Abstract

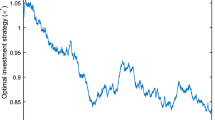

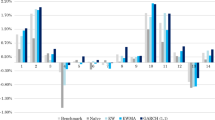

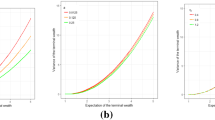

Based upon an observation that it is too restrictive to assume a definite correlation of the underlying asset price and its volatility, we use a hybrid model of the constant elasticity of variance and stochastic volatility to study a portfolio optimization problem for pension plans. By using asymptotic analysis, we derive a correction to the optimal strategy for the constant elasticity of variance model and subsequently the fine structure of the corrected optimal strategy is revealed. The result is a generalization of Merton’s strategy in terms of the stochastic volatility and the elasticity of variance.

Similar content being viewed by others

References

M. Asch, W. Kohler, G. Papanicolaou, M. Postel, B. White: Frequency content of randomly scattered signals. SIAM Rev. 33 (1991), 519–625.

S. Beckers: The constant elasticity of variance model and its implications for option pricing. Journal of Finance 35 (1980), 661–673.

J.-F. Boulier, S. Huang, G. Taillard: Optimal management under stochastic interest rates: The case of a protected defined contribution pension fund. Insur. Math. Econ. 28 (2001), 173–189.

P. P. Boyle, Y. S. Tian: Pricing lookback and barrier options under the CEV process. Journal of Financial and Quantitative Analysis 34 (1999), 241–264.

S. Cerrai: A Khasminskii type averaging principle for stochastic reaction-diffusion equations. Ann. Appl. Probab. 19 (2009), 899–948.

S.-Y. Choi, J.-P. Fouque, J.-H. Kim: Option pricing under hybrid stochastic and local volatility. Quant. Finance 13 (2013), 1157–1165.

J. C. Cox: The constant elasticity of variance option pricing model. The Journal of Portfolio Management 23 (1996), 15–17.

J. C. Cox, C.-F. Huang: Optimal consumption and portfolio policies when asset prices follow a diffusion process. J. Econ. Theory 49 (1989), 33–83.

J. C. Cox, S. Ross: The valuation of options for alternative stochastic processes. Journal of Financial Economics 3 (1976), 145–166.

D. Davydov, V. Linetsky: The valuation and hedging of barrier and lookback options under the CEV process. Manage. Sci. 47 (2001), 949–965.

G. Deelstra, M. Grasselli, P.-F. Koehl: Optimal design of the guarantee for defined contribution funds. J. Econ. Dyn. Control 28 (2004), 2239–2260.

P. Devolder, M. Bosch Princep, I. Dominguez Fabian: Stochastic optimal control of annuity contracts. Insur. Math. Econ. 33 (2003), 227–238.

W. H. Fleming, H. M. Soner: Controlled Markov Processes and Viscosity Solutions. Stochastic Modelling and Applied Probability 25, Springer, New York, 2006.

J.-P Fouque, G. Papanicolaou, K. R. Sircar: Derivatives in Financial Markets with Stochastic Volatility. Cambridge University Press, Cambridge, 2000.

J.-P. Fouque, G. Papanicolaou, R. Sircar, K. Sølna: Multiscale Stochastic Volatility for Equity, Interest Rate, and Credit Derivatives. Cambridge University Press, Cambridge, 2011.

I. Fredholm: Sur une classe d’équations fonctionnelles. Acta Math. 27 (1903), 365–390. (In French.)

J. Gao: Optimal portfolios for DC pension plans under a CEV model. Insur. Math. Econ. 44 (2009), 479–490.

E. Ghysels, A. Harvey, E. Renault: Stochastic volatility. Statistical Methods in Finance. Handbook of Statistics 14, North-Holland, Amsterdam, 1996.

S. Haberman, E. Vigna: Optimal investment strategies and risk measures in defined contribution pension schemes. Insur. Math. Econ. 31 (2002), 35–69.

C. R. Harvey: The specification of conditional expectations. Journal of Empirical Finance 8 (2001), 573–637.

J. C. Jackwerth, M. Rubinstein: Recovering probability distributions from option prices. Journal of Finance 51 (1996), 1611–1631.

R. Z. Khas’minskii: On stochastic processes defined by differential equations with a small parameter. Theory Probab. Appl. 11 (1966), 211–228; translation from Teor. Veroyatn. Primen. 11 (1966), 240–259. (In Russian.)

J.-H. Kim: Asymptotic theory of noncentered mixing stochastic differential equations. Stochastic Processes Appl. 114 (2004), 161–174.

R. C. Merton: Optimum consumption and portfolio rules in a continuous-time model. J. Econ. Theory 3 (1971), 373–413.

E.-J. Noh, J.-H. Kim: An optimal portfolio model with stochastic volatility and stochastic interest rate. J. Math. Anal. Appl. 375 (2011), 510–522.

B. Øksendal: Stochastic Differential Equations. An Introduction with Applications. Universitext, Springer, Berlin, 2003.

G. C. Papanicolaou, D. W. Stroock, S. R. S. Varadhan: Martingale approach to some limit theorems. Proc. Conf. Durham, 1976. Duke Univ. Math. Ser., Vol. III, Duke Univ., Durham, 1977.

M. Rubinstein: Nonparametric tests of alternative option pricing models using CBOE reported trades. Journal of Finance 40 (1985), 455–480.

J. Xiao, Z. Hong, C. Qin: The constant elasticity of variance (CEV) model and the Legendre transform-dual solution for annuity contracts. Insur. Math. Econ. 40 (2007), 302–310.

K. C. Yuen, H. Yang, K. L. Chu: Estimation in the constant elasticity of variance model. British Actuarial Journal 7 (2001), 275–292.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yang, SJ., Kim, JH. & Lee, MK. Portfolio optimization for pension plans under hybrid stochastic and local volatility. Appl Math 60, 197–215 (2015). https://doi.org/10.1007/s10492-015-0091-9

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10492-015-0091-9

Keywords

- pension plan

- portfolio optimization

- constant elasticity of variance

- stochastic volatility

- asymptotic analysis