Abstract

Distribution is a key aspect of insurers’ business models. Insurance companies use multi-channel and multi touch-point distribution methods to target their customers. Insurers must manage the distribution risk arising from actions of the distribution channel, which have the potential to impact the quality and volume of the insured portfolio, the insurer’s income-generating capacity, long-term financial sustainability and brand value. In this chapter we discuss the implications of the introduction of the Insurance Distribution Directive (IDD) on distribution risk management and on firm’s entire value chain. The expected impact of IDD main provisions (demands and needs analysis, suitability and appropriateness requirements, remuneration and incentive mechanisms, conflicts of interest dispositions, cross-selling, POG, information to customers, CPD) on product development, sales and distribution, underwriting and policy administration, claims, asset and customer management activities are analysed, considering the influence of digitalization on insurance distribution and value chain.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- Distribution risk

- Insurance Distribution Directive

- Risk management

- Digitalization in insurance

- InsurTech

- Digital intermediaries

JEL Codes

1 Introduction

Insurance companies use a wide range of distribution methods to target their customers (captive career agents, salaried employees, independent agents, brokers, corporate agents, insurance specific debit/credit cards, call centres, affinity group distribution—microfinance, retail outlets, post office, work site marketing, bancassurance, labour unions-, cell phone/PDA, kiosks, internet, e-commerce, work site and direct marketing), the relative importance of which depends upon the size and segmentation of the market, the available technological resources and innovation, competition and industry development and customer preferences.

Insurance distribution is currently at a turning point, as seen by the drastic changes in both the variety of emerging channels and transformation within channels. These distribution changes are driven by several key market forces including: (i) changing customer preferences and customer empowerment, with significant customer dissatisfaction and mistrust towards incumbents in the aftermath of the financial crisis and the deteriorating reputation of the financial services industry, increasing the willingness among customers (particularly the youngest) to try out new products and providers; (ii) connectivity and data, with customers increasingly connected and using mobile devices, demanding digital offerings, (iii) digital transformation and advancing technology (FinTech & InsurTech), with increasing infrastructure replacement, monetization of data and disintermediation of the value chain; (iv) an aging population, (v) new and more strict market regulations and increased regulatory scrutiny; and (vi) challenging market environment, poor market performance and economic uncertainty (e.g., low interest rate environment), that prevented incumbents to invest in the type of products, services, platforms, technology and distribution channels required to meet customer needs and expectations.

The number of distribution channels and partners is expected to increase, and insurers will have to align distribution channels to target customer segments offering “do-it-for-you, do-it-with-you, and do-it-yourself” products instead of “do-it-for-all” products. Customers want to receive from insurance the same levels of choice, convenience, transparency and value for money they enjoy across other industries, particularly (i) mobile solutions, (ii) connectedness at points of sale, (iii) data-driven personalization (target segmentation), (iv) on-demand services. New generations are strongly driven by price considerations. As a result, insurance products are likely to be sold more directly and in competitive markets at a lower price, reducing the share of distribution- and marketing-related expenses.

Distribution- and marketing-related activities can directly and indirectly pose significant financial risks to an insurer and other distribution channel participants, as well as to its customers. Risks caused by actions of the distribution channel (e.g., mis-selling, poor underwriting practices, reductions in the volume and quality of business, policyholder churn behaviour, partners risk), deficient management of an insurer’s distribution channel and agents (e.g., sales force qualifications, reputational risks due to inappropriate or fraudulent sales practices) have the potential to undermine an insurer’s income-generating capacity, long-term sustainability and brand value. In addition, supervisors are particularly vigilant with regards to inappropriate sales and service, which require consumer protection and consequential action.Footnote 1

The new legal framework regulating insurance distribution in EU Member States brought forward by the introduction of the Insurance Distribution Directive (IDD) in October 2018 raised the benchmark of minimum standards of insurance distribution and expanded the scope of regulation to include (re)insurers as well as (re)insurance intermediaries. In line with MiFID and PRIIPs, IDD aims at increasing consumer protection regardless of the distribution channel. IDD covers the entire distribution chain, including reinsurers, aggregators and price comparison websites from which individuals can buy insurance and distributors for whom insurance provides only ancillary services.

Key provisions included in the IDD include: (i) proper product oversight and governance, (ii) demands and needs analysis, suitability and appropriateness assessment; (iii) appropriate information to customers (PID—Insurance Product Information Document); (iv) more strict professional requirements, (v) Transparency on the existence of conflicts of interest (intermediaries must clearly state whether they are acting on behalf of the customer or the insurer), and (vi) Remuneration and incentive mechanisms (intermediaries must disclose the type and origin, the nature and basis of the compensation they receive in relation to a given contract of insurance).

In this chapter we identify and discuss the implications of the introduction of the IDD in the management of distribution risks in insurance companies. We revisit current insurance approaches to this risk and adopt a framework for the analysis covering both risks to the distribution channel, the impact of new underwriting practices caused by the distribution channel on the size and quality of insured portfolios, the impact of management decisions and poor management governance practices relating to the distribution channel and the way insurance companies address inappropriate market conduct risks and consumer protection. The design and implementation of sound distribution risk management guidelines and policies is expected to be within the scope of an insurer’s Enterprise Risk Management (ERM). Appropriate distribution risk management demands precise identification, measurement and management practices, along with the adoption of fair business conduct, fair and responsible pricing, and claims management.

The remainder of this chapter is organized as follows. In Sect. 2 we discuss the impact of digital transformation on insurance value chain primary activities, particularly on insurance distribution. In Section we catalogue and discuss the three main forms of distribution risk in insurance and their potential impact on the quality and volume of the insured portfolio or the insurer’s income-generating capacity and long-term financial sustainability and brand value. In Sect. 4 we critically examine the implications of the introduction of the Insurance Distribution Directive on distribution risk management and on firm’s entire value chain. Finally, Sect. 5 concludes.

2 Digital Transformation and the Changing Landscape for Insurer’s Distribution and Value Chain

Distribution is a key aspect of insurers’ business models. Insurance companies use a wide range of distribution methods to target their customers. The traditional model of insurance distribution involves direct sales employing own sales personnel (e.g., insurance agents, call centers, appointed representatives) and indirect sales using a captive and/or an independent network of agents, brokers and independent financial advisers (IFAs). In recent years technological innovation, digital transformation, increasing connectivity, data access, advances in predictive analytics, changing customer preferences and customer empowerment have broadened the distribution channels from the traditional paradigm to a wide range of direct and indirect channels between insurers and current and potential customers. The modern insurance distribution model is multi-channel and multi touch-point, includes the traditional intermediaries but incorporates new direct sales channels (e.g., internet, mobile devices) and new intermediaries such as banks, retailers, post office, affinity groups (e.g., members of a car club, sports organisations, union members), price comparison websites, managing general agents (MGA), broker networks and Peer-to-peer (P2P) groups. The increasing diversity of distribution channels follows consumers’ needs and preferences and varies across different countries, cultures, markets and even age groups. The number of distribution channels used by insurers and the channel selection process involves a cost/benefit analysis considering the types of products, services and customer segments they want to target, channel requirements by segment, an assessment of the existing business’s capabilities to meet customer requirements, a benchmark analysis against competitors, and an evaluation of the channel options.Footnote 2 The financial cost of using intermediaries include commission, training, monitoring and administration costs.

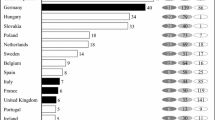

In Figs. 1 and 2 we plot the 2017 market share (computed in terms of gross written premiums) of the main distribution channels in Europe in the non-life and life insurance business, respectively.

Non-life distribution channels (% of GWP)—2017. Source: Insurance Europe Data. Notes: Market share computed in terms of gross written premiums (GWP). For NL, health is excluded. Also, “Other”, for 2013 and 2014, represents all non-direct distribution channels For SI, data is from SZZ members only. Branches of companies from EU/EEA countries and FOS are excluded

Life distribution channels in Europe (% of GWP)—2017). Source: Insurance Europe. Notes: Market share computed in terms of gross written premiums (GWP). For DE, employees are included under the category of Agents. For DE, SE and the UK, data is for new business only. For GR, there is no distinction between intermediaries. For NL, “Other” in 2013 and 2014 represents all non-direct distribution channels. For SI, data is from SZZ members only. Branches of companies from EU/EEA countries and FOS are excluded. For BE, bancassurance includes agents

We can observe that the relative importance of distribution channels varies significantly across countries and Lines of Business (LOB). For non-life products, direct sales through employees or distance-selling are predominant in some countries (e.g., Croatia, Luxembourg, Finland) but for most European countries reported intermediaries (agents and, to a lesser extent, brokers) are the largest distribution channels, particularly in countries like Italy, Poland, Portugal and Turkey. Bancassurance has a more modest share in non-life business in most countries. Contrarily, bancassurance is the main life distribution channel in many European markets, with notable exceptions in the United Kingdom, Slovenia, Greece, Poland and Luxembourg in which intermediaries are predominant and direct selling is also relevant in some countries.

Contrary to direct sales through employees, mobile technology and telematics do not constraint the location and timing of interactions between insurers and their customers. They will eventually enable customers to arrange most of their insurance needs through remote digital channels and are already affecting customer buying behaviour, from pre-sales activity such as soliciting advice and obtaining personalised quotes, to policy issuance and post-sales services for the policyholder.Footnote 3

The technology adoption trends observed in insurance in recent years include: (i) new tools for data acquisition and analysis such as Artificial Intelligence (AI), Big Data, the Internet of Things (IoT) (sensors and networks), Hyperscale computing, Enterprise Business Process Management (BPM), software that automates underwriting and claims or, (ii) technology for data storage, transaction and security such as Cloud computing, BockChain (mutual distribution ledgers) and digital security and (iii) technology for communication and sales such as mobile devices with apps, chatbots, robot-advisors, social networks, websites, video calls and video platforms. These technologies will first significantly change the way insurers and customers interact (e.g. chatbots, robot-advisors, social networks, video platforms). Second, they are increasingly being used to automatize, standardize and improve the effectiveness and efficiency of insurance business processes (e.g. sales, claims settlement, pricing). Finally, they create opportunities to redesign and customize existing insurance contracts (e.g. telematics insurance, pay-per-use) and to develop new ones.Footnote 4

The disruptive impact of digitalization will not trigger, at least in the short run, the end of insurance intermediaries, but for traditional intermediaries, who fear being replaced by direct sales methods, digital distribution is likely to create a distribution channel conflict, with agents and brokers less keen to remain loyal to a single insurer and more open to a multi-insurer, multi-product line of business. It is not clear how in the future customers will value the personal interaction and expert advice of traditional insurance distribution channels, but it is almost certain that insurance undertakings and distributors will need to alter their business models to meet the more demanding and diversified needs and preferences of customers.

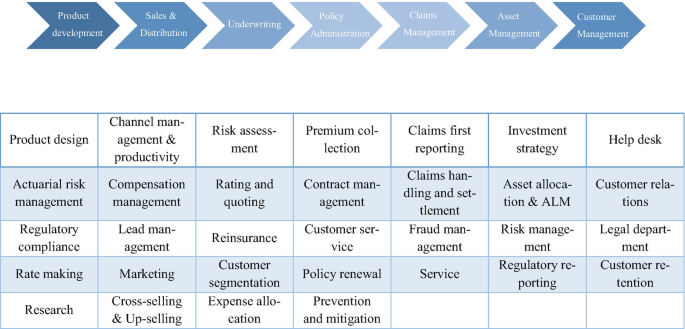

The importance of distribution in insurance goes well beyond the day-to-day activities related to a purchase/sale transaction and spreads out over the entire business value chain. Figure 3 plots the insurance business value chain primary activities, from product development, sales and distribution to customer management. We can observe that the activities in the insurance distribution process include the provision of and access to information on products, services and prices, expert advice, channel management, including productivity and compensation, cross-selling and up-selling activities, but also underwriting tasks, particularly risk assessment, rating and quoting, policy administration, customer service and policy renewal, premium collection and contract management, claims management, risk management and customer management. These activities have been traditionally developed by intermediaries such as captive or independent agents and brokers, but the enlargement of the distribution channel base is likely to disrupt many of the classical insurance value chain primary activities.

For instance, digitalization is changing the way insurance companies interact with their customers and how they reinvent themselves to meet the customer needs. From a distribution model in which customers typically required personal interaction for product information, demands and needs analysis or suitability and appropriateness assessment, we are moving towards a market in which customers get most information online, compare products and prices via aggregator platforms, purchased and settle contracts online without personal intervention. The buying journey for insurance may involve multiple touchpoints dispersed across different participants in the distribution chain in a more fragmented way. Moreover, in later stages of the value chain, telematics determines how much insurance premium you pay (e.g., pay-as-you-drive auto insurance), and online tools and apps assist in claims reporting and management. Help desks and chatbots assist in customer management. Moreover, digitalization is gradually automatizing business processes and decisions along the value chain, particularly in LOB such as motor insurance, health insurance and home insurance.

New technology has generated innovative personal Peer-to-Peer insurance (P2P) schemes (e.g., Friendsurance) and mutualising insurance, for instance, pooled annuity funds, modern tontines, risk-sharing contracts.Footnote 5 The new way of doing business in insurance demands new skills and capacities to extract economic value from the Big Datasets which are generated on a permanent basis by telematics devices, social networks and other sources. In a scenario in which insurers can use the additional information on individuals collected from multiple sources, they will be able to reinvent the underwriting process to structure smaller homogenous risk pools, with an important impact on the traditional implicit tax/subsidy embedded in pooling risks.Footnote 6

3 The Multiple Faces of Distribution Risk in Insurance

Insurance companies use multiple distribution channels to sell its products and the relationships they establish with distributors, partners and existing and potential customers (individuals, commercial companies, non-profit organizations, public entities) are one of their most important intangible assets. Insurance companies sell both short-term life insurance, motor, property, and other casualty insurance contracts and longer-duration complex insurance policies (e.g., variable annuities with embedded financial options) that establish a long-term customer relationship. Similar to other businesses, the risks associated with the entire distribution process can cause a tangible impact to an insurer’s long-term sustainability, reputation, brand value, and income-generating capacity, and should be part of a robust Enterprise risk management (ERM) framework in which insurers identify, measure, accept, control, report, and monitor all material risks. Distribution risks are ultimately the responsibility of the insurer, irrespective of the distribution channel used.

There are three main forms of distribution risk in insurance:Footnote 7

-

1.

Risks to the quality and volume of the insured portfolio caused by actions of the distribution channel;

-

2.

Risks to the insurer’s income-generating capacity, long-term financial sustainability and brand value caused by actions of the distribution channel;

-

3.

Risks to own distribution channels, which ultimately can affect the profitability and sustainability of companies.

The way insurance distribution channels perform in aligning the actual customer base with the insurer target markets, in terms of not only the size but also the quality of the insured pool, and the extent to which the observed frequency and the severity of risks deviates from the risk pricing assumptions and policyholder behaviour assumed at contract inception significantly influences the nature and type of exposure-to-risk the insurer will be subject to. Insurance distributors have often an important and relatively autonomous role in identifying potential customers and in the underwriting process, actively participating in risk selection. They are often more rewarded for the volume of new business created and less for the quality of business, more for bringing in new customers than for retaining existing policyholders. These incentive mechanisms often create conflicts of interest between the distributor profitability goals, the insurer long-term sustainability and customer interest. Frontloading distributors compensation, i.e., paying more at policy origination than at policy renewal has the potential to affect the distribution channel activities and its long-term sustainability. Distributors tend to become too dependent on generating new business for receiving regular cash flows, have little incentive to keep a policy in force and may not be able to maintain a stable and continuous income stream.Footnote 8

A poor risk selection process resulting in a claims experience inconsistent with pricing assumptions due to: (i) pre-contract informational asymmetry between the insurer and the insured and adverse selection (e.g., identifying potential customers with high-risk lifestyles—smokers, people employed in dangerous jobs, less experienced drivers) when compared to the general population, or to (ii) policyholder moral hazard resulting from misleading information provided and/or from an implicit incentive provided to individuals to take more risks than they normally would without insurance once covered by the insurance contract (e.g., engaging in dangerous driving after contracting maximum auto insurance coverage), or to (iii) applicant’s fraudulent operations or, finally to (iv) inappropriate underwriting of policies that do not fit the needs of customers, has the potential to significantly deteriorate insurer’s profitability. Insurance companies have many ways to mitigate the impact of adverse selection, moral hazard and fraudulent behaviour (e.g., by limiting the coverage, charging premium loadings, by adding exclusions) but the long-term effects of a poor risk selection process persist.

In the insurance market, the customers’ purchase process and claims management depends heavily on intermediaries. A poor risk selection process and inappropriate distribution channel activities are thus expected to have consequences on customer satisfaction, policyholder behaviour and abnormal lapse rates. For instance, an increase in premature voluntary policy terminations or the failure to pay insurance premiums relative to the insurer pricing expectations may be the result of insurance distribution intermediaries incentivising policyholders to swap insurance contracts (including moving to another insurer), not because there are acting in the best financial interest of the policyholder but simply because the broker receives larger front-end commissions for new long-term business or for moving blocks of short-term contracts from one company to another. Additionally, mis-selling practices at the distribution channel level are likely to raise discontent among policyholders and generate premature policy termination and low policy continuation, reducing the ability of insurers to recover acquisition expenses and impacting the company’s asset and liability management planning.Footnote 9 Moral hazard behaviour resulting in an abnormal frequency and severity of claims or fraudulent actions may sometimes have the connivance of the distribution channel. Some brokers may in extreme cases collude with a third party to take advantage of the insurer. In many cases, the insurance policyholder relationship is actually “owned” by brokers and dealers and not by the insurer, offering the distribution channel an increased capacity to influence policy lapse or non-continuation behaviour counter to the best interest of the policyholders, or increase anti-selection against the insurer.Footnote 10

Additionally, the operation of a given distribution channel has the potential to generate risks to the insurer’s income-generating capacity, long-term financial sustainability and brand value. For instance, insurance companies that are critically dependent on a single distribution channel (e.g., bank, retail network) or few group insurance contracts (e.g., large companies) and in which distribution tasks have been mostly outsourced to an intermediary or to a partner are highly exposed to the corporate decisions of the distribution channel (e.g., a sudden loss of sales if a distribution channel does not continue the strategic relationship, finishes the distribution agreement or becomes bankrupt, a big customer swapping insurer, or a lack of sufficient bargaining power in the relationship). Additionally, they lose much of the control over the business and maybe severely impacted by underwriting decisions, pricing levels, lack of coordination or misaligned incentives and strategy.

Intermediaries and partners may be more concerned with promoting themselves and their business than committed to a long-term successful and profitable relationship with the insurer. For instance, in the bancassurance distribution model the bank may divert bank customers from purchasing life insurance policies with a savings accumulation profile and try to sell them its own deposit or investment products or channel customers to another insurance company that is directly or indirectly controlled by the bank. In distribution arrangements in which the intermediary or partner are responsible for collecting premiums, additional monitoring and enforcement efforts must be put in place to guarantee premium payments are effectively received by the insurer, preventing fraud, loss of coverage situations and expense recovery risks with major litigation and reputational costs for the undertaking.

Finally, there are risks to the own distribution channels themselves that are similar to operational risks, which may produce adverse impact on existing and new business, loss of brand value and represent significant reputation and financial risks to the insurer. In extreme circumstances, they may even trigger regulatory penal action. According to the Basel Committee, operational risk is defined as “a risk of loss resulting from inadequate or failed internal processes, people and systems or from external events”. The main risks for distribution channels are disruptive innovation that deteriorates the continuity chances of some intermediaries, poor reputation of brokers/dealers due to, for instance, past inappropriate sales/claim practices, mis-selling by sales personnel, poor sales management (e.g., uncompetitive pricing or services, pushing products for higher commission LOBs), products and services failing to meet the customers’ needs (e.g., due to inadequate administration systems, delayed turnaround time, process failure), inability to maintain a strong relationship with the agents/brokers, lack of alignment of incentives, competition and cannibalization of traditional distribution channels by new channels (e.g., mobile/Internet-based), unskilled sales force due to inadequate hiring and training or regulatory and tax changes.

The capability of the agents/brokers network to remain competitive against other distribution channels and the ability of insurance undertakings to maintain a healthy and mutually profitable relationship with is distributors are critical for long-term competitiveness. Insurers compete for intermediaries with a proven track record of developing and delivering a risk-balanced, profitable book of business. To the extent that this competition for the best distribution partners increase and there are consolidation movements in the agents/brokers market, premium, volume and profitability could be negatively affected. To avoid internal friction when insurers use more than one channel to target the same customers, particularly when the implementation of direct distribution channels may adversely impact the brokers market-share, companies should adopt a multi-channel model. Notice that distribution risk may arise as a result of both people, system, process and external causes, with consequences revealed, for instance, through an increase in customer’s complaints and dissatisfaction, increase in churn rates, loss of reputation due to negative media coverage, loss of market-share and revenue.

4 The Impact of IDD on Distribution Risk Management

The Insurance Distribution Directive (IDD)Footnote 11 came into force in Europe on 23rd February 2016 replacing the Insurance Mediation Directive (IMD), as part of wider project to amend the way in which financial services are regulated in the European Union (EU). The IDD was implemented with a clear objective of increasing the level of harmonization for insurance distribution regulation across the EU member countries, creating a common playing field for all insurance intermediaries and insurance distribution activities, irrespective of the direct or indirect channel used by customers to purchase their products. This includes (re)insurance manufacturers that sell directly to customers and market participants who sell insurance on an ancillary basis. The IDD also aims to improve consumer protection and effective competition in the market. The directive includes multiple provisions whose impact goes well beyond the distribution function in insurance, regarding for instance the type of information that should be made available to consumers before they sign an insurance contract, the business and transparency conduct standards insurance distributors are required to comply, product oversight and governance requirements, procedures and rules for cross-border business, continuous professional requirements, conflicts of interest management, inducements or cross-selling activities. In line with other regulatory changes such as MiFID II and PRIIPS, IDD establishes more prescriptive rules for intermediaries selling insurance products that expose policyholders to financial markets (e.g., unit-linked and with-profit life insurance contracts).

One of the central principles of IDD is that insurance distributors ‘must always act honestly, fairly and professionally in accordance with the best interests (demands and needs) of their customers’.Footnote 12 This “best interests” duty of trust or confidence is inspired in similar dispositions contained in the European (MiFID)Footnote 13 and U. S. (Securities Exchange Act)Footnote 14 Regulatory Frameworks for Financial Instruments, applies to both brokers representing an actual or potential policyholder and insurer representatives, and requires them to act in a diligent and professional way to negotiate the terms of a deal on behalf of and to the principals’ advantage, including not using their position of trust to generate unacceptable benefits or profits for themselves without the knowledge and agreement of their represented, managing any conflicts of interest if necessary. It encompasses in some extent both a duty of care and a fiduciary duty.Footnote 15 The “customers’ best interests” rule requires, among other things, that all distributors (intermediaries or (re)insurance undertakers) in the distribution chain should make a proper suitability assessment of their actual or potential policyholders demands and needs, offering only contracts which are considered suitable, appropriate and deliver fair value instead of exhibiting their full catalogue of products with broad proclamations about the type of needs each product addresses.Footnote 16 Distributors must provide customers personalised recommendations detailing why a given insurance product would fit the customer’s demands and needs. The exception would be, in some jurisdictions (e.g., the UK), non-advised retail sales for which firms are not expected to carry out a detailed analysis of a customer’s circumstances but should, nevertheless, clearly identify the customer’s demands and needs and offer contracts that meets them.Footnote 17

This also signifies that, irrespective of the means of interaction with clients (including automated or semi-automated systems used as a client-facing tool such as robo-advice), insurance distributors will have to maintain and trace the whole process of collecting information about a client and the subsequent suitability and appropriateness assessment, informing and explaining their customers clearly about the distributor’s role, responsibility and purpose of the suitability assessment, which ultimately should be for the firm to act in the customer’s best interest.Footnote 18 Insurance companies that provide advice to customers on insurance-based investment products (IBIPs) must encourage customers to provide accurate and sufficient information about their protection and/or investment objectives, needs, knowledge, risk tolerance, time horizon, experience and financial position, including the capacity to bear losses (e.g., in unit-linked life insurance).Footnote 19

Each firm is in principle free to define the precise method they will use to inform their clients about the suitability and appropriateness assessment, but firms are expected to define and implement a robust record keeping suitability framework (e.g., one including knowledge assessment, customer categorization, individual and portfolio risk level classification, risk scoring, suitability and appropriateness result), enabling a systematic internal/external control and validation of the suitability and appropriateness obligation, both at the individual trade level and at portfolio level. The framework should include target market statements for all products including, for instance, the product description, the target market (age, sex, income, social group, literacy capabilities, family background), the product aim, the customer objectives and needs, the degree of complexity, the distribution strategy, the customers for whom the product is considered inappropriate).

If implemented properly, this framework is expected to reduce distribution risk by minimizing mis-selling practices, by better meeting customers’ needs, by improving insurer’s reputation and by improving sales management. The framework it also likely to contribute positively to the risk selection process. However, the operational risks and costs involved in consistently implementing the framework in all levels of the distribution chain are massive and should not be neglected. Since identifying customer’s needs is one of the key requirements for the success of insurance companies, proper adoption of IDD provisions is expected to have a long-term impact on insurer’s income-generating capacity and financial sustainability.

The IDD contains, however, precise pre-contract disclosures and provisions, namely the introduction of a detailed standardised Insurance Product Information Document (IPID) for non-life insurance products, and Key Information Documents (KIDs) for those who produce or sell insurance-based investment products, which had been previously introduced under the packaged retail and insurance-based investment products (PRIIPs) Regulation. The IPID is a precontractual and stand-alone document which aims to provide clearer and transparent information on non-life insurance products so that consumers can make informed decisions, facilitating also competition between insurance distributors. The IPID document should be easy to read, understand and compare, have a common design, structure and format and will have to be communicated at the time of quotation, renewal and any mid-term adjustment in the contract.Footnote 20

One of areas in which the IDD is expected to have more impact on distribution risk management refers to the new regulatory provisions regarding pre-contract disclosure and transparency on both the nature and basis of the remuneration (e.g., commission, bonus, profit share, other financial incentives or non-monetary benefits) distributors and its employees receive in relation to the insurance contract, and on the performance management practices of an insurer’s own sales force. Customers are to be provided information on fees, commissions or benefits all participants in the distribution chain receive in relation the insurance contract. Special attention is devoted to compensation components which are not guaranteed, or which are contingent on meeting certain business targets (e.g., new sales). The general principle is that the sales channel remuneration and performance management policies must not conflict with the general duty to act in the customer’s best interests, nor prevent any participant in the distribution chain from presenting product information in a clear and non-misleading way, nor making a suitable recommendation for a fair deal. This means insurance companies are responsible for defining and implementing actions aiming to prevent the negative effects of any incentive mechanisms on the quality of the relevant service to the customer and on the insurer or intermediary duty to act in accordance with the best interests of their customers.Footnote 21 In this regard, EIOPAFootnote 22 recommends insurance undertakings and insurance intermediaries to adopt inducements or inducement schemes that include both quantitative commercial criteria and appropriate qualitative criteria, reflecting compliance with the applicable regulations, fair treatment of customers and the quality of services provided to customers, that are proportionate when considered against the value of the product and the services provided, to avid inducements entirely or mainly paid upfront when the product is sold without any appropriate refunding mechanism if the product lapses or is surrendered at an early stage, and to be cautious about inducements that incorporate any form of variable or contingent threshold or value accelerator which is triggered by touching a sales target barrier based on volume or value of sales.

To that end, the IDD includes specific disclosure requirements for intermediaries in relation to conflicts of interest and transparency. The insurance “…distributor should develop, adopt and regularly review policies and procedures relating to conflicts of interest with the aim of avoiding any detrimental impact on the quality of the relevant service to the customer and of ensuring that the customer is adequately informed about fees, commissions or benefits”.Footnote 23 Prior the conclusion of an insurance contract, the IDD mandates an insurance intermediary to provides the customer with information on, for instance, whether he has a holding representing 10% or more of the voting rights of the capital in a given insurance undertaking or vice versa, whether he provides or not advice about the insurance products sold on the basis of a fair and personal analysis (which should be proceeded by an analysis of a sufficiently large number of similar contracts available on the market), whether he represents the customer or acts on behalf of the insurance undertaking, whether he is or not under a contractual obligation to conduct insurance distribution business exclusively with one or more insurance undertakings, the nature of the remuneration received in relation to the insurance contract and, particularly, the amount of the fee that is paid directly by the customer.Footnote 24

The new pre-contract disclosure and transparency provisions on the nature and basis of the remuneration and in relation to conflicts of interest reinforce a more client-centric approach embedded in the IDD and will force insurers to rethink their pricing, remuneration and distribution business strategies and product governance requirements to be better aligned with customers’ interests and to face a more competitive environment, with the corresponding price and margin pressures. In theory, this should contribute to improve the risk selection process and thus the quality of the insured portfolio, reducing distribution risk caused by the actions of the distribution channel. In practice, it is still too soon to confirm how the new disclosure requirements impact on distribution channel strategies, on insurance coverage, on the price of insurance contracts or on the long-term income generating capacity of firms. Guaranteed is that the IDD brings a substantial increase in the obligations relating to information, advisory services, documentation and business conduct.

Another IDD provision with relevant impact on distribution channels and risk management refers to cross-selling activities. When, as part of a package, a non-insurance ancillary product or service is offered together with an insurance product, the distributor must inform the customer about the components, costs, charges, and risks of each component and the customer must be given the chance to buy them separately.Footnote 25 This requirement does not prohibit the distribution of insurance products which provide coverage for various types of risks (e.g., multi-risk insurance policies), just requires distributors to unbundle packages detaching the pricing and risk characteristics of each coverage. Offering insurance and claims services on an unbundled basis is particularly useful for large policyholders (e.g., workers compensation insurance, general liability insurance and auto insurance) looking for more flexible, fitted to their specific needs and, potentially, cheaper risk management solutions. For insurers and distributors, this is however likely to reduce risk pooling mechanisms, to pressure revenues and profit margins and to challenge classical distribution infrastructures. Traditionally, to justify the manufacturing and distribution costs of insurance products and services and to be offered at an affordable competitive price, coverages had to be sufficiently broad to address the needs of a large reachable customer base, pooling risks efficiently, resulting in standardized products with complementary coverages. As the advent of digital intermediaries in insurance shows, new technologies such as digitization and aggregation platforms, new processes and methods have reduced the costs of manufacturing and distributing insurance, reducing the primary motive for packing coverages.

Similar to MiFID II, the IDD also introduces product oversight and governance (POG) requirements for all insurance products (except for insurance of large risks). The approval process for each insurance product should be defined as proportionate to the nature of the insurance products that are about to be sold to customers, it should specify the target market, the risk assessment and assure that the distribution strategy is aligned with the identified market. Regular reviews must also be conducted to verify that products remain effectively distributed and consistent with the objective of the respective target markets.Footnote 26 This will require insurers to select the distribution channel that is appropriate for the target market, distributors to define a distribution strategy that does not conflict with the strategy defined by the insurance undertaking and regular monitoring and implementation of corrective actions to better align the product with the needs and objectives of the target market.Footnote 27 Most insurance companies manufacture their products based essentially on the sales force feedback, fitting everyone with the same products, with little room for market research. POG requirements demand, together with needs analysis, a greater role for investing in market research and in alternative mechanisms for understanding customers preferences, trends and trust on the brand value.

In theory, the POG requirements have a relevant impact on the whole product value chain, from the process of designing and manufacturing insurance products, making them available to customers (distribution) and monitoring them once distributed. The provisions are aligned with governance requirements established by Solvency II arrangements which demand insurers to prudently manage the business under a risk-based approach. They are expected to contribute to better align the business strategy and interests of insurers and distributors, and thus positively impact on distribution risk. However, the substantial increase in the obligations relating to information, advisory services, documentation and business conduct is likely to reduce the business margins.Footnote 28

The IDD mandates relevant persons within the management structure of (re)insurance companies or intermediaries involved in the distribution of (re)insurance products, as well as the relevant employees of an (re)insurance distributor directly involved in (re)insurance distribution to be of good repute, have a clean criminal record or any other national equivalent in relation to serious criminal offences linked to crimes against property or other crimes related to financial activities and possess an appropriate level of knowledge and competence in relation to the distribution activity. The appropriateness of the level of knowledge and competence should be proportional to the complexity of the products sold, the type of distribution channel, the role distributors perform, and the activity carried out within the insurance or reinsurance distributor and must be assured by the application of specific Continuing Professional Development (CPD).

The IDD introduces a minimum 15 h CPD for certain staff who are directly involved in insurance distribution, who supervise such staff or who are responsible for insurance distribution within the firm’s management structure (IDD, Chapter IV, Article 10), but it is expected that professional bodies establish more demanding standards as good practice rather than a legal minimum. The new provisions regarding CPD aim at enhancing public trust in insurance intermediaries through raising professional standards rather than relying on onsite training and experience. Continuous education should target areas not typically covered by professional training (e.g., anti-money laundering legislation, assessment of consumer needs, insurance legislation and regulation), but also risk analysis skills (e.g. risk tolerance assessment, underwriting and risk-selection process) and ethics and professional standards. To the extent that CPD provisions succeed in raising public trust and in helping professions to act honestly, fairly and professionally in accordance with the best interests of their customers, mitigating fraud and mis-selling practices, the introduction of IDD will impact positively on distribution risk management in insurance. Table 1 summarizes the discussion on the impact of IDD main provisions on insurance value chain, including distribution activities.

The demands and needs analysis, the suitability and appropriateness requirements and the cross-selling provisions are expected to have the greatest impact on sales, distribution, underwriting and customer management practices. The remuneration and incentives provisions are expected to have a major impact on product manufacturing and sales and distribution activities. The product oversight and governance provisions are expected to impact product development and distribution activities within insurers and intermediaries.

The activities of claims handling, complaints handling and policy administration and the provision of after-sales services (e.g., loss adjusters and expert appraisers of claims) are key functions of an insurance undertaking that can be in some cases subcontracted. The managing of claims of an insurer on a professional basis and loss adjusting and expert appraisal of claims are activities which do not constitute insurance distribution under the IDD and, as such, are not directly impacted by the regulation.Footnote 29 However, since improper management of claims and complaints typically raises discontent among policyholders, generates premature policy termination and deteriorates the insurers reputation, with a non-negligible impact on the insurer’s long-term financial sustainability and brand value, insurance companies are expected to require their service providers to adopt at least some of the IDD provisions (e.g., on CPD).

5 Conclusions

The introduction of IDD in insurance distribution as part of wider legislative agenda to change the way in which financial services are regulated in the EU set common rules for all involved in (re)insurance distribution in Europe, including the new disruptive distribution channels brought forward by digital transformation in insurance. The directive includes multiple provisions which impact the whole insurance value chain and that go well beyond distribution activities. In this chapter we critically examined the impact of the introduction of IDD on distribution risk management in insurance undertakings and distribution intermediaries, analysing the consequences of IDD main provisions on the quality and volume of the insured portfolio, on the insurer’s income-generating capacity, long-term financial sustainability and brand value. We conclude that provisions related to demands and needs analysis, suitability and appropriateness requirements or cross-selling dispositions are expected to greatly influence insurer’s sales, distribution, underwriting and customer management primary activities. Inducements and inducement schemes are likely to have a major impact on product manufacturing, sales and distribution activities, whereas the product oversight and governance provisions will prominently impact insurers and intermediary’s business strategy, particularly product development and distribution primary activities. Further research is needed to quantitatively assess the economic impact of the introduction of IDD.

Notes

- 1.

Gutterman (2016), p. 9.

- 2.

Hutt and Speh (2012), p. 18.

- 3.

Swiss Re, 2014, Digital distribution in insurance: a quiet revolution. Sigma No 2 /2014, pp. 1–36.

- 4.

- 5.

- 6.

- 7.

Gutterman (2016), pp. 2–5.

- 8.

- 9.

- 10.

Gutterman (2016), pp. 8–10.

- 11.

Directive (EU) 2016/97 of the European Parliament and of the Council of 20 January 2016 on insurance distribution (Insurance Distribution Directive).

- 12.

See Recital 46 and Article 17 of the IDD.

- 13.

See Article 18 of Financial Instruments Directive (MiFID I) (Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments and Article 23 (Section I) and Article 13c (CHAPTER IIIA) of MiFID II Directive (Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014).

- 14.

See Sec 10b(5) of the Securities Exchange Act.

- 15.

For a discussion on this topic see, e.g., FCA, Discussion Paper on a duty of care and potential alternative approaches, Discussion Paper DP18/5, July 2018.

- 16.

See, specifically, paragraphs 1 and 2 of Article 30 of the IDD, which state that an assessment of the suitability or appropriateness of an insurance-based investment product (IBIP) for the customer by the insurance intermediary or insurance undertaking is generally required as part of the sale of an IBIP. For a detailed discussion on this topic see Marano and Rokas (2019).

- 17.

The UK Financial Conduct Authority (FCA) Handbook, Section COBS 10.4, states that a firm is not required to make a suitability assessment if: “… (a) the service only consists of execution and/or the reception and transmission of client orders, with or without ancillary services, it relates to particular financial instruments and is provided at the initiative of the client; (b) the client has been clearly informed (whether the warning is given in a standardised format or not) that in the provision of this service the firm is not required to assess the suitability of the instrument or service provided or offered and that therefore he does not benefit from the protection of the rules on assessing suitability; and (c) the firm complies with its obligations in relation to conflicts of interest”.

- 18.

For a recent detailed discussion on IDD and digital intermediaries of insurance products see, e.g., See Marano (2019a), pp. 294–315.

- 19.

See Marano and Rokas (2019), for a detailed discussion on the distribution of IBIPs.

- 20.

EC, 2017, Commission Implementing Regulation (EU) 2017/1469 of 11 August laying down a standardised presentation format for the insurance product information document. Official Journal of the European Union, L 209/19, 12.8.2017.

- 21.

See Delloite (2018), pp. 2–10.

- 22.

EIOPA, 2017, Technical Advice on possible delegated acts concerning the Insurance Distribution Directive. EIOPA 17/048, February, pp. 1–150.

- 23.

See, e.g., Recital 57 of the IDD.

- 24.

See, e.g., Article 19 of the IDD.

- 25.

See, e.g., Article 24 of the IDD.

- 26.

See, e.g., Article 25 of the IDD.

- 27.

For a detailed discussion of POG requirements under the IDD see Marano (2019b), pp. 60–96.

- 28.

Köhne and Brömmelmeyer (2018), pp. 704–739.

- 29.

See Article 2(2) of the IDD.

References

Alho J, Bravo JM, Palmer E (2013) Annuities and life expectancy in NDC. In: Holzmann R, Palmer E, Robalino D (eds) Non-financial defined contribution pension schemes in a changing pension world, Volume 2: gender, politics and financial stability. World Bank Publications, Washington, DC, pp 395–436

Anchen J, Frey A, Kirova M (2015) Life insurance in the digital age: fundamental transformation ahead. Swiss Re Sigma: 6/2015

Ayuso M, Bravo JM, Holzmann R (2017a) Addressing longevity heterogeneity in pension scheme design. J Financ Econ 6(1):1–21

Ayuso M, Bravo JM, Holzmann R (2017b) On the heterogeneity in longevity among socioeconomic groups: scope, trends, and implications for earnings-related pension schemes. Global J Human Soc Sci Econ 17(1):31–57

Ayuso M, Bravo JM, Holzmann R (2020) Getting life expectancy estimates right for pension policy: period versus cohort approach. J Pension Econ Financ. 1-20. https://doi.org/10.1017/S1474747220000050

Bravo JM (2016) Taxation of pensions in Portugal: a semi-dual income tax system. CESifo DICE Rep J Inst Comp 14(1):14–23

Bravo JM (2019a) Funding for longer lives: retirement wallet and risk-sharing annuities. EKONOMIAZ Basque Econ Rev 96(2): 268–291

Bravo JM (2019b) Pricing participating longevity-linked life annuities: a Bayesian model ensemble approach. Preprint. https://doi.org/10.13140/RG.2.2.10113.61283

Bravo JM (2020) Addressing the pension decumulation phase of employee retirement planning. In: Muenstermann I (ed) Who wants to retire and who can afford to retire? IntechOpen, pp 1–21

Bravo JM, El Mekkaoui de Freitas N (2018) Valuation of longevity-linked life annuities. Insur Math Econ 78:212–229

Bravo JM, Silva C (2006) Immunization using a stochastic process independent multifactor model: the Portuguese experience. J Bank Financ 30(1):133–156

Bravo JM, Corte-Real P, Silva C (2009) Participating life annuities incorporating longevity risk sharing arrangements. Working Paper, available from rdpc.uevora.pt

Bravo, JM Herce, JAH (2020) Career breaks, broken pensions? Long-run effects of early and late-career unemployment spells on pension entitlements. Journal of Pension Economics and Finance:1–27

Bravo JM, Ayuso M, Holzmann R, Palmer E (2020) Addressing life expectancy gap in pension policy. Insurance: Mathematics and Economics, preprint revised & resubmitted.

Chen A, Hieber P, Klein J (2017) Tonuity: a novel individual-oriented retirement plan. ASTIN Bull 49(1):5–30

EIOPA (2017) Technical Advice on possible delegated acts concerning the Insurance Distribution Directive. EIOPA 17/048

Eling M, Lehmann M (2018) The impact of digitalization on the insurance value chain and the insurability of risks. Geneva Pap Risk Insur Issues Pract 43(3):359–396

FCA (2018) Discussion Paper on a duty of care and potential alternative approaches. Discussion Paper DP18/5

Gutterman S (2016) Distribution risks. In: IAA risk book - governance, management and regulation of insurance operations. International Actuarial Association

Herce J, Bravo JM (2015) Las pensiones en España y Portugal: Descripción de los esquemas y evolución reciente comparada. In: ¿Es posible planificar la jubilación? Dos años del Instituto BBVA de Pensiones en España. Instituto BBVA de Pensiones, pp 89–126

Hutt MD, Speh TW (2012) Business marketing management: B2B. Cengage, Delhi

IAA (2004) A Global Framework for Insurer Solvency Assessment. International Actuarial Association. Insurer Solvency Assessment Working Party Report, pp 1–185

Köhne T, Brömmelmeyer C (2018) The new insurance distribution regulation in the EU—a critical assessment from a legal and economic perspective. Geneva Pap Risk Insur Issues Pract 43(4):704–739

Marano P (2019a) Navigating InsurTech: the digital intermediaries of insurance products and customer protection in the EU. Maastricht J Eur Comp Law 26(2):294–315

Marano P (2019b) The product oversight and governance: standards and liabilities. In: Marano P, Rokas I (eds) Distribution of insurance-based investment products: the EU regulation and the liabilities. Springer, pp 60–96

Marano P, Rokas I (2019) Distribution of insurance-based investment products: the EU regulation and the liabilities. Springer

Milevsky M, Salisbury T (2015) Optimal retirement income tontines. Insur Math Econ 64(1):91–105

Legislation and Other Documents

Directive (EU) 2016/97 of the European Parliament and of the Council of 20 January 2016 on insurance distribution (Insurance Distribution Directive)

EC (2017) Commission Implementing Regulation (EU) 2017/1469 of 11 August laying down a standardised presentation format for the insurance product information document. Official Journal of the European Union, L 209/19, 12.8.2017

Delloite (2018) Insurance Distribution Directive 2018: A challenging year for the European insurance sector. Performance magazine issue 25. New York, NY: Deloitte.

Swiss Re (2014) Digital distribution in insurance: a quiet revolution. Sigma: 2/2014

Acknowledgements

The author gratefully acknowledges comments and suggestions made by editors and by participants at the 8th AIDA Europe Conference, Lisbon, Portugal, 2019.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2021 The Author(s)

About this chapter

Cite this chapter

Bravo, J.M. (2021). IDD and Distribution Risk Management. In: Marano, P., Noussia, K. (eds) Insurance Distribution Directive. AIDA Europe Research Series on Insurance Law and Regulation, vol 3. Springer, Cham. https://doi.org/10.1007/978-3-030-52738-9_14

Download citation

DOI: https://doi.org/10.1007/978-3-030-52738-9_14

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-52737-2

Online ISBN: 978-3-030-52738-9

eBook Packages: Law and CriminologyLaw and Criminology (R0)