Abstract

In this paper we examine how Finnish municipalities’ expenditures depend on the share of citizens with foreign background out of the total population. Empirical analyses make use of Finnish panel data from 295 municipalities and 202 migrant nationalities for the period 1987–2018. It turns out that the share of foreign population tends to increase per capita expenditures up to the point where the respective semi-elasticity is about one. The result seems robust in terms of different control variables, subsamples of the data and estimation techniques. Sizeable differences between different nationalities could, however, be detected. Thus, we cannot assume that the use of public services is neutral in terms of demographic changes and that should be considered when making assessments on overall fiscal effects of migration.

Similar content being viewed by others

1 Introduction

In this paper we study the fiscal consequences of migration. More precisely, we study the local authorities’ expenditures in Finland and scrutinize how the share of migrant population affects the (per capita) expenditures of public services.Footnote 1 The question is, are the per capita expenditures of local entities unrelated to immigration, and if not, how the expenditures develop with different levels (and structures) of immigration. By doing that we can cover an area which is rather poorly analyzed in most economy-wide analyses dealing with fiscal effects of immigrationFootnote 2. Practically all economy-wide analyses like Liebig and Mo (2013), Holmøy and Strøm (2012) and Alden and Hammarstedt (2016) concentrate on (net) income transfers to public sector and either ignore public consumption/production entirely or assume that per capita expenditures are equal with native population and immigrants. Although these assumptions can be defended by lack of data, they are not innocent and clearly require closer scrutiny. The local authorities’ view is particularly important for countries like Finland where most (over two thirds) of public services are provided by municipalities while the central government is in charge of most income transfers.

Finnish municipalities are an interesting subject not only because of data reasons but also because of the rather special institutional set-up. Although Finnish municipalities have in principle a self-governing status they are rather service providers than independent decision-makers. The tasks and duties of municipalities are determined in the municipality law and more importantly the standard of services is controlled by the central government. A considerable part of municipalities income (over one fourth) comes from the central government so that the central government has a lot say of the quality of public services that are provided by the municipalities. Thus, the cross-municipality differences in expenditures can be interpreted rather from the “cost of providing services” than from the municipalities’ willingness to spend money point of view, even though that has also some role to play.

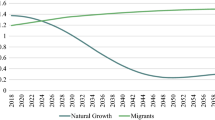

Thus far, migration to Finland has been relatively small; people with foreign background represent only about six per cent of the total population and in many municipalities, there are only a few or even zero foreigners. On the other hand, in big cities the share is getting close to twenty per cent. At the same time immigrant population has become more heterogeneous. Thus, in the end of 2018, there were already immigrants from 202 countries (see the Appendix).

In general, the effects of migration have been studied rather extensively although the emphasis has been on the labor market, where the hot potato has been the question whether immigration has a depressing on effect local residents wages (see e.g. Altonji and Card 1991). Here we skip that topic entirely and concentrate on the much narrower fiscal question of how the expenditures of municipalities are affected by immigration.

In this branch of literature, there have been quite few studies. Thus, there is the study of Gerdes (2011), which makes use of data on Danish municipalities and the study of Jofre-Monseny et al. (2016) that deals with Spanish municipalities’ public spending in the early 2000. Both studies consider the issue mainly from the point of the welfare state trying to answer to the question: does immigration reduce or increase local welfare spending. The question goes back to Alesina et al. (1999) who argued strongly that ethnic fragmentation strongly reduces welfare spending, i.e. willingness to spend. Evidence of this is documented in e.g. Alesina et al. (2018, 2019). Also, Dahlberg et al. (2012) found that in Sweden, a larger immigrant population leads to less support for redistribution in the form of preferred social benefit levels. In the same way, Speciale (2012) found that immigration has a negative effect on education expenditures. A somewhat related hypothesis was presented by Razin et al. (2002) who argued that low-skilled immigration increases the cost of redistribution and thus reduces the demand for redistributive public spending. Stichnoth and Van der Straeten (2013) provide a review of the empirical literature on the effects of ethnic fractionalization on redistribution. Gerdes’ (2011) results are somewhat at odds with this “willingness” view although the results are not very clear-cut and depend on the indicator of welfare spending that is used in the estimating equation. Jofre-Monseny et al. (2016) arrive at somewhat different results indicating that local public spending decreases along with immigration density. However, results at the country level seem to contradict this pattern. Thus, Gaston and Rajaguru (2013) using cross-country data arrive at conclusion that immigration has rather increased than decreased welfare spending.

As pointed out earlier, our purpose is not to test the Alesina hypothesis but rather to examine what is the fiscal (cost) impact of immigration on municipalities’ expenditures. In Finland, this issue has been studied earlier by Mäkelä and Viren (2018). They concluded that migration does indeed increase per capital expenditures. It is only that they had a rather short sample period and just part of the municipalities in the sample. The current study covers not only recent periods also periods when there were very few migrants (even zero) in Finnish municipalities and it also focusses on the nationality (altogether 202) and gender distribution of the migrant population instead of total number of immigrants only. Thus, we can study the expenditure effects of nationality related heterogeneity and also eventual effects of fragmentation e.g. by using the Herfindahl index for municipality level nationality shares.

Next, we present the outline of the empirical analysis and the testable hypotheses in a more detailed way in Sect. 2. After that we introduce the estimating equation and in the same vein summarize the empirical results in Sect. 3. After going through the empirical analysis, we make some concluding remarks in the fourth section.

2 The design of empirical analysis

When we focus on the relationship between municipal expenditures and migrant population, there are, of course, many conflicting effects. One effect is just the above-mentioned “supply effect” where the willingness to provide public services may depend on the ethnic diversity of the population. Although this effect might well be true we rather view Finnish municipalities as public services providers which must fulfil different legal requirements in providing these services to all inhabitants. The costs of services (expenditure) can, however, vary from municipality to municipality due to scale of economics, availability of resources (small municipalities in northern Finland often face recruitment problems which lead to higher wage offers) and demographic structure of population, just to mention the most important factors. And here we focus on immigration as one of the key elements in municipalities’ demographics.

The problem is that we do not have micro (individual level) data of the use of different public services which would allow for directly controlling the differences between immigrants and the native population. Thus, in principle, we cannot in advance say whether eventual cost differences reflect different individual characteristics (age, health status, education, gender and so on) or just the foreign background.

There are several reasons why immigration—total immigration and specific features of immigration—could affect municipalities’ expenditures but a common denominator for these (possible) additional costs is the need for additional immigration-related public services. The most apparent reason is language at least in a country like Finland where most foreigners do not originally speak the language and the language is also considered to be difficult. In the childcare and school system, extra expenditures must be used in providing teaching in several other languages. Although the language portfolio have included “only” about ten languages in a primary school that means a lot in terms of costs. Linguistic problems also show up in the need for other interpretation and legal counseling services that also tend to increase municipalities’ administrative costs. The employment and poverty rates of people with a foreign background are also quite different from those of the native population, which causes pressure on social assistance and housing assistance. Municipalities also have an obligation to provide community housing and at least in the short-run, migration flows put pressure on community housing. In Finland, municipalities were (during the sample period) also responsible for paying and administrating social assistance, which is the basic form of income subsidy. Also, legal assistance and (during the sample period) consumer guidance are/were part of municipalities’ compulsory services. Municipalities also have responsibility for all health services, and there are considerable costs of interpretation and counselling. Indirectly this shows up in larger central government’s health-expenditure related grants to municipalities, which are made according to the share of immigrant population. These considerations give some idea of the shape of the expenditure—foreign background population relationship even though we cannot predict the exact shape or numbers. That is why we go to the empirics.

The problem is that causality does not necessarily run only from immigrant population to expenditures but possibly also in the opposite direction; municipalities with better services are obviously more attractive choices for immigrants. Because migrants (other than refugees) have thus far been able to choose rather freely their domicile, these choices could explain the positive correlation between municipalities’ expenditures and share of the population with a foreign background even though it is obvious that this kind of simultaneity problem would not be so serious as between wages and immigration.

The main practical argument against this explanation is the fact that in Finland, central government controls rather extensively the quantity and quality of public services.Footnote 3 The services which the municipality can and must provide are regulated by the Municipality Law. Moreover, the quality of services is also controlled by the central government. Hence, the quality of services ought to be basically the same in all municipalities. True, this quality control only represents some sort of minimum quality level and some room is left for “better-than-required” public services, which could provide an incentive for migrants to move to a municipality with these “better services”. We try to scrutinize this hypothesis in the empirical analysis but already casual observations suggest that the hypothesis is not well consistent with the data.

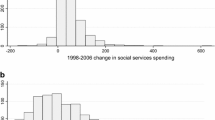

If we look at the data for municipalities expenditures, we find that the highest values are for small and poor (in terms of personal income) municipalities (Fig. 1). One would not expect that immigrants prefer these municipalities as their first choice.Footnote 4 So, based on these observed relationships, we might expect to find a negative relationship between immigration and municipality expenditures (high immigration shares in big cities with high income and low expenditure). But if the contrary is true, there must be some mechanism which turns things upside down, and that could be the extra costs which is caused by migration.

Otherwise, we try to solve the simultaneity issue in several different ways. First, we may think that the quality of public services as a determinant of immigrant flows is approximately constant over time. Hence the inclusion of fixed effects may already solve the main endogeneity concern. Similarly, we find that pattern of immigration is very persistent. Thus, in the data the coefficient of first-order autocorrelation for immigrants’ population share (denoted by fb) is 0.92. Cross-section correlation between fb values of fb for 1990 and 2018 is 0.67. Thus, the structure of immigration seems to stay rather constant over time. This pattern seems also to apply to different nationalities.

The autocorrelation coefficient for the population share of migrants coming from typical refugee countries is 0.88 for the whole data while the correlation coefficient for the respective populations shares for 1990 and 2018 is 0.65. The first-order autocorrelation coefficient for the shares of different nationalities of all immigrants (altogether 1,545,210 observations) turned out to be 0.969. These results suggest that immigrants follow a similar spatial pattern of immigration. Thus, immigrants settle down to municipalities with immigrants of the same nationality. This kind of behavior is analyzed in Klaesson and Öner (2021) which provides evidence of immigrants’ spatial distribution and its effect on employment and entrepreneurship. If indeed immigrants choose their domicile much on the basis of previous immigrants’ choices that would mean that the simultaneity problem in terms of expenditures is less severeFootnote 5.

The second alternative is to use an estimator other than the OLS. The obvious choice is the GMM (Arelano-Bond) estimator. Technically, this is straightforward, but the data are highly autocorrelated (as pointed out above) so that it is difficult to find good instruments for the foreign background population variable. Therefore, the respective estimates should rather be considered from the robustness check point of view instead of getting conclusive evidence of the migration—cost channel.

In migration studies, the so-called shift-share instrumenting is used routinely (cf. e.g. Altonji and Card 1991); see also the recent (somewhat skeptical) reviews by Ruist et al. (2017) and Jaeger et al. (2018). Thus, estimation relies on geographic variation in the concentration of immigrants to identify their impact on the labor market. National inflows of immigrants are interacted with their past geographic distribution to create an instrument to break endogeneity between labor market conditions and the location choice. In our case, we have some problems in using this approach because in the early part of the sample period, so many nationalities (altogether we have 202 with the maximum value in one municipality being 178) have zero values for most of municipalities so that we could use the instrument only on some rather broad country-aggregates (like America). We did indeed do that, but the results were almost identical to the case in which the cross-section average value of the immigration share is used as additional instrument (Eqs. 9 and 10 in Table 1).

In addition to these attempts to control the reverse causality (higher expenditures/better service quality persuade more immigrants to move to the municipality) we introduce a dummy variable which obtains the value one if there have been no foreigners in the municipality in the previous period but in the current period a nonzero number of foreigners are in the municipality. The hypothesis is that an arrival of first foreigners to the municipality requires a fixed cost investment in different facilities (interpreter, guide, social assistance counsellors and like). In a sense, the corresponding variable first gives a dif-in-dif interpretation for the corresponding set-up costs.

In studying the cost channel, we have a very simple analytical framework. On the one hand, we have municipalities’ expenditures—total expenditures and expenditures for major sub-categories (schooling and social services including health)—and, on the other hand, we have variables for the demographic structure of the population, most importantly the share of people of foreign nationality, denoted by for, or the share of people of foreign background out of total population denoted by fb.Footnote 6 We have also the number of foreign nationalities in the municipality, denoted by count and various distributional indicators like the Herfindahl index H for the population shares that we construct from the micro data. So, we just look at the relationship between expenditures (exp) and these variables, given a set of control variables and fixed effects in the panel estimation set-up. The arguments presented above suggest that the effect of (the share of) foreign population on expenditures is positive and, indeed, that seems to be the case.

3 Empirical analysis

3.1 Presentation of results

As pointed out earlier, the analysis boils down to estimating the following simple reduced form equation for expenditures from the panel data of municipalities:

where exp denotes the log of per capita real total expenditures, immig the immigration measure and X a vector of control variables which describe demographics, urbanization, size of the municipality, educational levels, domestic languages, employment and unemployment, income level and self-sufficiency of working places (the list of variables can be seen from Table 2). Index i indicates an individual municipality and t the year. The error term is denoted by eit. Alternatively, we use an error-correction specification, where the error-correction term is constructed using the static version of (1). The corresponding lagged (level) value is then added into the first-difference version of (1) so that we get both short- and long-run semi-elasticities of immig from these estimates.

The model is estimated both in levels and logs (and also in log differences) of expenditures but reporting concentrates on the log version, which allows for a semi-elasticity interpretation of the coefficient of the fb variable. In both cases, coefficient estimate c1 = 0 means that per capita expenditures do not depend on share of migrants in total population. In other words, expenditures are neutral in terms of the share of immigrant of total population.

In addition to total expenditures (exp), we consider two major subcategories of expenditures: education expenditures (edu) and social and health expenditures (soc). All these are expressed in per capita termsFootnote 7. We also estimate the same specification for the employment rate emp and for the real per capita debt.

The model is estimated with Finnish municipality panel data from 295 municipalities from the period 1987–2018. The total number of data points is 9440, but because of lags and differencing the number is somewhat smaller. The data and data sources are summarized in Table 3.

Now, let us turn to the results. As for the fixed effects, these are a conventional way of considering various difficult-to-measure variables (like production structure, income level, location, climate and so on). Unfortunately, municipality fixed effects absorb most of the cross-section variation in the data and in terms of demographic effects, the cross-section variation is of nontrivial interest. Thus, we also produce a set of estimates by not using fixed effects. In fact, this does not make much difference and the elasticity (coefficient estimate of fb) is practically the same as in the fixed effects specification. Because the Hausman test suggests that the random-effects model is not appropriate the respective results are not reported. In Table 1, we report only the coefficient estimates of the immig and exp−1 variables while a full set of coefficient estimates—including the controls—is provided in Table 2.

3.2 Commenting on the results

The results in Table 1 can be summarize quite easily: the coefficients of all three immigration variables are positive and with a few exceptions significant at conventional levels of significance. The count variable appears to have the best explanatory power, perhaps reflecting the fact that the shape of the aggregate time series comes close to that of log(fb) (see the estimate of log(fb) in column 4 in Table 1). The numeric values of the coefficients are rather robust and suggest that the short-run semi-elasticity of immigrant share fb comes close to one in the case of no control variables. With controls, the estimate is about 0.2 or 0.3. So, the estimates with and without controls represent some of sort upper and lower values for the estimated impact values. However, we have to point out that the long-run impact is much bigger because the coefficient of the lagged dependent variables is something like 0.8. Thus, the long-run semi-elasticity of immigration would be bigger than one. If we express the share of immigrant population in logs (column 4 in Table 1), we get a short-term elasticity of the magnitude of 0.005. It would mean that a doubling of the population share (say, from 1 to 2%) would increase per capita expenditures by ½%. In relative terms, the effect would obviously diminish, so if we go from, say 10 per cent to 20%, the percentage effect would be the same.

We did also estimate the (1) so that both expenditures and immigrant shares were expressed as relative values (relative to the mean values over all municipalities, cf. column 14 in Table 1). In this case, the coefficient of fb turned out to be 0.4. That is a bit more than in the unscaled case.

As pointed out earlier, fixed effects could also be considered from the point of view of endogeneity due to high persistence of municipalities’ service level. Thus, if we assume that the fixed effects take into account possible attractive features in municipality services, we could indeed interpret the effects of fb rather as immigration related cost-push elements. From this point of view, it is interesting that in qualitative (even if not in quantitative) terms the estimation results in terms of the fb variable do not change even if we do, or do not introduce the fixed effects.

This conclusion even applies to GMM results that are reported in Table 1. With the estimating (1), we experiment rather extensively with different sets of instruments even though it appears that the choice of a specific set of instruments would not crucially affect the results. In fact, the GMM results come quite close to the OLS result, which suggests that simultaneity bias is not a dominating feature in the data. The only difference in terms of OLS results is the coefficient of the lagged expenditure variable which is much lower when we use the specification of differenced data (column 9 in Table 1). This is very much the same as with OLS estimates with differenced data, see column 11. However, if we use orthogonal deviations of the data with the GMM estimator (column 10 in Table 1) the estimates are almost indistinguishable from OLS estimates. Also, the use of GLS as the estimator produces estimates that are practically the same as obtained with OLS and GMM (cf. columns 5–7 in Table 1).Footnote 8

Moreover, we find that the coefficient of the first variable, which indicates an arrival of first foreigners to the municipality, is positive and statistically significant (see Table 4, column 3). Thus, there appears to be some set-up costs in arranging services for newly arrived migrants. The coefficient of the first dummy suggests that the cost of total effect could be something like 1.5 per cent. Of course, we must keep in mind that the municipalities which in the first place had no foreign population are small remote are non-urban municipalities which are not highly representative from the point of view of all Finnish municipalities. Although the coefficient of first was significant, the coefficients of additional ∆fb (or ∆for or ∆count) terms were not significant (although positive) for the whole estimation period suggesting that the newly arrived immigrants do not in general increase expenditures significantly more than the earlier arrived immigrants (see Table 4, columns 1 & 2).

As pointed out earlier, the coefficients of fb, for and count appear to be robust with respect to sample periods and controls. An interesting question is whether these estimates are robust in terms of net flows of immigrants and non-immigrants to the municipality. Adding these variables (and also cross-terms with the migrant share variable) to the basic equation showed, however, that these terms were far from significant (see the first column of Table 4). The only additional term, which is significant is the change rate of population. Then the set of estimates for fb and ∆pop turned out to be: 0.304 and −0.664 (see column 1 in Table 2). In other words, population growth in the municipality shows up, at least in the short run, as a decrease in per capita expenditures. Thus, movers come first and then the services. Correlation between net change of municipalities’ foreign and domestic population is positive (0.51), which suggests that there has not been any significant “white flight” from municipalities with high migration densities, and that has not a reason for the observed pattern of municipalities’ expenditures.

As pointed out earlier, we have the following variables in addition to fb, for and count to take into account the distributional properties of the migrants: the standard deviation of the share of foreign nationals in the municipality denoted by sd, the Herfindahl index for the concentration of different nationalities in the municipality H, the mean value of the gender shares of immigrants (gender) and the standard deviation of this number (sd_geneder). The latter do not really contribute to the explanatory power of the equation and also the results for the Herfindahl indexes are somewhat puzzling. If we think that there are some nationality specific costs the coefficient sign of H should be negative. If we considered the results from the point of view of Alesina et al. (1999) fragmentation hypothesis, we would also expect the coefficient sign of H and sd to be negative.Footnote 9 The estimated coefficients are typically not significant and sensitive to the estimation setting (see Table 2, columns 4 & 5). It is only if we drop the immigration share indicator count from the estimating equation, the coefficient of the Herfindahl index for all nationalities (Ha) becomes negative and significant, but that only applies to case of no fixed effects. Basically, the same result emerges if we consider dispersion measures in terms of the growth of the nationality share ∆mi/m or ∆mi/POP, where mi denotes the number of immigrants of nationality i and m the total number of immigrants. For space reasons, these results are not reported here.

3.3 Role of control variables

The coefficients of other control variables seem to follow similar patterns for different estimated equations. To save space, we just show a few sets of estimates in Table 2, which includes all control variables. Next, we consider the results of each control variable one by one:

-

emp, which is the employment rate has always a significant and positive coefficient which probably reflects employment’s positive contribution of municipalities’ income (and less need for social assistance).

-

un, the unemployment rate has an opposite sort of effect on expenditures.

-

urban, the share of urban population in the municipality has typically a positive coefficient, which probably reflects higher income level and higher municipalities tax revenue plus lower transportation costs

-

sw, the share of Swedish speaking population has a persistently positive and significant coefficients presumably reflecting higher expenditures due to higher language related costs.

-

s15, the share of children out of total population has a systematically positive and significant coefficient due to higher schooling and child-care costs.

-

s64, which indicates the share of people aged 15 to 64 has also a positive coefficient probably reflecting higher tax base and higher municipality revenues.

-

high and school are the indicators of the educational level of the municipality population. If both are included, only school, which indicates the share of people having at lease secondary level of education, is significant and signed positively. The reason must be in the schooling-income link which in turn shows up in higher municipality tax revenues.

-

pop, is the log of total population in the municipality. It has always a negative and significant coefficient (see also Fig. 2) which reflects the scale of economies of the municipality.

-

own, which is the share of own workplaces (self-sufficiency) in the municipality, has a negative coefficient, which may reflect cases where “wealthy” municipalities surround big cities, which have lot of workplaces but not so much tax-payers.

-

pension, indicates the share of pensioners in the municipality, which obviously affect positively the need for different old-age services.

-

r_main, the higher is the maintenance ratio, the bigger is he cost pressure, and indeed the coefficient estimates reflect that presumption (although with fixed municipality effects, the coefficient is no more significant).

-

Dum is a dummy for 1995 when a major change in (all) municipalities’ bookkeeping practices took place. As expected, the change shows up in higher reported expenditures, but estimates for 1997–2018 make no difference with other coefficients (Table 2, Eq. 2).

-

we also have data for the mean per capita income level Y in the municipality but the data only cover the period 2005–2017. Somewhat surprisingly, with the data, personal income and municipality expenditures are negatively correlated reflecting probably the role of the central government subsidies. In Finland, we have municipalities in which tax revenues cover only a bit over 20% expenditures. This probably explains why the income variable (i.e. the tax base) is not instrumental in estimation. In the estimating equations (with the above-mentioned short sample period), it anyway works in a priori correct way increasing municipalities’ expenditures.

3.4 Robustness checks

Stability tests indicate that the results are robust, as also the comparison of columns 1 and 2 in Table 2 indicate. By contrast, differences were found between specific nationalities. Following previous literature (e.g. Gerdes 2011) we made a distinction between refugee and non-refugee nationalities and found some important differences. When the immigrants’ population share variable fb was split into two parts, namely to refugee country nationals’ population share fbr and to the non-refugee country nationals’ share, the coefficient of the former was considerably higher (roughly three times higher) than the latter in OLS estimation. The same result emerged when we introduced a third category, immigrants from Europe fbe (Table 4, columns 4 & 5) even though the difference vanished when fixed municipality effects were introduced. One possible reason could be the administrative arrangements in refugees’ initial settlement.

As mentioned above, we also estimated (1) in terms of the employment ratio and the (log per capita real) municipality debt. As can be seen from the Table 5, columns 1 and 2, the negative effect of immigration on the employment ratio is quite significant. That is something we may expect because of rather low aggregate employment numbers for immigrants. The short run elasticity is something like 0.1 which suggests that an increase of the immigrant share from 10 per cent to 20 per cent would lower the overall employment rate by 1 per cent. The long run effect would be much bigger; in this case close to 5 per cent.

As for the debt effect, the elasticity is 0.03 (column 3 in Table 5), which is quite a lot. Thus, a doubling of the immigrant share would increase the real debt stock by 3 per cent in the short run and 9 per cent in long run if we take the partial adjustment mechanism in (1) at the face value. With employment and debt, the effects cannot really be explained by the simultaneity effects. Thus, one might not expect that immigrants would settle down in municipalities with a low employment ratio and with a lot of debt. So, it is more reasonable to assume that causality runs from immigration to economic indicators of municipalities than vice versa.

4 Concluding remarks

Our results indicate that Finnish municipalities’ expenditures are not cost neutral in terms of immigration. More precisely, the per capita costs in providing public services increase along with migration in a quite substantial manner and thus assumption that immigrants and nonimmigrants use the same amount of public services is not warranted. Of course, there might be differences also in the menu of services and in the respective unit costs, which we cannot control. The data also suggest that there are important differences in the cost effects between countries of origin. Surely, this must be considered when designing migration policies. This observation also suggests that highly aggregative (National Accounts’ level) studies of fiscal effects of migration may miss a point in neglecting some important grass-roots elements of costs at the local level where most public services are produced. Our results also show that immigration has an adverse effect on employment which partly explains why migration tends to push up total municipality expenditures.

Notes

With municipalities’ service production we cannot distinguish between the quality and quantity and hence we only speak of expenditures in the rest of the paper. The quality issue is, however, discussed in Chap. 2.

For instance, The migration observatory (2019) states. “Another key limitation is that the studies depend on assumptions about how migrants use public services. Most studies simply estimate the share of the population represented by migrants and assume that they account for the same share of consumption of public services as people with similar demographic characteristics (e.g. age and gender). Yet migrants have different characteristics from UK-born individuals and as such may use public services differently. For instance, migrants may use services such as translation services in schools and hospitals that are not typically used by the native-born population. One difficulty in addressing this point is that there is no systematic collection of the user’s migration status at the point of delivery of many public services”.

Fulfilling the criteria for central government assistance a prerequisite for central government’s financial assistance to municipalities; on average roughly one third of municipalities expenditures are covered with government subsidies but in some cases the share comes close to three fourth. Obviously, these subsidies decrease the effective cost of additional expenditures creating an incentive to expand services.

Immigrants (other than refugees) probably choose municipalities with highest income, lowest unemployment, best social services, largest foreign population, urban environment and so on (see e.g. Hanson and McIntosh 2016).

We found also that e.g. the change of the number of refugees in a municipality depends heavily on the lagged stock of all immigrants and all refugees but not on total population: ∆ref = 13.06* + 0.017*m−1 + 0.014*ref−1 − 0.001*Pop−1 + 0.001exp, R2 = 0.90, where ref denotes the number refugees, m the number of immigrants and * significant values at the 5 per cent level of significance.. This feature applies also to different nationalities denoted by mi. Thus we can obtain the following results: ∆mi/pop = 0.001* + 0.038∆mi,−1/pop−1 + 0.029*mi,−1/POP−1, R2 = 0.032 and ∆mi/m = 0.022* − 0.029∆mi,−1/mi,−1 + 0.008*mi,−1/m−1, R2 = 0.002, where mi denotes immigrants of nationality i and m all immigrants. Thus, migrants of nationality i tend migrate to a municipality where the same nationality migrants already live.

According to statistics Finland, people of foreign background are people that have born in foreign countries, their children (if both of the parents, or the only known parent, have born in foreign countries) and also people that have born in Finland prior to 1970 and who speak foreign languages (not Finnish or Swedish). For details, see stat.fi.

All costs are so-called net costs that is, costs of producing services net of services sold and bought to/from other municipalities. The municipality classification corresponds to year 2018, values for municipalities that have ceased to exist (due to consolidation of municipalities) prior to 2018 have been calculated in Statistics Finland using a weighted average method.

In GMM estimation, we use the Arelano-Bond dynamic instruments procedure with lagged values with the (unweighted) average cross-section value of fb as an additional instrument. Notice that when we use the “partial adjustment type specification” such as in most equations in Table 1, the long-run values of the coefficients are roughly three times bigger than the short-run values.

Notice that the Herfindahl index is related to the standard deviation in the following way: H = n*SD2 + 1/n. When we compute the Herfindahl index for all nationals, we face the problem that because fb is so low, H is very close to (1 − fb)2 ≈ 1.

References

Alden L, Hammarstedt M (2016) Flyktinginvandring Sysselsättning, förvärvsinkomster och offentliga finanser. Rapport till Finanspolitiska rådet. Stockholm 2016/1. http://www.finanspolitiskaradet.se/download/18.21a8337f154abc1a5dd2876a/1463335875126/Underlagsrapport+2016+1+Ald%C3%A9n+och+Hammarstedt.pdf. Accessed 04.02.2017

Alesina A, Easterly W, Baqir R (1999) Public Goods And Ethnic Divisions. Q J Econ 114(4):1243–1284

Alesina A, Miano A, Stantcheva S (2018) Immigration and redistribution. Working Paper 24733. https://www.nber.org/papers/w24733. Accessed 12.22.2018

Alesina A, Murard E, Rapoport H (2019) Immigration and Preferences for Redistribution in Europe, NBER Working Paper 25562. https://www.nber.org/papers/w25562. Accessed 03.02.2019

Altonji J, Card D (1991) The effects of immigration on the labor market outcomes of less-skilled natives. In: Immigration, trade and the labor market, NBER chapters. National Bureau of Economic Research, pp 201–234

Dahlberg M, Edmark K, Lundqvist H (2012) Ethnic diversity and preferences for redistribution. J Polit Econ 120:41–76

Gaston N, Rajaguru G (2013) International migration and the welfare system revisited. Eur J Polit Econ 29:90–101

Gerdes C (2011) The impact of immigration on the size of government: empirical evidence from Danish municipalities. Scand J of Economics 113(1):74–79

Hanson G, McIntosh C (2016) Is the Mediterranean the New Rio Grande? US and EU Immigration Pressures in the Long Run. J Econ Perspect 30(4):57–83

Holmøy E, Strøm B (2012) Makroøkonomi og offentlige finanser i ulike scenarier for innvandring (Macroeconomics and Government Finances in Different Immigration Scenarios). Report No. 15/2012. Statistics

Jaeger D, Ruist JJ, Stuhler J (2018) “Shift-Share Instruments and the Impact of Immigration,” NBER Working Papers 24285. https://ideas.repec.org/p/nbr/nberwo/24285.html. Accessed 11.19.2021

Jofre-Monseny J, Sorribas-Navarro P, Vázquez-Grenn J (2016) Immigration and local spending in social services: evidence from a massive immigration wave. Int Tax Public Finance 23:1004–1029

Klaesson J, Öner Ö (2021) Ethnic enclaves and segregation—self-employment and employment patterns among forced migrants. Small Bus Econ 56:985–1006. https://doi.org/10.1007/s11187-019-00313-y

Liebig T, Mo J (2013) The fiscal impact of immigration in OECD countries; Chapter 3. In: OECD (ed) International Migration Outlook 2013

Mäkelä E, Viren M (2018) Migration effects on municipalities’ expenditures. Review of Economics 69, 59–86. https://www.degruyter.com/view/j/roe.2018.69.issue-1/roe-2017-0025/roe-2017-0025.xml. Accessed 02.03.2002

Migration observatory (2019) The Fiscal Impact of Immigration in the UK. https://migrationobservatory.ox.ac.uk/resources/briefings/the-fiscal-impact-of-immigration-in-the-uk/. Accessed 02.11.2020

Razin A, Sadka E, Swagel P (2002) Tax burden and migration: A political economy theory and evidence. J Public Econ 85:167–190

Ruist J, Stuhler J, Jaeger D (2017) Shift-share instruments and the impact of immigration. http://cep.lse.ac.uk/seminarpapers/17-03-17-STU.pdf (Unpublished mimeo). Accessed 08.11.2018

Speciale B (2012) Does immigration affect public education expenditures? Quasi-experimental evidence. J Public Econ 96:773–783

Stichnoth H, Van der Straeten K (2013) Ethnic diversity, public spending, and individual support for the welfare state: a review of the empirical literature. J Economic Surveys 27:364–389

Acknowledgements

Useful comments from Sami Oinonen as well as from the editor and anonymous referees are gratefully acknowledged.

Funding

Open Access funding provided by University of Turku (UTU) including Turku University Central Hospital.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Viren, M. The fiscal consequences of immigration: a study of local governments’ expenditures. Rev Reg Res 42, 75–94 (2022). https://doi.org/10.1007/s10037-022-00168-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10037-022-00168-z