Abstract

This paper extends the analysis of duopoly market by distinguishing two types of competition: (i) the basic form of competition where each firm is unrestricted in its choice of price and quantity and (ii) the non-basic form of competition where firms’ strategic choices over price and quantity are limited a priori. Our analysis focuses on the former rather than the latter. Under a very general setting of concave industrial revenue and asymmetric convex costs, we show that each firm typically makes more profit in the subgame perfect Nash equilibrium (SPNE) of the leader-follower price-quantity competition, one of the basic competition forms, than in the SPNE of the leader-follower price competition and that each firm always makes more profit under simultaneous move price-quantity competition than under simultaneous move price competition. We establish a generalized framework for endogenous timing in duopoly games which is capable of embodying and overcoming the inconsistency across the existing three frameworks in the field. We highlight the advantages of a 3-period general framework.

Similar content being viewed by others

Notes

Choosing price and quantity at the same stage is interpreted in the context of game equivalence. For example, firm 2 in the following 4-stage game can be regarded as choosing price and quantity at the same stage, thus reducing the game into a 3-stage game. The 4-stage game is: at stage 1, firm 1 decides its output; at stage 2, firm 2 names its price; at stage 3, firm 2 chooses its output; at stage 4, firm 1 names its price.

Gertner (1986) proves this under the condition of symmetric costs.

Formally speaking, the firm \(i\)’s threshold curve \(q = \tau _{i}(p)\) is determined in the following way. Assume firm \(i\) takes strategy (\(p,\,q)\). Firm \(k\)’s best respond is either to monopolize the residual demand by naming a price greater than \(p\) if \(q \le \tau _{i}(p)\) or to name a price slightly less than \(p\) and choose an output which equal to the minimum of the industrial demand and the output at which firm \(k\)’s marginal cost equals its price if \(q > \tau _{i}(p)\). On the threshold curve output is strictly decreasing with price. Key features of the threshold curve will be presented in Sect. 3.

The property of the threshold price is as follows. When the leader’s price is below the threshold, the best response of the follower is to monopolize the residual market. If the leader chooses a price above the threshold, the follower will match that price. If the leader’s price is equal to the threshold price then the follower will be indifferent between matching the price and quoting a higher price and monopolizing the residual demand (Dastidar and Furth 2005).

Similar to Cournot competition, Stakelberg game is equivalent to the following game: at stage 1, the leader firm chooses its output; at stage 2, the follower firm chooses its output; at stage 3, both firms cite the competitive price announced by a Walrasian auctioneer. Stackelberg game is not a basic competition form because both firms are restricted to citing the Walrasian price.

Hirata and Matsumura (2011) and Proposition 3 of this paper show that the leader firm always names its threshold price in the circumstance of endogenous price leadership.

For example, consider that both firms take the price strategy. Deneckere and Kovenock (1992) show that under capacity constraints, the leadership by the firm with greater capacity than the other is payoff-dominant. In contrast, under the HS framework, the leadership by the firm with smaller capacity than the other becomes pay-off dominant. Moreover neither of the above dominant outcomes is the outcome of Robson’s framework. Hirata and Matsumura (2011) extend the above DK result to a more general setting. However they show that the HS framework may still yield a dominant but seemingly unreasonable outcome that the firm with lower threshold price than the other acts as the leader.

This \(T\)-period framework for endogenous timing is also capable of making the choice of basic competition forms endogenous owing to that the difference across basic competition forms lies in the timing (cf. Sect. 1.1) and that the two firms are allowed to choose their prices and outputs in \(T\) periods. This framework can address the famous Cournot-Bertrand debate: Should the two firms engage in price or quantity competition? The outcomes of the KS game and Bertrand competition can emerge at the diagonal of several different 2 \(\times \) 2 payoff submatrices of the reduced 4-period framework. Qin and Stuart (1997) propose a game with 2 \(\times \) 2 payoff matrix to make the outcomes of Cournot competition and Bertrand competition on its diagonal. In their setting, the mythical Walrasian auctioneer is still present.

With the set \(\{t|t=\ldots -2, -1, 0, 1, 2, \ldots \}\), a firm can always act as the leader or as the follower whatever time the rival chooses in the set. However, the corresponding framework typically does not have an SPNE.

Intuitively speaking, that \(c(t)\) strictly decreases with \(t\) in (\(-\infty \), 0] reflects the fact that being the follower reaps extra profit in comparison with being the leader because the follower position is scarce in this framework. Analytically speaking, if \(c(t)\) strictly increases with \(t\), the (\(-\infty , l, c(t))\) framework either does not have an SPNE or have a unique outcome in which both firms move simultaneously and thus is not a framework for endogenous timing.

In a symmetry to note 10, if \(c(t)\) strictly decreases with time \(t\), the (\(+\infty , l, c(t))\) framework either does not have an SPNE or have a unique SPNE in which both firms move simultaneously.

Let \(P(Q)\) be the inverse total demand. We affirm that given firm \(k\)’s output \(q_{k}\), firm \(i\)’s revenue \(P( {q_i +q_k })q_i \) is concave in \(q_{i}\) or equivalently \(P^{\prime \prime } ({q_i +q_k })\;q_i +2P^{\prime } ( {q_i +q_k })\) is less than 0. Note that \(P^{\prime } <0\). We simply need to show that our affirmation holds if \(P^{\prime \prime }>0\). In fact, \(P^{\prime \prime }( {q_i +q_k })\;q_i +2P^\prime ( {q_i +q_k })<P^{\prime \prime }( {q_i +q_k })\;( {q_i +q_k })+2P^\prime ( {q_i +q_k })=\, \text{ marginal } \text{ industrial }\text{- }\text{ revenue } < 0_{.}\)

See footnote 4.

See footnote 5.

This result was first proved by Gertner (1986).

Under Assumption 1, in the same way as in Hirata and Matsumura (2011), one can show that the MSNE of Bertrand competition exists and that firm \(i\)’s expected profit in the MSNE is less than \(\pi _i^*( {Max\{ {p_1^{tp}, p_2^{tp} } \}})\).

If \(T = +\infty \), then all (\(T-\)1, \(T-\)1) pairs should be neglected in Theorem 4.

If \(T = -\infty \), then all (\(T\)+1, \(T\)+1) pairs should be neglected in Theorem 5.

With the help of the threshold curve, one can extend the result of Dastidar and Furth (2005) to the circumstance of Assumption 1 that the price leader may name either its threshold price or a price greater than its threshold price in the SPNE, and correspondingly the follower names a price greater than the leader’s or slightly less the leader’s.

If both firms take price strategies, then the outcome of the framework for endogenous timing is that both firms engage in a leader-follower price competition with the leader naming its threshold price and choosing the output at which its threshold price equals marginal cost (Hirata and Matsumura 2011 and Proposition 3 of this paper). This paper further proves that the leader firm’s threshold curve can be considered as its own demand curve (Theorem 1). Consequently the price-quantity leader makes decision like a monopolist, and the price leader makes decision like a competitive firm because its threshold price is determined by the intersection of its threshold curve (demand curve) and marginal cost.

References

Dastidar KG (2004) On Stackelberg games in a homogeneous product market. Eur Econ Rev 48:549–562

Dastidar KG, Furth D (2005) Endogenous price leadership in a duopoly: equal products, unequal technology. Int J Econ Theory 1:189–210

Deneckere R, Kovenock D (1992) Price leadership. Rev Econ Stud 59(1):143–162

Gertner RH (1986) Simultaneous move price-quantity games and equilibrium without market clearing. Essay two, Essays in Theoretical Industrial Organization, Doctoral Dissertation, MIT. Available at http://dspace.mit.edu/handle/1721.1/14892

Hamilton JH, Slutsky SM (1990) Endogenous timing in duopoly games: Stackelberg or Cournot equilibria. Games Econ Behav 2:29–46

Hirata D, Matsumura T (2011) Price leadership in a homogeneous product market. J Econ 104:199–217

Krugman P, Brainard L (1988) Problems in modeling competition in the aircraft industry. In: Paper prepared for the CEPR-NBER conference on strategic trade policy, July 1988

Kreps DM, Scheinkman JA (1983) Quantity precommintment and Bertrand competition yield Cournot outcomes. Bell J Econ 14(2):326–337

Levitan R, Shubik M (1978) Duopoly with price and quantity as strategic variables. Int J Game Theory 7:1–11

Maskin E (1986) The existence of equilibrium with price-setting firms. Am Econ Rev 76(2):382–386

McCulloch JH (2011) PQ-Nash duopoly: a computational characterization. Economics Department, Ohio State University, USA (Manuscript)

Mestelman S, Welland D, Welland D (1987) Advance production in posted offer markets. J Econ Behav Organ 8:249–264

Phillips OR, Menkhaus DJ, Krogmeier JL (2001) Production-to-order or production-to-stock: the endogenous choice of institution in experimental auction markets. J Econ Behav Organ 44:333–345

Qin C-Z, Stuart C (1997) Bertrand versus Cournot revisited. Econ Theory 10:497–507

Robson AJ (1990) Duopoly with endogenous strategic timing: Stackelberg regained. Int Econ Rev 31:263–274

Shubik M (1955) A comparison of treatments of a duopoly problem (part II). Econometrica 23:417–431

Tasnádi A (2003) Endogenous timing of moves in an asymmetric price-setting duopoly. Portuguese Econ J 2:23–35

Tasnádi A (2004) Production in advance versus production to order. J Econ Behav Organ 54:191–204

Tirole J (1988) The theory of industrial organization. MIT Press, Cambridge

van Damme E, Hurkens S (2004) Endogenous price leadership. Games Econ Behav 47:404–420

van den Berg A, Bos I (2011) Collusion in a price-quantity oligopoly. Department of Quantitative Economics, Maastricht University, The Netherlands (Manuscript)

Varian HR (1992) Microeconomic analysis, 3rd edn. W. W. Norton & Company, New York

Wu X-W, Zhu Q-T, Sun L (2012) On equivalence between Cournot competition and the Kreps-Scheinkman game. Int J Ind Organ 30(1):116–125

Zhu Q-T, Wu X-W (2006) Endogenous price leader: a geometric interpretation. In: Presented at the 2006 South and Southeast Asia Meeting of Econometric Society in Chennai, India

Acknowledgments

The authors thank Christine Oughton, Cheng-Zhong Qin, J Huston McCulloch and the two anonymous referees of this journal for very helpful comments and suggestions. The authors also gratefully acknowledge financial support from the National Social Science Foundation of China (10ZH026), Guangxi Social Science Foundation (11BJL001), Returned Overseas Scholar Scientific Research Foundation of the Ministry of Education of China ([2011]1139), Guangxi Soft Science Research Program (11217002-30), and the Humanity and Social Science Foundation of the Ministry of Education of China.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1

Note that the left hand side of equation \(\bar{\pi }_k^r (\tau _i )\!=\!\pi _k^*(p_i )\) strictly decreases with \(\tau _{i}\) and the right hand side strictly increases with \(p_i \) and that \(\bar{\pi }_k^r ( 0)\!=\!\pi _k^*( {p_k^m })\ge \pi _k^*( {p_i })\!>\! 0 \!=\!\mathop {\lim }\nolimits _{p\downarrow MC_k (0)} \bar{\pi }_k^r ( {D(p)})\) if \(MC_k ( 0)\!<\!p_i \le p_k^m \). Thus, given \(p_i \), there is a unique \(\tau _i ( {p_i })\) such that \(\bar{\pi }_k^r ( {\tau _i })\!=\!\pi _k^*( {p_i })\) and \(0\le \tau _i ( {p_i })\!<\!\mathop {\lim }\nolimits _{p\downarrow MC_k (0)} D( p)\). Moreover, \(\tau _i ( {p_i })\) strictly decreases with \(p_i ;\tau _i ( {p_k^m })\!=\! 0\) and \(\mathop {\lim }\nolimits _{p\downarrow MC_k (0)} \tau _i ( p)\!\le \! \mathop {\lim }\nolimits _{p\downarrow MC_k (0)} D( p)\). If \(\mathop {\lim }\nolimits _{p\downarrow MC_k (0)} \tau _i ( p)\!<\!\mathop {\lim }\nolimits _{p\downarrow MC_k (0)} D( p)\), then the following conflict emerges: \(0\!=\!\mathop {\lim }\nolimits _{p\downarrow MC_k (0)} \pi _k^*( p)\!=\!\bar{\pi }_k^r ( {\mathop {\lim }\nolimits _{p\downarrow MC_k (0)} \tau _i ( p)})>\bar{\pi }_k^r ( {\mathop {\lim }\nolimits _{p\downarrow MC_k (0)} D( p)})\!=\!0\). The inequality is set up owing to that \(\bar{\pi }_k^r \) is strictly decreasing.

In addition, \(d\bar{\pi }_k^r ( {\tau _i })/d\tau _i =-p_k^r +MC_k ( {D( {p_k^r })-\tau _i })<0\) and

Thus, Result (1) holds.

Let \(\tilde{p}_k \) satisfy \(D(\tilde{p}_k ) -\tau _i ( {p_i}) \!=\!\varphi _k (\tilde{p}_k )\) as shown in Fig. 1. If \(p_i \!>\!MC_k ( 0)\), then \(\tilde{p}_k \) uniquely exists and \(\tilde{p}_k \!>\!MC_{k} ( 0)\) owing to \(\mathop {\lim }\nolimits _{p\downarrow MC_k (0)} D( p)-\tau _i ({p_i }) > 0~\!=\!\mathop {\lim }\nolimits _{p\downarrow MC_k (0)} \varphi _k (p)\) and \(D({p_k^c })\!-\!\tau _i ( {p_i })\!\le \! \varphi _k ( {p_k^c })\). Note that \(\left. {\partial \pi _k^r ( {\left. p \right| \tau _i ( {p_i })})/\partial p} \right| _{p=\tilde{p}_k } =D( {\tilde{p}_k })-\tau _i ( {p_i })\!=\!\varphi _k ( {\tilde{p}_k })>0\). Thus, \(p_k^r ( {\tau _i ( {p_i })})\!>\!\tilde{p}_k \) and \(\pi _k^*( {\tilde{p}_k })<\bar{\pi }_k^r ( {\tau _i ( {p_i })})\!=\!\pi _k^*( {p_i })\). The latter inequality implies that \(\tilde{p}_k \!<\! p_{i}\) owing to the strictly increasing \(\pi _k^*(p)\) or that Result (2) holds because of the definition of \(\tilde{p}_k \).

If \(MC_k ( 0) <p_i <p_k^m \), then \(\tau _i ( {p_i }) > 0\) and \((\tilde{p}_k ,p_i ]\) is non-empty. Firm \(k\)’s profit by naming any price in interval \((\tilde{p}_k ,p_i ]\) with the residual demand \(D( p) -\tau _i ( {p_i })\) is always less than \(\pi _k^*( {p_i })\), thus \(p_k^r ( {\tau _i ( {p_i })})>p_i \) or Result (3) holds.

For Result (4), let \(\bar{\pi }_k^{rd} ( {\tau _i ( {p_i })})\) be firm \(k\)’s maximal profit under the residual demand \(D( p) -\tau _i ( {p_i })\) and its cost \(C_k^d ( q)\); let \(\pi _k ^{*d}( {p_i })\) be firm \(i\)’s maximum profit by naming price \(p_{i}\) with \(C_i^d ( q)\) being its cost; and let \(q=\varphi _k^d ( p)\) be the inverse function of \(q=MC_k^d ( q)\). If \(D( {p_i }) -\tau _i ( {p_i })\ge \varphi _k^d ( {p_i })\), then \(\tau _i^d ( {p_i })<\tau _i ( p)\) by Result (2). Otherwise let \(p_k^r \) be the price at which \(\pi _k^r ( {p\left| {\tau _i ( {p_i })} \right. })\) arrives at its maximal. Then \(p_k^r >p_i\) and

The first inequality results from the definition of \(\bar{\pi }_k^{rd} ( {\tau _i })\). The last inequality holds because \(D( {p_k^r })-\tau _i ( {p_i })<D( {p_i })-\tau _i ( {p_i })<Min\{ {D( {p_i }),\varphi _k^d ( {p_i })} \}\). \(\square \)

Proof of Theorem 2

Take \(\bar{p}\) such that \(\bar{p}D( {\bar{p}})<Min\left\{ {\pi _1^*( {p^c}),\pi _2^*( {p^c})} \right\} \). Define \(\bar{D}( p)\) equals \(D( p)\) if \(p<\bar{p}, D( {\bar{p}})( {2-p/\bar{p}})\) if \(\bar{p}\le p\le 2\bar{p}\), and 0 if \(p>2\bar{p}\). In the same way as proving the existence of the MSNE of the SMPQ competition in Gertner (1986), one can show that the SMPQ competition has an MSNE \(( {G_1 ( {p_1 ,q_1 }),G_2 ( {p_2 ,q_2 })})\) in which the industrial demand \(D(p)\) is replaced by \(\bar{D}(p)\).

Now we show that the MSNE is also the MSNE of the SMPQ competition where the industrial demand is \(D(p)\). Assume that firm \(k\) takes strategy \(G_k ( {p_k ,q_k })\) and firm \(i\) takes strategy (\(p\), \(q)\). Denote firm \(i\)’s expected profit by \(E_i ( {p,q})\) providing that the industrial demand is \(D(p)\) and by \(\bar{E}_i ( {p,q})\) providing that the industrial demand is \(\bar{D}( p)\). (a) If \(p\le \bar{p}\), then for any \(q, E_i ( {p,q})=\bar{E}_i ( {p,q})\). (b) If \(p>\bar{p}\), then for any \(q\), \(E_i ( {p,q})<\pi _i^*( {p^c})\le E( {\pi _i^s })\). The first inequality results from the definition of \(\bar{p}\). The second holds because of Lemma 2. \(\square \)

Proof of Lemma 3

There is a unique \(p_i^n \) such that \(E( {\pi _i^s })=\pi _i^*( {p_i^n })\), where \(E(\pi _i^s)\) is the expected profit of firm \(i\) in the MSNE of the SMPQ competition. Then firm \(i\) does not choose any strategy (\(p,\,q)\) with \(p<p_i^n \). Denote by \(\left[ {p_i^{\min } ,\;p_i^{\max } } \right] \) the support set of distribution \(\mu _i^*( {p_i })\), which implies that \(p_i^n \le p_i^{\min } \le p_k^m\). It is safe to assume that \(p_1^{\min } \le p_2^{\min }\). Then \(p_1^n \le p_1^{\min } \le p_2^{\min } \) as Fig. 2 shows. We affirm that \(p_1^n =p_1^{\min } =p_2^{\min } \). Otherwise \(p_1^n <p_2^{\min } \). Then for any \(\tilde{p}\in ( {p_1^n ,p_2^{\min } })\), \(E_1 (\tilde{p},\;Min\{D(\tilde{p}),\;\varphi _1 (\tilde{p})\})=\pi _1^*( {\tilde{p}})>\pi _1^*(p_1^n )=E(\pi _1^{s} )\), this leads to a contradiction. For the symmetric reason, that \(p_2^n <p_2^{\min } =p_1^{\min } \) can yields a contradiction. So \(p_2^n =p_2^{\min } =p_1^{\min } =p_1^n \equiv p^{\min }\). In addition, \(p^{\min }\ge p^c\). We affirm that \(p^{\min }>p^c\). Otherwise, the SMPQ competition has a PSNE in which firm \(i\)’s strategy is (\(p^{c}\), \(\varphi _{i}(p^{c}))\) for \(i\) = 1 and 2. This is in contradiction to that the SMPQ competition does not have a PSNE. Therefore Lemma 3 holds. \(\square \)

Proof of Lemma 4

Let \((G_1 (p_1 ,\;q_1 ),\;G_2 (p_2 ,\;q_2 ))\) be the accumulative distribution functions associated with the MSNE of the SMPQ competition. Assume that firm \(i\) takes strategy (\(p\), \(q)\). Let \(g_k (q_k )=G_k (p,q_k )-\mathop {\lim }\nolimits _{p^{\prime }\uparrow p} G_k ( p^{\prime },q_{k})\). If \(\mu _i^*(p_i )\) is continuous at \(p_i =p\), then \(g_k (q_k )\equiv 0\). Thus,

with

The first item on the right-hand side of the equation is independent of \(q\), the second and third are decreasing with \(q\), and the last one is strictly increasing with \(q\). Thus, there exists a unique \(q_i^*(p)\) at which \(E_i (p,q)\) reaches its maximum. \(\square \)

Proof of Lemma 5

Assume that \(p_k^{tp} \ge p_i^{tp}\). For any \(p\), equation \(pq_k^E-C_k ( {q_k^E })=\pi _k^*( {p^{\min }})\) can uniquely determine \(q_k^E\), with \(q_k^E =q_k^E (p)\). Then \(q_k^*(p)\ge q_k^E (p)\) holds almost everywhere (a.e.) under firm \(k\)’s strategy in the MSNE.

-

(a)

If \(\mu _i^*(p)\) is discontinuous at \(p=p^{\min }\), then for any \(q>D(p^{\min })-\varphi _i (p^{\min }),\)

$$\begin{aligned} \mathop {\lim }\limits _{p\downarrow p^{\min }} E_k (p,q)=\left( 1-\mu _i^*(p^{\min })\right) p^{\min }q-C_k (q)<\pi _k^*(p^{\min }) \end{aligned}$$and for any \(q\le D(p^{\min })-\varphi _i (p^{\min })\),

$$\begin{aligned} \mathop {\lim }\limits _{p\downarrow p^{\min }} E_k (p,q)=p^{\min }q-C_k (q)<\pi _k^*( {p^{\min }}) \end{aligned}$$As a result, the infimum of the support set of \(\mu _k^*(p_k )\) is greater than \(p^{\min }\), which is a contradiction.

-

(b)

If \(p^{\min }<p_k^{tp} \), then \(\bar{\pi }_k^r ( {\varphi _i ({p^{\min }})})>\pi _k^*( {p^{\min }})\). Thus, for any sufficiently small \(\varepsilon >\) 0, the curve \(q_k^E (p)\) intersects the curve \(D( p)-\varphi _i ( {p^{\min }})-\varepsilon \). Denote the price at the lowest intersection point of the two curves by \(p_k^s (\varepsilon )\). For any \(p\in \left[ {p^{\min },p_k^s (\varepsilon )} \right] ,\varphi _i ( {p^{\min }})+\varepsilon <D(p).\)

We affirm that for any \(p\in (p^{\min },p_k^s (\varepsilon )],\,q_i^*(p)\le \varphi _i (p^{\min })+\varepsilon \) holds almost everywhere (a.e.) under firm \(i\)’s mixed strategy in the MSNE, which implies that \(q_i^*(p)\le \varphi _i ( {p^{\min }})\) if \(p<\mathop {\lim }\nolimits _{\,\varepsilon \downarrow 0} p_k^s (\varepsilon )\). Otherwise, there is a \(p_i \le p_k^s (\varepsilon )\) such that \(E_i ( {p_i ,q_i^*(p_i )})=E_i ( {\pi _i^s })\) and \(q_i^*(p)>\varphi _i ( {p^{\min }})+\varepsilon \). We consider 2 cases.

-

(i)

If \(\mu _k^*(p)\) is continuous at \(p=p_i \), then

$$\begin{aligned} \partial E_i (p_i ,q)/\partial q|_{q\;=\;\varphi _i (p^{\min })\!+\!\varepsilon }\! =\!\left( 1-\mu _k^*({p_i })\right) p_i\! -\!MC_k \left( \varphi _i ( {p^{\min }})\!+\!\varepsilon \right) \ge 0\qquad \end{aligned}$$(1)The equation holds because \(q_k^*(p)\ge q_k^E (p)\) holds almost everywhere under firm \(k\)’s mixed strategy in the MSNE. The inequality results from that given \(p\), \(\partial E_i (p,q)/\partial q\) strictly decreases with \(q\) as shown in Lemma 4 and that \(q_i^*(p)\ge \varphi _i (p^{\min })+\varepsilon \). Thus,

$$\begin{aligned} E_i (p,\bar{q})>( {1-\mu _k^*(p)})p\bar{q}-C_k (\bar{q})\ge MC_k (\bar{q})\bar{q}-C_k (\bar{q})>\pi _i^*( {p^{\min }}) \end{aligned}$$(2)where \(\bar{q}=\varphi _i (p^{\min })+\varepsilon \). The first inequality in (2) results from the definition of \(E_i (p,\bar{q})\). The second holds because of the inequality in (1). The last inequality holds because \(qMC_k (q)-C_k (q)\) strictly increases with \(q\). However, (2) is in conflict with \(E_i (p,\bar{q})\le \pi _i^*( {p^{\min }})\).

-

(ii)

If \(\mu _k^*( {p_k })\) is discontinuous at \(p_k =p_i \), say, firm \(k\) takes strategy \(( {p_i ,q_i^*(p_i )})\) with a positive probability, then \(q_k^*( {p_i })\ge q_k^E ( {p_i })\). Thus, for any \(q>\varphi _i (p^{\min })+\varepsilon ,\,E_i (p_i ,q)<\mathop {\lim }\nolimits _{p^{\prime }\uparrow p_i } E_i (p^\prime ,q)\le \pi _i^*( {p^{\min }})\).

Owing to that \(\mu _i^*(p)\) is continuous from the right, take an \(\varepsilon >0\) such that for a sufficiently small \(\delta > 0,\) \(\mu ^*_i(p^s_k(\varepsilon ))-\mu ^*_i (\lim _{h\downarrow 0}p^s_k(h))<\delta \). Then for an \(x\in (0,\varepsilon )\),

The first inequality results from the definition of \(E_k(p,q)\). The second inequality holds owing to \(p^s_k(\varepsilon )>\lim _{h\downarrow 0} p^s_k(h)\gg MC_k(q^E_k(p^s_k(\varepsilon )))\). Thus, firm \(k\) can make a profit greater than \(\pi ^*_k(p^{\min })\) by naming price \(p^s_k(\varepsilon )\) and choosing an output slightly greater than \(q^E_k(p^s_k(\varepsilon ))\).

Thus, firm \(k\) can make a profit greater than \(\pi _k^*( {p^{\min }})\) by naming price \(p_k^{s*} \) and choosing an output slightly greater than \(q_k^E ( {p_k^{s*} })\). \(\square \)

Proof of Lemma 6

It is safe to assume that \(Max( {p_1^c ,p_2^c })=p_1^c \). Assume that \(p^{\min }>p_1^c \). For any \(p\ge p^{\min }\), define \(\mu _i ( p)=(\pi _k^*(p)-\pi _k^*( {p^{\min }}))/( {pD( p)})\). We proceed through the following 4 steps to prove the lemma.

Step 1: (a) \(\mu _i (p)\) is not constant in any interval; (b) \(( {1-\mu _i (p)})p>MC_k ( {D(p)})\); (c) \(\mu _i (p)< \text{ a } \text{ constant }<1\).

Proof:

-

(a)

If \(\mu _i (p)\equiv \alpha \) (a constant), then \((1-\alpha )pD(p)-C(D(p))-\pi _k^*(p^{\min })\equiv 0\) or \((1-\alpha )\dot{D}(p)(MR(p)-MC_k (D(p)))\equiv 0\). However, the left-hand side of the latter equation is not identical to 0 in any interval.

-

(b)

The result (b) is equivalent to \(\pi _k^*(p^{\min })>MC_k (D(p))D(p)-C_k (D(p))\). Note that the left-hand side of this inequality is strictly decreasing with \(p\) for any \(p>p_k^c \). So the inequality holds.

-

(c)

\(\mu _i (p)<1-\pi _i^*( {p^{\min }})/( {pD(p)})\). Because \(pD(p)\) has an upper bound, the result (c) holds.

Step 2: There is an \(\varepsilon >\) 0 such that for any \(p\in \left[ {p^{\min }, p^{\min }+ \varepsilon } \right) \) and \(i\in \left\{ {1, 2} \right\} \), (i) \(q_i^*(p)=D(p)\); (ii)\(\mu _i^*(p)\) is strictly increasing and continuous in [\(p^{\min }\), \(p^{\min }+\varepsilon )\); (iii) \(E_i (p,D(p))=E( {\pi _i^s })\); and (iv) \(\mu _i^*(p)=\mu _i (p)\).

Proof:

-

(i)

There is an \(\varepsilon >\) 0 such that for any \(p\in \left[ {p^{\min }, p^{\min }+ \varepsilon } \right) \) and \(i\in \left\{ {1, 2} \right\} \), \((1-\mu _i^*(p))p>p_1^c \) owing to that both \(\mu _1^*\) and \(\mu _2^*\) are continuous at \(p^{\min }\). Thus, for any \(q\le D(p)\), \(\partial E_i (p,q)/\partial q\ge (1-\mu _k^*(p))p-MC_k (q)>p_1^c -MC_k (q)>0\). Therefore, \(q_i^*(p)=D( p)_{.}\)

-

(ii)

If \(\mu _i^*(p)\) is constant in [\(p^{\prime }\), \(p^{\prime }\)+), where \(p^{\prime }\)+ is greater than \(p^{\prime }\), it is safe to assume that \(p^\prime =Min\{\left. p \right| \mu _i^*(p)=\mu _i^*(p^\prime )\}\). Then \(E_k ( {p^\prime ,D( {p^\prime })})=E( {\pi _k^s })\). For any \(p\in \left[ {p^\prime ,p^\prime +} \right) \)

$$\begin{aligned} E_k (p,D(p))=\left( 1-\mu _i^*(p^\prime )\right) pD(p)-C_k (D(p)), \end{aligned}$$(3)Note that \(E_k (p,D(p))\le E(\pi _k^s )=E_k (p^\prime ,D(p^\prime ))\), i.e. \(E_k (p,D(p))\) reaches its maximum at \(p^{\prime }\). Thus,

$$\begin{aligned} dE_k (p,D(p))/dp=\dot{D}(p)\;\left( (1-\mu _i^*(p^{\prime }))MR\;(p)-MC_k (D(p))\right) <0. \end{aligned}$$The inequality holds because marginal revenue MR(\(p)\) strictly increasing with \(p\) and \(\dot{D}(p)<0\). Namely, for any \(p > p^{\prime }, E_k (p,D(p))<E(\pi _k^s )=E_k (p^\prime ,D(p^\prime ))\). Moreover, for any (\(p, q)\) with \(p > p^{\prime }\),

$$\begin{aligned} E_k (p,q)\!\le \! \left( 1\!-\!\mu _i^*(p^\prime )\right) pq\!-\!C_k (q)\!\le \! \left( 1\!-\!\mu _i^*(p^\prime )\right) pD(p)\!-\!C_k (D(p))\!<\!E\left( {\pi _k^s }\right) \!\!\!\!\!\nonumber \\ \end{aligned}$$(4)The first inequality in (4) results from the definition and \(q_i^*(p)=D(p)\) for any \(p\le p^\prime \). That \(( {1-\mu _i^*( {p^\prime })})p>p_k^c \) implies that the second term strictly increases with \(q\). So the second inequality holds. The last inequality holds because of the Eq. (3) and the inequality \(E_k (p,D(p))<E( {\pi _k^s })\). Thus, firm \(k\) does not choose the strategy (\(p\), \(q)\) with \(p > p^{\prime }\) or \(\mu _k^*(p^\prime )=1\). This conflicts with that \(( {1-\mu _i^*( {p^\prime })})p^\prime >p_1^c \). If \(\mu _i^*(p)\) is discontinuous at \(p^{\prime \prime }\), then for any \(q\), \(\mathop {\lim }\nolimits _{p\downarrow p^{\prime \prime }} E_k (p,q)<\mathop {\lim }\nolimits _{p\uparrow p^{\prime \prime }} E_k (p,q)\le E( {\pi _k^s })\). Thus, \(\mu _k^*(p)\) is constant on [\(p^{\prime \prime }\), \(p^{\prime \prime }\)+) and this contradicts the result we just confirmed.

-

(iii)

If \(E_i (p,D(p))<E( {\pi _i^s })\), owing to the result (ii) of Step 2, \(E_i (p^{\prime \prime \prime \prime },D(p^{\prime \prime \prime \prime })<E( {\pi _i^s })\) for any p\(^{\prime \prime \prime \prime }\) in a neighborhood of p, which implies that \(\mu _i^*(p)\) is constant in the neighborhood. Therefore, for any \(p\in \left[ {p^{\min },p^{\min }+ \varepsilon } \right) \) and \(i\in \left\{ {1, 2} \right\} \), \(E_i (p,D(p))=E( {\pi _i^s })\), which can immediately yield \(\mu _i^*(p)=\mu _i (p)\) by applying the results (i) and (ii) of Step 2.

Step 3: Let \(p^{x}\) be the maximum of all \(p^{\prime \prime \prime }\) such that for any \(p\in \left[ {p^{\min },p^{\prime \prime \prime }} \right) \) and \(i\in \left\{ {1, 2} \right\} \), \(\mu _i^*(p)=\mu _i (p)\). Then \(p^{x }<\) +\(\infty \) because of the result (c) of Step 1 and \(\mu _i^*(p)\) is strictly increasing and continuous on [\(p^{\min }\), \(p^{x})\) owing to the result (a) of Step 1. Moreover, for \(p\in \left[ {p^{\min },p^x} \right) \), \(q_i^*(p)=D(p)\) and \(E_i (p,D(p))=\pi _i^*(p^{\min })\). In fact,

The first inequality in (5) results from the definition of \(E_{i }(p, q)\). The last holds owing to the result (b) of Step 1.

-

(a)

If \(\mu _k^*(p^x)\ne \mu _k ( {p^x}),\mu _k^*(p)\) is discontinuous at \(p^{x}\), and \(E_k (p^x,q_k^*(p^x))=\pi _k^*(p^{\min })\). By the definition of the left-hand side of this equation, we have that \(q_k^*(p^x)=D( {p^x})\) and \(\mu _i^*(p)\) is continuous at \(p^{x}\) or \(\mu _i^*( {p^x})=\mu _i ( {p^x})< 1\). Moreover, for any \(q\),

$$\begin{aligned} \mathop {\lim }\limits _{p\downarrow p^x} E_i (p,q)<\mathop {\lim }\limits _{p\uparrow p^x} E_i (p,q)\le \pi _i^*(p) \end{aligned}$$Hence \(\mu _i^*(p)\) is constant on [\(p^{x}, p^{x}\)+). Using the same argument in the proof of the result (ii) of Step 2, we arrive at that \(\mu _k^*(p^x)=1\). This implies that firm \(k\)’s profit is identical to 0 by taking any strategy (\(p, q)\) with \(p > p^{x }\)or \(\mu _i^*(p^x)=1\), which contradicts \(\mu _i^*(p^x)<1\).

-

(b)

If \(\mu _i^*(p^x)=\mu _i (p^x)\) for \(i=1\) or 2, then \(\mu _i^*(p)\) is continuous at \(p^{x}\) for \(i\in \left\{ {1, 2} \right\} \). There is an \(\varepsilon >\) 0 such that for any \(p\in \left[ {p^x,p^x+ \varepsilon } \right) \) and \(i\in \left\{ {1, 2} \right\} _{,} (1-\mu _i^*(p))p>MC_k (D(p))\) owing to the result (b) of Step 1. As a result, the inequality (5) still holds and \(q_k^*(p)=D(p)\). Using the same argument in the proof of the results (ii) and (iii) of Step 2 with \((1-\mu _i^*(p^{\prime }))p^{\prime }>p_1^c \) being replaced by \((1-\mu _i^*(p^{\prime }))p^{\prime }>MC_k (D(p^{\prime })))\), we obtain that \(\mu _i^*(p)=\mu _i (p)\) for \(i=1\) or 2. This leads to a contradiction.\(\square \)

Proof of Theorem 4

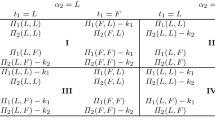

Let \(c(t)\) be strictly increasing. (1) if \(t_{1 }< t_{2}\) and (\(t_{1}, t_{2})\) is on the SPNE path of the (\(T, l, c(t))\) framework, then (\(t_{1}, t_{2})\) = (0, 1). In fact, given that firm 2 chooses \(t_{2}\) at stage 1, firm 1 prefers time 0 to \(t_{1}\) if \(t_{1}>\) 0 because firm 1’s profit is fixed but its time cost decreases. Thus, \(t_{1 }\) = 0. Given that firm 1 chooses time 0 at stage 1, firm 2 prefers time 1 to \(t_{2}\) if \(t_{2 }>\) 1 for the same reason. (2) For the symmetric reason, if \(t_{1 }> t_{2}\) and (\(t_{1}\), \(t_{2})\) is on the SPNE path of the (\(T, l, c(t))\) framework, then (\(t_{1}, t_{2})\) = (1, 0). Thus, only (0, 0), (1, 1), ..., (\(T-\)1, \(T-\)1), (1, 0) and (0, 1) may be on the SPNE path of the \(T\)-stage framework.

Writing out the condition under which (\(j, j)\) (\(j\) = 1, 2, ..., \(T-\)1) is on the SPNE path of the (\(T, l, c(t))\) framework and then letting \(l\) approach to 0 lead to the condition that \(L_{i }<\) 0 and \(F_{i }\le \) 0 for \(i\) = 1 and 2. On the other hand, if \(L_{i }<\) 0 and \(F_{i }\le \) 0, there is a sufficiently small \(l\) such that only (\(j\), \(j)\) (\(j \) = 0, 1, 2, ..., \(T-\)1) is on the SPNE path of the (\(T, l, c(t))\) framework. Thus, the result (1) holds. In the same way we can confirm that the results (2) and (3) hold. \(\square \)

Proof of Theorem 6

Define \(\bar{p}=Max\{\bar{p}^1,\bar{p}^2\}\), where \(D(\bar{p}^i)=\varphi _i (p^c)\). Define \(\bar{D}(p)\) equals \(D(p)\) if \(p<\bar{p}\), equals \(D(\bar{p})(2-p/\bar{p})\) if \(\bar{p}\le p\le 2\bar{p}\), and equals 0 if \(p>2\bar{p}\). Then the simultaneous move price competition has an MSNE \((g_1 (p_1 ),g_2 (p_2 ))\) in which the industrial demand \(D(p)\) is replaced by \(\bar{D}(p)\). Let \([\bar{p}_i^n ,\bar{p}_i^x ]\) be the support set of \(g_{i}(p_{i})\) and \(E(\pi _i^{sp} )\) be firm \(i\)’s expected profit in the MSNE. Denote firm \(i\)’s expected profit by \(\bar{E}_i (p)\) in corresponding with firm \(k\) taking strategy \(g_k (p_k )\) and firm \(i\) naming price \(p\).

-

(1)

It is easy to show that for firm \(i\), any price less than \(p^{c}\) is dominated by price \(p^{c}\). Thus, \(\bar{p}_i^n \ge p^c\) and \(E(\pi _i^{sp} )\ge \pi _i^*(p^c)\).

-

(2)

If \(\bar{p}_1^x =\bar{p}_2^x \), then either firm 1 or firm 2 names price \(\bar{p}_1^x \) with a probability of 0. Otherwise both firm name price \(\bar{p}_1^x \) with a positive probability, which implies that \(\bar{E}_i (\bar{p}_1^x )=E(\pi _i^{sp} )\). However, \(\mathop {\lim }\nolimits _{p\uparrow \bar{p}_1^x } \bar{E}_i (p)-\bar{E}_i (\bar{p}_1^x )>\) 0, which implies that there is a \(p_i \) such that \(\bar{E}_i (p_i )>\bar{E}_i (\bar{p}_1^x )=E(\pi _i^{sp} )\). A contradiction emerges.

-

(3)

We affirm that if \(\bar{p}_1^x >\bar{p}_2^x \) or “\(\bar{p}_1^x =\bar{p}_2^x \) and firm 2 names price \(\bar{p}_1^x \) with a probability of 0”, then (a) \(\bar{E}_1 (\bar{p}_1^x )=E(\pi _1^{sp} )\) and (b) \(\bar{p}_1^x <\bar{p}\). For the result (a), (i) If firm 1 names price \(\bar{p}_1^x \) with a positive probability, the affirmation holds. (ii) If firm 1 names price \(\bar{p}_1^x \) with a probability of 0, then for any \(\tilde{p}<\bar{p}_1^x \), there is \(\hat{p}\in (\tilde{p},\bar{p}_1^x )\) such that \(\bar{E}_1 (\hat{p})=E(\pi _1^{sp} )\) because otherwise the supremum of the support set of firm 1’s mixed strategy in the MSNE must be less than \(\bar{p}_1^x \). Thus, there is a strictly increasing sequence \(\{\hat{p}_n \}_{n=1}^{+\infty } \) such that \(\bar{E}_1 (\hat{p}_n )=E(\pi _1^{sp} )\) for any \(n\) and \(\mathop {\lim }\nolimits _{n\rightarrow +\infty } \hat{p}_n =\bar{p}_1^x \), which yields that \(\bar{E}_1 (\bar{p}_1^x )=\mathop {\lim }\nolimits _{n\rightarrow +\infty } \bar{E}_1 (\hat{p}_n )=E(\pi _1^{sp} )\). For the result (b), \(\pi _1^*(p^c)\le E(\pi _1^{sp} )=\bar{E}_1 (\bar{p}_1^x )\le \pi _1^r (\left. {\bar{p}_1^x } \right| \varphi _2 (p^c))\). The last inequality holds because firm 2’s output is greater than \(\varphi _2 (p^c)\) if it names a price in \([\bar{p}_2^n ,\bar{p}_2^x ]\) and firm 1 names price \(\bar{p}_1^x \). Note that for any \(p\ge \bar{p}\), \(\pi _1^r (\left. p \right| \varphi _2 (p^c))\equiv 0\). Thus \(\bar{p}_2^x \le \bar{p}_1^x <\bar{p}\).

-

(4)

Symmetrically, if \(\bar{p}_1^x <\bar{p}_2^x \) or “\(\bar{p}_1^x =\bar{p}_2^x \) and firm 1 names price \(\bar{p}_1^x \) with a probability of 0”, then \(\bar{p}_2^x <\bar{p}\).

In summary, \(\bar{p}>Max\{\bar{p}_1^x ,\bar{p}_2^x \}\) and \(Min\{\bar{p}_1^n ,\bar{p}_2^n \}\ge p^c\).

Now we affirm that \((g_1 (p_1), g_2 (p_2 ))\) is an MSNE of simultaneous move price competition providing that the industrial demand is \(D(p)\). Denote by \(E_{i}(p)\) firm \(i\)’s expected profit where firm \(i\) names price \(p\) and firm \(k\) takes strategy \(g_{k }(p_{k})\). Then for any \(p\le \bar{p}, E_i (p)=\bar{E}_i (p)\); and for any \(p>\bar{p}, E_i (p)=0=\bar{E}_i (p)\). Thus, the affirmation holds. \(\square \)

Proof of Proposition 4

It is equivalent to the following result. Assume that both firms take price-quantity strategy and that the SPNE of the \(-\)3-period (or 3-period) framework under endogenous timing exists, then the profit of firm \(i\) (\(i\) = 1, 2) is greater than \(\pi _i^*(Max\{p_1^{tp} ,p_2^{tp} \})\).

By the result 2 of Theorem 5, if (\(-\)1, 0) is on the SPNE path, then \(L_{1 }>0,\) or equivalently \(p_1^*\tau _1 (p_1^*)-C_1 (\tau _1 (p_1^*))>E(\pi _1^s )\ge \pi _1^*(Max\{p_1^{tp} ,p_2^{tp} \})\), where \(p_1^*\in P_1^*\) and the last inequality results from Theorem 3. Thus, \(p_1^*>Max\{p_1^{tp} ,p_2^{tp} \}\), which implies that firm 2’s profit is greater than \(\pi _2^*(Max\{p_1^{tp}, p_2^{tp} \})\).

Symmetrically, if (0, \(-\)1) is on the SPNE path, Proposition 4 is true.

If (2, 2) is on the SPNE path, then \(\pi _i^*(p^{\min })=E(\pi _i^s )>\pi _i^*(p_k^*)\) for \(i\) = 1, 2. The equality results from Theorem 3 and the inequality holds because of the result 2 of Theorem 5. Thus, \(p^{\min }>Max\{p_1^*,p_2^*\}>Max\{p_1^{tp} ,p_2^{tp} \}\), where the first inequality results from the fact that \(\pi _i^*(p)\) is strictly increasing on (0, \(p_i^m )\) and the last results from Proposition 1. Hence, Proposition 4 is true.

If (0, 0) is on the SPNE path, then

The first inequality results from the result 2 of Theorem 5 and the last results from Proposition 1. Thus, \(p^{\min }>Max\{ {p_1^{tp} ,p_2^{tp} }\}\) and Proposition 4 holds. \(\square \)

Rights and permissions

About this article

Cite this article

Zhu, Qt., Wu, Xw. & Sun, L. A generalized framework for endogenous timing in duopoly games and an application to price-quantity competition. J Econ 112, 137–164 (2014). https://doi.org/10.1007/s00712-013-0347-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-013-0347-3