Abstract

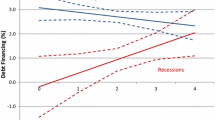

Using administrative confidential data on the universe of Canadian corporate firms, we compare debt financing choices of private and public firms. Private firms have higher leverage ratios, which are entirely driven by private firms’ stronger reliance on short-term debt. Further, private firms rely more of leverage during economic expansions, while public firms rely on equity financing. Specifically, private firms manage to increase their long-term debt during expansions, while short-term debt is used during downturns. Our findings have implications for a better understanding of the role of asymmetric information in private firms’ capital structure decisions.

Similar content being viewed by others

Notes

For example, private firms generate 90% of total sales and 90% of the employment in Canada. In the UK more than two-thirds of corporate assets are owned by private firms (Brav 2009).

The pecking order theory postulates that the cost of financing increases with asymmetric information (Myers and Majluf 1984). Companies prioritize their sources of financing, first preferring internal financing, followed by debt, and lastly raising equity as a “last resort.”

See Appendix A.2 for details.

We compare the total number of firms in COMPUSTAT with the number of firms in our sample. COMPUSTAT is widely used to conduct research on US and Canadian public firms. The total coverage of public firms in COMPUSTAT is 2869, or 82% of the population.

According to the PWC (2010), there were 731 IPOs for the period 2000–2008.

We use sales growth as opposed to the market-to-book ratio as a proxy for growth opportunities because private firms do not have market values. Both measures are conceptually different because the market-to-book ratio as a market-based measure contains forward-looking information, unlike firm-level sales growth.

See Appendix A.1 for definitions of short- and long-term debt.

The total number of observations in columns 2 and 3 is different because some firms have zero debt in column 2 and as a result the ratio of long-term debt to total debt cannot be computed.

Appendix A.3 provides details on this procedure.

NAICS 21, 22, 54 and 55 correspond to “Mining, quarrying, and oil and gas extraction, “Utilities,” “The Professional, Scientific, and Technical Services,” and “Management of Companies and Enterprises,” respectively. The complete list of industry definitions is available in Table 2.

The \(H_0: \sum \hbox {Unexp}=0\) row provides the F-statistic on the null hypothesis that the industry conditions do not affect private firms. The null hypothesis is \(({ Unexp}\;{ growth}+{ Unexp}\; { Growth}\times { Private})=0\) in columns 1–3, while in columns 4–6 the null hypothesis is \(({ Unexp}\; { volatility}+ { Unexp}\; { volatility} \times { Private})=0\).

References

Asker, J., Farre-Mensa, J., Ljungqvist, A.: Comparing the investment behavior of public and private firms. NBER Working Papers 17394, National Bureau of Economic Research, Inc. (2011). http://www.nber.org/papers/w17394.pdf

Barclay, M., Smith, C.: The maturity structure of corporate debt. J Finance 50, 609–631 (1995)

Berger, A., Espinosa-Vega, M., Frame, W., Miller, N.: Debt maturity, risk, and asymmetric information. J Finance 60, 2895–2923 (2005)

Brav, O.: Access to capital, capital structure, and the funding of the firm. J Finance 64(1), 263–308 (2009)

Caballero, R., Krishnamurthy, A.: Collective risk management in a flight to quality episode. J Finance 63, 2195–2230 (2008)

Carvalho, D.: Financing constraints and the amplification of aggregate downturns. Rev Financ Stud 28(9), 2463–2501 (2015)

Castro, R., Clementi, G., Lee, Y.: Cross sectoral variation in the volatility of plant level idiosyncratic shocks. J Ind Econ 1, 1–29 (2015)

Covas, F., Haan, W.J.: The cyclical behavior of debt and equity finance. Am Econ Rev 101(2), 877–899 (2011)

Custódio, C., Ferreira, M., Laureno, L.: Why are us firms using more short-term debt? J Financ Econ 108(1), 182–212 (2013)

Diamond, D.: Debt mturity strucutre and liquidity risk. Q J Econ 106(3), 709–737 (1991)

Erel, I., Julio, B., Kim, W., Weisbach, M.: Macroeconomic conditions and capital raising. Rev Financ Stud 25, 341–376 (2012)

Flannery, M.: Asymmetric information and risky debt maturity choice. J Finance 41, 19–37 (1986)

Gao, H., Harford, J., Li, K.: Determinants of corporate cash policy: insights from private firms. J Financ Econ 109, 623–639 (2013)

Greene, W.: Econometric Analysis, 7th edn. Prentice-Hall, Englewood Cliffs (2012)

Heckman, J., Ichimura, H., Todd, P.: Matching as an econometric evaluation estimator. Rev Econ Stud 64, 605–654 (1997)

Hovakimian, A., Opler, T., Titman, S.: The debt-equity choice. J Financ Quant Anal 36, 1–24 (2001)

Huynh, K.P., Petrunia, R.J., Voia, M.C.: The impact of initial financial state on firm duration across entry cohorts. J Ind Econ 58(3), 661–689 (2010)

Lemmon, M., Roberts, M., Zender, J.: Back to the beginning: persistence and the cross-sectional distribution of capital structure. J Finance 63, 1–37 (2008)

Maksimovic, V., Phillips, G., Yang, L.: Private and public merger waves. J Finance 68(5), 2177–2217 (2013)

Michaely, R., Roberts, M.: Corporate dividend policies: lessons from private firms. Rev Financ Stud 25(3), 711–746 (2012)

Myers, S., Majluf, N.: Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13, 187–222 (1984)

PWC: The Canadian IPO market: decade in review. PWC Report, PricewaterhouseCoopers (2010). http://www.pwc.com/ca/en/ipo/publications/ipo-decade-in-review-2010-en.pdf

Rajan, R.G., Zingales, L.: What do we know about capital structure? some evidence from international data. J Finance 50, 1421–1460 (1995)

Saunders, A., Steffen, S.: The costs of being private: evidence from the loan market. Rev Financ Stud 24(12), 4091–4122 (2011)

Author information

Authors and Affiliations

Corresponding author

Additional information

The views stated herein are those of the authors and not necessarily of the Bank of Canada or the Board of Governors. We are very grateful for the comments and suggestions an anonymous referee.

Appendix

Appendix

1.1 Data appendix

The data appendix provides details on the assets, equity, short-term debt, long-term debt, debt, profits, tangible assets and sales variables. The following information lists the components of each variable along with the corresponding tax line from the T2 tax forms in brackets. The information is taken from the general index of financial information (GIFI) on the T2 corporate tax return.

-

1.

Total assets (2599) =

-

Total current assets (1599) [Cash and deposits (1000) + Accounts receivable (1060) + Allowance for doubtful accounts (1061) + Inventories (1120) + Short term investments (1180) + Loans and notes receivable (1240) + Other currents assets (1480)]

-

Tangible capital assets (2008) [Land (1600) +Depletable assets (1620) +Buildings (1680) +Machinery, Equipment, Furniture and Fixtures (1740) +Other tangible assets (1900)]

-

Intangible capital assets (2178) [Intangible assets (2010) (i.e., goodwill, quota, licenses, incorporation costs, trademarks/patents, customer lists, rights, and research and development). + Resource rights (2170)]

-

Long term assets (2589) [Due from shareholder(s) and/or director(s) (2180) + Due from members (2190) + Investment in joint venture(s) and/or partnership(s) (2200) + Long term investments (2300) + Long term loans (2360) + Other long term assets (2420)]

-

Assets held in trust (2590)

-

-

2.

Total liabilities and shareholder equity (3640)

-

3.

Total debt = Total liabilities (3499) =

-

Total short-term debt = Total current liabilities (3139)

-

Total long-term debt = Total long-term liabilities (3450)

-

-

4.

Total shareholder equity (3620) =

-

Common shares (3500) +

-

Preferred shares (3520) +

-

Retained earnings/deficit (3600) [Retained earnings/deficit—Start (3660) + Net income/loss (3680) + Capital contributed at the beginning of the fiscal period (3690) + Dividends declared (3700) + Prior period adjustments (3720) + Other items affecting retained earnings (3740)]

-

-

5.

Total sales = total revenues (8299)

-

Total sales of goods and services (8089) +

-

Investment revenue (8090) +

-

Interest income (8100) +

-

Commission revenue (8120) +

-

Rental revenue (8140) +

-

Vehicle leasing (8150)

-

Fishing revenue (8160) +

-

Realized gains/losses on disposal of assets (8210) +

-

NPO amounts received (8220) +

-

Other revenue (8230) (Income/loss on subsidiaries/affiliates + Income/loss on joint ventures + Income/loss on partnerships + Alberta royalty tax credits)

-

-

6.

Profits = Net income for tax purposes (300)

All variables are measured in nominal terms within the database. We use the consumer price index data available through CANSIM (CANSIM Table No. 326-0001) to deflate values of these variables.

Accounting rules dictate that:

-

total assets (2599) \(\equiv \) total liabilities (3499) + total shareholder equity (3620) identity holds.

1.2 Definition: private versus public firms

We classify firms as private or public on the following criteria:

-

1.

Canadian-controlled private corporation (CCPC):

-

Resident incorporated firm not directly or indirectly controlled by non-residents, a public corporation or any combination; or

-

a private, resident corporation not directly or indirectly controlled by one or more public corporations or Federal Crown corporation

-

-

2.

Public corporation:

-

Resident in Canada and having a class of shares listed on a prescribed Canadian stock exchange; or

-

Any Canadian corporation controlled by a public corporation

-

1.3 Industry sales growth and volatility of unexpected firm sales growth

Following Castro et al. (2015), we use a two-step procedure to measure unexpected industry sales growth and its volatility. As the first step, a firm’s sales growth is decomposed into predicted and unexpected components using the following regression:

where the residual \(\mu _{{ it}}\) captures the unexpected component to firm sales growth. The dummy variable d1984 takes the value one for firms that existed prior to 1984 because we do not know their exact age, and zero otherwise. In the second stage, both \(\mu _{{ it}}\) and \(\mu _{{ it}}^{2}\) are regressed against time-specific, two-digit industry dummy variables given in the following equation:

and

for firm i in industry j at time t. These regressions include a full set of industry-time dummy variables \(\varPsi \) and \(\varGamma \).Footnote 15 \(\varPsi _{jt}\) gives the unexpected firm sales growth within industry j at time t, while \(\varGamma _jt\) gives the variance of the unexpected sales growth within industry j at time t. The estimated coefficients on the dummy variables in Eq. (A.2) capture the average unexpected sales growth within an industry at a given time (\({\widehat{\varPsi }}_{jt}\)), while the estimated coefficients on the dummy variables in Eq. (A.3) capture the volatility of the unexpected firm sales-growth at a given time and industry (\({\widehat{\varGamma }}_{jt}\)).

Rights and permissions

About this article

Cite this article

Huynh, K.P., Paligorova, T. & Petrunia, R. Debt financing in private and public firms. Ann Finance 14, 465–487 (2018). https://doi.org/10.1007/s10436-018-0323-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-018-0323-6