Abstract

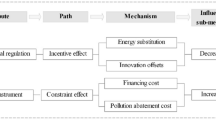

The green credit policy is an important green financial tool that can achieve the win–win scenario with economic development and environmental protection through the reasonable allocation of credit resources. Using the green credit guidelines (GCGs) in China as a quasi-natural experiment, this study explored the impacts of the green credit policy on the capital investment of energy-intensive enterprises in a difference-in-differences framework and established the mediation effect model to analyze the mechanisms. The empirical results showed that the capital investment of energy-intensive enterprises was significantly reduced after the promulgation of the GCGs. Considering the intermediary paths along with the green credit policy on energy-intensive investment through financial constraints, the total bank loans and long-term bank loans played partial intermediary roles, whereas the short-term bank loans as mediator variable showed no significant intermediary effect. The findings of this study illustrated that the green credit policy has been well implemented and promoted in China. It inhibited energy-intensive investment, which is of great significance to improving the efficiency of resource utilization and promoting green and low-carbon development.

Similar content being viewed by others

Notes

We thank the anonymous reviewers for constructive suggestions about the category of environmental regulation policies.

References

Bai Y, Song S, Jiao J, Yang R (2019) The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. J Clean Prod 233:819–829. https://doi.org/10.1016/j.jclepro.2019.06.107

Beck T, Levine R, Levkov A (2010) Big Bad Banks? The winners and losers from bank deregulation in the United States. J Financ 65:1637–1667. https://doi.org/10.1111/j.1540-6261.2010.01589.x

Bertrand M, Duflo E, Mullainathan S (2004) How much should we trust differences-in-differences estimates? Q J Econ 119:249–275. https://doi.org/10.1162/003355304772839588

Biswas N (2011) Sustainable Green banking approach: The need of the hour. Bus Spectr 1:32–38

Cai H, Wang X, Tan C (2019) Green credit policy, incremental bank loans and environmental protection effect. Account Res 3:88–95

Chang S, Yang X, Zheng H et al. (2020) Air quality and health co-benefits of China’s national emission trading system. Appl Energy 261:114226. https://doi.org/10.1016/j.apenergy.2019.114226

Chen D, Li S, Zhong Y (2012) Government quality, investment and capital allocation efficiency. J World Econ 35:89–110

Chen Q (2019) Has China’s green credit policy been implemented? An analysis of loan scale and costs based on “Two Highs and One Surplus” enterprises. Contemp Financ Econ 3:118–129

Chen S, Li Z (2019) An introduction to green finance theory and practice. Fudanpress, Shanghai.

China Banking Regulatory Commission (2012) Notice of the China Banking Regulatory Commission on issuing the green credit guidelines. http://www.cbrc.gov.cn. Accessed 24 Feb 2012

Chung SS, Fryxell GE, Lo CW (2005) Corporate environmental policy statements in mainland China: to what extent do they conform to ISO 14000 documentation? Environ Manag 35:468–482. https://doi.org/10.1007/s00267-003-0085-3

Ding J (2019) Green credit policy, credit resources allocation and strategic response of enterprises. Econ Rev 4:62–75. https://doi.org/10.19361/j.er.2019.04.05

Du G, Sun C, Ouyang X, Zhang C (2018) A decomposition analysis of energy-related CO2 emissions in Chinese six high-energy intensive industries. J Clean Prod 184:1102–1112. https://doi.org/10.1016/j.jclepro.2018.02.304

Du W, Li M (2019) Influence of environmental regulation on promoting the low-carbon transformation of China’s foreign trade: Based on the dual margin of export enterprise. J Clean Prod 244:118687. https://doi.org/10.1016/j.jclepro.2019.118687

Feng M, Li X (2020) Evaluating the efficiency of industrial environmental regulation in China: A three-stage data envelopment analysis approach. J Clean Prod 242:118535. https://doi.org/10.1016/j.jclepro.2019.118535

Hao Y, Ye B, Gao M, Wang Z, Chen W, Xiao Z, Wu H (2020) How does ecology of finance affect financial constraints? Empirical evidence from Chinese listed energy- and pollution-intensive companies. J Clean Prod 246:119061. https://doi.org/10.1016/j.jclepro.2019.119061

He D-X (2016) Coping with climate change and China’s wind energy sustainable development. Adv Clim Change Res 7:3–9. https://doi.org/10.1016/j.accre.2016.06.003

He LY, Liu RY, Zhong ZQ, Wang DQ, Xia YF (2019) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew Energy 143:974–984. https://doi.org/10.1016/j.renene.2019.05.059

Hoang TC, Black MC, Knuteson SL, Roberts AP (2019) Environmental pollution, management, and sustainable development: strategies for Vietnam and other developing countries. Environ Manage 63:433–436. https://doi.org/10.1007/s00267-019-01144-z

Hu A-G (2016) The Five-Year Plan: A new tool for energy saving and emissions reduction in China. Adv Clim Change Res 7:222–228. https://doi.org/10.1016/j.accre.2016.12.005

Hu N, Cao D (2011) Green credit policy and environmental risk management of commercial banks. Econ Probl 3:103–107. https://doi.org/10.16011/j.cnki.jjwt.2011.03.027

International Energy Agency (2019) Global Energy & CO2 Status Report 2019. https://www.iea.org/reports/global-energy-co2-status-report-2019. Accessed 26 Mar 2019

Jiang K-J, Zhuang X, He C-M, Liu J, Xu X-Y, Chen S (2016) China’s low-carbon investment pathway under the 2 °C scenario. Adv Clim Change Res 7:229–234. https://doi.org/10.1016/j.accre.2016.12.004

Jin D, Mengqi N (2011) The paradox of green credit in China. Energy Procedia 5:1979–1986. https://doi.org/10.1016/j.egypro.2011.03.340

Li C, Bai W, Wang Y, Li Y (2016) How can green credit policies be effectively implemented by commercial banks?—A study based on evolutionary game theory and the DID model. South China Financ 1:47–54

Li J, Lin B (2017) Environmental impact of electricity relocation: a quasi-natural experiment from interregional electricity transmission. Environ Impact Assess Rev 66:151–161. https://doi.org/10.1016/j.eiar.2017.07.002

Li J-F, Gu AL, Ma Z-Y, Zhang C-L, Sun Z-Q (2019) Economic development, energy demand, and carbon emission prospects of China’s provinces during the 14th Five-Year Plan period: application of CMRCGE model. Adv Clim Change Res 10:165–173. https://doi.org/10.1016/j.accre.2019.09.003

Liao J, Hu W, Yang D (2019) Dynamic analysis of the effect of green credit on bank operating efficiency—based on panel VAR model. Collect Essays Financ Econ 2:57–64. https://doi.org/10.13762/j.cnki.cjlc.2019.02.005

Lin B, Tan R (2017) Estimating energy conservation potential in China’s energy intensive industries with rebound effect. J Clean Prod 156:899–910. https://doi.org/10.1016/j.jclepro.2017.04.100

Liu J-Y, Xia Y, Fan Y, Lin S-M, Wu J (2017) Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J Clean Prod 163:293–302. https://doi.org/10.1016/j.jclepro.2015.10.111

Liu Q, Chen Y, Tian C, Zheng X-Q, Li J-F (2016) Strategic deliberation on development of low-carbon energy system in China. Adv Clim Change Res 7:26–34. https://doi.org/10.1016/j.accre.2016.04

Liu X, Wen S (2019) Should financial institutions be environmentally responsible in China? Facts, theory and evidence. Econ Res J 54:38–54

Liu X, Wang E, Cai D (2019) Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ Res Lett 29:129–135. https://doi.org/10.1016/j.frl.2019.03.014

Lu J, Zhao Y, Su Y (2020) “Civilized City” selection and environmental pollution control: a quasi-natural experiment. J Financ Econ 46:109–124. https://doi.org/10.16538/j.cnki.jfe.2020.04.008

Ng AW (2018) From sustainability accounting to a green financing system: Institutional legitimacy and market heterogeneity in a global financial centre. J Clean Prod 195:585–592. https://doi.org/10.1016/j.jclepro.2018.05.250

Pang R, Zheng D, Shi M, Zhang X (2019) Pollute first, control later? Exploring the economic threshold of effective environmental regulation in China’s context, J Environ Manage 248:109275. https://doi.org/10.1016/j.jenvman.2019.109275

Ren S, Liu D, Li B, Wang Y, Chen X (2020) Does emissions trading affect labor demand? Evidence from the mining and manufacturing industries in China. J Environ Manage 254:109789. https://doi.org/10.1016/j.jenvman.2019.109789

Shi D, Ding H, Wei P, Liu J (2018) Can smart city construction reduce environmental pollution. China Indus Econ 6:117–135. https://doi.org/10.19581/j.cnki.ciejournal.2018.06.008

Su D, Lian L (2018) Does green credit policy affect corporate financing and investment? Evidence from publicly listed firms in pollution-intensive industries. J Financ Res 12:123–137

Sun JX, Wang F, Yin HT, Zhang B (2019) Money talks: the environmental impact of China’s Green Credit Policy. J Policy Anal Manag 38:653–680. https://doi.org/10.1002/pam.22137

Swanson KE, Kuhn RG, Xu W (2001) Environmental Policy Implementation in Rural China: A Case Study of Yuhang, Zhejiang. Environ Manag 27:481–491. https://doi.org/10.1007/s002670010164

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Financ Res Lett 31:98–103. https://doi.org/10.1016/j.frl.2019.04.016

Tan R, Lin B (2018) What factors lead to the decline of energy intensity in China’s energy intensive industries? Energy Econ 71:213–221. https://doi.org/10.1016/j.eneco.2018.02.019

The People’s Bank of China (1995) The notice on implementing credit policies and strengthening environmental protection. http://www.pbc.gov.cn. Accessed 6 Feb 1995

Wang Y, Pan D, Yu P, Liang X (2019) China’s incentive policies for green loans: a DSGE approach. J Financ Res 11:1–18

Weaver CP, Miller CA (2019) A Framework for climate change-related research to inform environmental protection. Environ Manage 64:245–257. https://doi.org/10.1007/s00267-019-01189-0

Wen Z, Ye B (2014) Analyses of mediating effects: the development of methods and models. Adv Psychol Sci 22:731–745. https://doi.org/10.3724/sp.j.1042.2014.00731

Wu W, An S, Wu C-H, Tsai S-B, Yang K (2020) An empirical study on green environmental system certification affects financing cost of high energy consumption enterprises-taking metallurgical enterprises as an example. J Clean Prod 244:118848. https://doi.org/10.1016/j.jclepro.2019.118848

Xie T, Liu J (2019) How does green credit affect China’s green economy growth? China Population. Resour Environ 29:83–90

Ye K, Zhang R, Xu H (2010) Reputation, institutional environment and debt financing: evidence from Chinese private listed companies. J Financ Res 8:171–183. https://doi.org/10.1360/972010-1084

Ye Q-Z (2016) Safety and effective developing nuclear power to realize green and low-carbon development. Adv Clim Change Res 7:10–16. https://doi.org/10.1016/j.accre.2016.06.005

Yoshino N, Taghizadeh–Hesary F, Nakahigashi M (2019) Modelling the social funding and spill-over tax for addressing the green energy financing gap. Econ Model 77:34–41. https://doi.org/10.1016/j.econmod.2018.11.018

Zhang B, Yang Y, Bi J (2011) Tracking the implementation of green credit policy in China: top-down perspective and bottom-up reform. J Environ Manag 92:1321–1327. https://doi.org/10.1016/j.jenvman.2010.12.019

Zhang Y, Ma S, Yang H, Lv J, Liu Y (2018) A big data driven analytical framework for energy-intensive manufacturing industries. J Clean Prod 197:57–72. https://doi.org/10.1016/j.jclepro.2018.06.170

Zhu J, Han F, Lu Z (2015) Industrial policy, bank connections, and debt financing: an empirical research based on A-share listed companies. J Financ Res 3:176–191

Zhu N, Bu Y, Jin M, Mbroh N (2020) Green financial behavior and green development strategy of Chinese power companies in the context of carbon tax. J Clean Prod 245:118908. https://doi.org/10.1016/j.jclepro.2019.118908

Acknowledgements

This study was financially supported by the Ministry of Education of Humanities and Social Science Project of China (19YJA790086), the Key Project of National Social Science Foundation of China (No.18AZD014) and the Major project of National Social Science Foundation of China (No.19ZDA107). We would like to thank the editor (Bram F. Noble) and the anonymous reviewers for constructive and insightful comments.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, Y., Lei, X., Long, R. et al. Green Credit, Financial Constraint, and Capital Investment: Evidence from China’s Energy-intensive Enterprises. Environmental Management 66, 1059–1071 (2020). https://doi.org/10.1007/s00267-020-01346-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00267-020-01346-w