Abstract

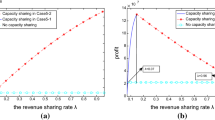

In the repeated Bertrand duopoly with capacity constraints, we introduce a sales maximization rationing rule, instead of a standard rationing rule, Efficient rule (E rule). Under our new rule, when the demand of a firm with a lower price exceeds its capacity, the consumers who are willing to buy at that price are rationed to that firm according to their unwillingness to buy. We find that the maximum one-shot total payoff under our rule is not less than that under E rule at any capacities; it is achieved by an asymmetric price pair rather than a symmetric monopoly price pair and it is strictly greater than that under E rule unless each firm’s capacity is too large. Under the one-shot total payoff maximization, total surplus under our rule is also equal to or greater than that under E rule at any capacities. Hence, our rule is also appealing to the social planner, and it is implementable due to information technology which collects information about the consumers’ willingness to pay. In the repeated game, patient firms can achieve the total payoff maximization by an equilibrium under our rule. Moreover, a range of discount factors within which the total payoff maximization can be sustained under our rule is wider than that under E rule at some capacities.

Similar content being viewed by others

Notes

When the capacities are too large, the maximum one-shot total profits are the same between S rule and E rule. They can be achieved by a symmetric price pair.

See Proposition 2.

Within the range, the size of consumers who prefer S rule to E rule can also be larger than that of consumers who prefer E rule to S rule. Therefore, if the consumers casted a vote for a rationing rule, S rule would be elected.

The monopoly price is that of a firm with aggregate capacities of the two firms.

However, under some range of capacities, SMP is an equilibrium within a wider range of discount factors than SAP.

Liu and Serfes (2006), Jentzsch et al. (2013) and Shy and Stenbacka (2016) are theoretical papers which consider consumer information sharing among competitors and analyze the effect on social welfare. In their models, firms which know accurate consumer preferences such as brand loyalties use targeted pricing based on consumers’ preferences.

Each firm has an interior optimal capacity (middle-size level) which maximizes the total profit under one-shot full collusion. Also, the one-shot total profit of the two firms with optimal capacities is strictly greater than the monopoly profit of a firm with aggregate capacities of the two firms. See Sect. 2.2.

When \(k = 2/3\), there exist both two types of one-shot full collusion price pairs in the case of \(k < 2/3\) and in the case of \(k > 2/3\).

This is the case where we suppose a merged firm cannot use price discrimination.

When we suppose that firms choose prices and quantities which they are willing to sell at the prices, then they might be able to maximize \(\pi _{S}\) without reducing their capacities.

If \(k = 2/3\), then there exist two types of one-shot full collusion price pair under S rule; \((p_{l}, p_{h}) = (1/6, 5/6)\) or \((p_{l},p_{h}) = (1/2,p)\) such that \(p \geqslant 1/2\). Since the former makes consumer surplus larger than the latter, we calculate consumer surplus at the price pair \((p_{l}, p_{h}) = (1/6, 5/6)\) in this subsection.

If \(k \le 2/5\), then the size of consumers who suffer from the price discrimination is large relative to that of consumers who benefit from the price discrimination. Therefore, if \(k = 2/5\), then CS(S) and CS(E) are the same, since the negative effect of the price discrimination offsets the positive effect of the price discrimination. If \(k < 2/5\), then the negative effect of the price discrimination is large and CS(S) is smaller than CS(E).

When \(k \le 1/3\), \(p_{l} = 1-2k < p_{S}^{\min } = \big (1-3k + \sqrt{(1-k)^{2} + (2k)^{2}} \big )/2\). When \(k \in (1/3, 2/3)\), \(p_{l} = (1-k)/2 < p_{S}^{\min } = \big (1-3k + \sqrt{(1-k)^{2} + (2k)^{2}} \big )/2\). Thus, \(\pi _{l,S} = p_{l} \cdot k < {\underline{v}}^{S} = p_{S}^{\min } \cdot k\).

We can confirm that \(D(p_{S}^{\min }) <2k\).

This is the case where total capacities are greater than \(50 \%\) but are smaller than \(58 \%\) of an industry, since \(\hat{k} \in (0.294, 0.295)\).

We can also observe that \(\lim _{k \rightarrow 0} {\underline{\delta }} (k) = - \frac{1}{2} + \frac{\sqrt{5}}{2}\). This observation implies that the advantage of E rule such that the minimum discount factor for full collusion is lower than under S rule does not vanish as k goes to 0.

References

Abreu D (1986) Extremal equilibria of oligopolistic supergames. J Econ Theory 39:191–225

Abreu D (1988) On the theory of infinitely repeated games with discounting. Econometrica 56:383–396

Aoyagi M (2003) Bid rotation and collusion in repeated auctions. J Econ Theory 112:79–105

Brock WA, Scheinkman JA (1985) Price setting supergames with capacity constraints. Rev Econ Stud 52:371–382

Jentzsch N, Sapi G, Suleymanova I (2013) Targeted pricing and customer data sharing among rivals. Int J Ind Organ 31:131–144

Lambson VE (1987) Optimal penal codes in price-setting supergames with capacity constraints. Rev Econ Stud 54:385–397

Lambson VE (1994) Some results on optimal penal codes in asymmetric Bertrand supergames. J Econ Theory 62:444–468

Levitan R, Shubik M (1972) Price duopoly and capacity constraints. Int Econ Rev 13:111–122

Liu Q, Serfes K (2006) Customer information sharing among rival firms. Eur Econ Rev 50:1571–1600

Radner R, Myerson R, Maskin E (1986) An example of a repeated partnership game with discounting and with uniformly inefficient equilibria. Rev Econ Stud 53:59–69

Rob R, Sekiguchi T (2006) Reputation and turnover. Rand J Econ 37:341–361

Shy O, Stenbacka R (2016) Customer privacy and competition. J Econ Manag Strategy 25:539–562

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author has no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This paper is based on my doctoral dissertation, which is submitted to Kyoto University. I am especially grateful to my supervisor Tadashi Sekiguchi for many thoughtful and helpful comments. We also thank the associate editor, whose comments significantly improved the paper.

Appendix

Appendix

Proof of Proposition 1

First, we consider the case in which \(k < 1/2\). Note that \(R^{S}(p_{l},p_{h}) \geqslant R^{S}(1-2k,1-k) =(1 -2k)k + (1 - k)k = k(2 - 3k)\). Suppose that \(p_{l} < 1 - 2k\). Note that \(\pi _{l,S} < (1 - 2k)k\) and \(\pi _{h,S} \leqq (1 - k)k\) always holds, since \(k < 1/2\) and \(1-p_{l} \geqslant k\). This is a contradiction. Next, suppose that \(p_{l} \geqslant 1 - k\). Note that \(\pi _{l,S} + \pi _{h,S} = p_{l}(1 -p_{l}) \leqq (1 - k)k < k(2 - 3k)\), since \(k < 1/2\). This is a contradiction. Thus, we consider the case in which \(1 - 2k \leqq p_{l} < 1 - k\) in the following.

Note that \(R^{S}(p_{l},p_{l}+k) = p_{l}k + (p_{l} + k)(1- p_{l} - k)\), since \(1 - p_{l} - k \leqq k\). Suppose that \(p_{h} > p_{l} + k\). Note that \(p_{l} + k \geqslant 1-k > 1/2\), since \(k < 1/2\). Thus, we have \(\pi _{l,S} + \pi _{h,S} < p_{l}k + (p_{l} + k)(1 - p_{l} - k)\), since \(\pi _{h,S} = p_{h}(1 - p_{h}) < (p_{l} + k)(1 - p_{l} - k)\). This is a contradiction.

Suppose that \(p_{l}< p_{h} < p_{l} + k\). Note that \(\pi _{l,S} + \pi _{h,S} = p_{l}k+p_{h} (1-p_{l}-k) < R^{S}(p_{l},p_{l}+k)\), since \(\max \big \{0, \min \{1-p_{l}-k,1-p_{h},k\} \big \} = 1-p_{l}-k\). This is a contradiction.

Suppose that \(p_{h} = p_{l}.\) Since \(p_{l} \geqslant 1 - 2k\), the total sales of both firms is \(1 - p_{l}\). Thus note that \(\pi _{l,S} + \pi _{h,S} = p_{l}(1 - p_{l}) < p_{l}k + (p_{l} + k)(1 - p_{l} - k)\). This is because \(p_{l}k + (p_{l} + k)(1 - p_{l} - k) - p_{l}(1 - p_{l}) = k(1 - k - p_{l}) > 0\), since \(p_{l} < 1 - k\). This is a contradiction.

Therefore, \(\pi _{S} = \max _{1-2k \leqq p_{l} <1-k} \big \{ p_{l}k+ (p_{l} + k)(1 - p_{l} - k) \big \}.\) We find that if \(k \leqq 1/3\), then \(p_{l} = 1 - 2k\) and \(p_{h} = 1 -k\), since \(\frac{1-k}{2} \leqq 1-2k\). In this case, \(\pi _{l,S} = (1 - 2k)k\), \(\pi _{h,S} = (1 - k)k\) and thus \(\pi _{S} =2k-3k^{2}.\) Also, we find that if \(1/3 \leqq k (< 1/2)\), then \(p_{l}=\frac{1-k}{2}\) and \(p_{h}=\frac{1+k}{2}\), since \(1-2k \leqq \frac{1-k}{2}\). In this case, \(\pi _{l,S} = \frac{1-k}{2} \cdot k\), \(\pi _{h,S} = \frac{1+k}{2} \cdot \frac{1-k}{2}= \frac{1-k^{2}}{4}\) and thus \(\pi _{S} = \frac{1+2k-3k^{2}}{4}.\)

Second, we consider the case in which \(k \geqslant 1/2\). Consider the price pair \((p_{l}',p_{h}')\) such that \(p_{h}' \geqslant p_{l}' \geqslant 1 - k\). Note that \(\max _{1-k \leqq p_{l}', p_{h}'} R^{S}(p_{l}',p_{h}') = R^{S}(1/2,1/2) = 1/4\).

Next, consider the price pair \((p_{l}', p_{h}')\) such that \(1-k >p_{l}'\) and \(p_{l}' \leqq p_{h}'\). Note that \(R^{S}(p_{l}',p_{l}'+k) =p_{l}'k+ (p_{l}' + k)(1 - p_{l}' - k)\). Suppose that \(p_{h}' > p_{l}' + k\), then note that \(R^{S}(p_{l}',p_{h}') =p_{l}'k+p_{h}'(1-p_{h}') <p_{l}'k+ (p_{l}' + k)(1 - p_{l}' - k)\), since \(p_{h}'(1-p_{h}') < (p_{l}' + k)(1 - p_{l}' - k)\). This is because \(p_{l}' + k \geqslant 1/2\), since \(k \geqslant 1/2\).

On the other hand, suppose that \(p_{h}' < p_{l}' + k\). Then note that \(R^{S}(p_{l}',p_{h}') < p_{l}'k+ (p_{l}' + k)(1 - p_{l}' - k)\), by the same discussion of the case in which \(k < 1/2\). Thus, we find that under the constraint that \(p_{l}' < 1 - k\), \(\max _{p_{l}',p_{h}'} R^{S}(p_{l}',p_{h}') = R^{S}(\frac{1-k}{2},\frac{1+k}{2}) = \frac{1+2k-3k^{2}}{4}\).

Therefore, \(\pi _{S} = \max \{1/4, \frac{1+2k-3k^{2}}{4}\}\). We find that if \((1/2 \leqq )k<2/3\), then \(\pi _{S} = \frac{1+2k-3k^{2}}{4} >1/4\) and \((p_{l},p_{h}) = (\frac{1-k}{2},\frac{1+k}{2})\). In this case, \(\pi _{l,S} = \frac{1-k}{2} \cdot k\), \(\pi _{h,S} = \frac{1+k}{2} \cdot \frac{1-k}{2}= \frac{1-k^{2}}{4}\). We also find that if \(k=2/3\), then \(\pi _{S} = \frac{1+2k-3k^{2}}{4}=1/4\) and either (a) \((p_{l},p_{h}) = (1/2,p)\) such that \(p \geqslant 1/2\), or (b) \((p_{l},p_{h}) = (1/6, 5/6)\). In addition, we also note that if \(2/3 <k\), then \(\pi _{S} = 1/4 > \frac{1+2k-3k^{2}}{4}\) and \((p_{l},p_{h}) = (1/2,p)\) such that \(p \geqslant 1/2\).

By the above discussions, we have proven Proposition 1. \(\square\)

Proof of Proposition 2

We first show that \(\pi _{E} = \max _{p} R^{E}(p,p)\). Suppose that \(\pi _{E} = R^{E}(p_{l}',p_{h}')\) for some \(p_{l}' < p_{h}'\). If \(p_{l}' \geqslant 1-k\), then \(R^{E} (p_{l}', p_{h}' ) = R^{E} (p_{l}',p_{l}' ).\)

If \(p_{h}'> 1- k > p_{l}'\), then \(R^{E}(p_{l}',p_{h}') = p_{l}'k \leqq R^{E}(p_{l}',p_{l}')=p_{l}' \cdot \min \{1 - p_{l}',2k\}\).

If \(p_{h}' \leqq 1 - k\), then \(R^{E}(p_{l}',p_{h}') = p_{l}'k + p_{h}' \cdot \min \{ 1 - p_{h}' - k, k\} < R^{E}(p_{h}',p_{h}') = p_{h}' \cdot \min \{ 1-p_{h}', 2k \}\). Therefore, \(\pi _{E} = \max _{p} R^{E}(p,p)\).

Second, we find a solution of \(\max _{p} R^{E}(p,p)\). Note that \(R^{E} (p,p) = p \cdot \min \{1-p, 2k \}\).

- (i):

-

If \(k \leqq 1/4\), then \(p_{1,E} = p_{2,E} = 1 - 2k\). In this case, \(\pi _{1,E} = \pi _{2,E} = (1 - 2k)k\) and thus \(\pi _{E} = (1 - 2k)2k.\)

- (ii):

-

If \(1/4 \leqq k <1/2\), then \(p_{1,E} = p_{2,E} = 1/2\). In this case, \(\pi _{1,E} = \pi _{2,E} = 1/8\) and thus \(\pi _{E} = 1/4\).

Finally, note that if \(1/2 \leqq k\), then \(R^{E}(1/2,1/2) = R^{E}(1/2, p_{2})\) for any \(p_{2}>1/2\) and we show the following.

- (iii):

-

If \(1/2 \leqq k\), then \(\pi _{E} = 1/4\), and \(p_{2,E} \geqslant p_{1,E} = 1/2\).

\(\square\)

Proof of Proposition 3

Recalling Propositions 1 and 2, if \(k < 1/4\), then \(\pi _{E} = (1-2k) \cdot 2k < \pi _{S} = 2k-3k^{2}\). Also, if \(1/4 \leqq k \leqq 1/3\), then \(\pi _{E} = 1/4 < \pi _{S} =2k-3k^{2}\). Also, if \(1/3 \leqq k<2/3\), then \(\pi _{E} = 1/4 < \pi _{S} =\frac{1+2k-3k^{2}}{4}\). Also, if \(2/3 \leqq k\), then \(\pi _{E} = \pi _{S} = 1/4\). \(\square\)

Proof of Proposition 4

Suppose that firm 2 charges the price \(p_{S}^{\min } = (1 - 3k + \sqrt{5k^{2}-2k+1} \, )/2\). Firm 1 charging a price \(p_{1} > p_{S}^{\min }\) confronts the demand, \(\max \big \{0,\min \{1-p_{S}^{\min }-k,1-p_{1},k \} \big \}\). Since \(0< 1-p_{S}^{\min }-k < k\),

Note that

Since \(p_{S}^{\min }+k > 1/2\), \(r_{1}^{S}(p_{1},p_{S}^{\min }) < r_{1}^{S}(p_{S}^{\min } + k,p_{S}^{\min })\) for any \(p_{1} > p_{S}^{\min } + k.\) Furthermore, for any \(p_{1} \in (p_{S}^{\min },p_{S}^{\min }+k)\), \(r_{1}^{S}(p_{1},p_{S}^{\min }) < r_{1}^{S}(p_{S}^{\min } + k,p_{S}^{\min })\).

On the other hand, since \(k< 1-p_{S}^{\min }<2k\),

It is also clear that \(r_{1}^{S}(p_{1},p_{S}^{\min }) < r_{1}^{S}(p_{S}^{\min } + k,p_{S}^{\min })\) for any \(p_{1} \leqq p_{S}^{\min }\). To summarize, \(p_{S}^{\min }+k\) is a unique best response to \(p_{S}^{\min }\).

Next, consider the case in which firm 2 charges a price \(p_{2} < p_{S}^{\min }\). Thus, for sufficiently small \(\epsilon >0\), firm 1 charging the price \(p_{S}^{\min } + k-\epsilon\) confronts the demand, \(\max \big \{0,\min \{1-p_{2}-k,1-p_{S}^{\min }-k+\epsilon ,k \} \big \}= 1-p_{S}^{\min }-k+\epsilon\). Note that \(r_{1}^{S}(p_{S}^{\min }+k-\epsilon ,p_{2}) = (1-p_{S}^{\min }-k+\epsilon )(p_{S}^{\min }+k-\epsilon ) > (1-p_{S}^{\min }-k)(p_{S}^{\min }+k) = k p_{S}^{\min }\) for sufficiently small \(\epsilon >0\), since \(p_{S}^{\min } + k > 1/2\). Hence \(\sup _{p_{1}} r_{1}^{S}(p_{1},p_{2}) > k p_{S}^{\min }.\)

Finally, consider the case in which firm 2 charges a price \(p_{2} > p_{S}^{\min }\). Since \(1-p_{S}^{\min }-k>0\), \(r_{1}^{S}(p_{S}^{\min }+\epsilon ,p_{2})=(p_{S}^{\min }+\epsilon ) \min \{1-p_{S}^{\min }-\epsilon ,k\} =(p_{S}^{\min }+\epsilon )k > kp_{S}^{\min }\) for sufficiently small \(\epsilon >0\). Hence \(\sup _{p_{1}} r_{1}^{S}(p_{1},p_{2}) > k p_{S}^{\min }.\)

To conclude, \(kp_{S}^{\min } = \max _{p_{1}} r_{1}^{S}(p_{1},p_{S}^{\min }) = \min _{p_{2}} \sup _{p_{1}} r_{1}^{S}(p_{1},p_{2})={\underline{v}}^{S}.\) \(\square\)

Proof of Proposition 6

First, consider the case in which \(k \leqq 1/3\). We have

Second, consider the case in which \(1/3< k < 1\). We have

Note that \(-7k^{2} + 4k - 1 < 0\). Next, we have

Let \(L(k)=29k^{3} - 19k^{2} + 7k - 1\). Note that \(L^{'}(k) = 87(k - \frac{19}{87})^{2}+\frac{248}{87} >0\), and that \(L(1/3) = \frac{8}{27}\). Thus, \(L(k) > 0\) if \(1/3< k < 1\). We have shown that \({\underline{v}}^{S}-{\underline{v}}^{E}>0\). \(\square\)

Proof of Proposition 8

(a). Consider the following trigger strategy; Unless some deviations happen, the SAP is played. Once a firm deviates, a rival firm punishes a deviator by the repetition of charging the price \(p_{S}^{\min }\). On the other hand, the deviator charges the price \(p_{S}^{\min } +k\) every period. When both firms deviate at the same time, firm 1 charges the price \(p_{S}^{\min } +k\), and firm 2 charges the price \(p_{S}^{\min }\) henceforth.

Note that if \(k < 2/3\), then charging \(p_{h}\) is a best response to charging \(p_{l}\) in the stage game. Thus, it is enough to consider the incentive of the firm which charges \(p_{l}\) at the initial period on the SAP. Recall that if \(k \geqslant 2/3\), we focus on the price pair \((p_{l},p_{h})=(1/2, \, 1/2)\). In this case, it is also enough to consider the incentive of the firm which charges \(p_{l}\) at the initial period on the SAP by the symmetry.

Denote the value of firm 1, which charges \(p_{l}\) at the initial period on the SAP by

Thus, the SAP can be sustained under an \({ NE}\) if and only if

Multiplying \(1+\delta\), we have

This is (C1).

(b). We first prove the following lemma. \(\square\)

Lemma 1

For any k, (i) \(\pi _{S} - 2 {\underline{v}}^{S} >0\), (ii) \(T_{l,S} - {\underline{v}}^{S} > 0\), and (iii) \(\pi _{l,S} - T_{l,S} <0\) hold.

(i) Note that \(2 {\underline{v}}^{S} = R^{S} ( p_{S}^{\min }, \, p_{S}^{\min } +k )\) and \(\pi _{S} - 2 {\underline{v}}^{S} \geqslant 0\) for any k. Suppose that \(\pi _{S} - 2 {\underline{v}}^{S}=0\). From Proposition 4, it is clear that if \(k < 2/3\), then \(p_{S}^{\min } = p_{l}\) must hold. However, if \(k \leqq 1/3\), then we have \(p_{S}^{\min } = \big (1-3k+\sqrt{5k^{2}-2k+1} \, \big )/2 \ne 1-2k\). Also, if \(1/3 \leqq k \leqq 2/3\), then we have \(p_{S}^{\min } = \big (1-3k+\sqrt{5k^{2}-2k+1} \, \big )/2 \ne (1-k)/2\). These are contradictions.

In addition, note that if \(2/3 <k\), then \(p_{S}^{\min } =1/2\) must hold. However, if \(2/3 \leqq k\), then we have \(p_{S}^{\min } = \big (1-3k+\sqrt{5k^{2}-2k+1} \, \big )/2 \ne 1/2\), since \(-3k+\sqrt{5k^{2}-2k+1} <0\). This is a contradiction.

Also, note that if \(k =2/3\), then either \(p_{S}^{\min } =(1-k)/2\) or \(p_{S}^{\min } =1/2\) must hold. However, these do not hold because of the previous arguments. This is a contradiction. Thus, \(\pi _{S} - 2 {\underline{v}}^{S} >0\) for any k.

(ii) We have \(T_{l,S}-{\underline{v}}^{S} >0\) by the definition of \(T_{l,S}\) and the uniqueness of \(p_{S}^{\min }\).

(iii) Since we consider an SAP, \(\pi _{l,S} = 1/8\) when \(2/3 \le k\). For any k, \(\pi _{l,S} - T_{l,S} <0\) holds by Proposition 2 and the Eq. (1).

Now, we define \(f (\delta )\) as

By (ii) of Lemma 1, \(f (\delta )\) is strictly convex. Also, \(f (0) <0\) by (iii) of Lemma 1 and \(f (1) > 0\) by (i) of Lemma 1. Then there exists a unique \({\underline{\delta }} (k) \in (0,1)\) such that \(f (\delta ) \ge 0\) if and only if \(\delta \ge {\underline{\delta }} (k)\). Also, we have

since \(f (\delta )\) is quadratic and strictly convex.

More specifically, \({\underline{\delta }}(k)\) is as follows.

(i) If \(k \leqq 1/3\), we have \(T_{l,S} = (1-k)k\), \(\pi _{l,S} = (1-2k)k\) and \(\pi _{h,S} = (1-k)k\). Substituting these to (\(**\)), we have

(ii) If \(1/3 \leqq k \leqq 1/2\), we have \(T_{l,S} = (1-k)k\), \(\pi _{l,S} = (1-k)k/2\) and \(\pi _{h,S} = (1-k^{2})/4\). Substituting these to (\(**\)), we have

(iii) If \(1/2 \leqq k < 2/3\), we have \(T_{l,S} = 1/4\), \(\pi _{l,S} = (1-k)k/2\) and \(\pi _{h,S} = (1-k^{2})/4\). Substituting these to (\(**\)), we have

(iv) If \(2/3 \leqq k\), we have \(T_{l,S} = 1/4\), \(\pi _{l,S} = 1/8\) and \(\pi _{h,S} = 1/8\). Substituting these to (\(**\)), we have

(c). We first prove the following Lemma 2.

Lemma 2

If (C1) holds, the following also holds.

Let \(D(\delta )\) be the difference between the left hand side of (C1) and that of (C2).

Note that \(D(1) = \pi _{h,S}+\pi _{l,S}-\pi _{S} = 0\). Since

we have

We can easily confirm that if \(k \leqq 1/2\), then \(D(0) < 0\) holds, since \(\sqrt{5k^{2}-2k+1} = \sqrt{(1-k)^{2} + (2k)^{2}}\). Consider the case in which \(1/2 \leqq k\). Let us denote H(k) by

We observe that \(H(1/2) = 1/4\) and that if \(1/2 \leqq k\), then \(H^{'}(k) = 8(2k - 1)(5k^{2} + k - 1) \geqslant 0\). Thus, note that if \(1/2 \leqq k < 2/3\), then \(D(0) < 0\) holds. Also, we can confirm that if \(2/3 \leqq k\), then \(D(0) < 0\) holds, since

To conclude, \(D(\delta ) \leqq 0\), since \(T_{l,S} - {\underline{v}}^{S} >0\) by (ii) of Lemma 1.

Second, fix k and \(\delta \geqslant {\underline{\delta }}(k)\). Consider the following strategy profile \(\sigma ( \delta )\):

-

Unless some deviations happen, both firms play an SAP. When some deviations happen, both firms switch to the worst stick-and-carrot equilibrium from the next period. In the worst stick-and-carrot equilibrium, both firms charge the minmax price mutually at the initial period. Next period, each firm behaves in the following manner. (i) The case in which \(k<2/3\); With the probability \(\gamma (\delta )\), both firms switch to the collusive behavior such that both firms choose the two SAPs with equal probability, using randomization devices, and henceforth they play the SAP. Also, both firms replay the worst stick-and-carrot equilibrium with the remaining probability \(1 - \gamma (\delta )\). (ii) The case in which \(k \geqslant 2/3\); Both firms switch to the fully collusive path, which is the unique SAP, with the probability \(\gamma (\delta )\) and replay the worst stick-and-carrot equilibrium with the remaining probability \(1 - \gamma (\delta )\). The probability \(\gamma (\delta )\) is as follows.

$$\begin{aligned} \gamma (\delta ) = \frac{(1-\delta )({\underline{v}}^{S}-M)}{\delta \big ( \frac{\pi _{S}}{2}- {\underline{v}}^{S} \big )}. \end{aligned}$$Also, in the worst stick-and-carrot equilibrium, both firms switch to the worst stick-and-carrot equilibrium with probability 1 after some deviations.

Note that \(\delta ( \frac{\pi _{S}}{2} - {\underline{v}}^{S} ) > 0\) by (i) of Lemma 1. Also, note that if (C2) holds, then \(\gamma (\delta ) \leqq 1\) and \(\sigma (\delta )\) is well-defined. By the construction, the value of a firm in the worst stick-and-carrot equilibrium W is

We solve this by using the definition of \(\gamma (\delta )\) to have

Therefore, a firm in the worst stick-and-carrot equilibrium indeed earns \({\underline{v}}^{S}\).

Thus, we have shown this proposition by Proposition 8(a),(b) and Lemma 2. \(\square\)

Proof of Proposition 9

(a) Suppose that \(k < 1/4\). Since \(1-2k < p_{S}^{\min }\) and \({\underline{v}}^{S} = p_{S}^{\min } \cdot k\), \(\hat{\pi } = (1-2k) k < {\underline{v}}^{S}\). Therefore, the SMP cannot be sustained by an SPE.

Suppose that \(k \ge 1/4\). Then the sign of \(({\underline{v}}^{S} - \hat{\pi })\) corresponds to that of Q(k). Since \(Q (k) > 0\) at any \(k \in [1/4, k')\), the SMP cannot be sustained by an SPE.

Suppose that \(k = k'\). Then \(\hat{\pi } = {\underline{v}}^{S}\) since \(Q (k') =0\). On the other hand, \(\sup _{p_{1}} r_{1}^{S}(p_{1}, 1/2) = 1/4 > \hat{\pi }\). This means that the value of a firm which deviates at an initial period in the SMP is at least \((1-\delta )1/4 + \delta {\underline{v}}^{S}\). Therefore, the SMP cannot be sustained by an SPE if \(k = k'\).

(b) Suppose that \(k \in ( k', 2/3)\). Then \(\hat{\pi } = 1/8 > {\underline{v}}^{S}\) since \(Q (k) <0\). First, as with the proof of Proposition 8(a), the SMP can be sustained under an \({ NE}\) if and only if

This is equivalent to

Note that (\(C1'\)) holds if \(\delta \ge \tilde{\delta } (k)\), where

Second, we construct a worst stick-and-carrot equilibrium, which grants each firm to \({\underline{v}}^{S}\) in a similar manner in the proof of Proposition 8(c); in the worst stick-and-carrot equilibrium, both firms charge the price \(p^{\min }_{S}\) mutually at the initial period. Next period, both firms switch to the SMP with an appropriate probability \(\gamma (\delta ) = \frac{(1-\delta )({\underline{v}}^{S} - M)}{\delta \big (\frac{1}{8} - {\underline{v}}^{S} \big )}\) and replay the worst stick-and-carrot equilibrium with the remaining probability.

Recalling \(M=p_{S}^{\min } \cdot (1-p_{S}^{\min })/2\) and \(1/8 > M\) at any \(k \in (k', 2/3)\), note that if

holds, then \(\gamma (\delta ) \leqq 1\). Also, by the construction, the value of a firm in the worst stick-and-carrot equilibrium is \({\underline{v}}^{S}\). Note that (\(C2'\)) holds if \(\delta \ge \overline{\delta } (k)\), where

Third, we show that if (\(C1'\)) holds, then (\(C2'\)) also holds. Let \(\overline{D}(\delta )\) be the difference between the left hand side of (\(C1'\)) and that of (\(C2'\)).

Since \(Q (k) <0\), \(\Big ( \frac{1}{8} - {\underline{v}}^{S} + M \Big ) >0\). Also, note that \(\overline{D} (1) =0\) and \(\overline{D} (0) = - \Big ( \frac{1}{8} - {\underline{v}}^{S} + M \Big ) < 0\). Therefore, if (\(C1'\)) holds, then (\(C2'\)) also holds. Then, we have \(\underline{\underline{{\delta }}} (k) = \tilde{\delta } (k) > \overline{\delta } (k)\). \(\square\)

Proof of Proposition 10

Suppose that \(k \in (k', 2/3)\). First, we show the following Lemma 3. \(\square\)

Lemma 3

If \(k \in (k', 2/3)\), then \({\underline{v}}^{S}\) is decreasing in k.

The proof of Lemma 3 is as follows. The derivative of the numerator of \({\underline{v}}^{S}\) is

Note that \((1-6k) \sqrt{5 k^{2} - 2k +1} < 0\) and \(10 k^{2} - 3k+1 >0\) for any \(k \in (k', 2/3)\). We have

Therefore, the derivative of \({\underline{v}}^{S}\) is strictly negative for all \(k \in (k', 2/3)\).

By Lemma 3 and (\(C1'\)), if \(k \in (k', 2/3)\), then \(\tilde{\delta } (k)\) is decreasing in k. Therefore, if \(k \in (k', 2/3)\), then \(\underline{{\underline{\delta }}} (k)\) is decreasing in k, since \(\underline{{\underline{\delta }}} (k) = \tilde{\delta } (k)\) in the proof of Proposition 9(b).

Second, we denote \(V^{1}\) by the value of firm 1 which charges \(p_{l}\) at the initial period on an SAP.

Note that \(V^{1}\) is increasing in \(\delta\). Also, \(V^{1} > 1/8\) if and only if \(\delta \ge I (k)\), where

Also, if \(k \in (k', 2/3)\), then I(k) is increasing in k, since

and \(-4 (2k^{2}-3k+1) >0\) for any \(k \in (k', 2/3)\).

Third, \(\lim _{k \rightarrow 2/3} I (k) = 1\) and \(\lim _{k \rightarrow k'} \underline{{\underline{\delta }}} (k) = 1\). Therefore, there exists \(k'' \in (k', 2/3)\) such that if \(k \in (k', k'')\), then \(\underline{{\underline{\delta }}} (k) > I (k)\) and if \(k \in (k'', 2/3)\), then \(\underline{{\underline{\delta }}} (k) < I (k)\). Also, if \(k = k''\), then \(\underline{{\underline{\delta }}} (k) = I (k)\).

If \(k \in (k', k'')\), then under \(\delta = \underline{{\underline{\delta }}} (k)\),

From this, we have \({\underline{\delta }} (k) < \underline{{\underline{\delta }}} (k)\) if \(k \in (k', k'')\).

If \(k = k''\), then under \(\delta = \underline{{\underline{\delta }}} (k)\),

From this, we have \({\underline{\delta }} (k) = \underline{{\underline{\delta }}} (k)\) if \(k = k''\).

If \(k \in (k'', 2/3)\), then under \(\delta = \underline{{\underline{\delta }}} (k)\),

From this, we have \({\underline{\delta }} (k) > \underline{{\underline{\delta }}} (k)\) if \(k \in (k'', 2/3)\). \(\square\)

Proof of Proposition 11

Suppose that \(k \in (k', 2/3)\) and \(\delta \ge \max \big \{ {\underline{\delta }} (k), \underline{{\underline{\delta }}} (k), I (k) \big \}\). We denote a payoff vector of an SAP by \((V^{1}, V^{2})\) where \(V^{1}\) is the payoff of firm 1 charging \(p_{l}\) at the initial period and \(V^{2}\) is the payoff of firm 2 charging \(p_{h}\) at the initial period on the SAP. That is,

and \(V^{2} > V^{1}\) since \(\pi _{h,S} > \pi _{l,S}\). Also, we find \(V^{1} \ge 1/8\), since \(\delta \ge I (k)\). Therefore, the payoff vector of the SMP (1/8, 1/8) is Pareto dominated by \((V^{1}, V^{2})\). \(\square\)

Proof of Proposition 12

Consider \({\underline{\delta }}(k)\) in the case of \(k \le 1/3\). From Proposition 8(b), note that \({\underline{\delta }}(k)\) is the greater solution of the following equation.

This is equivalent to

From this, we have

Reformulating this, we have

From this, we see that \({\underline{\delta }}(k)\) is increasing in k when \(k \leqq 1/3\). \(\square\)

Proof of Proposition 13

First, it is clear that if \(k \leqq 1/4\), then \(\delta ^{E} (k) < {\underline{\delta }} (k)\), since \(\delta ^{E} (k) =0\) and \({\underline{\delta }} (k) >0\).

Second, consider the case in which \(1/4<k \leqq 1/3\). Note that \(\delta ^{E}(k) = 1/4k\) is decreasing in k. We observe that

Also, recall that \({\underline{\delta }}(k)\) is increasing in k by Proposition 12. We observe that

Therefore, we have shown that there exists \(\hat{k} \in (1/4,1/3)\) such that if \(1/4 < k \leqq \hat{k}\), then \({\underline{\delta }}(k) \leqq \delta ^{E}(k)\) holds and \({\underline{\delta }} (k) = \delta ^{E} (k)\) if and only if \(k = \hat{k}\). Also, we have shown that if \(\hat{k} < k \leqq 1/3\), then \(\delta ^{E} (k) < {\underline{\delta }} (k)\).

Third, consider the case in which \(1/3 \leqq k \leqq 1/2\). Note that \(\delta ^{E}(k)=\frac{4k-1}{2(4k-k^{2}-1)}\). Also, note that \(\delta ^{E}(k)\) is decreasing in k and that \(\delta ^{E} (1/3) = 3/4\). Thus, \(\delta ^{E} (k) \leqq 3/4\). Then, we have

where \(f (\delta )\) is defined by (\(*\))

We restrict our attentions to the numerator to show that \(f (3/4)<0\). It is clear that \(55k^{2} - 19k + 6 > 0\). Also, we define

Note that \(J_{ii}^{''} (k) = -2460k^{2}+ 1812k-290\), which is concave. Since \(J_{ii}^{''} (1/3) = 122/3 >0\) and \(J_{ii}^{''} (1/2) = 1 >0\), \(J_{ii}^{''} (k) >0\) for any \(k \in [1/3, 1/2]\). Since \(J_{ii}^{'} (k) = -820k^{3} + 906k^{2}-290k+57\), \(J_{ii}^{'} (1/3) = 827/27 >0\) and \(J_{ii} (1/3) = 206/81 >0\), \(J_{ii} (k) >0\) for any \(k \in [1/3, 1/2]\). Thus, \(55k^{2} - 19k + 6 - 21k\sqrt{5k^{2}-2k+1} < 0\) when \(1/3 \leqq k \leqq 1/2\). Therefore, \(\delta ^{E} (k) < {\underline{\delta }} (k)\), since \(f (3/4)<0\).

Fourth, consider the case in which \(1/2 \leqq k \leqq 2/3\). Note that \(\delta ^{E}(k) = \frac{1}{2k(2-k)}\). Also, note that \(\delta ^{E}(k)\) is decreasing in k and \(\delta ^{E}(1/2) = 2/3\). Thus, \(\delta ^{E} (k) \leqq 2/3\). Then we have

where \(f (\delta )\) is defined by (\(*\)).

We restrict our attentions to the numerator to show that \(f (2/3)<0\). It is clear that \(1 - 2k + 36k^{2} > 0\). Also, we define

Note that \(J_{iii}^{''} (k) = 8448k^{2}-3936k+648 >0.\) Since \(J_{iii}^{'} (k) = 2816k^{3} -1968k^{2}+ 648k+4\), \(J_{iii}^{'} (1/2) = 188 >0\) and \(J_{iii} (1/2) = 44 >0\), \(J_{iii} (k) >0\) for any \(k \in [1/2, 2/3]\). Thus, \(1-2k+36k^{2} - 20k \sqrt{5k^{2}-2k+1} <0\). Therefore, \(\delta ^{E} (k) < {\underline{\delta }} (k)\), since \(f (2/3)<0.\)

Finally, consider the case in which \(2/3<k\). Considering the incentives on the SAP under S rule and the full collusion path under E rule, respectively.

Thus, we have shown that \(\delta ^{E}(k) < {\underline{\delta }}(k)\), since \({\underline{v}}^{S} > {\underline{v}}^{E}\) by Proposition 6. \(\square\)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Notsu, T. Collusion with capacity constraints under a sales maximization rationing rule. Int J Game Theory 52, 485–516 (2023). https://doi.org/10.1007/s00182-022-00827-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-022-00827-y