Abstract

Business groups, the dominant organizational form in many Asian markets, have expanded their operations into international markets. We combine the resources-based view with the institutional perspective to highlight the costs and benefits of business groups’ internationalization, rather than business groups’ affiliated firms’ internationalization, and consider how ownership heterogeneity among business groups influences the internationalization-performance relationship. Three ownership types—family, domestic financial institution, and foreign corporate—serve as distinguishing characteristics of business groups and potential moderators of this relationship. In a sample of 185 Indian business groups examined over more than a decade (2000–2010), we find that these three ownership types have a differential impact on the internationalization-performance relationship¸ depending on the level of internationalization of the business group. Specifically¸ we find that at lower levels of internationalization, family and foreign corporate ownership has a positive moderating effect whereas domestic financial institutional ownership has a negative moderating effect. Conversely¸ at higher levels of internationalization, family and foreign corporate ownership has a negative moderating effect, while domestic financial institutional ownership positively moderates the internationalization-performance relationship.

Similar content being viewed by others

Notes

1 USD = Rs 65.00 (approx.).

We discuss this further in our Discussion and Conclusion section as a limitation to our study.

We have also used the sample mean of internationalization to categorize business groups into lower and higher levels of internationalization. The results are similar though less statistically significant.

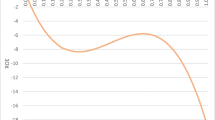

To test the validity of our inverted U-shaped relationship, we obtained the turning (maximum) point of our curve. Since all our models in Table 4 have both the linear and quadratic term, we use the most complete model (Model 8). We find that the maximum occurs when our value of internationalization is .035, which is very close to the mean (.038, Table 2), thus validating our relationship (Meyer, 2009).

Model 3 also incorporates the interaction of the squared term of internationalization with family ownership. The co-efficient though negative is insignificant.

References

Aguilera, R. V., & Jackson, G. 2003. The cross-national diversity of corporate governance: Dimensions and determinants. Academy of Management Review, 28(3): 447–465.

Allen, J. W., & Phillips, G. M. 2000. Corporate equity ownership, strategic alliances and product market relationships. Journal of Finance, 55(6): 2791–2815.

Anderson, R. C., & Reeb, D. M. 2003. Founding family ownership and firm performance: Evidence from S&P 500. Journal of Finance, 58(3): 1301–1328.

Ayyagari, M., Dau, L. F., & Spencer, J. 2015. Strategic responses to FDI in emerging markets: Are core members more responsive than peripheral members of business groups?. Academy of Management Journal, 58(6): 1869–1894.

Baek, J. S., Kang, J. K., & Lee, I. 2006. Business groups and tunneling: Evidence from private securities offerings by Korean chaebols. Journal of Finance, 61(5): 2415–2449.

Barkema, H. G., Bell, J. H. J., & Pennings, J. M. 1996. Foreign entry, cultural barriers, and learning. Strategic Management Journal, 17(2): 151–166.

Barkema, H. G., & Vermeulen, F. 1998. International expansion through start-up or acquisition: A learning perspective. Academy of Management Journal, 41(1): 7–26.

Bausch, A., & Krist, M. 2007. The effect of context-related moderators on the internationalization-performance relationship: Evidence from meta-analysis. Management International Review, 47(3): 319–347.

Berger, P. G., & Ofek, E. 1995. Diversification’s effect on firm value. Journal of Financial Economics, 37(1): 39–65.

Bertrand, M., Mehta, P., & Mullainathan, S. 2002. Ferreting out tunneling: An application to Indian business groups. Quarterly Journal of Economics, 117(1): 121–148.

Bhaumik, S. K., Driffield, N., & Pal, S. 2010. Does ownership structure of emerging–market firms affect their outward FDI? The case of the Indian automotive and pharmaceutical sectors. Journal of International Business Studies, 41(3): 437–450.

Brickley, J. A., Lease, R. C., & Smith, C. W., Jr. 1988. Ownership structure and voting on antitakeover amendments. Journal of Financial Economics, 20: 267–291.

Campa, J. M., & Kedia, S. 2002. Explaining the diversification discount. Journal of Finance, 57(4): 1731–1762.

Cantwell, J., & Mudambi, R. 2005. MNE competence-creating subsidiary mandates. Strategic Management Journal, 26(12): 1109–1128.

Cantwell, J., & Mudambi, R. 2011. Physical attraction and the geography of knowledge sourcing in multinational enterprises. Global Strategy Journal, 1(3–4): 206–232.

Carney, M. 2004. The institutions of industrial restructuring in Southeast Asia. Asia Pacific Journal of Management, 21(1/2): 171–188.

Carney, M., Gedajlovic, E. R., Heugens, P. P. M. A. R., van Essen, M., & van Oosterhout, J. 2011. Business group affiliation, performance, context and strategy: A meta-analysis. Academy of Management Journal, 54(3): 437–460.

Casson, M. 1999. The economics of the family firm. Scandinavian Economic History Review, 47(1): 10–23.

Caves, R. E. 1971. International corporations: The industrial economics of foreign investment. Economica, 38(Feb): 1–27.

Chacar, A., & Vissa, B. 2005. Are emerging economies less efficient? Performance persistence and the impact of business group affiliation. Strategic Management Journal, 26(10): 933–946.

Chami, R. 1999. What’s different about family businesses?. Working paper, University of Notre Dame.

Chang, S. J. 1995. International expansion strategy of Japanese firms: Capability building through sequential entry. Academy of Management Journal, 38(2): 383–407.

Chang, S., Chung, C., & Mahmood, I. P. 2006. When and how does business group affiliation promote firm innovation? A tale of two emerging economies. Organization Science, 17(5): 637–656.

Chang, S. J., & Hong, J. 2000. Economic performance of group–affiliated companies in Korea; Intra-group resource sharing and internal business transaction. Academy of Management Journal, 43(3): 429–448.

Chang, S. J., & Rhee, J. H. 2011. Rapid FDI expansion and firm performance. Journal of International Business Studies, 42(8): 979–994.

Chao, M., & Kumar, V. 2010. The impact of institutional distance on the international diversity-performance relationship. Journal of World Business, 45(1): 93–103.

Chen, G., Chittoor, R., & Vissa, B. 2015. Modernizing without westernizing: Social structure and economic action in the Indian financial sector. Academy of Management Journal, 58(2): 511–537.

Chen, V. Z., Li, J., Shapiro, D. M., & Zhang, X. 2014. Ownership structure and innovation: An emerging market perspective. Asia Pacific Journal of Management, 31(1): 1–24.

Chittoor, R., & Ray, S. 2007. Internationalization paths of Indian pharmaceutical firms–A strategic group analysis. Journal of International Management, 13(3): 338–355.

Chittoor, R., Kale, P., & Puranam, P. 2015. Business groups in developing capital markets: Towards a complementary perspective. Strategic Management Journal, 36(9): 1277–1296.

Chittoor, R., Sarkar, M. B., Ray, S., & Aulakh, P. S. 2009. Third-world copycats to emerging multinationals: Institutional changes and organizational transformation in the Indian pharmaceutical industry. Organization Science, 20(1): 187–205.

Claessens, S., Djankov, S., & Lang, L. H. P. 2000. East Asian corporations: Heroes or villains?. Discussion paper no. 409. Washington, DC: The World Bank.

Clavier, E., Rienda, L., & Quer, D. 2009. Family firms’ international commitment: The influence of family-related factors. Family Business Review, 22(2): 125–135.

Contractor, F. 2012. Why do multinational firms exist? A theory note about the effect of multinational expansion on performance and recent methodological critiques. Global Strategy Journal, 2(4): 318–331.

Contractor, F. J., Kumar, V., & Kundu, S. K. 2007. Nature of the relationship between international expansion and performance: The case of emerging market firms. Journal of World Business, 42(4): 401–417.

Contractor, F. J., Kundu, S., & Hsu, C.-C. 2003. A three-stage theory of international expansion: The link between multinationality and performance in the service sector. Journal of International Business Studies, 34(1): 5–18.

Cuervo-Cazurra, A. 2012. How the analysis of developing country multinational companies helps advance theory: Solving the Goldilocks debate. Global Strategy Journal, 2(3): 153–167.

Daily, C. M., & Dollinger, M. J. 1993. Alternative methods for identifying family vs. nonfamily managed small businesses. Journal of Small Business Management, 31(2): 79–90.

Delios, A., Gaur, A. S., & Kamal, S. 2009. International acquisitions and the globalization of firms from India. In J. Chaisse & P. Gugler (Eds.). Expansion of trade and FDI in Asia: Strategic and policy challenges. New York: Routledge.

Dieleman, M., & Sachs, W. M. 2008. Co-evolution of institutions and corporations in emerging economies: How the Salim group morphed into an institution of Suharto’s crony regime. Journal of Management Studies, 45(7): 1274–1300.

Douma, S., George, R., & Kabir, R. 2006. Foreign and domestic ownership, business groups, and firm performance: Evidence from a large emerging market. Strategic Management Journal, 27(7): 637–657.

Economic Times. 2014. The Mukesh Ambani’s twin kids Isha & Akash made directors of Reliance Jio Infocomm & Reliance Retail Ventures. Oct 12.

Elango, B., & Pattnaik, C. 2007. Building capabilities for international operations through networks: A study of Indian firms. Journal of International Business Studies, 38(4): 541–555.

Fernández, A., & Nieto, M. J. 2006. Impact of ownership on the international involvement of SMEs. Journal of International Business Studies, 37(3): 340–351.

Fiegenbaum, A., Shaver, J. M., & Yeung, B. 1997. Which firms expand to the Middle East: The experience of US multinationals. Strategic Management Journal, 18(2): 141–148.

Filatotchev, I., Lien, Y. C., & Piesse, J. 2005. Corporate governance and performance in publicly listed, family-controlled firms: Evidence from Taiwan. Asia Pacific Journal of Management, 22(3): 257–283.

Gallo, M. A., & Sveen, J. 1991. Internationalizing the family business: Facilitating and restraining factors. Family Business Review, 4(2): 181–190.

Gaur, A. S., & Delios, A. 2015. International diversification of emerging market firms: The role of ownership structure and group affiliation. Management International Review, 55(2): 235–253.

Gaur, A. S., & Kumar, V. 2009. International diversification, business group affiliation and firm performance: Empirical evidence from India. British Journal of Management, 20(2): 172–186.

George, R., & Kabir, R. 2012. Heterogeneity in business groups and the corporate diversification-firm performance relationship.Journal of Business Research, 65(3): 412–420.

Ghemawat, P., & Khanna, T. 1998. The nature of diversified business groups: A research design and two case studies. Journal of Industrial Economics, 46(1): 35–61.

Goto, A. 1982. Business groups in a market economy. European Economic Review, 19(1): 53–70.

Gubbi, S. R., Aulakh, P. S., & Ray, S. 2015. International search behavior of business group affiliated firms: Scope of institutional changes and intragroup heterogeneity. Organization Science, 26(5): 1485–1501.

Guillén, M. F. 2000. Business groups in emerging economies: A resource-based view. Academy of Management Journal, 43(3): 362–380.

Guillén, M., & Garcia-Canal E. 2012. Emerging markets rule: Growth strategies of the new global giants. New York: McGraw Hill.

Habbershon, T. J., & Williams, M. L. 1999. A resource-based framework for assessing the strategic advantages of family firms. Family Business Review, 12(1): 1–22.

Hennart, J. F. 2007. The theoretical rationale for a multinationality-performance relationship. Management International Review, 47(3): 423–452.

Hill, C. W. L., & Snell, S. A. 1989. Effects of ownership structure and control on corporate productivity. Academy of Management Journal, 32(1): 25–46.

Hitt, M. A., Connelly, B., Tihanyi, L., & Certo, T. 2010. Marching to the beat of different drummers: The influence of institutional owners on competitive actions. Academy of Management Journal, 53(4): 723–742.

Hsiao, C. 2003. Analysis of panel data. Cambridge: Cambridge University Press.

Hope, O., Thomas, W., & Vyas, D. 2011. The cost of pride: Why do firms from developing countries bid higher?. Journal of International Business Studies, 42: 128–151.

Hoskisson, R. E., Johnson, R. A., & Moesel, D. D. 1994. Corporate divestiture intensity in restructuring firms—Effects of governance, strategy, and performance. Academy of Management Journal, 37(5): 1207–1251.

Hundley, G., & Jacobson, C. K. 1998. The effects of the keiretsu on the export performance of Japanese companies: Help or hindrance?. Strategic Management Journal, 19(10): 927–937.

Hymer, S. H. 1976. A study of direct foreign investment. Cambridge: MIT Press.

Jacquemin, A. P., & Berry, C. H. 1979. Entropy measure of diversification and corporate growth. Journal of Industrial Economics, 27(4): 359–369.

Januszewski, S. I., Köke, J., & Winter, J. K. 2002. Product market competition, corporate governance and firm performance: An empirical analysis for Germany. Research in Economics, 56(3): 299–332.

Johnson, R. A., Schnatterly, K., Johnson, S. A., & Chiu, S. C. 2010. Institutional investors and institutional environment: A comparative analysis and review. Journal of Management Studies, 47(8): 1590–613.

Kakani, R.K. 2000. Financial performance and diversification strategy of Indian business groups. Doctoral dissertation, Indian Institute of Management, Calcutta.

Khanna, T., & Palepu, K. 1997. Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4): 41–51.

Khanna, T., & Palepu, K. 2000. Is group affiliation profitable in emerging markets: An analysis of Indian diversified business groups. Journal of Finance, 55(2): 867–891.

Khanna, T., Palepu, K. & Bullock, R. 2009. House of Tata: Acquiring a global footprint. Harvard Business School Case, 9–708–446.

Khanna, T., & Rivkin, J. W. 2001. Estimating the performance effects of business groups in emerging markets. Strategic Management Journal, 22(1): 45–74.

Khanna, T., Song, J., & Lee, K. 2011. The globe: The paradox of Samsung’s rise. Harvard Business Review, 89(7/8): 142–147.

Khanna, T., & Yafeh, Y. 2007. Business groups in emerging markets: Paragons or parasites?. Journal of Economic Literature, 45(2): 331–372.

Kim, H., Kim, H., & Lee, P. M. 2008. Ownership strategy and the relationship between financial slack and R&D investments: Evidence from Korean firms. Organizational Science, 19(3): 404–418.

Kim, W. C., Hwang, P., & Burgers, W. P. 1993. Multinationals’ diversification and the risk-return trade-off. Strategic Management Journal, 14(4): 275–286.

Kirca, A. H., Roth, K., Hult, G. T. M., & Cavusgil, S. T. 2012. The role of context in the multinationality-performance relationship: A meta-analytic review. Global Strategy Journal, 2: 108–121.

Kogut, B. 1985. Designing global strategies: Comparative and competitive value added chains. Sloan Management Review, 27(Fall): 27–38.

Kogut, B., & Chang, S. J. 1991. Technological capabilities and Japanese foreign direct investment in the United States. Review of Economics and Statistics, 73(3): 401–413.

Köke, J., & Renneboog, L. 2005. Do corporate control and product market competition lead to stronger productivity growth? Evidence from market-oriented and blockholder-based governance regimes. Journal of Law and Economics, 48(2): 475–516.

Kumar, N., & Aggarwal, A. 2005. Liberalization, outward orientation and in-house R&D activity of multinational and local firms: A quantitative exploration for Indian manufacturing. Research Policy, 34(4): 441–460.

Kumar, V., Gaur, A. S., & Pattnaik, C. 2012. Product diversification and international expansion of business groups: Evidence from India. Management International Review, 52(2): 175–92.

Kumar, V., Mudambi, R., & Gray, S. 2013. Internationalization, innovation and institutions: The 3 I’s underpinning the competitiveness of emerging market firms. Journal of International Management, 19(3): 203–206.

Lamin, A. 2013. The business group as an information resource: An investigation of business group affiliation in the Indian software services industry. Academy of Management Journal, 56(5): 1487–1509.

Lang, L. H. P., & Stulz, R. M. 1994. Tobin’s q, corporate diversification, and firm performance. Journal of Political Economy, 102(6): 1248–1280.

Leff, N. H. 1978. Industrial organization and entrepreneurship in the developing countries: The economic groups. Economic Development and Cultural Change, 26(4): 661–675.

Li, L. 2007. Multinationality and performance: A synthetic review and research agenda. International Journal of Management Reviews, 9(2): 117–139.

Lien, Y. C., Piesse, J., Strange, R., & Filatotchev, I. 2005. The role of corporate governance in FDI decisions: Evidence from Taiwan. International Business Review, 14(6): 739–763.

Lu, J., & Beamish, P. 2001. The internationalization and performance of SMEs. Strategic Management Journal, 22(6–7): 565–586.

Lu, J., & Beamish, P. 2004. International diversification and firm performance: The S-curve hypothesis. Academy of Management Journal, 47(4): 598–609.

Luo, Y., & Tung, R. 2007. International expansion of emerging market enterprises: A springboard perspective. Journal of International Business Studies, 38(4): 481–498.

Mackie, J. 1992. Changing patterns of big business in Southeast Asia. In R. McVey (Ed.). Southeast Asian capitalism: 161–190. Ithaca: Cornell University Southeast Asia Program.

Majocchi, A., & Strange, R. 2012. International diversification: The impact of ownership structure, the market for corporate control and board independence. Management International Review, 52(6): 879–900.

Majumder, S. 1997. The Impact of size and age on firm-level performance: Some evidences from India. Review of Industrial Organization, 12(2): 231–241.

Manikandan, K. S., & Ramachandran, J. 2015. Beyond institutional voids: Business groups incomplete markets, and organizational form. Strategic Management Journal, 36(4): 598–617.

Mathews, J. A. 2006. Dragon multinationals: New players in 21st century of globalization. Asia Pacific Journal of Management, 23(1): 5–27.

Meyer, K. E. 2009. Motivating, testing, and publishing curvilinear effects in management research. Asia Pacific Journal of Management, 26(2): 187–193.

Monks, R., & Minow, N. 1995. Corporate governance. Cambridge: Blackwell Business.

Morck, R., Wolfenzon, D., & Yeung, B. 2005. Corporate governance, economic entrenchment, and growth. Journal of Economic Literature, 43(3): 655–720.

Nachum, L. 2000. Economic geography and the location of TNCs: Financial and professional service FDI to the USA. Journal of International Business Studies, 31(3): 367–385.

Nieto, M. J. 2001. Tipos de propiedad y comportamiento estratégico de la empresa. Unpublished PhD dissertation, Departamento de Economía de la Empresa, Universidad Carlos III de Madrid, Spain.

Oh, C. H., & Contractor, F. J. 2012. The role of territorial coverage and product diversification in the multinationality-performance relationship. Global Strategy Journal, 2: 122–136.

Oh, C. H., & Contractor, F. J. 2014. A regional perspective on multinational expansion strategies: Reconsidering the three-stage paradigm. British Journal of Management, 25(S1): S42–S59.

Pedersen, T., & Stucchi, T. 2014. Business groups, institutional transition, and the internationalization of firms from emerging economies. In A. Cuervo-Cazurra & R. Ramamurti (Eds.). Understanding multinationals from emerging markets. Cambridge: Cambridge University Press.

Poza, E. J., Alfred, T., & Maheshwari, A. 1997. Stakeholder perceptions of culture and management practices in family and family firms: A preliminary report. Family Business Review, 10(2): 135–155.

Qian, G., Khoury, T. A., Peng, M. W., & Qian, Z. 2010. The performance implications of intra- and inter-regional geographic diversification. Strategic Management Journal, 31(9): 1018–1030.

Ramamurti, R. 2000. A multilevel model of privatization in emerging economies. Academy of Management Review, 25(3): 525–550.

Ramamurti, R. 2009. What have we learned about EMNEs?. In R. Ramamurti & J. V. Singh (Eds.). Emerging multinationals from emerging markets. Cambridge: Cambridge University Press.

Ramamurti, R., & Singh, J. V. 2009. Emerging multinationals from emerging markets, Ch. 2. Cambridge: Cambridge University Press.

Ramaswamy, K., Li, M., & Petitt, B. 2012. Why do business groups matter? A study of market failure and performance among Indian manufacturers. Asia Pacific Journal of Management, 29(3): 643–658.

Ramaswamy, K., Li, M., & Veliyath, R. 2002. Variations in ownership behavior and propensity to diversify: A study of the Indian corporate context. Strategic Management Journal, 23(4): 345–358.

Rugman, A. M., & Oh, C. H. 2010. Does the regional nature of multinationals affect the multinationality and performance relationship?. International Business Review, 19(5): 479–488.

Ruigrok, W., & Wagner, H. 2003. Internationalization and performance: An organizational learning perspective. Management International Review, 9(2): 63–83.

Singh, D. A., & Gaur, A. S. 2013. Governance structure, innovation and internationalization: Evidence from India. Journal of International Management, 19(3): 300–309.

Strachan, H. 1976. Family and other business groups in economic development: The case of Nicaragua. New York: Praeger.

Tan, D., & Meyer, K. E. 2010. Business groups’ outward FDI: A managerial resources perspective. Journal of International Management, 16(2): 154–164.

The Indian Express. 2014. Jet Airways, Etihad Airways deal rocked by fresh trouble, http://indianexpress.com/article/business/companies/jet-airways-etihad-airways-deal-rocked-by-fresh-trouble/#sthash.92ySHbCD.dpuf. June 19.

Thomas, D. E., & Eden, L. 2004. What is the shape of the multinationality-performance relationship?. Multinational Business Review, 12(1): 89–110.

Tihanyi, L., Johnson, R. A., Hoskission, R. E., & Hitt, M. A. 2003. Institutional ownership differences and international diversification: The effects of boards of directors and technological opportunity. Academy of Management Journal, 46(2): 195–211.

Verbeke, A., & Forootan, M. Z. 2012. How good are multinationality-performance (M‐P) empirical studies?. Global Strategy Journal, 2(4): 332–344.

Verbeke, A., Li, L., & Goerzen, A. 2009. Toward more effective research on the multinationality-performance relationship. Management International Review, 49(2): 149–162.

Wan, W. P., & Hoskisson, R. 2003. Home country environments, corporate diversification strategies, and firm performance. Academy of Management Journal, 46(1): 27–45.

Ward, J. 1988. The special role of strategic planning for family businesses. Family Business Review, 1(2): 105–117.

Wooldridge, J. M. 2000. Introductory econometrics: A modern approach. Cengage Learning Custom Publishing.

Wruck, K. H. 1989. Equity ownership concentration and firm value: Evidence from private equity financings. Journal of Financial Economics, 23(1): 3–28.

Yaprak, A., & Karademir, B. 2010. The internationalization of emerging market business groups: An integrated literature review. International Marketing Review, 27(2): 245–262.

Yiu, D. 2011. Multinational advantages of Chinese business groups: A theoretical exploration. Management and Organization Review. 7(2): 249–277.

Yoshihara, K. 1988. The rise of ersatz capitalism in South-East Asia. Oxford: Oxford University Press.

Young, M., Peng, M., Ahlstrom, D., & Bruton, G.D. 2002. Governing the corporation in emerging economies: A principal-principal perspective. Academy of Management Proceedings, E: 1–6.

Zaheer, S. 1995. Overcoming the liability of foreignness. Academy of Management Journal, 38(2): 341–363.

Zahra, S. A. 2003. Entrepreneurial risk taking in family firms. Family Business Review, 18(1): 23–40.

Zattoni, A., Pedersen, T., & Kumar, V. 2009. The performance of group-affiliated firms during institutional transition: A longitudinal study of Indian firms. Corporate Governance: An International Review, 17(4): 510–523.

Acknowledgments

We would like to thank the Special Issue editors Bersant Hobdari, Jing Li, Klaus Meyer, Peter Gammeltoft, and two anonymous reviewers for their feedback as well as Michael Carney for final guidance on this manuscript. Saptarshi would like to thank the Indian Institute of Management Calcutta for a research grant for this paper.

Author information

Authors and Affiliations

Corresponding author

Appendix: Construction of industry-adjusted variables and ownership variables

Appendix: Construction of industry-adjusted variables and ownership variables

We consider a business group with j affiliated listed firms. These j firms are present in n two-digit NIC industries. Here, TABG is the sum of the total assets of all listed within the business group, and SBG is the sum of sales of all listed firms within the business group.

-

a.

Excess ROA = ROA of business group − Imputed ROA of the business group

ROA of business group = \( {\displaystyle {\sum}_{i=1}^j\frac{PBDIT{A}_i}{Asset{s}_i}*\frac{Asset{s}_i}{TAB{G}_b}} \) for the i th firm within the b th business group.

Imputed ROA of the business group = \( {\displaystyle {\sum}_{k=1}^n{\displaystyle {\sum}_{i=1}^j\frac{Asset{s}_i}{TAB{G}_b}*RO{A}_k^{median}}} \), where ROA median k is the median ROA for the k th two-digit NIC industry. Firm i belongs to the k th two digit NIC industry.

-

b.

Industry-weighted foreign sales to total sales = FSTS of business group − Imputed FSTS of the business group

FSTS of business group = \( {\displaystyle {\sum}_{i=1}^j\frac{Foreign\ sale{s}_i}{Sale{s}_i}*\frac{Sale{s}_i}{SB{G}_b}} \) for the i th firm within the b th business group

Imputed ROA of the business group = \( {\displaystyle {\sum}_{k=1}^n{\displaystyle {\sum}_{i=1}^j\frac{Sale{s}_i}{SB{G}_b}*FST{S}_k^{median}}} \), where FSTS median k is the median FSTS for the k th two-digit NIC industry

-

c.

Industry-weighted marketing intensity = Marketing intensity of business group − Imputed marketing intensity of the business group

Marketing intensity of business group = \( {\displaystyle {\sum}_{i=1}^j\frac{Marketing\ expenditur{e}_i}{Sale{s}_i}*\frac{Sale{s}_i}{SB{G}_b}} \) for the i th firm within the b th business group

Imputed marketing intensity of the business group = \( {\displaystyle {\sum}_{k=1}^n{\displaystyle {\sum}_{i=1}^j\frac{Marketing\ expenditur{e}_i}{SB{G}_b}* Marketing\ intensit{y}_k^{median}}} \), where Marketing intensity median k is the median marketing intensity for the k th two-digit NIC industry

-

d.

Control-cash flow rights wedge = \( {\displaystyle {\sum}_{i=1}^j\frac{Asset{s}_i}{TAB{G}_b}*{\left( Control\ rights- Cash\ flow\ rights\right)}_i} \) for the i th firm within the b th business group

-

e.

Degree of business group family ownership = \( {\displaystyle {\sum}_{i=1}^j\frac{Asset{s}_i}{TAB{G}_b}*\ {\left(\%\ shareholding\ by\ founding\ family\ and\ group\ firms\right)}_i} \)

-

f.

Degree of business group domestic financial institutional ownership = \( {\displaystyle {\sum}_{i=1}^j\frac{Asset{s}_i}{TAB{G}_b}*\ {\left(\%\ shareholding\ by\ domestic\ \left(i.e.\ Indian\right)\ financial\ institutions\right)}_i} \)

-

g.

Degree of business group foreign corporate ownership = \( {\displaystyle {\sum}_{i=1}^j\frac{Asset{s}_i}{TAB{G}_b}*\ {\left(\%\ shareholding\ by\ foreign\ non- financial\ corporations\ \right)}_i} \)

Rights and permissions

About this article

Cite this article

Purkayastha, S., Kumar, V. & Lu, J.W. Business group heterogeneity and the internationalization-performance relationship: Evidence from Indian business groups. Asia Pac J Manag 34, 247–279 (2017). https://doi.org/10.1007/s10490-016-9489-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-016-9489-5