Abstract

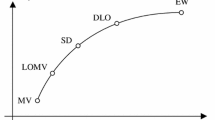

It is well documented that the classical mean variance theory (MVT) may yield portfolios (MVTP) that are highly concentrated and/or are outperformed by equal weight portfolios (EWP). In this work, it is proposed to expand the MVT minimizing objective function with an additional term that explicitly controls portfolio diversity (diversity booster DB). DB decreases with growing number of non-zero portfolio weights and has a minimum when all weights are equal. As a result, high values of DB yield EWP. For performance analysis, portfolio constructed with 12 major US equity ETFs is considered. Out-of-sample performance of maximum Sharpe portfolios is tested using statistics of bootstrapped Sharpe ratios for monthly rebalancing periods. It is found that for the 3-year calibrating window, the diversified MVT portfolio (DMVTP) outperformed both MVTP and EWP in 2012–2015. While the MVTP weights were highly concentrated and had sharp jumps between rebalancing periods, the DMVTP weights slowly changed with time.

Similar content being viewed by others

References

Bender, J., Briand, R., Nielsen, F., & Stefek, D. (2010). Portfolio of risk premia: A new approach to diversification. Journal of Portfolio Management, 36(2), 17–25.

Brandtner, M. (2013). Conditional value-at-risk, spectral risk measures and (non-) diversification in portfolio selection problems—A comparison with mean-variance analysis. Journal of Banking & Finance, 37(12), 5526–5537.

Brock, W., Lakonishok, J., & LeBaron, B. (1992). Simple technical trading rules and the stochastic properties of stock returns. Journal of Finance, 47, 1731–1764.

Bullen, P. S., Mitrinovic, D. S., & Vasic, P. M. (1988). Means and their inequalities. Dordrecht: D. Reidel Publishing Company.

Chaves, D., Hsu, J., Li, F., & Shakernia, O. (2011). risk parity portfolios vs. other asset allocation heuristic portfolios. The Journal of Investing, 20(1), 108–118.

Choueifaty, Y., & Coignard, Y. (2008). Toward maximum diversification. The Journal of Portfolio Management, 35(1), 40–51.

de Vassal, V. (2001). Risk diversification benefits of multiple-stock portfolios. Journal of Portfolio Management, 27(2), 32–39.

DeMiguel, V., Garlappi, L., & Uppal, R. (2009). Optimal versus Naïve diversification how inefficient is the 1/N portfolio strategy? Review of Financial Studies, 22, 1915–1953.

DeMiguel, V., Plyakha, Y., Uppal, R., & Vilkov, G. (2013). Improving portfolio selection using option-implied volatility and skewness. Journal of Financial and Quantitative Analysis, 48, 1813–1845.

Denvir, E., & Hutson, E. (2006). The performance and diversification benefits of funds of Hedge funds. Journal of International Financial Markets, Institutions & Money, 16(1), 4–22.

Duchin, R., & Levy, H. (2009). Markowitz versus the Talmudic portfolio diversification strategies. Journal of Portfolio Management, 35, 71–74.

Elton, E. J., Gruber, M. J., Brown, S. J., & Goetzmann, W. N. (2009). Modern portfolio theory and investment analysis. New York: Wiley.

Gerber, S., Markowitz, H., & Pujara, P. (2015). Enhancing Multi-Asset Portfolio Construction Under Modern Portfolio Theory with a Robust Co-Movement Measure. http://ssrn.com/abstract=2627803.

Green, R. C., & Hollifield, B. (1992). When will mean–variance efficient portfolios be well diversified? Journal of Finance, 47, 1785–1809.

Hirschman, A. O. (1964). The paternity of an index. The American Economic Review, 54(5), 761.

Ibragimov, R., & Walden, J. (2007). The limits of diversification when losses may be large. Journal of Banking & Finance, 31(8), 2551–2569.

Inker, B. (2011). Dangers of risk parity. The Journal of Investing, 20(1), 90–98.

Jacobs, H., Müller, S., & Weber, M. (2013). How should individual investors diversify? An empirical evaluation of alternative asset allocation policies. Journal of Financial Markets, 19, 62–85.

James, G., Witten, D., Hastie, T., & Tibshirani, R. (2013). An introduction to statistical learning with applications in R. Berlin: Springer.

Kritzman, M., Page, S., & Turkington, D. (2010). In defense of optimization: The fallacy of 1/N. Financial Analysts Journal, 66, 31–39.

Lee, W. (2011). Risk-based asset allocation: A new answer to an old question? The Journal of Portfolio Management, 37(4), 11–21.

Maillard S., Roncalli, T., & Teïletche J. (2010). The properties of equally weighted risk contribution portfolios. Journal of Portfolio Management, 36(4), 60–70.

Meucci, A. (2009). Managing diversification. Risk, 22(5), 74–79.

Nadler, D., & Schmidt, A. B. (2014). Portfolio theory in terms of partial covariance. http://ssrn.com/abstract=2436478. Accessed 14 June 2016.

Pérignon, C., & Smith, D. R. (2010). Diversification and value-at-risk. Journal of Banking & Finance, 34, 55–66.

Qian, E. (2011). Risk parity and diversification. Journal of Investing, 20(1), 119–127.

Rudin, A. M., & Morgan, J. S. (2006). A portfolio diversification index. Journal of Portfolio Management, 32(2), 81–89.

Sankaran, J. K., & Patil, A. R. (1999). On the optimal selection of portfolios under limited diversification. Journal of Banking & Finance, 23(11), 1655–1666.

Tu, J., & Zhou, G. (2009). Markowitz meets Talmud: A combination of sophisticated and naïve diversification strategies. Journal of Financial Economics, 99, 204–215.

White, H. (2000). A reality check for data snooping. Econometrica, 68, 1097–1126.

Acknowledgements

I am grateful to anonymous reviewers for constructive comments to my work.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Schmidt, A.B. Managing portfolio diversity within the mean variance theory. Ann Oper Res 282, 315–329 (2019). https://doi.org/10.1007/s10479-018-2896-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2896-x