concerns as an explanation for CSR behavior (Bénabou and Tirole 2010). NEOs’ negative CSR actions may be topics of discussion with shareholders, and therefore the subject of reputation concerns. We argue that this is especially the case for NEOs whose compensation is formally linked to CSR goals. Formal exposure to CSR-related reputation value or image concerns can induce NEOs to focus specific attention on the firm’s business risks and force them to implement policies preventing the occurrence of negative events, so as to have good news to report.

The Moderating Effect of CSR-Focused Governance Systems

Table 8 summarizes the results yielded by Eq. (2), which explores the effects of the interaction between experience in using CSR-linked executive compensation and the use of specific CSR-focused governance systems with an advisory role (CSR COMMITTEE) or a monitoring function (CSR REPORT and CSR AUDIT), on firms’ CSR performance. We performed five different analyses using the following proxies for CSR performance as alternative dependent variables: CSR net score (CSR SCORE), CSR environmental concerns (ENV CONCERNS), CSR environmental strengths (ENV STRENGTHS), CSR social concerns (SOC CONCERNS), and CSR social strengths (SOC STRENGTHS). Based on H2, we expected the coefficients of the interaction terms between CSR COMPEXP and, respectively, CSR COMMITTEE, CSR REPORT, and CSR AUDIT to be significant and positively associated with CSR net score, CSR environmental and social strengths (models 1, 3 and 5, respectively), but negatively associated with CSR environmental and social concerns (models 2 and 4, respectively). Using different proxies for CSR performance to test for the moderating effect of CSR-focused monitoring systems also helps to address directly and control for the potential influence of NEOs’ manipulating behavior (Milgrom and Roberts 1992). For example, assuming that NEOs considered negative CSR issues as being easier to measure and therefore to improve as compared to positive CSR issues, they may tend to cherry pick and work on those issues that are likely to show the best results in the easiest way. The interaction terms capture the effects of CSR-linked executive compensation when opportunistic behavior is less likely given the presence of monitoring by the BOD.

Overall, the use of specific CSR-focused governance systems is found to moderate positively the effect of firms’ accumulated experience in using CSR-linked executive compensation on CSR performance. Results suggest that CSR-linked executive compensation complements the marginal contribution of CSR-focused governance systems in promoting CSR performance. These findings support H2: firms using CSR-focused governance systems are more likely to have better CSR performance, as they accumulate experience in using CSR-linked executive compensation.

Interestingly, the results also show that a firm’s experience in using CSR-linked executive compensation is likely to affect CSR performance only when specific CSR-focused governance systems are in place. Indeed, the coefficient of the main term CSR COMPEXP is significant only when the term is regressed on ENV STRENGTHS (model 3). In the absence of a CSR committee within the BOD or without the public release of a CSR report, accumulating experience in using CSR-linked incentives exerts a significant effect only through fostering CSR environmental strengths.

In particular, CSR COMMITTEE positively moderates influences the effect of CSR COMPEXP. In model 1, the coefficient of the interaction term between CSR COMPEXP and CSR COMMITTEE is strongly significant and positively associated with CSR SCORE (model 1). The coefficient of this interaction term is also significant when regressed on SOC CONCERNS (model 4), while it is insignificant when regressed on ENV CONCERNS, ENV STRENGTHS, and SOC STRENGTHS (models 2, 3, and 5, respectively). These findings indicate that the CSR committee is likely to support NEOs with CSR-linked compensation contracts effectively only as regards taking actions to reduce CSR social concerns, not as regards actions to increase CSR social strengths or to improve CSR environmental performance.

Similarly, CSR REPORT positively moderates the effect of CSR COMPEXP. In model 1, the coefficient of the interaction term between CSR COMPEXP and CSR REPORT is strongly significant and positively associated with CSR SCORE (model 1). The coefficient of this interaction term is also significant when regressed on ENV CONCERNS (model 2) and on SOC CONCERNS (model 4), while it is insignificant when regressed on the CSR strengths. These results indicate that a firm’s public release of a CSR report is likely to play an effective monitoring role regarding the NEOs whose compensation contract is linked to specific CSR goals. CSR reporting therefore seems to moderate the effect of CSR-linked executive compensation by contributing to reducing the firm’s CSR environmental concerns as well as CSR social concerns, but it does not affect CSR strengths. Not surprisingly, the results also show that a firm’s release of a CSR report influences its CSR strengths as well as its CSR concerns positively, regardless of the use of CSR-linked executive compensation (the coefficient of the main term CSR REPORT is significant across all models analyzed).

Finally, CSR AUDIT does not moderate the effect of CSR COMPEXP. Models 1–4 reveal that the coefficient of the interaction term between CSR COMPEXP and CSR AUDIT is not significantly associated with the different CSR performance measures, i.e., the purchase of an assurance of the CSR report is not likely to promote further CSR improvements. This result confirms the fact that assurances of the CSR report can play a symbolic role (Simnett et al. 2009).

In line with previous literature on corporate governance (Armstrong et al. 2012; Coles et al. 2008), overall these results emphasize the key role played by BODs in both advising and monitoring accountable NEOs, particularly in the context of CSR activities.

Conclusions

We examined the effectiveness of firms’ use of CSR-linked executive compensation empirically. Using a cross-industry sample of 4472 firm-year observations over the period 2002–2013, we found that the use of CSR-linked executive compensation generally promotes CSR performance providing the following evidence. Firstly, the mere use of CSR-linked executive compensation incentives does not immediately exert a significant effect; however, its reiterated use produces positive effects starting from the 3rd year after adoption. CSR performance improvements are also promoted monotonically as firms accumulate experience and learn how to use the system over the eight following periods analyzed. Secondly, explicitly incentivized NEOs focus differently on specific CSR performance areas: they mitigate risks deriving from CSR environmental and social concerns and enhance only CSR environmental strengths. Thirdly, as regards the moderating role of specific governance systems (i.e., the release of a CSR report, the purchase of a CSR audit and the presence of a CSR committee at the BOD level), the joint use of CSR-focused governance systems is likely to moderate positively the effects of CSR-linked executive compensation on the firm’s CSR performance.

We believe that the evidence gathered on the direct link between CSR-linked executive compensation incentives and CSR performance improves the body of knowledge reported in the extant literature for a number of reasons. Firstly, our findings open avenues to further investigation on the features of the CSR learning process triggered by the use of CSR-linked incentives. We have explained the outcome of CSR learning in terms of better measurability of CSR performance and better balance of the multiplicity of tasks embedded in CSR activities. However, this needs further and more specific testing. Recent findings by Journeault (2016) have shown how CSR learning helps to better achieve CSR performance. Although the author focused on a more holistic definition of control mechanisms (eco-control) and addressed specifically environmental performance, his findings suggest that the eco-control package fosters eco-learning, continuous environmental innovation, stakeholder integration and shared environmental vision capabilities, by providing information, focusing attention, and supporting decision making. A closer observation of how the cumulative use of CSR-linked executive compensation supports these last three processes would shed light on its effectiveness.

Secondly, our specifications of CSR performance allowed us to verify that different CSR outcomes need separate investigation. According to our findings, CSR environmental strengths increase and both CSR environmental and social concerns decrease as a result of a firm’s accumulated experience in using CSR-linked executive compensation. The insights we provide align us with Arjaliès and Mundi (2013) in as much as they proved that CSR outcomes stem from different and more or less formalized processes of learning and encouragement of innovative behavior, as well as the fact that these can be captured by different key metrics with heterogeneous degrees of measurability. This may explain how CSR-linked incentives impact differently on different CSR performance areas. In other words, CSR-linked incentives seem to be more effective when used to reduce concerns, i.e., to mitigate both environmental and social risks, rather than to build additional strengths by means of increased discretionary opportunities in the environmental domain. However, this calls for a finer degree of observation and more testing.

Thirdly, although our findings on the combined use of CSR-linked executive compensation with a CSR committee or with a CSR report are in line with previous work on corporate governance (Armstrong et al. 2012; Coles et al. 2008), more insights could be sought on how their combined use is associated with better CSR performance. More details could be gathered on the features and the quality of both the CSR committee (composition, skills, and activities) and the CSR report in relation to CSR performance. In our study we have observed only the mere existence of a CSR committee and the mere issuing of a CSR report. Lastly, we have found that the CSR audit does not seem to moderate the relationship under investigation. This latter result confirms the fact that the purchase of external assurance on the CSR report may play a symbolic role (Simnett et al. 2009), raising questions as to what could instead enable better CSR performance.

The policy implications of our study may be of some relevance for both regulators and BODs. BODs should reconsider some CSR incentive design variables, e.g., the time frame of the incentives and a detailed specification of the CSR outcome, as well as the substitutive/complementary effect of both issuing a CSR report and the presence of a CSR committee at the BOD level. In the context of CSR activities, policy makers may find inspiration on how to promote, incentivize or render compulsory the adoption of specific corporate governance mechanisms that help firms to better achieve CSR results. Regulators may also deem it important that CSR auditing tends to have a symbolic value.

The results are robust after controlling for potential endogeneity concerns using an event study (Granger 1969). They did not change after checking for potential measurement errors in the main variables. Our work has addressed other potential confounding effects, including agency concerns associated with corporate governance characteristics (Berrone and Gomez-Mejia 2009; Deckop 2006; Johnson and Greening 1999; Kock et al. 2012; Krüger 2010) and managerial influence (Bebchuk et al. 2002; Bebchuk and Fried 2003). However, our results suffer from data limitations; there are four important concerns here. Firstly, despite all our attempts to mitigate any potential endogeneity concerns, we acknowledge that the use of a choice variable as the main explanatory variable (i.e., CSR-linked executive compensation) constitutes an inherent limitation of the study, as there is the possibility that self-selection could influence the results. Secondly, ASSET4 does not give any information concerning the weight placed on CSR performance goals in NEOs’ total annual compensation. Thirdly, this study focuses on a US-based sample, as most of the input data were consistently available only for US firms. Fourthly, the time series covers 12 years (2002–2013) in a period of rapid development in CSR awareness.

Future research could attempt to address both operational design issues and inherent limitations. Identifying the relative importance of CSR-linked incentives would add important knowledge and provide a more detailed backdrop for the interpretation of our results. We believe that understanding the weight of incentives could help in assessing the magnitude of CSR performance improvements more precisely, as well as in determining the costs of using CSR-linked compensation. Further, replicating analysis across countries with different business cultures where the role of corporate governance is understood differently may lead to different results. Lastly, it is clear that with increasing emphasis on CSR and the widespread understanding that it is a pre-condition for sustainable business, we have entered a new CSR era; the role of CSR contracting and CSR-related governance mechanisms may have shifted in the meantime.

On a theoretical level, this study has adopted a principal-agent framework with BOD representing the principal, assumed to be making decisions in the best interests of shareholders, and NEOs representing the agents. NEOs are assumed to have interests potentially not aligned with those of shareholders. At the same time the study does not address the potential agency problem of BODs not being completely aligned with the interests of shareholders. Indeed, BODs too can pick and choose among the various CSR activities, adopting a “low hanging fruit strategy” which does not necessarily lead to improved CSR performance while showing good results at a specific CSR target level. Moreover, this study fails to address the issue of defining what constitutes an “optimal” CSR performance level for a firm, a question more recently being raised. We believe that these aspects constitute inherent theoretical limitations of this study and represent promising avenues for future research.

Notes

Based on the Securities and Exchange Commission Regulation S-K Item 402 on executive compensation, the Named Executive Officers (NEOs) are the principal executive officer (CEO), the principal financial officer (the CFO), the three most highly compensated executive officers of the company other than the CEO and the CFO, or the three most highly compensated individuals acting in a similar capacity other than the CEO and CFO, whose total compensation was, individually, more than $150,000; and each individual who would be considered a named executive officer but for the fact that the individual was not serving as an executive officer of the company or a subsidiary of the company, nor acting in a similar capacity, at the end of the last completed financial year.

See Maas (2018) for a detailed review of this literature.

In 2015, Thomson Reuters’ ASSET4 collected environmental, social and governance public information from more than 4500 global listed firms.

In 2013, 42.8% of CSR champions did not use CSR-linked compensation contracts for NEOs. Conversely, some firms used other governance systems focusing on the social and environmental aspects of their business: 85.7% issued a CSR report, 40.5% had a standing CSR committee, and 30.9% underwent a CSR audit to assure the quality of the CSR report. Furthermore, 30% of CSR champions reported a discontinuous use of CSR-linked executive compensation: about half of these CSR champions stopped using the system, one third stopped and then re-adopted it, and the remaining firms stopped and re-adopted it more than once. Overall, 77.68% of all dropping firms dismissed the system within the first two years after adoption.

In the executive compensation section of their 2014 proxy statement, Walmart International declared that a portion of NEOs’ 2013 annual cash incentive was subject to satisfying pre-established diversity and inclusion targets, namely, ‘good faith efforts’ and ‘placement goals’ (Walmart International 2014, p. 55). Each NEO’s variable pay could be reduced by up to 15% if these objectives were not satisfied.

A 2015 study by PwC reported that 79% of investors questioned declared they were dissatisfied with the comparability of CSR reports produced by S&P 500 companies in the same industry (https://www.pwc.com/us/en/cfodirect/publications/in-the-loop/sustainability-disclosure-guidance-sasb.html).

Based on Argote and Miron-Spektor (2011), organizational learning is a change in the organization’s knowledge that occurs as the organization acquires experience in using routines, and constitutes a critical determinant for its long-term success.

ASSET4 reports that the proportion of firms disclosing a separate CSR report or publishing a CSR-related section in the annual report increased from 5.44% in 2002 to 59.38% in 2013. Firms also increasingly purchase external assurances of their CSR reports, with percentages rising from 17.07 in 2002 to 37.19 in 2013. The proportion of firms with a CSR committee increased from 7.21% in 2002 to 29.91% in 2013.

See Cheng et al. (2014) for a more detailed description of the database.

The time frame of our sample data runs from 2002 to 2013. ASSET4 started collecting data in 2002. In 2014, Morgan Stanley Capital International (MSCI) RiskMetrics Group acquired KLD Research & Analytics Inc., an investment research firm that owned the data-set of US listed companies’ statistics on environmental, social and governance (ESG) metrics. As a result of this acquisition, the KLD STATS was renamed MSCI ESG STATS. This transition implied a major restructuring of the data base architecture effective as of 2014, thus creating discontinuity, with a higher number of indicators being created, others replaced or eliminated. Reconciliation tables between the old data base architecture and the new structure have been made available. However, in our view, despite the effort of assuring comparability, the 2014 transition poses a severe methodological problem of data homogeneity. Further, our sample data look consistent with Flammer et al (2019) who limited their longitudinal data-set covering listed US companies until 2013. Also, as this work focuses on testing the presence and the extent of a learning effect associated with the use of CSR contracting, we believe that the fairly prolonged time series of 12 years is compatible with the testing. Given the above mentioned reasons, we closed the time frame at 2013.

As reported in Krüger (2015), MSCI ESG filed the following event regarding Archer Daniels Midland (ADM) as a negative indicator in the environment category: “In May 2006, the Political Economy Research Institute included ADM on its Toxic 100, a list of the top 100 corporate air polluters in the US. ADM ranked tenth on the Toxic 100, which is based on quantity and toxicity of hundreds of chemicals released into the air.”

Like Servaes and Tamayo (2013), we acknowledge that the number of strengths and concerns in each category has evolved over time (although moderately) as MSCI ESG has refined the database, making direct comparison across years impossible. We therefore controlled for the confounding effect of annual modifications in the scale of MSCI ESG ratings in two ways. Firstly, we ran our model inserting an additional covariate that accounts for the algebraic sum of the changes in the number of strengths and concerns on a yearly basis. Secondly, we tested our model over a restricted sample, excluding years 2012 and 2013 when higher variability was detected. Results from these analyses (not tabulated) remained substantially unchanged.

Based on the ASSET4 definition, a board member is considered strictly independent if she or he complies with the following criteria: she or he is not employed by the company; she or he has not served on the board for more than ten years; she or he is not a reference shareholder with more than a 5% holding; she or he does not have any cross-board membership; she or he does not have any recent, immediate family ties to the corporation; she or he is not receiving any compensation other than compensation for board service.

Variables LT_COMP, MTB, LEV and ROE were winsorized at the 1st and 99th percentiles to control for the potential effects of outliers.

Angrist and Pischke (2009, pp. 243–246) noted that the use of a model that includes both lagged dependent variables and unobserved individual FE leads to inconsistent estimates. Thus, our FE estimates did not include the lagged dependent variables. However, we also checked the robustness of FE estimates by running a first-difference model including the lagged dependent variable. This specification captures the effect of a time-varying prior engagement towards CSR activities, potentially explaining both CSR performance and the use of CSR-focused practices. Results from this analysis (not tabulated) are similar.

In accordance with model specifications, all covariates in Table 3 are presented with a one-year lag and therefore refer to the period 2002–2012, explaining the additional sample reduction to 4472 firm-year observations.

Although CSR SCORE is a censored variable, sample distribution reveals two features that justify the measure being treated as a continuous variable in our setting (Agresti 2002). Firstly, the variable has a sufficiently large number of categories. Secondly, all data fall within the middle section of the rank scale (between 25 and 60% of the theoretical distribution) with no need to obtain predicted values beyond these values.

Appendix B reports the distribution characteristics of additional variables including CSR CONCERNS, CSR STRENGTHS, ENV SCORE and SOC SCORE. CSR CONCERNS and CSR STRENGTHS refer to the sum of concerns and the sum of strengths in all six categories of MSCI ESG ratings investigated. ENV SCORE refers to the net score obtained by a firm in the MSCI ESG Environment category, and SOC SCORE groups the other five MSCI ESG performance categories investigated. The mean values of CSR CONCERNS and CSR STRENGTHS are 2.25 and 3.18 respectively. Across sample years, the worst performing firm obtained 15 concerns out of a maximum of 37 while the best performer obtained 21 strengths out of a maximum of 52. The mean values of ENV SCORE and SOC SCORE are 5.21 (ranging from 0 to 10) and 9.72 (ranging from 0 to 23) respectively.

Given the high value of R2, we performed a test for multicollinearity with variance inflation factors (VIFs) for Eq. (1). Test results report VIFs lower than 4 for all covariates, suggesting that our model does not reveal any multicollinearity concerns requiring corrective measures.

Caution is required when interpreting the magnitude of the coefficients because of the few firm observations in the categories with more than 6 years’ experience. Recoding the variable by grouping all companies with more than 5 years’ experience in one single group provides clearer results (not tabulated).

We also ran a logistic regression and obtained consistent estimates.