Abstract

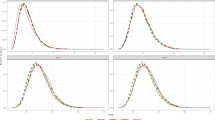

Time series forecasting is an important application of many statistical methods. When it is appropriate to assume that the data may be projected towards the future based on the past history of the dataset, a preliminary examination is usually required to ensure that the data sequence is autocorrelated. This is a quite obvious assumption that has to be made and can be the object of a formal test of hypotheses. The most widely used test is the portmanteau test, i.e., a sum of the squared standardized autocorrelations up to an appropriate maximum lag (the truncation point). The choice of the truncation point is not obvious and may be data-driven exploiting supplementary information, e.g. the largest autocorrelation and the lag where such maximum is found. In this paper, we propose a portmanteau test with a truncation point equal to the lag of the largest (absolute value) estimated autocorrelation. Theoretical and simulation-based comparisons based on size and power are performed with competing portmanteau tests, and encouraging results are obtained.

Similar content being viewed by others

Notes

However, the choice of q may not be simple, for example, Hill and Motegi (2020) selected \(q=3\).

The time needed for computing all entries in Table 1 was approximately 8 seconds on a desktop with an Intel i7 core vPro processor (2.53 GHz).

The range 1:20 is essentially exhaustive, since for \(20 \le L \le 50\), \(Pr\{M<1\}<0.001\) and \(Pr\{M>20\}<0.001\).

Density \(2f(x)F(\beta x)\), where f and F are the standard normal density and cumulative probability functions.

References

Anderson TW, Walker AM (1964) On the asymptotic distributions of the autocorrelations of a sample from a linear stochastic process. Ann Math Stat 35:1296–1303

Baragona R, Battaglia F, Cucina D (2022) Data-driven portmanteau tests for time series. TEST 31:675–698

Box GEP, Pierce DA (1970) Distribution of residual autocorrelations in autoregressive-integrated moving average time series models. J Am Stat Assoc 65:1509–1526

Coffrey CS, Muller KE (2000) Properties of doubly-truncated gamma variables. Commun Stat Theory Meth 29:851–857

Deo RS (2000) Spectral tests of the martingale hypothesis under conditional heteroscedasticity. J Econom 99:291–315

Dufour JM, Roy R (1986) Generalized portmanteau statistics and tests of randomness. Commun Stat Theory Meth 15:2953–2972

Escanciano JC, Lobato IN (2009) An automatic portmanteau test for serial correlation. J Econ 151:140–149

Gallagher CM, Fisher TJ (2015) On weighted portmanteau tests for time series goodness-of-fit. J Time Ser Anal 36:67–83

Guay A, Guerre E, Lazarova S (2013) Robust adaptive rate-optimal testing for the white noise hypothesis. J Econ 176:134–145

Hannan EJ, Heide C (1972) On limit theorems for quadratic functions of discrete time series. Ann Math Stat 43:2058–2066

Hill JB, Motegi K (2020) A max-correlation white noise test for weakly dependent time series. Economet Theor 36:907–960

Inglot T, Ledwina T (2006) Towards data driven selection of a penalty function for data driven Neyman test. Linear Algebra Appl 417:124–133

Kan R, Wang X (2010) On the distribution of the sample autocorrelation coefficients. J Econ 154:101–121

Katayama N (2008) An improvement of the portmanteau statistic. J Time Ser Anal 29:359–370

Lee WM (2007) Robust M tests using kernel-based estimators with bandwidth equal to sample size. Econ Lett 96:295–300

Ljung GM, Box GEP (1978) On a measure of lack of fit in time series models. Biometrika 65:297–303

McLeod AI, Li WK (1983) Diagnostic checking ARMA models using square-residual autocorrelations. J Time Ser Anal 4:269–273

Romano JP, Thombs LA (1996) Inference for autocorrelations under weak assumptions. J Am Stat Ass 91:590–600

Shao X (2011) Testing for white noise under unknown dependence and its applications to goodness-of-fit for time series models. Econom Theor 27:312–343

Xiao H, Wu WB (2014) Portmanteau test and simultaneous inference for serial covariances. Stat Sin 24:577–599

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendix. Approximate asymptotic distribution

Appendix. Approximate asymptotic distribution

We derive now the asymptotic distribution of the statistic \(Q_{max}\) under Assumptions A and S. It is obtained starting from the joint asymptotic distribution of \((M, Q_d ,p)\) where \(M= \max \{N{\hat{r}}(1)^2, N{\hat{r}}(2)^2, \ldots , N{\hat{r}}(L)^2\}\) and \(p = {{\mathrm{arg\,max}}_{1 \le j \le L}} \{ {\hat{r}}(j)^2 \}\), obtained in Baragona et al. (2022).

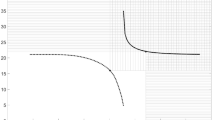

Under Assumptions A and S the asymptotic distribution of M is that of the maximum of L asymptotically independently distributed \(\chi ^2_1\) variables: \(\Pr \{M<x\}=\varPhi _1(x)^L\).

The joint distribution of M and \(Q_d\) for \(1 \le d \le L\) is considered in Baragona et al. (2022) (which the reader is referred to for more details) and has a different analytical expression if \(d<p\) or \(d \ge p\). We only need the expression for \(d=p\). In this case, when \(p=1\), \(Q_{max} \equiv M\), while for \(p>1\)

is the sum of M plus \((p-1)\) (asymptotically independent) chi squares with one degree of freedom and values limited from 0 to M. Therefore

where \(\Pr \{M=y\}\) denotes the density of the maximum: \(L \phi _1(y)\varPhi _1(y)^{L-1}\). The distribution function inside the integral equals asymptotically the probability that the sum \(S_{p-1}=Z_1+Z_2+\ldots +Z_{p-1}\) is less than \((x-y)\), where the \(Z_j\)’s are \((p-1)\) independent chi squares with one degree of freedom and truncated at M. The distribution of \(S_{p-1}\) may be approximated by a \(c \, \chi ^2_\nu \) variate with the same mean and variance, as usual. From the results of Coffrey and Muller (2000):

the following values for the constants c and \(\nu \) are obtained:

With this approximation we obtain

and finally

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Baragona, R., Battaglia, F. & Cucina, D. A simple portmanteau test with data-driven truncation point. Comput Stat 39, 733–749 (2024). https://doi.org/10.1007/s00180-022-01320-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00180-022-01320-6