Abstract

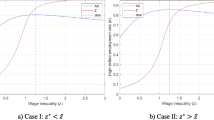

This paper investigates the transitional dynamics of a basic Schumpeterian growth model under constant relative risk aversion. In this model, there are three patterns governing the evolution of wage inequality, but only if the intertemporal elasticity of substitution in consumption is sufficiently low: (a) skill-biased technological change, i.e., technological progress leads to a widening of wage inequality; (b) unskill-biased technological change, i.e., technological progress leads to a contraction of wage inequality; and (c) unbiased technological change, i.e., technological progress is independent of wage inequality. By conducting comparative dynamics of an unexpected permanent increase in research productivity in any sector, which we interpret as the arrival of new general purpose technologies, we show that the property of technological change shifts entirely from unskill-biased to skill-biased. The evolution of wage inequality in the model is then consistent with the shift in the trend in wage inequality beginning in the 1970s in the US economy.

Similar content being viewed by others

Notes

Bresnahan and Trajtenberg (1995) define GPTs as displaying three features: (i) pervasiveness (they spread to most sectors), (ii) improvement (they make improvements over time), and (iii) innovation spanning (they make it easier to invent new products and processes). Well-known examples include the steam engine, electricity, and IT. As in Boucekkine and de la Croix (2003), Howitt (1998), and Mattalia (2013), we treat the arrival of new GPTs as an increase in the research productivity of any sector because it captures at least two of these essential features, i.e., pervasiveness and innovation spanning.

According to Aghion (2002), the increase in the supply of skilled labor in the US during the 1920s was because of the high school movement (the period from 1910 to 1940 when secondary schools expanded across the US). However, this did not result in an increase in wage inequality. Hence, if we rely on the supply of skilled (or unskilled) labor to explain the evolution of wage inequality, we may fail to explain these developments over a longer period. However, note that according to Fang et al. (2008), we can explain the decline in wage inequality during these periods using the larger technology spillovers from skilled to unskilled labor, as in the Acemoglu (1998), Acemoglu (2002) economy. This is because if the spillover effect dominates the effect of skill-biased technological change, wage inequality contracts to its steady state level, despite the increase in the supply of skilled labor.

Later we assume that the evolution of frontier technology \(A_t^{max} \) is governed by a spillover effect produced by R&D activity. Even though \(A_t^{max} \) continuously increases over time, at least one intermediate good producer will attain frontier technology through R&D activity at any date. This is because innovations are continuously arriving somewhere in the economy.

We can ensure Arrow (1962) replacement effect is present in this model. Thus, the vintage technology remains constant, given the monopolist does not have an incentive to undertake innovation.

Nelson and Phelps (1966) consider that the increment in technology in practice equals educational attainment times the gap between the theoretical technology and the technology in practice

$$\begin{aligned} \dot{A}_{t} = {\Phi }\left( h \right) \left( {T_{t} - A_{t}} \right) , \end{aligned}$$where \(h\) is the stock of human capital and \(T_t \) is the theoretical level of technology at date \(t\). This specification of human capital is empirically supported by Benhabib and Spiegel (1994).

Chen and Chu (2010) investigate the Grossman and Helpman (1991) model with a nonlinear R&D spillover effect and find multiple steady states and indeterminacy. Similarly, the present model imposed on nonlinear spillovers may produce analogical results. However, we eliminate this case in order to focus on the basic results arising from the more usual assumption.

According to the specification of the productivity of the spillover effect \(\sigma _t \) in Caballero and Jaffe (1993), \(\sigma _t \) converges to a positive constant as the speed of the diffusion of technology goes to infinity. Moreover, Caballero and Jaffe (1993) find that the speed of diffusion is sufficiently fast in the real economy. Thus, we can justify a positive constant spillover coefficient \(\sigma \).

If an economy chooses an initial value of \(\omega _{{s,0}}\) below the saddle path, the paths of \(\left\{ {\omega _{s,t} , a_t } \right\} _{t=0}^\infty \) converge to the wage condition \({{\underline{\omega }}}_{s,t} =( {1-\beta })^2( {U/S})^\beta a_t^\beta .\) Hence, there exists a continuum of steady states on \({{\underline{\omega }}_{s,t}}\). In such steady states, the manufacturing sector uses all skilled labor and the economy does not attain sustained growth because of zero R&D.

Later we assume \(( {\theta -1})\beta -1-\sigma >0\). This is a necessary condition for the existence of three patterns of wage inequality.

In this paper, we do not consider the structure of GPTs. Instead, we focus on two aspects of a new GPT, namely, pervasiveness and spawning. See, for example, Helpman and Trajtenberg (1998) for modeling on how GPTs diffuse and affect the entire economy.

Note that the assumption \(( {\theta -1})\beta -1-\sigma >0\) can be satisfied if intertemporal elasticity of substitution is sufficiently low. For example, in the case of log preference (\(\theta =1)\), it violates the assumption.

References

Acemoglu D (1998) Why do new technologies complement skills? Directed technical change and wage inequality. Q J Econ 113(4):1055–1089

Acemoglu D (2002) Directed technological change. Rev Econ Stud 69(4):781–809

Acemoglu D, Aghion P, Zilibotti F (2006) Distance to frontier, selection, and economic growth. J Eur Econ Assoc 4(1):37–74

Aghion P (2002) Schumpeterian growth theory and the dynamics of income inequality. Econometrica 70(3):855–882

Aghion P, Howitt P (1992) A model of growth thorough creative destruction. Econometrica 60(2):323–351

Aghion P, Howitt P (1998) Endogenous growth theory. MIT Press, Cambridge

Aghion P, Howitt P (2009) The economics of growth. MIT Press, Cambridge

Aghion P, Howitt P, Violante GL (2002) General purpose technology and wage inequality. J Econ Growth 7(4):315–345

Arrow KJ (1962) Economic welfare and the allocation of resources for invention. In: Nelson RR (ed) The rate and direction of inventive activity: economic and social factors. Princeton University Press, Princeton, pp 609–626

Autor DH, Katz LF, Kearney MS (2008) Trends in U.S. wage inequality: revising the revisionists. Rev Econ Stat 90(2):300–323

Benhabib J, Spiegel M (1994) The role of human capital in economic development: evidence from aggregate cross-country data. J Monet Econ 34(2):143–173

Boucekkine R, de la Croix D (2003) Information technologies, embodiment and growth. J Econ Dyn Control 27(11–12):2007–2034

Bresnahan TF, Trajtenberg M (1995) General purpose technologies ‘engines of growth’? J Economet 65(1):83–108

Caballero RJ, Jaffe AB (1993) How high are the giants’ shoulders: an empirical assessment of knowledge spillovers and creative destruction in a model of economic growth. In: Blanchard OJ, Fischer S (eds) NBER macroeconomics annual 1993. MIT Press, Cambridge, pp 15–74

Chen BL, Chu AC (2010) On R&D spillovers, multiple equilibria and indeterminacy. J Econ 100(3):247–263

Cozzi G (2005) Animal spirits and the composition of innovation. Eur Econ Rev 49(3):627–637

Cozzi G, Spinesi L (2006) Intellectual appropriability, product differentiation, and growth. Macroecon Dyn 10(1):39–55

Galor O, Moav O (2000) Ability-biased technological transition, wage inequality, and economic growth. Q J Econ 115(2):469–497

Grossman GM, Helpman E (1991) Quality ladders in the theory of growth. Rev Econ Stud 58(1):43–61

Guvenen F (2006) Reconciling conflicting evidence on the elasticity of intertemporal substitution: a macroeconomic perspective. J Monet Econ 53(7):1451–1472

Fang C, Huang L, Wang M (2008) Technology spillover and wage inequality. Econ Model 25(1):137–147

Helpman E, Trajtenberg M (1998) A time to sow and a time to reap: growth based on general purpose technologies. In: Helpman E (ed) General purpose technologies and economic growth. MIT Press, Cambridge, pp 55–83

Howitt P (1998) Measurement, obsolescence, and general purpose technologies. In: Helpman E (ed) General purpose technologies and economic growth. MIT Press, Cambridge, pp 219–251

Howitt P (1999) Steady endogenous growth with population and R&D inputs growing. J Polit Econ 107(4):715–730

Howitt P (2000) Endogenous growth and cross-country income differences. Am Econ Rev 90(4):829–846

Howitt P, Mayer-Foulkes D (2005) R&D, implementation, and stagnation: a Schumpeterian theory of convergence clubs. J Money Credit Bank 37(1):147–177

Howitt P, Aghion P (1998) Capital accumulation and innovation as complementary factors in long-run growth. J Econ Growth 3(2):111–130

Jacobs B, Nahuis R (2002) A general purpose technology explains the Solow paradox and wage inequality. Econ Lett 74(2):243–250

Jones CI (1995) R&D-based models of economic growth. J Polit Econ 103(4):759–784

Jovanovic B, Rousseau PL (2005) General purpose technologies. In: Aghion P, Durlauf S (eds) Handbook of economic growth. Elsevier North Holland, Amsterdam, pp 1181–1224

Machin S, Van Reenen J (1998) Technology and changes in skill structure: evidence from seven OECD countries. Q J Econ 113(4):1215–1244

Mattalia C (2013) Embodied technological change and technological revolution: which sectors matter? J Macroecon 37:249–264

Minniti A (2010) Product market competition. R&D composition and growth. Econ Model 27(1):417–421

Nahuis R (2004) Learning for innovation and the skill premium. J Econ 83(2):151–179

Nahuis R, Smulders S (2002) The skill premium, technological change and appropriability. J Econ Growth 7(2):137–156

Nelson R, Phelps E (1966) Investment in humans, technological diffusion, and economic growth. Am Econ Rev 56(1/2):69–75

Segerstrom P (2000) The long-run growth effects of R&D subsidies. J Econ Growth 5(3):277–305

Van Reenen J (2011) Wage inequality, technology and trade: 21st century evidence. Labour Econ 18(6):730–741

Vandenbussche J, Aghion P, Meghir C (2006) Growth, distance to frontier and composition of human capital. J Econ Growth 11(2):92–127

Wälde K (1999) A model of creative destruction with undiversifiable risk and optimizing households. Econ J 109(454):156–171

Zeng J (2003) Reexamining the interaction between innovation and capital accumulation. J Macroecon 25(4):541–560

Zeng J, Zhang J (2002) Long-run growth effects of taxation in a non-scale growth model with innovation. Econ Lett 75(3):391–403

Acknowledgments

I am grateful to two anonymous referees for their constructive comments and suggestions on an earlier version of this paper and the encouragement of the editor-in-chief (Giacomo Corneo) in submitting a revision. I especially thank Tatsuro Iwaisako and Yoichi Gokan for their useful comments and encouragement. This research was partly supported by a Grant for Excellent Graduate Schools, from the Japanese Ministry of Education, Culture, Sports, Science, and Technology (MEXT). Of course, all remaining errors are mine.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

This appendix derives Eq. (22). According to Eqs. (10) and (12), we obtain

Substituting Eq. (16) into (31), yields

Next, we derive the required return on assets on an equilibrium path. According to Eqs. (16), (19), and (20), the growth rate of consumption satisfies

Solving Eq. (33) with respect to \(r_t \), yields

Substituting Eq. (34) into (32), we obtain

Finally, substituting Eq. (17) into (35), we obtain Eq. (22).

Appendix B

This appendix shows that the steady state \(( {\omega _s^*,a^*})\) satisfies the transversality condition (21). Following Aghion and Howitt (1998, Ch. 3) and Howitt (1999), we can derive the long-run distribution function of relative productivity parameters \(a_{it} \equiv A_{it} /A_t^{max} \)

In the steady state \(( {\omega _s^*,a^*})\), the expected present value of future profits to be earned by an incumbent whose technology is of vintage \(\tau \le t\) can be expressed as

where superscript “\({*}\)” denotes the steady-state value. According to Eq. (8), we can rewrite Eq. (37) as

Note that \(\tilde{\pi }_t^*\) represents the steady-state value of Eq. (7). According to Eqs. (36) and (38), total assets can be written as

where \(f( a)\equiv F^{'}( a)=( {1/\sigma })a^{( {1-\sigma })/\sigma }\) represents the density function, and each asset \(\tilde{V}_t^*( a)\) is given by

Solving Eq. (39), we obtain

This equation also represents the average asset value as intermediate firms are distributed as \(i\in \left[ {0,1} \right] \). The growth rate of term \(e^{-\rho t}C_t^{-\theta } ({Total Assets})_t \) in the steady state \(( {\omega _s^*,a^*})\) obtains

Thus, the steady state \(( {\omega _s^*,a^*})\) satisfies the transversality condition.

Appendix C

This appendix considers the log-linearization of differential Eqs. (17) and (22). Log-linearizing around the steady state \(( {\omega _s^*,a^*})\) obtains

with a Jacobian matrix

where each \(\text{ J }_k \) for \(k=1,2,3, \text{ and } 4\) is given by

Note that superscript “\({*}\)” denotes the steady-state value. Computing the eigenvalues, denoted by \(\varepsilon _1 \) and \(\varepsilon _2 \), we obtain

Hence, the steady state \(( {\omega _s^*,a^*})\) is a saddle point. Using the stable eigenvalue, we obtain the differential equation

According to Eqs. (40) and (41), we obtain the relationship \(\omega _{s,t} \) and \(a_t \) on the saddle path

where \(\Psi =\left[ {\text{ J }_2 /( {\varepsilon _2 -\text{ J }_1 })} \right] >0\). Thus, the saddle path is an upward-sloping curve. Additionally, differentiating Eq. (42) with respect to time, we obtain

Appendix D

In this Appendix, we derive the inequality (27) via a proof by contradiction. Suppose that

Hence, we have

Rewriting Eq. (43), yields

Moving the first term on the right-hand side of Eq. (44) to the left-hand side, and subtracting the term \(( {1-\beta })\left[ {1+\theta \left( {\frac{1-\beta }{\beta }}\right) } \right] ^{-1}\left[ {1+\sigma ( {1-\beta +\theta \beta })} \right] \lambda s_m^*\) from both sides, yields

Using the fact that \(\phi ^*=\lambda ( {S-s_m^*})\), and multiplying \(\left[ {1+\theta ( {\frac{1-\beta }{\beta }})} \right] \) from both sides, yields

This is a contradiction, because the left-hand side of Eq. () has a negative value, while the right-hand side has a positive value. Hence, we obtain the result \(\Psi <\beta /( {1-\beta })\).

Rights and permissions

About this article

Cite this article

Kishi, K. Dynamic analysis of wage inequality and creative destruction. J Econ 115, 1–23 (2015). https://doi.org/10.1007/s00712-014-0403-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-014-0403-7

Keywords

- Endogenous growth

- Innovation

- Creative destruction

- Wage inequality

- Factor-biased technological change

- General purpose technologies