Abstract

Grounded in signaling theory, this paper investigates the signals reflecting product quality, innovativeness, reputation and cultural background which influence film performance, that is, film survival (duration on cinema screen) and box office success, in China’s changing institutional context. This market has grown substantially and still possesses potential for further development. However, China’s unique institutional context presents challenges. By examining an expanded range of potential signals, two of which have not previously been examined in the literature, namely imported films and enhanced format film formats such as 3D and IMAX, we develop a conceptual framework and argue that signaling theory needs to be combined with institutional context. Similar to findings for film industries in other countries, we find quality and reputational signals including budget, star power, sequels, and online consumer reviews to be important in China. However, unique results are also revealed. Chinese consumers react to an innovativeness signal in that they are specifically attracted to enhanced format films. Film award nominations and prizes are insignificant reputational signals. Once other signals are taken into account, imported films on average do not perform as well as domestic films. We link these findings to China’s unique institutional setting and offer important implications for management, recognizing the challenges to film companies of competing in an increasingly globalized market. This paper is also of relevance to policymakers given their continued efforts in shaping the development of China’s film industry.

Similar content being viewed by others

China’s rate of economic growth has been slowing in recent years with the year-on-year GDP quarterly growth rate decreasing from 9.7% in the first quarter of 2011 (KPMG, 2015) to 6.8% in the last quarter of 2015, a figure representing a 25-year low (KPMG, 2016). However, against the background of weaker overall economic growth is the dramatic growth of the film industry. By 2010, China had become the world’s third-largest producer of films, trailing only India and the US (Su, 2014). Despite the widespread proliferation of piracy, China has also become one of the largest markets for film consumption. As of 2012, China was ranked the second largest film market in the world in terms of revenue,Footnote 1 and may overtake the largest market—the US—by 2017.Footnote 2 This rapid growth and the resulting opportunities have attracted many investors, both domestic and foreign. Not only has the film industry been among the strongest sectors for investment within China, but Chinese producers and distributors listed overseas have also enjoyed stellar growth.Footnote 3

However, against this optimistic economic backdrop for the film industry in China are institutional challenges. The industry is still subject to a complex regulatory system involving censorship and import quotas. Out of 638 domestically-produced films in 2013, only 273 were shown on screens (see Table 1), that is, only 39% of films produced were distributed. Indeed, the figure of 39% is the highest in years. Failing to pass China’s censoring process can be because a film’s content is not in line with the Party’s ideology, Confucian morality and social harmony or because the film’s quality fails to conform to State standards.Footnote 4 Given these opportunities and challenges, it is imperative to understand what contributes to a film’s success in China’s unique institutional environment. Yet, to the best of our knowledge, there has been no research to date studying this topic.

Our research employs insights from signaling theory to address the research question “what signals are important to film performance in China?” A range of signals have been examined in the literature, but set against different institutional contexts, namely the US and, to a lesser extent, the UK and the European markets. Very few have studied the factors determining film success in Southeast Asia, let alone China. We thus investigate which signals resonate with Chinese audiences and, in so doing, impact on film performance in China. Consequently, we address Kim and Jensen’s (2014) concern that insufficient literature addresses which signals consumers use as opposed to focusing on producers’ use of such market signals. Besides those signals studied in the extant literature, we also examine two signals that have been typically overlooked in previous studies (i.e., imported films and enhanced film formats such as 3D or IMAX). In this way, we cover a range of signals that reflect film quality, innovativeness, reputation and cultural background. Our empirical findings, although indicating broad support for hypotheses based on signaling theory, suggest that the theory needs to be considered with specific reference to China’s institutional and cultural context. Analysis of the use of potential signals in the Chinese film industry context is made more complicated because of the changing nature of competition and consumers in this market, with Chinese producers highly motivated to gain international market recognition, alongside serving their domestic market.

Consequently, the fundamental contribution of this paper is to develop a conceptual framework based on signaling theory which reflects the complex, and arguably unique, institutional context of China. Bhagat, McDevitt, and McDevitt (2010) argued that there is a need to consider cultural variables and the impact of globalization to develop effective and robust management theories relevant for Asia Pacific countries. Bruton and Lau (2008), in their review of Asian management research, also called for taking account of context-specific conditions in extending and revising theories. Reflecting this, the current paper considers the impact of potential signals in a changing cultural market that is facing the institutional challenges of greater liberalization and gradual globalization. Understanding the commercial success of films in China is important for studios and investors alike. Chinese film producers and distributors face increased competition from foreign firms who possess advanced technologies and globally-recognized brand names. For example, in 2012, out of 298 films shown in China, 65 were imported firms and they accounted for 51% of gross box office revenues (see Table 1). While Chinese firms have slightly improved their market performance in recent years, the average revenue per film remains much less than that of foreign films. Results below highlight the benefits foreign films garner from their typically larger production budgets, as well as highlighting the differing fortunes of films from the US and other countries when they compete in the Chinese market. Our findings should therefore be of value to both domestic and foreign firms when making strategic decisions to better meet consumer demand and to guide their marketing efforts as they compete in China’s large and expanding market. The research should also be of policy interest given the strategic role of the industry and Chinese policymakers’ continued efforts in shaping the development of the industry.

The following section sets out the institutional context of China’s film industry and provides an overview of its development. Section 3 reviews the literature and develops hypotheses. We then present the data, model, measurement and estimation methods. Section 5 presents empirical results and discussions. The final section offers our conclusions and indicates the limitations of the research.

China’s film industry

The Chinese film industry offers an interesting case for analysis. Like many other industries, the film industry has undergone significant institutional changes since China’s opening up in 1978. Despite the country-wide economic liberalization in the 1980s and 1990s, the transition of the film industry to a market-oriented and profit-driven industry has only started gathering pace since 1994 (Su, 2014). By 1994, the financial losses of film studios which were all SOEs reached record highs and many were on the brink of bankruptcy (Yeh & Davis, 2008).

Facing this dire situation, China adopted a wide-ranging reform package in an attempt to increase film production and consumption. This involved steps to improve quality and reach international standards through rapid corporatization/privatization, rejuvenation of domestically-owned studios, the reform of the distribution-exhibition system and the opening up of the industry to foreign competition (Yeh & Davis, 2008). Many of the reforms between 1994 and 2001 were gradual and incremental and had limited effects on the development of the industry (Su, 2014). The big leap came when China joined the World Trade Organization (WTO) in 2001. Since then, non-SOEs have been able to enter the industry, which has facilitated competition. Despite being heavily regulated, the Chinese film industry has now become a very competitive industry in production, distribution and exhibition.

In terms of production, the number of feature film studios approved by the State Council has remained fairly stable over the past few decades (see Table 1). However, there are now many private production firms. For example, in 2013, 638 films were produced by more than 400 producers (MPA [Motion Picture Association] and CFCC [China Film Co-Production Corporation], 2014) and the top ten players only accounted for 26% of the market share for production (Entgroup, 2014). Furthermore, although an SOE, The China Film Group Corporation (CFGC) is still the leading player, its dominance has been significantly eroded by privately-owned enterprises (POEs). Its market share was only 5% in 2013. In contrast, out of the top ten players, six are POEs. Foreign firmsFootnote 5 can engage in co-production and joint ventures with Chinese firms (Yeh & Davis, 2008). As co-production means that films are produced, at least in part, in China, co-production films do not count as foreign films but foreign studios are able to receive a fixed 50% share of the box office receipts (O’Connor & Armstrong, 2015). Excluding Hong Kong and Taiwan, Chinese firms have limited co-production activities with foreign firms. In 2012, only 16 films were co-produced, of which four were with the US and three with Japan.

On the distribution and exhibition front, the government launched a film theater chain system in 2001 (Su, 2014). The first 30 theater chains were formed and in operation in June 2002. By 2012, there were 46 theater chains in urban areas, accounting for more than 90% of total box office revenues (Entgroup, 2014). The liberalization in the film distribution sector since 2003 has seen the market share of the former monopoly distributor, CFGC, eroded. CFGC and Huaxia (CFGC owns a 20% share of Huaxia) together accounted for less than 50% of market share in 2013 (Entgroup, 2014). In contrast, out of the top ten film distributors, six are POEs. CFGC and Huaxia barely maintain their leading position thanks to the monopolistic advantages they enjoy in owning distribution rights on all imported films. Foreign firms remain excluded from distribution. In 2012 the government increased the proportions of film box office revenues that both domestic and foreign producers and distributors could keep. Film exhibitors in China have no incentive to favor the screening of Chinese over imported films; in fact exhibitors earn slightly more from the screening of imported films (Cain, 2012a).

Given the changes in the institutional context, the Chinese film industry first encountered the period of transition with difficulties. Box office revenues continuously declined from ¥1.73 billion in 1995 to a low of merely ¥840 million in 2001, the year China acceded to the World Trade Organization (WTO) and the year China made substantial commitment to market liberalization. Box office revenues have increased rapidly ever since, registering ¥28.80 billion in 2014 (see Table 1). By 2013 there were 18,398 screens across the country, of which 17,505 were digital screens and 12,607 were 3D screens. China’s film industry also has strong growth potential. Chinese box office revenues have grown at more than 30% per year for the past decadeFootnote 6 and the growth trend does not seem to be slowing. China has also been investing heavily in advanced technologies. Only two 3D films were produced in 2010, but by 2013 the number increased to 28, generating box office revenues of ¥3.861 billion. The country would need approximately 160,000 further screens to have as many screens per capita as in the US and there remain cities in China with a population of more than 1 million that are still without any modern, digital cinema screens (Cain, 2012a). This rapid growth and the resulting opportunities have attracted many investors, both domestic and foreign. Domestic film companies lost ground to foreign ones during the early reform period, accounting for only 20% of the market share in 1995. But, over time, the trend has been somewhat reversed. In 2008, 60% of box office revenues were generated by domestic producers and in the following years, the share oscillated around 55%. Among the top films generating the highest revenues in China, more are Chinese films than foreign imported films. For example, out of the top ten films in 2015, only three are non-Chinese (Table 2).

Despite the increasing liberalization process in the film industry, there remain institutional challenges. The biggest hurdle for firms, both foreign and domestic, is censorship. All films distributed in China remain subject to censorship by the State Administration of Press, Publication, Radio, Film and Television (SAPPRFT). The main law of Chinese Film Censorship currently in force is The Regulations on Administration of Movies enacted in December 2001 and implemented in February 2002, covering film content and ideology, as well as technical and quality issues. Operating within China’s censorship laws is challenging as SAPPRFT’s regulations and the censorship process can appear arbitrary and ambiguous despite SAPPRFT’s efforts in providing guidelines to improve transparency (Cain, 2011). However, filmmakers have no choice but to meet censorship requirements and make requested changes.

Foreign firms face additional challenges related to censorship, including competitive release scheduling and delayed releases to control when films screen in Chinese cinemas. For example, Mission Impossible 4, the second most popular foreign film in China in 2012 was released in North America on December 16, 2011, but in China on January 28, 2012 and this could be associated with China’s ban on foreign films during the Lunar New Year celebration. Additionally, Spider-Man and Dark Knight Rises had to wait for the end of China’s “domestic film protection period” and were pitted against each other on August 27, 2012 (Cain, 2012b) even though the films were released 17 days apart in the US.Footnote 7

Foreign films also face an entry barrier of import quotas. China now runs two models (Cain, 2012a). The first is a revenue-sharing model which permits foreign studios to take a certain percentage of gross box office revenues from China. Following a MOU (Memorandum of Understanding) signed by China with the US in 2012,Footnote 8 China has raised the number of foreign films that can be imported on a revenue-sharing basis from 20 to 34, but 14 of those films must be 3D or IMAX films. The revenue share of gross box office receipts has also increased from 13% to 25%.

The second model involves outright sale of the local Chinese rights (i.e., a flat-fee or buy-out model). This model has a separate quota from the revenue-sharing model but the figure for quotas is vague, hovering around 40 films annually since 2012 (O’Connor & Armstrong, 2015). Films imported using this model appear not to be as carefully regulated as revenue-sharing foreign films.Footnote 9 Quality-wise, revenue-sharing films are mostly big budget studio films with major international stars while the flat-fee model is often used to import independent (art house) “B” level films that are made by smaller film studios and in general distributed on a much smaller scale for a niche market (Cain, 2013). Marketwise, revenue-sharing films perform much better than flat-fee films. For example, in 2012, the 34 revenue-sharing films accounted for 45.6% of China’s box office revenues, while the 31 flat-fee films captured only 5.4% of market share (Cain, 2013). There is no clear information on how import quota slots are determined by the Chinese government and their agencies (CFGC and Huaxia), although it appears that the decisions are very much based on economic incentives given the degree of competition between SOEs and their non-SOE counterparts. The main advantage that CFGC and Huaxia have over these competitors is their monopoly on distribution rights on all imported films. Thus, the commercial success of imported films that meet censorship requirements is of vital importance to CFGC and Huaxia when considering which films to import. There is no evidence that the allocation of import quotas depends on the country of origin. Data from 2012 reveal that 85% of quota slots for revenue-sharing films (29 out of 34 films) went to the US and the others were awarded to Australia (1), UK (2), South Korea (1) and France (1). Out of 30 imported flat-fee films, 9 were from the US. The dominance of the US as country of origin for imported films is in line with Hollywood’s global popularity (Lee, 2006; Su, 2014).

Literature review and hypothesis development

Films are experience goods (Connelly, Certo, Ireland, & Reutzel, 2011), some traits of which cannot be fully appreciated before viewing. There is therefore information asymmetry between consumers and film producers/distributors/exhibitors. Potential consumers lack a priori knowledge about the quality of films before consumption. An effective means by which information asymmetry can be reduced and consumers can be encouraged to make purchases is the transmission of credible signals. A market signal is defined by Porter (1982) to include any actions that provide a direct or indirect indication of a firm’s intentions, motives, goals or internal situation. Signals act as a mechanism to reduce uncertainties about product traits and increase their visibility, facilitating business transactions and improving market performance. The uncertainties associated with films are exacerbated as there are severe time constraints due to short product life cycles in cinemas (Akdeniz & Talay, 2013; De Vany & Walls, 1999), making signals particularly important to all parties concerned in the film business. Thus signaling theory is particularly relevant for examining film performance. However, despite the fact that the theory has been applied in a wide array of research contexts (e.g., Connelly et al., 2011; Hou, Liu, Fan, & Wei, 2016; Wu, Li, & Li, 2013) and various signal variables have been examined in film industry research, its explicit application to the film industry literature remains limited, exceptions including Akdeniz and Talay (2013), Basuroy, Desai, and Talukdar (2006), and Kim and Jensen (2014).

At the core of signaling theory are signals that contain positive and/or negative information which is conveyed to the receivers: signals must be credible to attract a receiver’s attention and receivers stand to gain from making decisions based on the information contained in credible signals. Credible signals decrease the perceived uncertainty of consumers and lead to consumer satisfaction. Therefore they can be a source of value creation for producers/products. In the context of the film industry, the basic challenge is to identify the credibility of those signals that may be perceived by filmgoers as important signals of film traits. The key issue pertinent to this study is which signals matter in the Chinese institutional context. We will examine a range of signals that reflect product quality, innovativeness, reputation and cultural background.

In the broad institutional context, there are formal and informal institutions (North, 1990). Formal institutions are explicitly-created structures, comprising constitutions, laws, regulations, property rights and contracts; informal institutions largely relate to culture. In the previous section, we have described China’s changing formal institutional context. Individual film performance may also be influenced by informal institutions (i.e., cultural specifics). Hofstede (2001) defined culture as “the collective programming of the mind that distinguishes the members of one group or category of people from another” (9). Clearly, both formal and informal institutions could affect the effectiveness of signals for product consumption.

Drawing on insights from signaling theory and the literature on film performance, we build our hypotheses recognizing China’s unique institutional context (Golley, 2016). The literature, regardless of the explicit use of signaling theory, has examined a number of signal variables including production budget (Akdeniz & Talay, 2013; Brewer, Kelley, & Jozefowicz, 2009; De Vany & Walls, 2002; Elliott & Simmons, 2008; McKenzie, 2009; Ravid, 1999); star power (Akdeniz & Talay, 2013; Brewer et al., 2009; De Vany & Walls, 1999; Nelson & Glotfelty, 2012; Prag & Casavant, 1994; Ravid, 1999); sequels (Akdeniz & Talay, 2013; Basuroy et al., 2006; Moon, Bergey, & Iacobucci, 2010); major film award nominations and prizes (Deuchert, Adjamah, & Pauly, 2005; Nelson, Donihue, Waldman, & Wheaton, 2001; Prag & Casavant, 1994) and online film reviews (Moon et al., 2010). In terms of geographical coverage of the research, literature to date on film performance has rarely focused on countries other than the US, the UK and European markets. Walls (1998) offered an early contribution, analyzing factors determining the number of weeks a film continues to be shown in cinemas in Hong Kong, while Lee (2006) considered the factors, in particular the genre of Hollywood films, that contribute to those films’ box office success in Hong Kong.

Empirical findings from these studies, although informative, may not be applicable to the Chinese context, given the above mentioned unique institutional environment of the country.Footnote 10 Below we develop hypotheses explicitly reflecting signaling theory, while taking into account the institutional context under consideration. In addition to the signaling variables considered in the extant literature, we consider two more variables: enhanced film formats and imported films.

The literature shows that box office revenues are affected by the potential quality signaling role of three factors under film producers’ control: production budget, star power and sequels. Film producers take actions to indicate unobservable film quality to audiences. Big budgets translate into lavish sets, costumes and special effects, reflecting film producers’ belief in the quality of a film produced (Brewer et al., 2009; De Vany & Walls, 2002; Elliott & Simmons, 2008; McKenzie, 2009; Ravid, 1999). The careers of studio executives depend on the success of films. Big budget films are high risk, only to be undertaken if executives are confident about the quality of the films and the potential revenues that they will generate. Thus production budget could act as a signaling device about the quality of the film to film distributors in their intermediary position and audiences as final consumers. In contrast with other industries where production costs tend to be kept secret, film budget information is often readily available and is a signal used by film producers, distributors and exhibitors when marketing films.Footnote 11

The use of star actors or actresses can be a signal of film quality because consumers’ prior experience associated with seeing a film with those stars can influence their preference for a new film. From the perspective of film producers, they will be more willing to pay the higher fees associated with employing stars if they are confident about the quality of a film (Akdeniz & Talay, 2013; Brewer et al., 2009; De Vany & Walls, 1999; Nelson & Glotfelty, 2012; Prag & Casavant, 1994; Ravid, 1999).

A film sequel builds on the original film’s commercial success and the high quality of the original film can be a signal indicating the quality of a sequel (Akdeniz & Talay, 2013; Basuroy et al., 2006; Moon et al., 2010). The success of the original film also helps the sequel to secure generous production budgets, which may further enhance film performance. We do not envisage that the impact of production budget, star power and sequels on film performance would vary in the Chinese institutional context. Consequently, the above discussion gives rise to the first hypothesis to be tested in the Chinese context:

Hypothesis 1

The effect of (a) production budget, (b) the use of star actors and actresses and (c) sequels on film performance will be positive.

There is an additional signal that is also under film producers’ control but has yet to be studied in the film industry literature—enhanced format films (i.e., 3D or IMAX films). 3D or IMAX films require advanced technologies, and producing them is more costly than producing films of standard format. Consequently, film producers need to be confident that the additional outlay is justified and their use of an enhanced format with special effects (3D and/or IMAX) can be interpreted as a signal of their intrinsic belief in the high quality of the film being produced. From the consumer’s perspective, with the liberalization of markets and rising income, Chinese consumers have had access to greater choice of goods and services and they have been growing in experience and sophistication (Curtin, 2012; Fang, 2010). An enhanced format represents a creative and innovative presentation of the film, hence a credible signal for consumption choice. The Chinese regulation that 14 imported films each year must be in enhanced format films similarly reflects a belief that these films can be expected to be high quality. The discussion gives rise to a second hypothesis:

Hypothesis 2

The enhanced format of a film will have a positive effect on film performance.

Signals can be derived from other sources aside from the ones under the control of film producers. A particular area of interest is the evaluation of films from either industry award-giving bodies or amateur communities, both of which act as reputational signals. First, major award nominations and prizes, reflecting professional critics’ opinions, may provide signals as to the artistic nature of films (Gemser, Leenders, & Wijnberg, 2008). Awards also make films more prominent to consumers. There are a large number of studies examining the impact on box office revenues of major award nominations and prizes (Deuchert et al., 2005; Gemser et al., 2008; Nelson et al., 2001; Prag & Casavant, 1994). However, as yet, the impact of major Asian film awards nominations and prizes has not been considered.

In the context of the current study, there are four major Chinese-language film awards: the Hong Kong Film Awards (HKFAs); the Golden Horse Awards (GHAs) in Taiwan; the Golden Rooster Awards (GRAs) and Hundred Flowers Awards (HFAs) in Mainland China. HKFAs, GHAs and GRAs are based on professional critics’ views and are given on the basis of artistic quality. In recent years, HFAs have reflected amateurs’ views of a film, with votes cast via the Internet, text or telephone call. HKFAs and GHAs are held annually. Like such international film awards as the US Academy Awards (Oscars), Golden Globes and British Academy Film Awards (BAFTAs), they are open to films commercially released within the previous calendar year.Footnote 12 GRAs and HFAs were also annual events until 2005. Since then they have taken place in alternate years with GRAs being held in odd numbered years and HFAs in even numbered years. Films produced during the preceding two years leading to the China Golden Rooster and Hundred Flowers Film Festivals can be put forward for GRAs or selected for HFAs. Thus, similar to major film awards, HKFAs, GHAs, GRAs and HFAs are often conducted on a retrospective basis, with most winners being announced after films are released. However, as the dates for the awards tend to be fixed, it is common industry practice to alter the release dates of films that are considered to be award-winning material towards the award dates.Footnote 13 By so doing, the film producers, distributors and exhibitors expect to profit from the awards being bestowed (Gemser et al., 2008).

Second, with the development and proliferation of online consumer reviewer forums, filmgoers increasingly consult online reviews for film reputation (Liu, 2006; Moon et al., 2010). These constitute a channel of signals that have received disproportionately less attention than major award nominations and prizes. Indeed, China has the largest number of Internet users in the world and has sustained continuous growth in Internet penetration.Footnote 14 The Internet has both encouraged and enabled consumers to search for information with minimum effort. Therefore online reviews serve as an information cue for prospective filmgoers’ purchases. Good reviews from online communities provide a signal of high reputation from earlier filmgoers. It has been argued that online consumer communities’ collective opinions can have a similar level of impact on other consumers as professional critics’ opinions (Moon et al., 2010) and can be more credible and trustworthy than advertising (Liu, 2006).

Hypothesis 3

The evaluation of films reflected by (a) major film award nominations and prizes and (b) online consumer review, will have a positive, significant effect on film performance.

The final potential signal that is considered in this paper relates to the importation of films, a quality signal yet to be considered in the film industry literature. Previous research on country-of-origin effects indicates that consumers in developing countries prefer foreign products/brands from more developed countries or regions, because they are considered to be high-quality (Verlegh & Steenkamp, 1999). As highlighted above, there are limits on the number of foreign films that can be imported into the Chinese market each year. Hence, we may expect that the foreign films approved for distribution will be high quality. Further, the two firms that share a monopoly in distribution rights for all foreign films, CFGC and Huaxia, face fierce competition from their private counterparts. It is in their interests to distribute high quality foreign films to enhance their ability to compete effectively with increasingly successful POEs who are restricted to distributing Chinese films. There are also precedents in the marketing literature suggesting that Chinese consumers perceive goods from Western/the most advanced economies to be high quality (Sklair, 1994; Zhou & Meng, 2004). As all but one of the imported films in the dataset were produced in the US, Europe, Australia and Japan this argument may apply in the current context. Finally, most foreign films imported into China are released in other major countries prior to their Chinese release, which provides quality signals to Chinese consumers. Importation therefore could be a quality signal. We thus propose:

Hypothesis 4a

A film’s imported status will have a positive effect on film performance.

Alternatively, there is another possibility related to China’s informal institutions or culture. Products such as films can be easily affected by the product’s cultural background (Akdeniz & Talay, 2013). Cultural proximity promotes film acceptance since cultural compatibilities between consumers and producers can act as a bond to information exchange. This reflects their shared tacit background, similar ways of thinking and common grounds on pre-existing and accumulated know-how, know-why and know-what. Consequently filmgoers should have better understanding of domestic artistic conventions and domestic film products (Kim & Jensen, 2014). Therefore, tacit information embodied in a film is more easily accepted by consumers of the same or similar cultural background as producers. By extension, a film’s imported status, rather than acting as a quality signal, could be cultural signal, or a signal of foreignness. Imported films may face “cultural discount,” which refers to the loss in value for films when moved across cultural boundaries. Language is also an important component of cultural discount. Although foreign films can be translated, something is lost in translation (Lee, 2006). The cultural discount hypothesis has received support in the East Asian country context including Hong Kong, Taiwan, South Korea, Japan, Malaysia, Singapore and Thailand (Fu & Lee, 2008; Lee, 2006, 2008, 2009; Moon, Bayus, Yi, & Kim, 2015). Therefore, we propose:

Hypothesis 4b

Imported films reflect a different cultural background from that of Chinese consumers, and as such will have a negative effect on film performance.

Data and methodology

Data

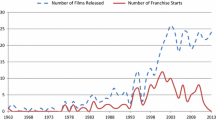

An original dataset was compiled, comprising all films, ranked in the top ten in terms of box office revenues in China during the period from the first week of 2012 to the last week of the first quarter of 2013. It remains very difficult to obtain reliable box office revenue data for the Chinese market. While ideally data on box office revenues across all films’ release on cinema screens would have been collated, the most reliable and only widely accessible data still come from weekly top ten films (Cain, 2012a). Hence, this paper can only identify the factors that contribute to the success of the best performing films released in the Chinese market. Yet arguably, it is also justifiable to use data on films’ revenue and duration on screens while films remain in the top ten films in any week for at least two reasons. First, films tend to have very short shelf-lives, usually only a few weeks (De Vany & Walls, 1999). Sawhney and Eliashberg (1996) highlighted the shelf-life of a typical film is less than 15 weeks in the US theatrical release market. In the context of China, the rapid growth of the Chinese film industry has resulted in the vast majority of cinemas using digital rather than print copies of filmsFootnote 15 and most revenues are amassed in the first weeks after a film’s initial digital release (Cain, 2012a). See Fig. 1 for information on how many weeks each film in the sample remained in the top ten. The mean length of time for a film to remain in the top ten releases is approximately three weeks.

Table 3 provides variable information. After removing missing values, the final sample contains 160 films with 491 weekly film revenue observations. Cinema revenue and budget data were collected in US dollars, and converted into Chinese Yuan using the Principal Global Indicators website.Footnote 16 As suggested above, a number of explanatory variables may provide signals to potential consumers.

As well as the BUDGET variable which is often considered a signal of film quality in the literature, a dummy variable STAR indicating whether a film contains at least one very high profile actor or actress was created by identifying actors and actresses who had previously won an award for best actor/actress or best supporting actor/actress in major film awards, namely the GHA in Taiwan; the GRA and HFA in Mainland China; and the Hong Kong HKFA. Given the international significance of the US Academy Awards (Oscars), actors and actresses who were nominated as well as who won awards for best actor/actress and best supporting actor/actress at these awards were classified as stars as well. Two dummy variables, SEQUEL and ENHANCED were created to indicate if a film is a sequel or of “enhanced format,” typically in 3D and IMAX format, respectively.

An AWARD variable was created to indicate a film in the dataset that had won any of the GHA. GRA. HKFA. HFA or was at least nominated for Oscar awards. One could argue that an award that was given to a film after it was released might not qualify as a credible signal. What is relevant are those awards (including Oscar nominations) that were bestowed to films before they entered into general release. We therefore created another variable, AWARD_B, to capture the effects of GHA, GRA, HKFA, HFA awards and Oscar nominations that were bestowed to films before they entered into general release.

RATINGS captures online viewer ratings of films. The final key variable of interest is FOREIGN which reflects whether a film is an imported foreign film. This can then be subdivided into USA, EUROPE, and OTHERCOUNTRY indicating the country-of-origin of a film. There are 92 films in the dataset classed as of Chinese origin, 55 from the US, 24 from Europe and only three from other countries. These numbers sum to more than 160, the number of films in the dataset, as some films have multiple countries stated as their provenance. Of the three films from other countries, one is from Australia, one from Iran and one from Japan.

We include a number of further control variables. Distributors play an important role in film performance as highlighted in Mackenzie (2012). Many papers take into account film distribution through the inclusion of explanatory variables indicating the timing of a film’s release. There remains debate in the literature regarding the impact of releasing films around holiday periods. For example, Brewer et al. (2009) concluded that films released in the US during the summer and Thanksgiving periods could be expected to enjoy higher cinema revenues, while Litman (1983) indicated the financial benefits of releasing a film at Christmas. Consequently, a set of dummy variables, SEASON, was created to indicate films released during Christmas and the New Year (SPRING) and summer periods (SUMMER). Less attention has been paid in the literature to the identity of film distributors, with Corts (2001) and Gemser, Oostrum, and Leenders (2007) being notable exceptions. Below, a set of dummy variables, DISTRIBUTOR, controls for the identity of major film distributors in the Chinese market.

Dummy variables were also created to indicate if a film is an ADAPTATION, with a set of dummy variables indicating alternative genres of films.Footnote 17 In our preliminary analysis, the coefficients on some of the genres of films including ANIMATION, COMEDY, ROMANCE, HISTORY were statistically insignificant, as in the literature to date (Elliott & Simmons, 2008). Hence, in the reported results, we only consider three genre dummy variables, that is, ACTION& ADVENTURE; THRILLER and SCI-FI&FANTASY. Descriptive statistics for all variables can be found in Table 4, with a correlations matrix in Table 5. Correlation coefficient values indicate that multicollinearity is not a particular concern.

Methodology

The extant literature has predominantly considered film performance as reflected in box office revenues. There is much less literature on film survival (the duration of a film on cinema screens or more precisely in the current context the number of weeks that a film remains in the top ten chart of Chinese box office film revenues). The few exceptions include De Vany and Walls (1997), Walls (1998), McKenzie (2009) and Chisholm and Norman (2006). Each week, on average, between 5 and 6 new films are released in the Chinese market. These films compete not only between themselves but also with those films that are already showing on screens. On a given day, data from Entgroup (http://english.entgroup.cn/nowplaying/) reveal between 40 and 50 films are shown on Chinese cinema screens. Films need time on cinema screens to establish an audience. Therefore, their survival in cinemas is also an important measure of performance. Although films must “survive” on screens to gather box office revenues and box office revenues are necessary to ensure film survival, these two performance measures are conceptually distinct, representing distinct performance outcomes (Sapienza, Autio, George, & Zahra, 2006; Simonton, 2009). Empirically, film survival and box office revenues do not necessarily co-vary. For example, in our sample, there are a few films which only survived for one or two weeks but ranked highly in terms of box office revenues. Consequently, this study seeks to identify the factors impacting upon film performance measured by films’ duration in the top ten films on release on China’s cinema screens and box office revenues. This also helps illustrate the robustness of the results across different models.

We investigate, first, films’ duration in the top ten films on cinema screens. The survival model is specified below:

where h(t) is the transition rate of a film surviving in the top ten and h 0 (t) is the baseline rate. Subscripts i and t refer to the i th film and week t, respectively. LOGBUDGET is the logarithm of BUDGET.

Survival analysis is carried out using two parametric methods, the lognormal and loglogistic models and a nonparametric method, the Cox proportional hazard model. Both parametric methods assume the hazard function is non-monotonic, appropriate to film survival studies, but potentially less flexible than the Cox proportional hazard model. This does not impose a particular distribution on survival times and leaves the baseline hazard function unspecified but assumes proportional hazard (i.e., the covariates multiplicatively shift the baseline hazard function and the effect of each covariate does not change over time).

Second, factors determining Chinese film revenues are modeled. To date most of the literature has adopted single equation modeling approaches, exceptions including Elberse and Eliashberg (2003), Moul (2007), and Elliott and Simmons (2008). As well as using an OLS approach, we use a 2SLS model with budget and revenues as endogenously determined. This reflects a conjecture that film companies normally decide film budgets mindful of anticipated revenues. We use the set of GENRE dummies to instrument film budget, reflecting the larger budgets often associated with films of particular genres, for example, action and science fiction films. Hence, in the reported results, the instruments included in the first stage regression are the genre dummy variables ACTION&ADVENTURE; THRILLER and SCIFI&FANTASY.

The model is specified below:

where LOGREVENUES is the logarithm of REVENUES. WEEK is a set of weekly dummies.

Regressions were estimated using the Huber-White sandwich estimators to account for heteroscedasticity. Non-normal distributions of film revenues have been identified as a challenge in the literature since De Vany and Walls (1996). However, while this has been identified, for example as a feature of US revenues (De Vany & Walls, 1999, 2002), the Shapiro-Wilk W tests for normality confirmed that for the current dataset, both total logged Chinese revenues and logged revenues for the first week of a film’s release are normally distributed.Footnote 18

Results

The Cox proportional hazard model results are reported in Table 6, as this model was preferred slightly in terms of model fit to the two parametric methods and the results of the parametric and non-parametric models are reassuringly robust.Footnote 19 The Global Schoenfeld test statistic was statistically insignificantly different from zero, indicating that the proportional hazards assumption is not violated. Harrell’s Concordance test statistic reveals the model correctly identifies the order of the film survival times for pairs of fills in approximately 75% of cases, indicating good model fit. Although values in Table 5 indicate high correlations between some variables, multicollinearity is unlikely to be a problem as the values of the variance inflation factor (VIF) are small, ranging between 1.12 and 3.19. Test statistics presented in the last row of the table indicate the presence of heteroscedasticity, so robust standard errors are used.

Note in Table 6 that a negative coefficient indicates a variable increases the likelihood of survival, that is, in the context of this study, a film will continue in the top ten for an additional week. As shown in specification (1), a large budget, the use of stars, and a sequel all have a positive, significant impact on the likelihood of film survival, strongly supporting Hypothesis 1. Of particular note are the results related to Hypothesis 2. The significant and positive impact of enhanced format films lends support to this hypothesis. Statistically insignificant effects of winning major film awards and a significant impact of higher audience online ratings on film survival indicate that Hypothesis 3 is only partially supported.

We considered whether the award result may reflect the timings of film releases in China, and the timing of award nominations and prizes. If films are released long in advance of major award nominations and prizes being announced, then the announcements may be expected to have no significant impact on survival times on cinema screens. 26 films in the dataset had received major film awards. Twenty of these films were released in China before the award nominations were announced, 17 of the films being Chinese. These figures suggest that Chinese films tend to be released in China before award nomination announcements, and so it is not surprising that award nominations and prizes do not impact significantly on box office revenues and survival. Of the 6 films released in China after they had been nominated for awards, only one was Chinese. The other 5 films had all received Oscar awards prior to their Chinese release. Consequently, Chinese audiences appear not to be particularly influenced by US Academy Awards as would be anticipated if Chinese and US audiences have different film tastes.

Imported films perform significantly worse in terms of film survival, which suggests that Hypothesis 4b rather than Hypothesis 4a is supported in the Chinese context. This finding is at odds with basic descriptive statistics that indicate that foreign firms enjoy slighter longer survival time (mean = 3.176 weeks) than domestic films (mean = 3 weeks), although the difference is statistically insignificant. Further examination of the sample reveals that foreign films tend to enjoy higher budgets. On average, the 68 foreign films have a budget of 17.821 (logged value), while the comparative figure for Chinese films is 15.608. In particular, US films tend to have larger budgets with an average of 18.195. We ran further regressions dropping the budget variable, and the variable FOREIGN becomes positive and statistically significant. Thus large budget is an important factor behind foreign films’ survival time in the top ten chart. Once budget and other variables are controlled for, foreign films do not enjoy longer survival times than Chinese films.

We further separate foreign films into three categories: those imported from the US, Europe and other countries. In terms of survival, US films are the only group that does not perform significantly worse than Chinese films. It is expected that star power might be more effective as a signal for domestic films, whereas for imported films Chinese audiences might have limited knowledge regarding foreign stars. We include an interaction term between STAR and FOREIGN to examine this but the interaction term is statistically insignificant. Another possibility is that the signal of enhanced format works more effectively for imported versus domestic films. An interaction term between ENHANCED and FOREIGN is again statistically insignificant, thus indicating that the innovativeness signal is important but its effects are not contingent on whether a film is domestically produced or imported.Footnote 20

Table 7 reports the OLS and 2SLS revenue regression results. The Hausman test indicates that LOGBUDGET is endogenously determined, so attention below focuses on 2SLS rather than OLS results. Nevertheless, it is worth noting the consistent results of OLS and 2SLS in terms of coefficient signs and significance levels. VIF values range between 1.04 and 4, suggesting that multicollinearity is again unlikely to be a problem for regression analysis.

A number of signals under the control of production companies are associated with box office revenue success, including budget, the use of stars, sequels and enhanced format films, indicating further support for Hypotheses 1 and 2. Considering potential signals that are outside film companies’ control, favorable audience review is associated with greater box office revenues, although again award success is not found to be statistically significant. Thus Hypothesis 3 is partially supported.

The awards result contradicts the US result of Nelson et al. (2001) and warranted further research to confirm the robustness of results. Revenue regressions were rerun using alternatives to capture award success.Footnote 21 Regressions were rerun using four alternatives to capture award success: (1) replacing AWARD with NOMINATION, a dummy variable indicating films that had been at least nominated for one of the “major” awards, namely best picture; best actor/actress or best director in the GHA, GRA, HKFA, HFA and Oscars; (2) using both “major” NOMINATION and AWARD variables; (3) including separate NOMINATION and AWARD dummy variables for each of the awards ceremonies as all ceremonies may not be equally influential with audiences; (4) using count variables indicating the number of nominations/awards that a film received in the best film; director; actor or actress categories, for the separate awards ceremonies. Consistently, a significant coefficient was not found to be associated with any of the dummy or count variables. This confirms the initial result that box office revenues are not influenced by award nominations and prizes.

Imported films perform significantly worse, a result in line with Hypothesis 4b and an outcome confirmed by Palmeri (2013) and Larson (2014).Footnote 22 Similar to the survival analysis above, we check whether this could reflect foreign films having larger budgets than Chinese films. However, the coefficient on the variable FOREIGN remains negative and statistically significant even after removing the budget variable from estimations. Further examination of different groups of foreign films again shows that US films are the only group that does not perform worse than Chinese films, highlighting the different fortunes of US and other countries’ film imports into the Chinese market.

In summary, the results of Tables 6 and 7 suggest that Hypotheses 1, 2 and 4b are supported, and Hypothesis 3 is partially supported. The only notable difference between the two tables is that films released during the summer period are likely to enjoy greater box office revenues, but this does not influence survival times.

Discussion

The Chinese government has both liberalized the film industry and provided subsidies to foster the industry’s development. Given the lucrative market, foreign firms are eager to enter China. As a result, the market has gradually faced greater international competition, particularly in the form of films imported from the US and the UK. While previously Chinese (as documented in, for example, Curtin, 2012) and Western, particularly US, film industries have been charged with cultural/media imperialism (as discussed in Chadha and Kavoori, 2000), a move towards cultural pluralism in films has emerged (Jin, 2007). For the US, this is documented in Walls and McKenzie (2012) who indicate that, in contrast to the earlier analysis of Jayakar and Waterman (2000), US domestic demand for films has declined. This has resulted in filmmakers needing to produce films that are attractive to international audiences, relying to a greater extent on international as well as domestic box office revenues. Meanwhile, Chinese film producers face the challenge of greater numbers of imported films, forcing them similarly to consider making films with large production budgets and the use of “star” actors (Curtin, 2012). A further challenge emerges as Chinese audiences are perceived to be changing. Curtin’s (2012) analysis suggests more sophisticated Chinese audiences in the Internet age, complementing Fang’s (2010) description of people with “multicultural identities and multicultural minds”.

This paper offers a timely attempt to model the signals impacting on film performance in China as the industry continues to grow, with performance measured both in terms of survival and box office revenues. Signals contain information that can be linked to product quality, innovativeness, reputation and cultural background, some of which may otherwise be unobservable to filmgoers prior to their experience of the film. Consumer responses to signals could be context-specific (Dawar & Parker, 1994). Studies of the film industry have largely focused on the US and the European markets. To the best of our knowledge there has not yet been a study of Mainland China. Based on signaling theory, we develop hypotheses related to a range of signals including quality, innovativeness, reputation and culture in the Chinese institutional context. The empirical results also enable a comparison between China and other countries.

As in existing US and European analyses, we conclude that signals under the control of film producers such as large film budgets, the employment of star actors and actresses and film sequels, each increase the likelihood of a film continuing to be shown on cinema screens for an additional week, as well as contributing to greater box office revenues.

Yet, new results also emerge from the current analysis. Of particular note is the robust result regarding the importance of enhanced format films in the Chinese market. The literature to date has not considered the impact of these films specifically on box office revenues and survival times. This paper identifies enhanced format films as having a large, positive, significant effect on box office revenues, these films also being shown for a greater number of weeks on cinema screens. This may reflect China’s informal institutions and the characteristics of Chinese consumers. As noted in a recent article in the Economist (2014), Chinese consumers are increasingly aspirational, conspicuous in their consumption and are willing to try new things. The novelty of enhanced format films appears attractive to filmgoers. It is also possible that audiences are particularly keen to watch these films at the cinema as any special effects are likely to be less impressive when watched on DVD, television or a computer.

There is more mixed evidence on the potential role of film signals that are not under the control of film producers. Online review scores are found to be a signal of film reputation, being positively and significantly related to box office revenues and a film’s survival in the Chinese top ten. However, a particularly robust finding is that Chinese audiences are not swayed by film awards, neither major Asian awards nor US Academy Awards. This could also be linked to Chinese culture, the characteristics of Chinese consumers and China’s unique institutional environment. In the same Economist (2014) article, it is highlighted that the Chinese distrust official information and rely heavily on peer review. Major film awards in Mainland China, Hong Kong and Taiwan are often criticized on the grounds of lack of fairness and transparency.Footnote 23 Therefore Chinese filmgoers may be skeptical regarding the awards. When choosing which film to see, more emphasis may be placed on audience online ratings than awards as through reading online reviews filmgoers can better gauge a film’s entertainment value against personal preference.

Finally, reflecting signaling theory while taking into account the institutional context, it was hypothesized that the importation of a film may be a signal of its foreignness. This was found to be the case: imported films do significantly worse than films produced by China, Hong Kong and Taiwan producers, this finding being particularly relevant to films imported from countries other than the US. Here we can again reiterate the importance of a cultural perspective. Fang (2010), who opposes Hofstede (2007), highlights the scope for people to absorb cultural learning and to engage in information sharing, unrestricted by traditional national borders and cultural differences. Nevertheless, Kim and Jensen (2014) highlight a continuing difficulty in promoting cultural, experience goods such as films in a foreign market due to the greater cultural distance (as described by Hofstede, 2001) between the filmmakers and the foreign audience. Walls and McKenzie (2012) similarly refer to the challenge of cultural discount when films are exported to audiences with less knowledge of the “social values, historical perspective and context, and language.” Films, which, by nature, are cultural products, are embedded in the national cultural context in which the films were originally made. The consumption of films is also influenced by consumer preferences deeply rooted in national culture. Differences in cultures between the film producers and consumers therefore present challenges to international film success. Although for some filmgoers foreign films have novelty, foreignness can be a liability as the majority of consumers are more likely to identify with domestic films.

Some foreign films have made adaptions for the Chinese market. For example, the international promotional campaign for Iron Man 3 was launched in Beijing’s Forbidden City, not Hollywood or London’s Leicester Square.Footnote 24 The firm also has an extra scene featuring a Chinese actress with extra storyline. However, overall such a localization strategy is costly and is not a widely accepted approach by filmmakers (Kim & Jensen, 2014). Some literature already considers the factors determining the success of imported films into a particular market, with a consensus having emerged that imported films perform better only if the cultural distance from the home market is less (Fu & Lee, 2008). This study provides further evidence on the liability of foreignness in the Chinese film market. Hence, it can be concluded that if foreign filmmakers want to produce films which will be successful in the world’s second largest film market, much greater attention needs to be given to producing films more akin to the preferences of Chinese audiences.

A weakness of the present analysis is that reliable data for advertising expenditure, numbers of screens on which films are initially shown and Chinese expert critics’ reviews were unavailable. These variables have been found to have an impact on box office revenues in other country contexts, for example Elberse and Eliashberg (2003), Elliott and Simmons (2008) and Eliashberg and Shugan (1997).

Notwithstanding the above caveats, the current study offers important theoretical, policy and managerial implications. It makes a theoretical contribution to our understanding of the success of films which should be considered cultural products. Specifically, we argue for the application and extension of signaling theory, taking into account institution-specific conditions. This paper thus adds value to Asian business and management research, emphasizing the simultaneous roles played by signals and institutions in explaining film survival and success.

Policy implications

The Chinese government wants to expand and improve the competitiveness of the domestic film industry. Reforms in recent years have aimed to create and maintain an environment conducive to domestic industrial development and to facilitate technology transfer from foreign film producers to the domestic industry, simultaneously protecting domestic firms against foreign competition to some extent. The results of this paper challenge the usefulness of such protection. We find that domestic films on average do better than foreign films in the Chinese market.

However, it is reported that the performance of domestic films on the international stage is disappointing. For example, one of the biggest Chinese box office successes, Lost in Thailand, earned over US$205 million between December 2012 and February 2013, but sales in the US in February 2013 only reached $57,397.Footnote 25 Many reasons account for Chinese films’ weak performance in the international market, including the liability of foreignness suffered by Chinese films in a foreign country setting. From a policy perspective, the weak competitiveness of Chinese films could be a result of import-substitution policies (Balasubramanyam, Salisu, & Sapsford, 1996) which China has been practicing in the film industry. Although in the short run domestic production may prosper under such a policy regime, in the longer run, domestic producers, not facing as severe competition as they would in an international market, have no incentive to improve efficiency, reduce costs or improve products. Hence, they are unlikely to improve their international competency. Opening the film industry further may not wipe out the domestic industry given consumers’ preferences towards domestic cultural products including films, but offers domestic film producers more opportunities to observe and learn from foreigners, eventually to be able to compete with them more effectively. Of course, in the international market, Chinese films suffer from the liability of foreignness, just as foreign films do in the Chinese market. However, being close to foreign producers in China would expose Chinese producers to knowledge of international operations. The subsequent learning would naturally help Chinese producers manage the liability of foreignness in international markets. Moreover, further openness may enable greater transfer of advanced technologies such as those required to make 3D and IMAX films. This is particularly relevant given our result that enhanced format films on average perform better than standard format 2D films.

Managerial implications

Film producers, distributors and exhibitors have been informed by the literature regarding the importance of production budget, star power and sequels as quality signals in improving film performance. There is no exception in the Chinese market. However, this study also shows the importance of an innovativeness signal to Chinese consumers: Chinese consumers appear to be attracted to enhanced format films. Piracy levels in China are alarming, despite the government’s claimed best efforts in implementing intellectual property protection law, with more than 90% of all music CDs, movie DVDs and software sold in China estimated to be pirated (Priest, 2006). Using survey data of Chinese college students, Bai and Waldfogel (2012) found that three quarters of films consumed are unpaid for. However, 3D and IMAX effects cannot be easily pirated, and to experience the theatrical end results of 3D and IMAX films would require superior sound systems that few families can afford and few neighbors can endure. This can only be beneficial for film box office performance. Thus the managerial implications are straightforward for both domestic and foreign film producers: pay attention to innovativeness signals and invest in enhanced format film technologies as well as securing generous budgets, good scripts and quality casts.

Our results highlight that consumers are significantly influenced by online reviews rather than official awards. This indicates to film businesses, both domestic and foreign, that money could be better spent on advertising and promotion. Films have short product life cycles and businesses must strive for effective marketing campaigns in the right channels to ensure sustainable film performance. Clearly, in the context of China, online reviewer ratings are a more credible signal to consumers than public awards which, although high profile, do not help film business translate into commercial success in terms of both screen survival and box office revenues.

Results in Tables 6 and 7 also highlight that the leading film distributors have differing levels of success in ensuring films’ survival (in China’s top ten in terms of weekly box office revenues) and box office success. This suggests that further research, potentially in the form of a case study analysis, is warranted to explain why the films distributed by Huayi and Bona typically survive in the top ten for longer, while films distributed by these firms as well as Enlight enjoy significantly greater box office revenues than films distributed by other leading distributors.

Our final managerial implication relates to cultural signals. Foreign businesses clearly want and need to tackle the Chinese market. Co-production might be a viable strategy. Co-productions are not subject to import quotas, simultaneously offering both foreign and domestic partners opportunities to learn from each other and to understand each other’s cultures. However, co-production is not a new strategy: it is widely used by Hong Kong and Taiwanese firms, while the US and European firms are trailing behind. SARFT data show that together Hong Kong and Taiwan were involved in coproduction of 343 projects, accounting for 80% of the total, during 2002–2012.

From the perspective of Chinese film businesses, they will face significant barriers when venturing into international markets due to cultural differences. Nevertheless, we should not assume that Chinese film makers need only be concerned with producing films able to compete successfully in the domestic market, against imported as well as other domestically produced films. Rather, for Asian film makers, including Chinese film producers, there are similar pressures to produce films that may appeal to international audiences. While this does not reflect stagnant domestic market demand (rather we highlight the rapid and continuing growth of the Chinese film market), increasingly films may be produced to appeal to the growing diasporas who may be aware of their cultural heritage but also who enjoy increasingly international tastes, including in films (Jin, 2007).

Notes

See Article 25 of The Regulations on Administration of Movies (http://www.wipo.int/edocs/lexdocs/laws/en/cn/cn067en.pdf)

In general, China classifies investments from Hong Kong and Taiwan as foreign investments. However, in the film industry, Hong Kong and Taiwan firms are often treated differently from other foreign firms thanks to the Closer Economic Partnership Agreement (CEPA) signed between Hong Kong and China and the Economic Cooperation Framework Agreement (ECFA) signed between Taiwan and China. Under both agreements, Chinese language films produced by Hong Kong and Taiwan firms can be exempted from import quotas.

Occasionally, foreign films are released simultaneously in China and in other major countries. For example, the third and the fourth most popular foreign film in China in 2012, Avengers and Life of Pi, respectively were released theatrically in both the US and China within a day.

Memorandum of Understanding between the People’s Republic of China and the United States of America Regarding Films for Theatrical Release (MOU) (http://www.state.gov/documents/organization/202987.pdf).

Entgroup (http://english.entgroup.cn/report.aspx) produces China Film Industry Reports, providing information on industry-specific government policies, production, distribution and international trade.

For example, www.mtime.com contains budgets for Chinese films and www.imdb.com has budget information for foreign films.

There are different practices. For example, film festivals such as Berlin, Cannes and Venice only consider new films that are produced during the 12 months leading up to the festival and that remain intended for future theatrical release.

As reported in The Guardian on January 14, 2013, research by Jerry Vermanen and Chris Helt at NU.nl shows that films released between October and December are more likely to be nominated and awarded for an Oscar than those released early in the year. (http://www.theguardian.com/news/datablog/2013/jan/14/oscar-winners-break-down-genre-release-date)

Fewer than 1000 cinemas rely on print copies of films, and these tend to be older, single screen cinemas, typically showing these copies of the films after the digital release of films.

Note that many films are associated with more than one genre dummy, with no one genre identifiable as a main genre for each film. If each film was associated with a single genre, then it is possible that coefficients on more of the genre dummy variables may have been significantly different from zero.

For the sake of brevity test results are available on request.

Survival analysis results not reported here are of course available on request.

The results are not presented for the sake of brevity but are available on request.

For the sake of brevity results are available on request.

This is despite the observation made in the introduction that foreign films tend to do well in terms of box office revenues in China, and can be explained by the use of regression analysis which allows us to isolate the impact of an explanatory variable, such as the import of a foreign film, holding all other variables constant.

References

Akdeniz, M. B., & Talay, M. B. 2013. Cultural variations in the use of marketing signals: A multilevel analysis of the motion picture industry. Journal of the Academy of Marketing Science, 41(5): 601–624.

Bai, J., & Waldfogel, J. 2012. Movie piracy and sales displacement in two samples of Chinese consumers. Information Economics and Policy, 24: 187–196.

Balasubramanyam, V. N., Salisu, M., & Sapsford, D. 1996. Foreign direct investment and growth in EP and IS countries. Economic Journal, 106: 92–105.

Basuroy, S., Desai, K. K., & Talukdar, D. 2006. An empirical investigation of signaling in the motion picture industry. Journal of Marketing Research, 43(2): 287–295.

Bhagat, R. S., McDevitt, A. S., & McDevitt, I. 2010. On improving the robustness of Asian management theories: Theoretical anchors in the era of globalization. Asia Pacific Journal of Management, 27(2): 179–192.

Brewer, S. M., Kelley, J. M., & Jozefowicz, J. J. 2009. A blueprint for success in the US film industry. Applied Economics, 41(5): 589–606.

Bruton, G. D., & Lau, C.-M. 2008. Asian management research: Status today and future outlook. Journal of Management Studies, 45(3): 636–659.

Cain, R. 2011. Hey, you’ve got to hide your @#!* away: The rules of film censorship in China. http://chinafilmbiz.com/2011/11/28/hey-youve-got-to-hide-your-away-the-rules-of-film-censorship-in-china/.

Cain, R. 2012a. How China’s movie distribution system works?. http://chinafilmbiz.com/2012/11/07/how-chinas-movie-distribution-system-works-part-1/.

Cain, R. 2012b. Not-So-Amazing China debuts for Spider-Man and Dark Knight. http://chinafilmbiz.com/2012/08/28/not-so-amazing-china-debuts-for-spider-man-and-dark-knight/.

Cain, R. 2013. ‘Upside Down’ flips the script at China’s theaters. http://chinafilmbiz.com/2013/03/12/upside-down-flips-the-script-at-chinas-theaters/.

Chadha, K., & Kavoori, A. 2000. Media imperialism revisited: Some findings from the Asian case. Media, Culture and Society, 22(4): 415–432.

Chisholm, D. C., & Norman, G. 2006. When to exit a product: Evidence from the U.S. motion-picture exhibition market. American Economic Review, 96(2): 57–61.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. 2011. Signaling theory: A review and assessment. Journal of Management, 37(1): 39–67.

Corts, K. 2001. The strategic effects of vertical market structure: Common agency and divisionalization in the U.S. motion picture industry. Journal of Economics and Management Strategy, 10(4): 509–529.

Curtin, M. 2012. Chinese media and globalization. Chinese Journal of Communication, 5(1): 1–9.

Dawar, N., & Parker, P. 1994. Marketing universals: Consumers’ use of brand name, price, physical appearance, and retailer reputation as signals of product quality. Journal of Marketing, 58(2): 81–95.

De Vany, A., & Walls, W. D. 1996. Bose-Einstein dynamics and adaptive contracting in the motion picture industry. Economic Journal, 106(439): 1493–1514.

De Vany, A., & Walls, W. D. 1997. The market for motion pictures: Rank, revenue, and survival. Economic Inquiry, 35(4): 783–797.

De Vany, A., & Walls, W. D. 1999. Uncertainty in the movie industry: Does star power reduce the terror of the box office?. Journal of Cultural Economics, 23(4): 285–318.

De Vany, A., & Walls, W. D. 2002. Does Hollywood make too many R-rated movies? Risk, stochastic dominance, and the illusion of expectation. Journal of Business, 75(3): 425–451.

Deuchert, E., Adjamah, K., & Pauly, F. 2005. For Oscar glory or Oscar money?. Journal of Cultural Economics, 29(3): 159–176.

Economist. 2014. Doing it their way. http://www.economist.com/news/briefing/21595019-market-growing-furiously-getting-tougher-foreign-firms-doing-it-their-way.

Elliott, C., & Simmons, R. 2008. Determinants of UK box office success: the impact of quality signals. Review of Industrial Organization, 33(2): 93–111.

Eliashberg, J., & Shugan, S. M. 1997. Film critics: Influencers or predictors?. Journal of Marketing, 61(2): 68–78.

Elliott, C., & Simmons, R. 2008. Determinants of UK box office success: The impact of quality signals. Review of Industrial Organization, 33(2): 93–111.

Entgroup. 2014. China Film Industry report 2013–2014. http://english.entgroup.cn/report.aspx.

Entgroup. 2015. China Film Industry report 2014–2015. http://english.entgroup.cn/report.aspx.

Fang, T. 2010. Asian management research needs more self-confidence: Reflection on Hofstede. Asia Pacific Journal of Management, 27(1): 155–170.

Fu, W. W., & Lee, T. K. 2008. Economic and cultural influences on the theatrical consumption of foreign films in Singapore. Journal of Media Economics, 21(1): 1–27.

Gemser, G., Leenders, M. A. A. M., & Wijnberg, N. M. 2008. Why some awards ae more effective signals of quality than others: A study of movie awards. Journal of Management, 34(1): 25–54..

Gemser, G., Oostrum, M. V., & Leenders, M. 2007. The impact of film reviews on the box office performance of art house versus mainstream motion pictures. Journal of Cultural Economics, 31: 43–63

Golley, J. 2016. A ‘socialist’ economy in a capitalist world. Journal of Chinese Economic and Business Studies, 14(1): 9–24.

Hofstede, G. H. 2001. Culture’s consequences: Comparing values, behaviors, institutions and organizations across nations. Thousand Oaks: Sage.

Hofstede, G. H. 2007. Asian management in the 21st century. Asia Pacific Journal of Management, 24(4): 411–420.

Hou, M., Liu, H., Fan, P., & Wei, Z. 2016. Does CSR practice pay off in east Asian firms? A meta-analytic investigation. Asia Pacific Journal of Management, 33(1): 195–228.

Jayakar, K. P., & Waterman, D. 2000. The economics of American theatrical movie exports: An empirical analysis. Journal of Media Economics, 13(3): 153–169.

Jin, D. Y. 2007. Reinterpretation of cultural imperialism: Emerging domestic market vs continuing US dominance. Media, Culture and Society, 29(5): 753–771.

Kim, H., & Jensen, M. 2014. Audience heterogeneity and the effectiveness of market signals: How to overcome liabilities of foreignness in film exports?. Academy of Management Journal, 57(5): 1360–1384.

KPMG. 2015. China Outlook 2015. http://www.kpmg.com/ES/es/Internacionalizacion-KPMG/Documents/China-Outlook-2015.pdf.

KPMG. 2016. China Outlook 2016. http://www.kpmg.com/CN/en/IssuesAndInsights/ArticlesPublications/Documents/china-outlook-2016.pdf.

Larson, C. 2014. China’s surging film box office leads global rise in movie sales. BusinessWeek: Mar. 16.

Lee, F. L. F. 2006. Cultural discount and cross-culture predictability: Examining the box office performance of American movies in Hong Kong. Journal of Media Economics, 19(4): 259–278.

Lee, F. L. F. 2008. Hollywood movies in East Asia: Examining cultural discount and performance predictability at the box office. Asian Journal of Communication, 18(2): 117–136.

Lee, F. F. 2009. Cultural discount of cinematic achievement: The academy awards and U.S. movies’ east Asian box office. Journal of Cultural Economics, 33(4): 239–263.

Litman, B. R. 1983. Predicting success of theatrical movies: An empirical study. Journal of Popular Culture, 16(4): 159–175.

Liu, Y. 2006. Word of mouth for movies: Its dynamics and impact on box office revenue. Journal of Marketing, 70(3): 74–89.

McKenzie, J. 2009. Revealed word-of-mouth demand and adaptive supply: Survival of motion pictures at the Australian box office. Journal of Cultural Economics, 33(4): 279–299.

McKenzie, J. 2012. The economics of movies: A literature survey. Journal of Economic Surveys, 26(1): 42–70.

Moon, S., Bayus, B. L., Yi, Y., & Kim, J. 2015. Local consumers’ reception of imported and domestic movies in the Korean movie market. Journal of Cultural Economics, 39(1): 99–121.

Moon, S., Bergey, P. K., & Iacobucci, D. 2010. Dynamic effects among movie ratings, movie revenues, and viewer satisfaction. Journal of Marketing, 74(1): 108–121.

Moul, C. C. 2007. Measuring word of mouth’s impact on theatrical movie admissions. Journal of Economics & Management Strategy, 16(4): 859–892.

MPA (Motion Picture Association) and CFCC (China Film Co-Production Corporation). 2014. China-International Film co-production handbook. http://www.mpaa-india.org/og-content/uploads/documents/1423832835China-InternationalFilmCo-Production Handbook2014(English).pdf.

Nelson, R., & Glotfelty, R. 2012. Movie stars and box office revenues: En empirical analysis. Journal of Cultural Economics, 36(2): 141–166.

Nelson, R. A., Donihue, M. R., Waldman, D. M., & Wheaton, C. 2001. What’s an Oscar worth?. Economic Inquiry, 39(1): 1–6.

North, D. 1990. Institutions, institutional change and economic performance. Cambridge: Cambridge University Press.

O’Connor, S., & Armstrong, N. 2015. Directed by Hollywood, edited by China: How China’s censorship and influence affect films worldwide. Staff Research Report, U.S.-China and Security Review Commission, http://origin.www.uscc.gov/sites/default/files/Research/Directed by Hollywood Edited by China.pdf.

Palmeri, C. 2013. Chinese moviegoers prefer local films to Hollywood’s. BusinessWeek: Oct.

Porter, M. E. 1982. Competitive strategy: Techniques for analyzing industries and competitors. New York: Free Press.

Prag, J., & Casavant, J. 1994. An empirical study of the determinants of revenues and marketing expenditures in the motion picture industry. Journal of Cultural Economics, 18(3): 217–235.

Priest, E. 2006. The future of music and film piracy in China. Berkeley Technology Law Journal, 21(2): 795–871.